ADVERTISER DISCLOSURE: The Frugal Tourist is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as MileValue.com This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Additionally, the content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Did you know you can use gift cards to pay your home mortgage?

Yes, that is true, and I will walk you through the steps on how you can do it too.

Home mortgages are typically impossible to pay using credit cards or gift cards, but in this blog post, I will show you how to use a service called Plastiq to liquidate your growing stack of gift cards to send mortgage payments.

If you have gift cards you haven’t touched in months or years, this method might be perfect for you.

Feb 2024 Update: MCGC No Longer Works

We’ve received numerous reports indicating that Plastiq no longer accepts Mastercard Gift Cards (MCGCs) as a payment option for mortgages.

Unless there are updates, this method of gift card liquidation is now deemed “prohibited”.

Currently, Mastercard credit cards continue to be accepted by Plastiq as a payment method.

This blog post also lists some other ideas that you can utilize to liquidate your gift cards.

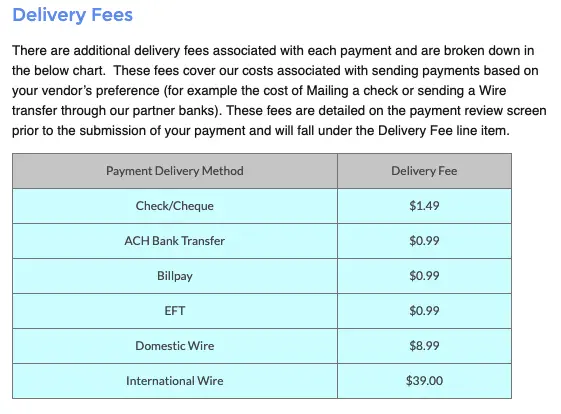

Nov 2023 Update: Delivery Fees

Plastiq recently added delivery fees to all payments.

Please add this fee to each payment type whenever sending mortgage payments through Plastiq.

There are additional delivery fees associated with each payment and are broken down in the below chart. These fees cover our costs associated with sending payments based on your vendor’s preference (for example the cost of maliing a check or sending a wire transfer through our partner banks). These fees are detailed on the payment review screen prior to submission of your payment and will fall under the Delivery Fee line item.

Plastiq.com

| Payment Delivery Method | Delivery Fee |

|---|---|

| Check | $1.49 |

| ACH/Bank Transfer | $0.99 |

| Billpay | $0.99 |

| EFT | $0.99 |

| Domestic Wire | $8.99 |

| International Wire | 39.00 |

What is Plastiq?

Plastiq.com is a service that allows you to pay your bills with a credit or debit card.

Although Plastiq charges a 2.9% service fee plus the delivery fee, it could be worth it if you do not have any other methods to convert your Mastercard gift cards to cash.

And if you ask me, using my gift cards to pay off my mortgage is a much better option than letting them go unused.

Before Using Plastiq, Check PayPal Bill Pay

Since Plastiq charges a 2.9% fee, it is unappealing to many folks.

Before taking the plunge and using Plastiq, check if your home mortgage lender or credit union is on PayPal Bill Pay (PPBP).

Paypal Bill Pay accepts mortgage payments using credit cards without charging extra fees, but only if your lender allows it. It’s worth a try, though!

If your mortgage lender accepts credit card payments via Paypal Bill Pay, you have struck gold as you will completely avoid debit card/credit card transaction fees when using it.

It is arguably the best and cheapest way to send mortgage payments using your debit and credit cards.

The only downside is that not all mortgage companies are on PayPal Bill Pay, and not all accept credit cards, but check periodically as they add new billers frequently.

What Type of Gift Cards to Use?

Plastiq currently accepts Mastercard gift cards or Mastercard credit cards for mortgage payments.

American Express and Visa gift cards can be used for other payments on Plastiq, but not mortgages.

Where Do I Buy These Gift Cards?

The gift cards I use to pay my mortgage are purchased using credit cards that earn travel points when used at specific merchants.

Ultimately, these travel points are what I use to book free or discounted travel.

For example, the Chase Ink Business Cash® Credit Card earns 5 Chase Ultimate Rewards Points per dollar at Office Supply Stores such as Staples or Office Depot.

Staples and Office Depot frequently run gift card promos where you can buy Mastercard gift cards on sale.

Chase Ultimate Rewards is one of my favorite points currencies.

I typically use them to stay at luxurious Hyatt properties for free or to fly premium cabins on United, Air France, Singapore Airlines, and many other carriers.

Is the Plastiq Fee Worth It?

Since I am getting 5% back in travel rewards points when I use my Ink Business Cash to purchase Mastercard gift cards at office supply stores, I am essentially coming out ahead.

Why? Plastiq charges a 2.9% service fee. When I crunch the numbers, 5% travel rewards minus the 2.9% Plastiq Fee is a 2.1% return per dollar when I employ this strategy.

Nevertheless, this is a much more rewarding alternative than sending money straight from my bank account, which earns zero rewards.

Update: Given that each gift card will now incur an additional charge of $0.99 to $1.49 delivery fee, please determine if this liquidation method is still cost-effective for you. I would spend those gift cards elsewhere if you have other ways to convert them to cash.

When Do These Gift Cards Go On Sale?

We announce these gift card deals at our free Facebook Group – Travel Miles and Points. Feel free to join other points enthusiasts there!

This is Not For Everyone

This strategy will only work for folks willing to pay the 2.9% Plastiq fee plus delivery fee when liquidating Mastercard gift cards purchased using credit cards that earn travel rewards.

Since this also works with Mastercard credit cards, this can be a great way to meet the spending requirements of new Mastercard cardholders to earn generous welcome bonuses.

At any rate, crunch the numbers first to see if you think this service is worth the fee before using Plastiq.

Steps in Earning Travel Rewards When Purchasing Gift Cards

Step 1: Use A Credit Card That Earns 5X At Office Supply Stores

As mentioned above, you will need a credit card with a category bonus when spending at office supply stores.

Currently, Chase is offering an incredible welcome bonus for their no-annual-fee Ink Business Cash, which earns 5 points per dollar at office supply stores.

However, since it is a business card, you would need some type of side hustle before applying for it.

Don’t worry, any side hustle, such as selling random items in Facebook Marketplace, may make anyone eligible.

The related post below will walk you through the steps to apply for your first Chase business credit card.

Step 2: Keep an Eye Out for Mastercard Gift Card Sales

Wait for gift card sales that periodically happen in office supply stores such as Staples and Office Depot/Max.

Buying discounted gift cards is one of my favorite ways of accumulating miles and points, which I ultimately use for discounted airfare or free hotel stays.

Since these deals are extremely popular, you must be prepared to pounce when sales are announced.

As mentioned above, we post these gift card deals as we learn about them in the Travel Miles and Points Facebook Group. It’s free to join!

Step 3: Buy Mastercard Gift Cards When They Are On Sale

Just a reminder to only purchase gift cards that you can use.

If you have the luxury of time, you can visit the store multiple times during the promo week.

I also recommend calling the store before driving to make sure the gift cards are not sold out.

Both Staples and Office Depot/Max allow one transaction per person/day, so you can possibly take advantage of this gift card sale every single day that the discount is offered.

Step 4: Pay Your Mortgage Using Mastercard Gift Cards on Plastiq

I will walk you through how to do this in the next section.

Step 5: Redeem Your Points For Free or Discounted Travel

Since the Chase Ink Business Cash generates cashback points, you would need to execute another step to convert those cashback points to transferrable Chase Ultimate Rewards Points, which can ultimately be transferred to Chase’s many travel partners.

Transfer your cashback points from the Ink Business Cash to one of Chase’s premium cards, such as the Chase Sapphire Preferred® Card, or the Chase Sapphire Reserve®, to access Chase’s many travel partners.

Steps In Using Gift Cards on Plastiq

Step 1: Sign Up for a Plastiq Account

The button below is a referral link.

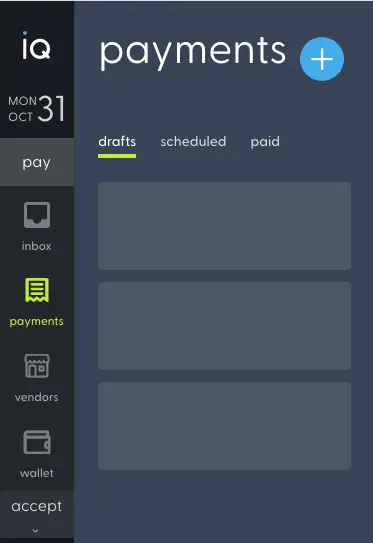

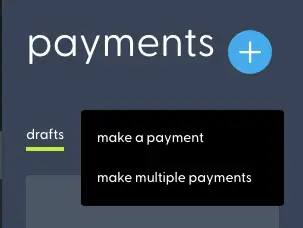

Step 2: Click “Make a Payment”

Click the “+” sign to make a payment

When you click the “+” sign, you will also be given the option to make multiple payments.

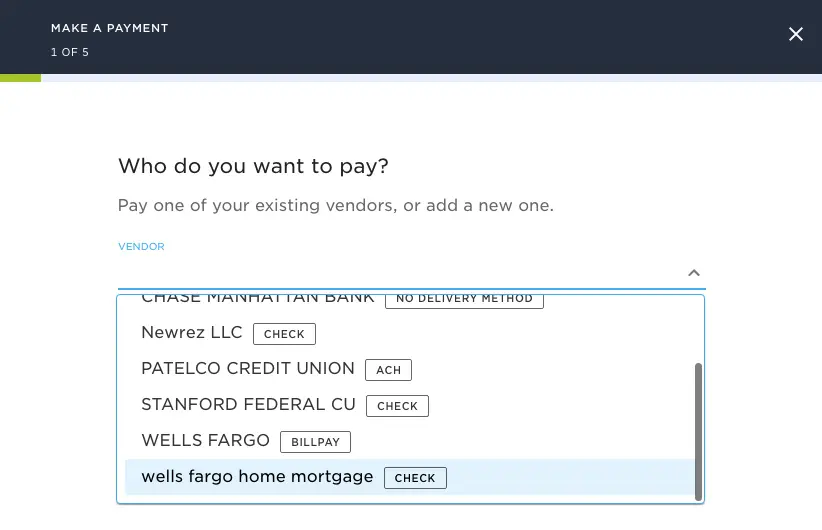

Step 3: Add a Vendor

You only need to add a “vendor” once by clicking “Create New Vendor“.

Plastiq will then indefinitely save all previous payees and payment methods until you remove them.

You can also indicate how you want the funds delivered to your recipient. Your options include ACH, Check, or Bill Pay.

If you have already saved a payee, click the drop-down arrow and select the agency to which you want to send your payment.

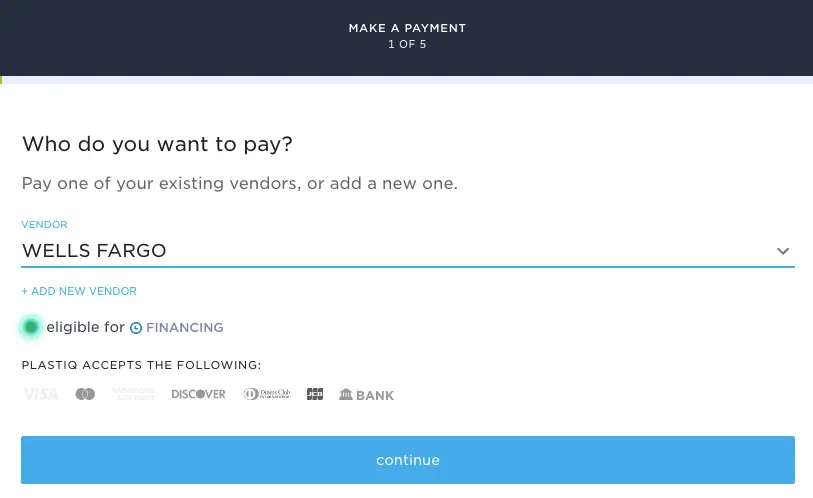

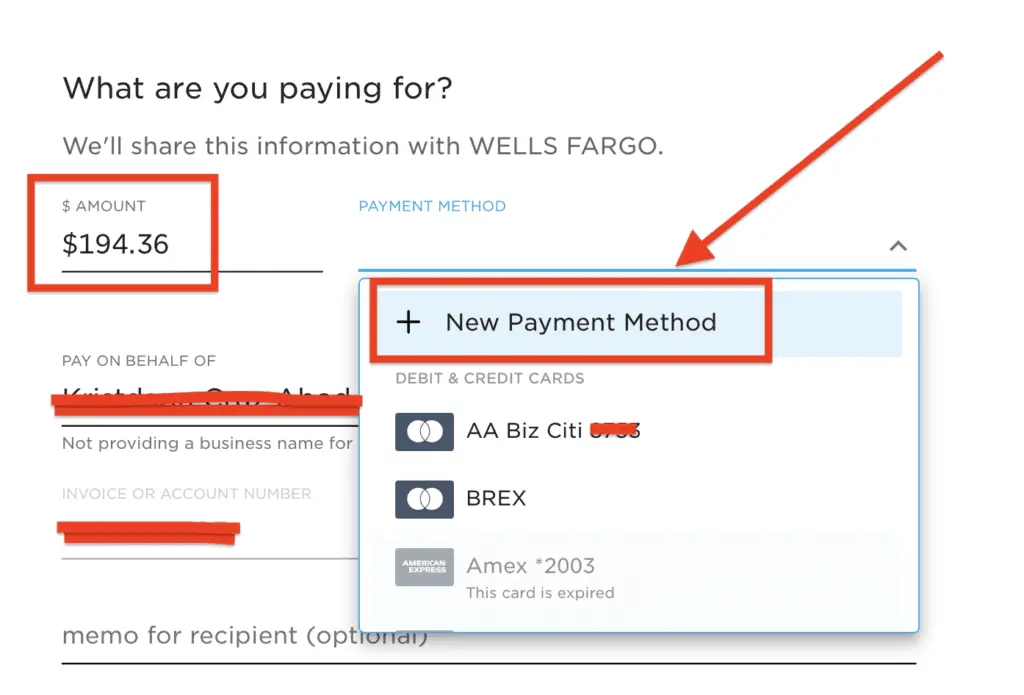

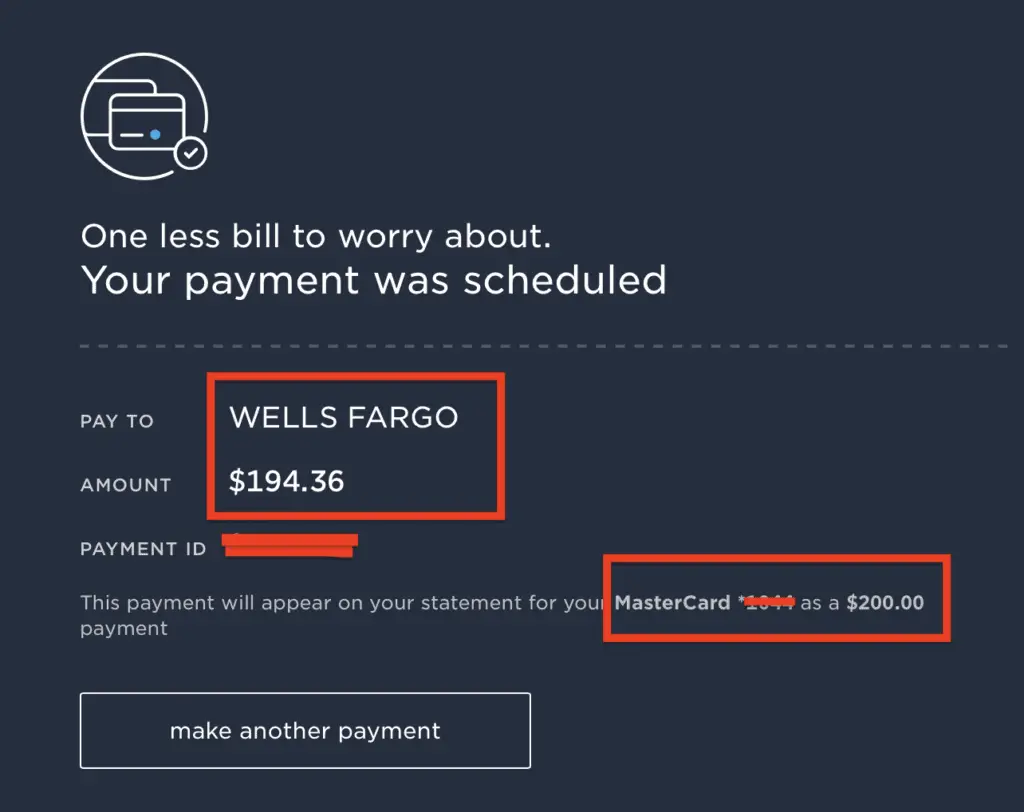

In the example below, I selected to send payments to Wells Fargo.

Step 4: Enter Your Payment Details

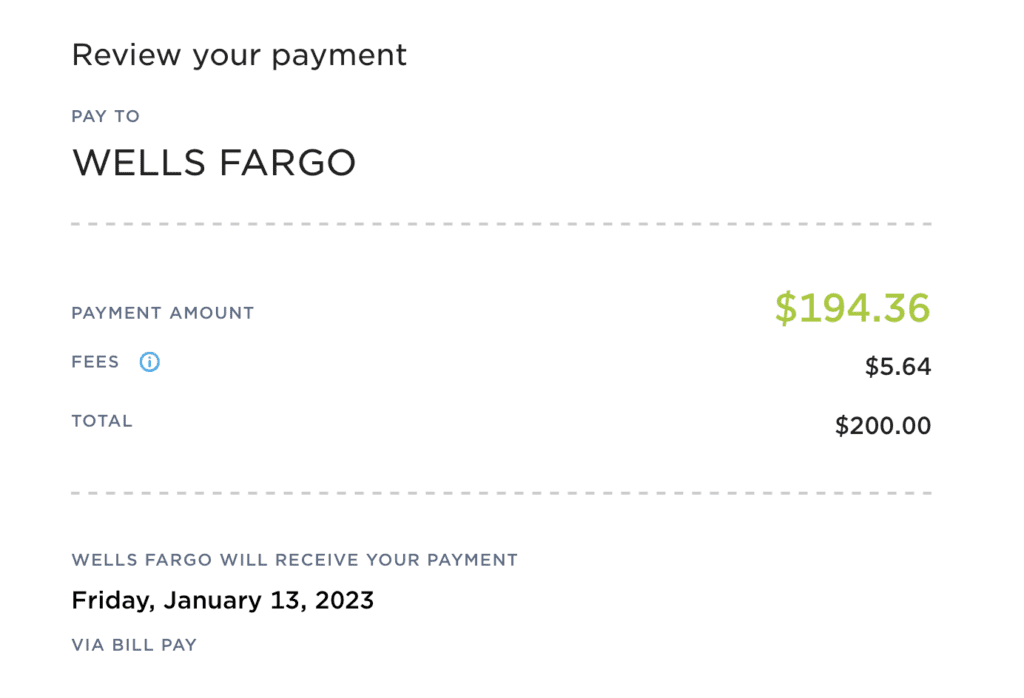

Since each Mastercard gift card has $200, I subtracted the 2.9% fee and typed in the difference in the amount field ($194.36).

You can pay any amount as long as your payment does not exceed the gift card amount.

Next, fill out the rest of the form:

- Pay on behalf of (your name)

- Invoice or Account Number

- Memo for recipient

New: Plastiq Now Charges Delivery Fees

Step 5: Add/Select Your Payment Method

Since we are paying using Mastercard gift cards, we need to enter each card individually by clicking “+ New Payment Method“.

Plastiq makes keeping your payment information on the site easy, so you don’t have to enter it every time. I only delete my cards when I know the vendor has received my payments.

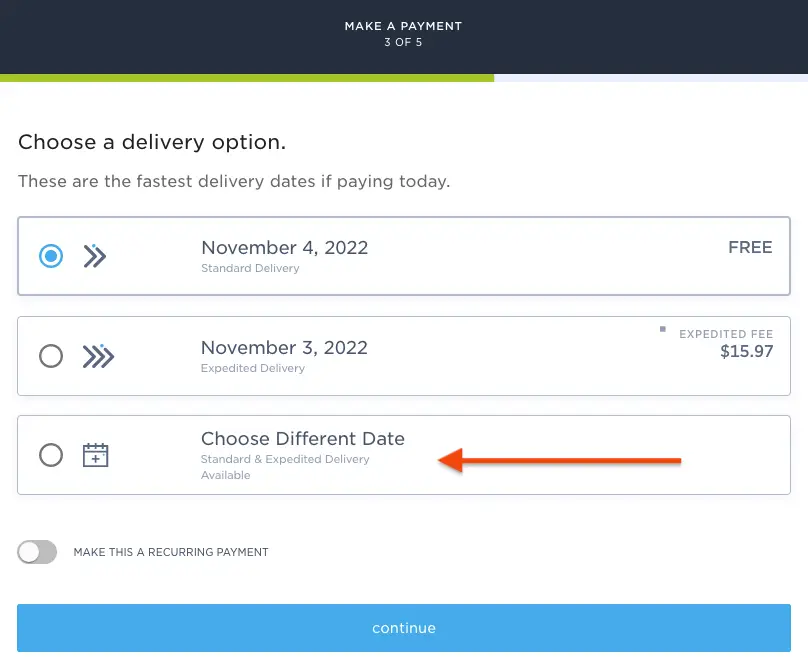

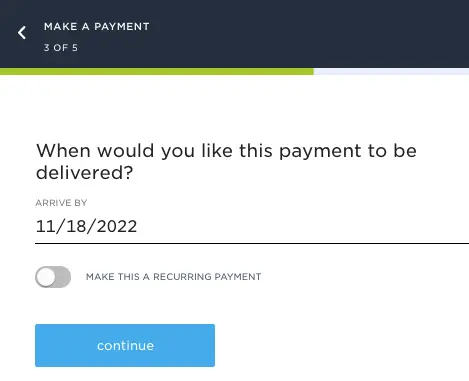

Step 6: Choose a Delivery Option & Date

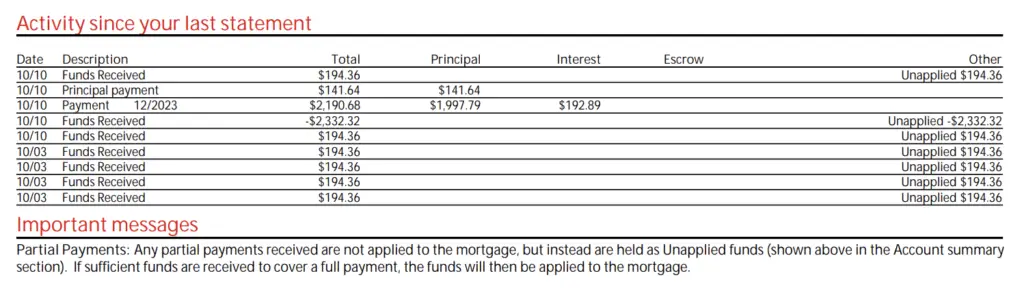

Since I am sending multiple partial payments to my mortgage lender, I schedule all of my payments to arrive at the same time before the payment due date.

If you schedule all of your payments to arrive at the same time through Plastiq, they will be sent as one payment.

Heads up: Whenever I send partial payments to my mortgage lender through Plastiq and other sources (i.e. bill pay from another bank), I always call my lender ahead of time to let them know. For example, Wells Fargo wrote a note on my account saying that all future partial payments would go toward my monthly mortgage instead of the principal balance. They now have a permanent alert on my account that all partial payments are specifically for home mortgage payments.

An advantage of using Plastiq is that it gives me the opportunity to have some flexibility on how I send payments.

This allows me to simultaneously liquidate unused Mastercard gift cards and use new Mastercard credit cards to meet minimum spending requirements. The remainder can be paid in cash.

It is not unusual for me to send my mortgage lender 2-3 partial payments to cover a single mortgage payment at any given month.

My mortgage payments typically consist of the following methods:

- Partial payments using Mastercard gift cards through Plastiq (2.9% fee)

- Partial payments using a NEW Mastercard credit card through Plastiq (2.9% fee)

- Bill Pay from my bank account (free)

Step 7: Upload an Invoice (Optional)

Step 8: Schedule Payment

Verify all the information is correct, then click “Schedule Payment“.

Step 9: Wait For Payment Confirmation

Plastiq will confirm that the payment was successful. You will also get an email confirmation.

Step 10: Check the “Scheduled” Tab

Check the “Scheduled” or “Completed” tab to ensure all your payments are accounted for.

Plastiq will also send you an email once the payments have been delivered.

Step 11: Alert Your Mortgage Lender About Partial Payments

Notify your mortgage lender that incoming partial payments should be applied toward the monthly mortgage.

| You can use this script: “I will send several partial payments in the next few weeks. Can you note on my account that I would like any future partial payments to be applied toward my monthly mortgage and not toward the principal? Thank you!” |

After I sent the above request to Wells Fargo, all of my statements now include the following disclaimer:

Partial Payments: Any partial payments received are not applied to the mortgage but instead are held as Unapplied funds (shown above in the Account summary section). If sufficient funds are received to cover a full payment, the funds will then be applied to the mortgage.

Frequently Asked Questions

What is the Maximum Amount Plastiq Allows?

Although Plastiq can process payments made with personal prepaid debit cards, there is a limit of $10,000 per month. Plastiq will decline payments that exceed this amount.

How Many Gift Cards Per Day Can I Use on Plastiq?

I have inconsistent data points. Some days, Plastiq stops accepting payments after five gift cards. Sometimes, it can accept more than ten.

When Plastiq stops accepting after 5, you can try using their service again the next day. Alternatively, you can try to log out and log back in using a different browser.

Final Thoughts

If you have many Mastercard gift cards sitting around that you never use, put them to good use by paying your home mortgage with them!

By using Plastiq.com, you can finally pay your house payments using gift cards, even if your mortgage company doesn’t accept them.

While Plastiq.com charges a small fee, this fee may be worth spending if you earned travel rewards from the gift card purchase.

Plus, isn’t liquidating gift cards better than having them accumulate dust?

Nonetheless, I love that I can now leverage mortgage payments to help me inch closer to the vacation of my dreams using travel points. Thanks to Plastiq!

Have you used Plastiq.com yet to pay your mortgage using gift cards that earned travel rewards? If yes, how was your experience?

EDITORIAL DISCLOSURE – Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. The content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

I read your post about using MCGCs to pay your mortgage using Plastiq. I received an email from Plastiq claiming they did not take GCs. How are you using the MCGCs through Plastiq? Thanks

I click “credit cards”.

Thanks for this very straightforward explanation!

In your Wells Fargo example, you send 7 payments … does your bank require you to indicate whether each payment is a “partial regular payment” or what portion should go for principal or interest? Do you (or did you) have to follow up with your bank to ensure they allocate properly?

I tried this some years ago with the Pentagon Federal Credit Union and they misapplied my payments, and it was a hassle to get them to re-apply the payments every month. But maybe it’s worth trying again.

Are you pausing paying through Plastiq while their ownership changes?

Hi Gerry! Thank you for reaching out. These are great questions. Regarding payments, I called Wells Fargo and requested that all payments go towards my mortgage. So, they wait until all the partial payments are enough to pay one month’s worth of mortgage. I have reached out to another lender (NewRez) and they were able to do the same for me for another property. Just call and have them write a note on your account.

Sorry to hear about the hassle. If your lender is a credit union, have you checked PayPal BillPay? There are a bunch of credit unions on there, and you may be able to send payments through there to avoid the 2.9% Plastiq fee. I do have an article about it, just google “Paypal BillPay” and look for my article.

Regarding the ownership changes, I have not paused my payments. To the contrary, I’ve ramped them up so I can liquidate all of my MCGCs before the situation worsens. I hope that they can get out of this quagmire soon. Disclaimer though – this is not advice, please do what is comfortable for you 🙂

I heard that Plastiq has recently filed for bankruptcy. Any insights whether we can continue to send mortgage payments?

It’s been BAU (business as usual) for me with Plastiq, so it will depend on your comfort level and risk tolerance. As for me, I’ve sent multiple gift card payments to pay my mortgage despite the bankruptcy announcement and they have all been going through smoothly. Thanks for asking!

Does it have to be physical gift cards or can it be e-gift cards?

Hi Bill. I use physical and e-gift cards as long as they are Mastercards.

I did this but my mortgage lender applied my gift card payments towards the principal. Has that ever happened to you? Do I call to ask them to move it towards my mortgage. Thanks so much for this step by step guide.

HI Trisha, thanks for reaching out. Yes, that has happened to me. You can troubleshoot by calling your lender and asking them to move your payments from principal to monthly mortgage. They were able to do this for me without any hiccups. Keep me posted.

Hey, thanks for this – do you need to call your mortgage company every time you’re sending partial payments?

Hi Lance, I only called once to both Wells Fargo and NewRez.I updated the post to include a script I’ve used when I called. Check Step 11.

Hey! I’m just learning how to set this up – in your example in step 3, you’re sending money to Wells Fargo which just happens to be the same bank that I’m paying my mortgage to. For mortgage payments, do you typically choose ACH, Check, or Wire? I assumed it was through ACH, but I don’t know what the routing number would be in this case (can I just use the same routing number that a checking account at Wells Fargo would have, or is there a mortgage-specific number?)

Hello. Great question. I send through Bill Pay (ACH). When you add a biller, do the following steps:

a. Search for Wells Fargo “Bill Pay”

b. Plastiq will generate a drop down menu of various addresses, select the address where you want to send your payment to.

c. Follow the rest of the prompts.

Recently, Plastiq started charging a delivery fee per payment type, so sending ACH will incur an additional $0.99 fee, so make sure you factor that fee before sending payments. Keep us posted.

Hi have you done this recently? Paying my mortgage with MCGC’s via Plastiq worked without any issues until this month. Just tried to make a payment for my mortgage payment due 3/1 using 20 or so $200 GC’s from Staples and every single payment declined. Both Plastiq and Blackhawk have not been very helpful in figuring out the issue. Thanks

You’re right. They have stopped working. Bummer! Plastiq appears to be blocking the MCGC BIN#. I’ll update the post that this is no longer working as of this week. Thanks for sharing the DP.