ADVERTISER DISCLOSURE: The Frugal Tourist is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as MileValue.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

The Deal

Office Depot/Max is back with their regular deal on discounted Mastercard gift cards.

This discount is only available for in-store purchases from June 30th through July 6th, 2024.

With this deal, $15 is instantly deducted from your total bill if you purchase at least $300 worth of Mastercard gift cards.

This is a wonderful opportunity to help you meet the minimum spending requirement of a new credit card you just got approved for, as long as that card is not an American Express Credit Card.

You can also use a credit card that earns bonus points at Office Supply Stores.

Updates

| Date | Details |

|---|---|

| March 2024 | Mastercard Gift Cards are accepted again by the 3 IRS payment processors when paying Estimated Taxes or Federal Taxes. |

| Feb 2024 | Mastercard Gift Cards are no longer accepted by Plastiq for mortgage payments. |

| August 2023 | When you purchase 6 X $200 Visa Gift Cards in one transaction, $60 will be automatically discounted. You must provide your driver’s license to complete purchases over $1000. |

| May 2023 | When you purchase 3 X $200 Mastercard Gift Cards (total: $600 + activation fees), $30 will be automatically discounted. |

Stacking Ideas

Stack 1: Dosh – Possible Account Shutdown

The cashback app “DOSH” also offers a 2% cashback for purchases at Office Depot/Max.

Although Dosh states that gift cards do not earn cashback, my experience has been the opposite. However, add a few random items to prevent an audit.

Just be mindful that Dosh can claw back any cashback bonuses they’ve given at any time, so YMMV (your mileage may vary).

This deal is a fantastic opportunity to get travel points and earn a $15 discount simultaneously, but the possibility of receiving cashback from Dosh makes this deal even more lucrative.

If you do not have DOSH yet, sign up by clicking the button below (referral link).

Make sure you link the credit card you plan on using to your Dosh account before making this purchase.

Some data points (DPs) indicate that you would need the card linked 24 hours before your purchase, but my experience has been quicker.

The cashback is usually instant, and the maximum cashback from Office Depot per day is $10.

Stack 2: Payce

Another cashback app that you can use at office supply stores is Payce.

The critical thing to remember with Payce is that you must activate the deals each month to trigger the cash bonus.

You must also link the credit cards on the app before purchasing.

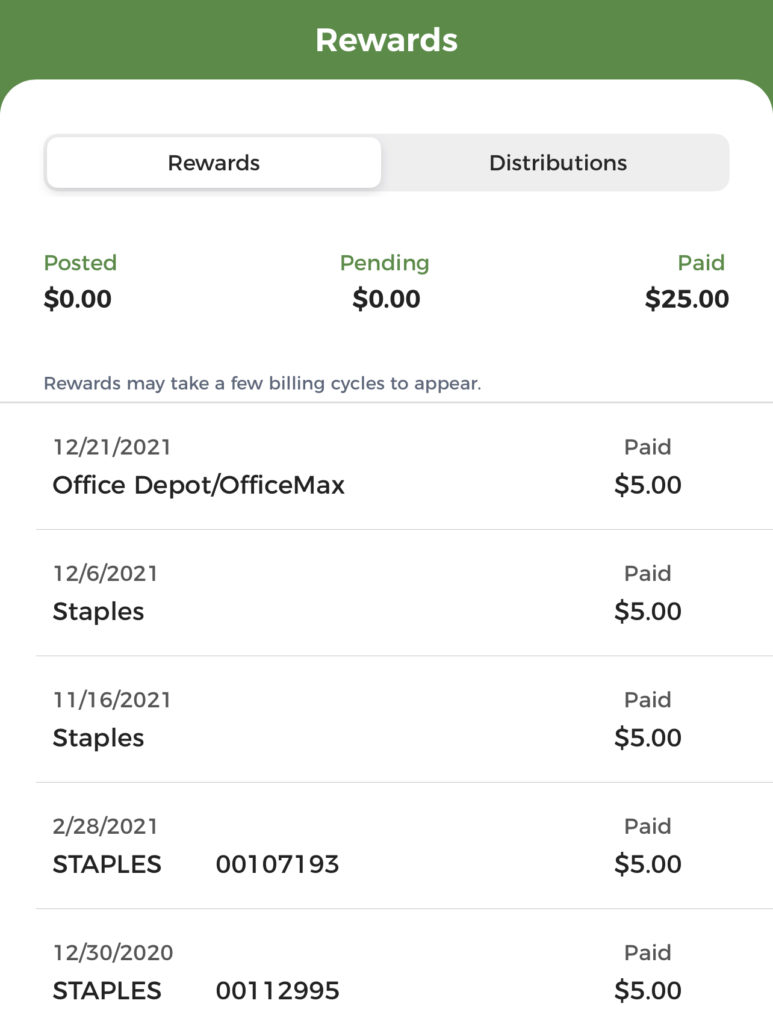

Stack 3: Bank Offers

After setting up DOSH and PAYCE, check your bank offers to see if they have cashback opportunities with Office Depot or Office Max.

I use the Cardpointers Chrome Extension to automatically add all my bank offers to my credit cards so I don’t forget them.

Easy Steps To Maximize This Mastercard Gift Card Promo

STEP 1:

We announce these gift card deals on our Travel Miles and Points Facebook Group. It is free to join.

STEP 2:

- Set up Payce by linking the card you plan to use.

- Add/Activate any Office Depot/Office Max bank offers.

STEP 3:

The following options will trigger the discount:

Option 1: Buy two (2) $200 Mastercard Gift Cards (MCGC)

Option 2: Purchase one (1) $200 MCGC and one (1) $100 MCGC

Option 3: NEW! Buying 3 X $200 gift cards can trigger the discount twice. Thus, buying $600 worth of gift cards (3 X $200) will give a discount of $30 ($15 X 2)

Update: The New $200 Gift Cards now have an activation fee of $7.95.

| Options | Total Cost | With $15 Discount | Profit |

|---|---|---|---|

| A. Two (2) $200 MC gift cards for 207.95 each. | $415.90 | $400.90 | -$.90 |

| B. One (1) $207.95 MC and one (1) $106.95 VGC | $314.90 | $299.90 | $.1 |

| C. Three (3) $207.95 MCGCs | $623.85 | $593.85 ($30 off) | $6.15 |

STEP 4:

They also typically offer these cash-back deals from multiple bank credit cards – both consumer/personal and business cards – so make sure to check all your credit card offers.

Earn the $15-$30 discount, cashback from Dosh, Payce, or bank offers, and credit card points with just one swipe of your linked credit card.

Pro-Tip: If no gift cards are left on the racks, ask any employee to check the back office. Sometimes, they forget to replenish when the cards on display run out.

STEP 5:

If you want to rack up more points, try visiting the store a few times during the promotional week.

That way, you can keep repeating the process and stack extra points for awesome rewards!

Caution: Only purchase the number of gift cards that you can comfortably use in the future. Later in this post, I will list the best ways to redeem these gift cards. Also, since these purchases are charged to your credit card, please be mindful to purchase an amount you can quickly pay in full once your credit card statement comes around. It is NEVER a good idea to pay banks hefty bills. Hence, do not employ this strategy if you anticipate difficulties settling your bill in full on or before the due date.

Best Ways To Use These Gift Cards

You can use these gift cards to cover any of the below expenses:

- Estimated Taxes

- Medical Bills

- Utilities: Electricity, Water, Internet, Phone, Garbage, etc.

- Groceries

- Gas (you need to pay inside)

- Auto Insurance

- Home Insurance

- Car Repair/Maintenance

- Restaurants

- Shopping (in-store and online)

- Home Mortgage via Plastiq

Frequently Asked Questions (FAQs)

1. When Does Office Depot/Office Max Announce These Gift Card Sales?

The only way to find out whether there is a gift card sale is to drop by Office Depot on a Sunday.

We also announce it on our free Travel Miles and Points Facebook Group.

2. How Often Does Office Depot/Office Max Have These Gift Cards Sales?

Office Depot/Office Max has been running Visa and Mastercard gift card sales about 1-2X per month.

As stated above, we announce these sales in our free Travel Miles and Points Facebook Group.

3. Do I Need to Register These Gift Cards Before Use?

It is not necessary to register these gift cards before use.

If the gift cards are not registered, you can complete your online purchases using any billing address.

However, no worries if you run into any issues using these gift cards online!

Just register the cards like you normally would, and that should fix the problem.

4. When Should I Use These Gift Cards?

These gift cards are considered debit cards, so you can use them anywhere debit cards and credit cards are accepted in the United States.

This blog post has a list of ideas on where you can use these gift cards.

5. When Should I Not Use These Gift Cards?

We do not recommend using these gift cards in the following scenarios:

- Do not use gift cards when purchasing high-ticket items that require purchase protection. Instead, I’d use a credit card that offers purchase protection or an extended warranty.

- Do not use gift cards when you will likely need to return items in the future.

Final Thoughts

I am a huge fan of these promotions and try to take advantage of them at every opportunity.

I strongly recommend doing the same, especially if you collect credit card points or have a minimum spending requirement to meet.

It is essential to remember that you should only buy gift cards for an amount that you will be able to comfortably pay when your credit card statement arrives.

It is never a good idea to keep a balance on your cards and consequently pay high-interest charges.

That will defeat the purpose of this hobby, which is frugal travel.

Do you plan to swing by Office Depot/Max this week, too?

EDITORIAL DISCLOSURE – Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. The content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.”