ADVERTISER DISCLOSURE: The Frugal Tourist is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as MileValue.com This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Additionally, the content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

This blog post walks you through the steps on how to transfer Chase Ultimate Rewards Points to Singapore KrisFlyer.

Chase Ultimate Rewards Points are a popular travel points currency among both points enthusiasts and frugal tourists like myself.

The reason? They offer the opportunity to redeem points for discounted flights across multiple airlines and free hotel stays.

Since Singapore Airlines KrisFlyer is a transfer partner of Chase, you can essentially accumulate Singapore Airlines miles by earning Chase Ultimate Rewards (UR) points.

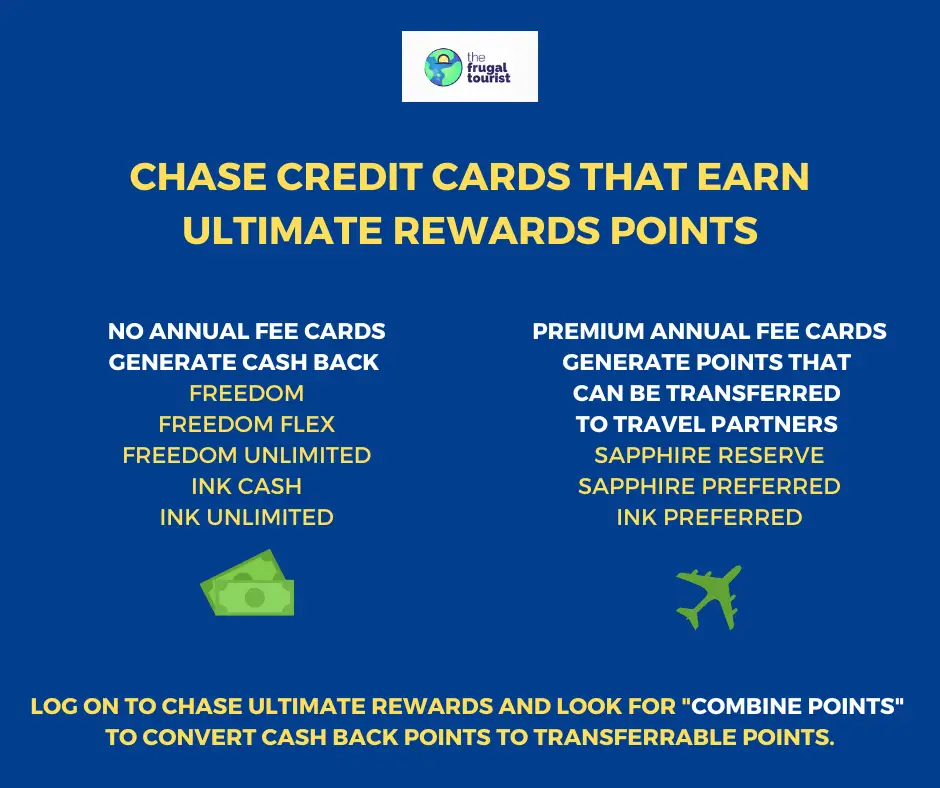

Earning Ultimate Rewards Points is relatively easy and straightforward – they are typically earned through generous sign-up bonuses and regular spending using any of the credit cards below:

| Chase Personal Credit Cards That Earn Ultimate Rewards Points | Chase Business Credit Cards That Earn Ultimate Rewards Points |

|---|---|

| Chase Freedom Unlimited® | Ink Business Cash® Credit Card |

| Chase Freedom Flex® | Ink Business Unlimited® Credit Card |

| Chase Sapphire Preferred® Card | Ink Business Preferred® Credit Card |

| Chase Sapphire Reserve® |

Feel free to skip to Instructions on How to Transfer Chase Ultimate Rewards to Singapore KrisFlyer if you already know why transferring to a Chase premium card is necessary before we can initiate this transfer.

Important: You Need to Have A Chase Premium Card

To transfer your Chase Ultimate Rewards Points to the Singapore Airlines KrisFlyer Program, you must hold at least one of Chase’s three premium cards.

| Chase Premium Credit Cards |

|---|

| Chase Sapphire Preferred® Card Chase Sapphire Reserve® Ink Business Preferred® Credit Card |

Pro Tip: Without one of these three Chase premium cards, you cannot transfer your Chase Ultimate Rewards points to any of Chase’s Travel Partners. In my opinion, the Chase Sapphire Preferred is the best of the three.

Deep Dive on Chase Credit Cards: No Annual Fee Cashback Cards versus Premium Cards

Before we proceed with the steps involved in transferring Chase Ultimate Rewards Points to the Singapore Airlines KrisFlyer Program, we must understand the distinction between no-annual-fee Chase cards and premium Chase cards.

The table below illustrates which category each card belongs in.

| No-Annual-Fee Cards | Premium Cards (AF=Annual Fee) |

|---|---|

| Chase Freedom Flex | Chase Sapphire Preferred ($95 AF) |

| Chase Freedom Unlimited | Chase Sapphire Reserve ($550 AF) |

| Ink Business Cash | Ink Business Preferred ($95 AF) |

| Ink Business Unlimited |

To soften the blow of the steep annual fees on Chase’s premium cards, Chase provides additional benefits to premium card consumers that are not available to those who only have no-annual-fee cards.

One of these valuable premium Chase card benefits is having access to my all-time favorite Ultimate Rewards (UR) redemption option – TRANSFER TO TRAVEL PARTNERS.

Redemption Options for Chase No-Annual-Fee Cashback Cards and Premium Cards

Let’s compare the redemption options of “no-annual fee” cashback cards versus premium travel cards.

Redemption Options for No-Annual-Fee Cards

| No-Annual-Fee Chase Card Redemption Options |

|---|

| Travel Pay Yourself Back Gift Cards Chase Dining Cash Back Pay With Points |

At first glance, you might think that the choices are pretty generous for no-annual-fee cards, specifically, the cashback and gift card options.

But if you want to maximize the value of your Chase Ultimate Rewards Points, it is recommended that you explore redemption methods other than cashback, especially if you also have a premium card.

Unless you have an emergency and need cash, exchanging your hard-earned points for cash or gift cards will not generate the best bang for your buck.

Redemption Options for Premium Chase Cards

| Premium Chase Card Redemption Options |

|---|

| Travel Pay Yourself Back Gift Cards Chase Dining Cash Back Pay With Points Transfer to Travel Partners |

The table above shows that “Transfer to Travel Partners” became a redemption option for Chase premium cards.

This exclusive “transfer benefit” will appear on your Chase Sapphire Preferred, Chase Sapphire Reserve, or Ink Business Preferred accounts because they are all premium cards but not in your no-annual-fee cards.

Transfer Chase Ultimate Rewards Points to Singapore Airlines KrisFlyer

It is essential to underscore that each Ultimate Rewards Point is not created equal.

The value of each Ultimate Rewards Point will depend on whether they originate from a premium card or a no-annual-fee credit card.

Even if no-annual-fee cards generate Chase Ultimate Reward points, you cannot transfer them to partners, including Singapore Airlines KrisFlyer, unless you have one of Chase’s premium cards.

That is why I strongly recommend owning at least ONE premium Chase card.

This incredibly fantastic redemption option would not be possible without one.

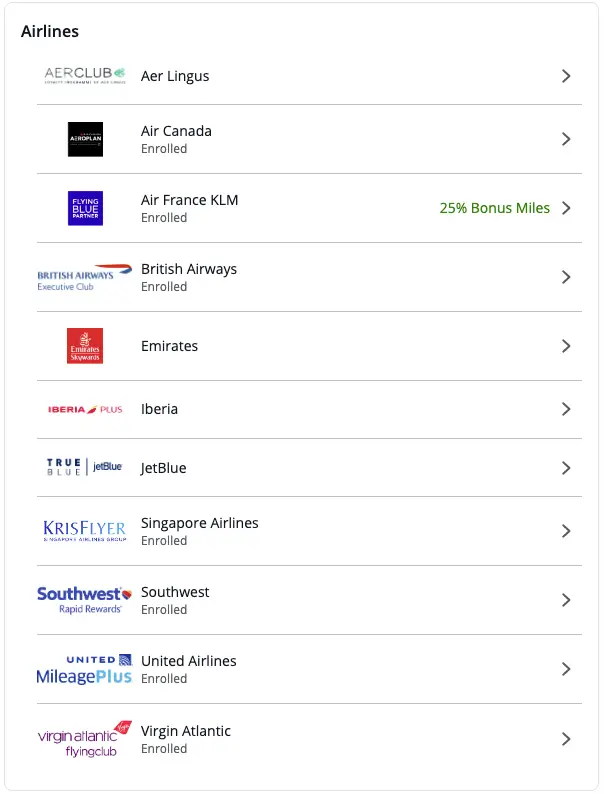

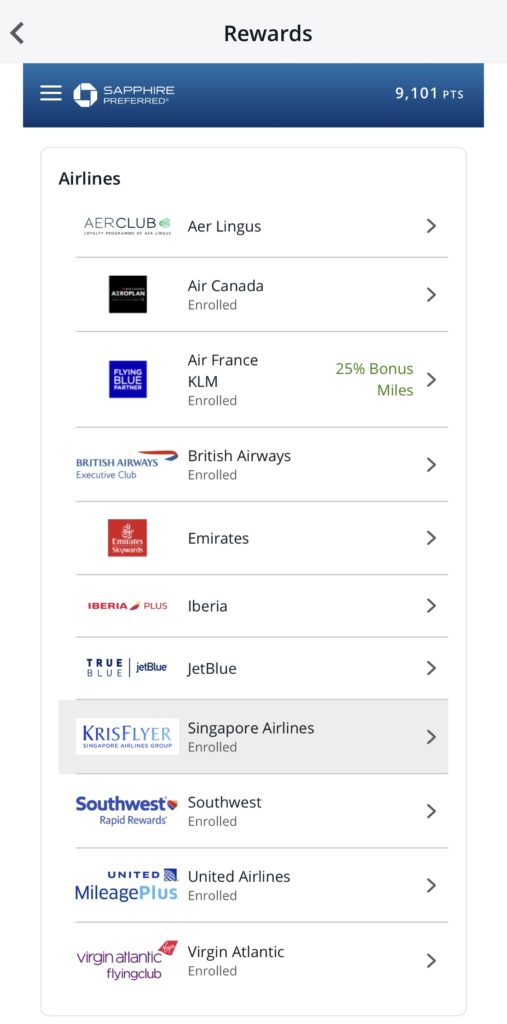

Chase Travel Partners

The image below lists all the other Chase travel partners.

Please check their website regularly.

It is not unusual for Chase to initiate new relationships (Aer Lingus) and terminate old ones (Korean Air).

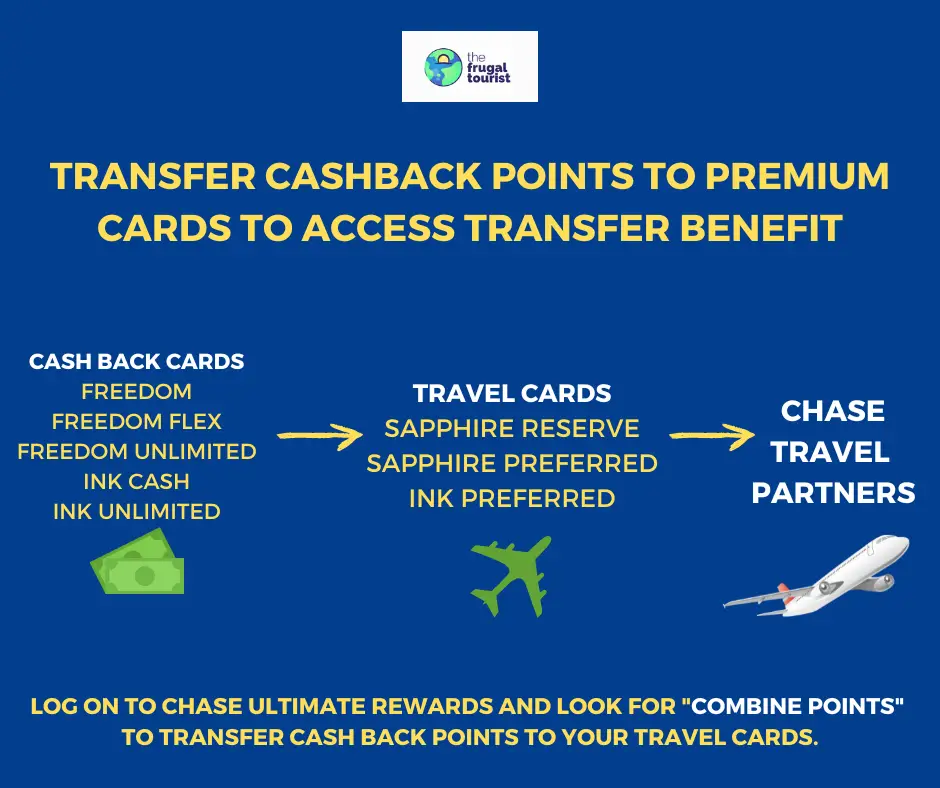

What if my Ultimate Reward Points are in my No-Annual Fee Cashback Cards?

Should you find most of your points in a no-annual-fee card, do not worry.

Chase allows the transfer of points between Chase Ultimate Rewards credit cards.

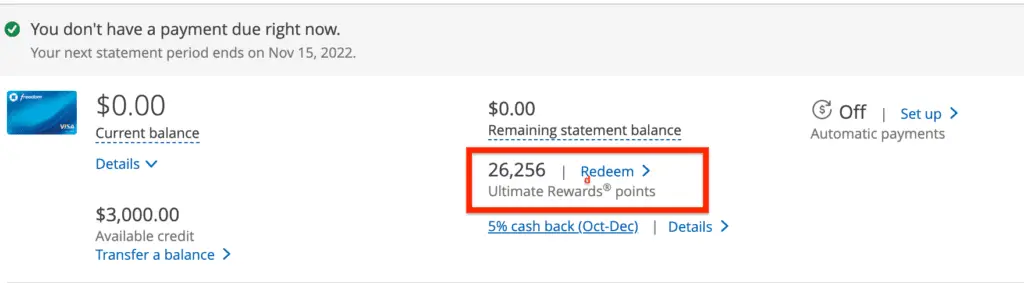

Log in to your Chase account and navigate to any of your Ultimate Rewards-earning credit cards.

Look for the “Ultimate Rewards Points” button, then click “Redeem” to access your points.

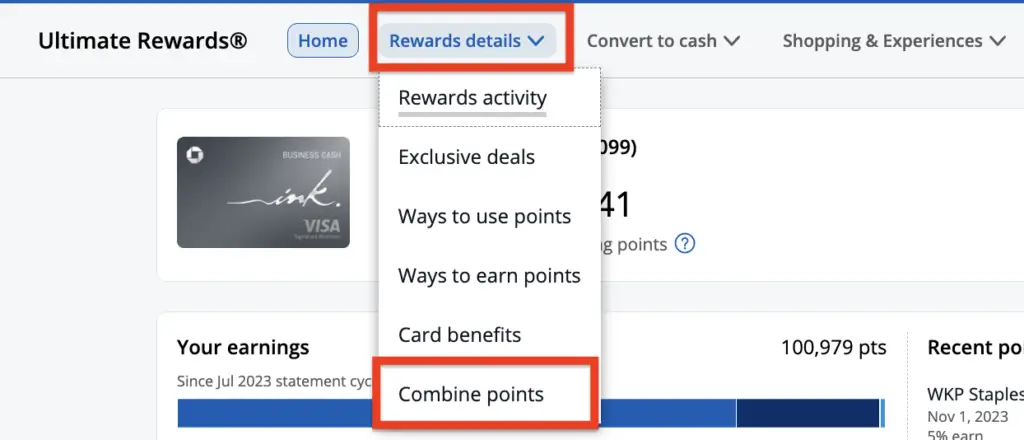

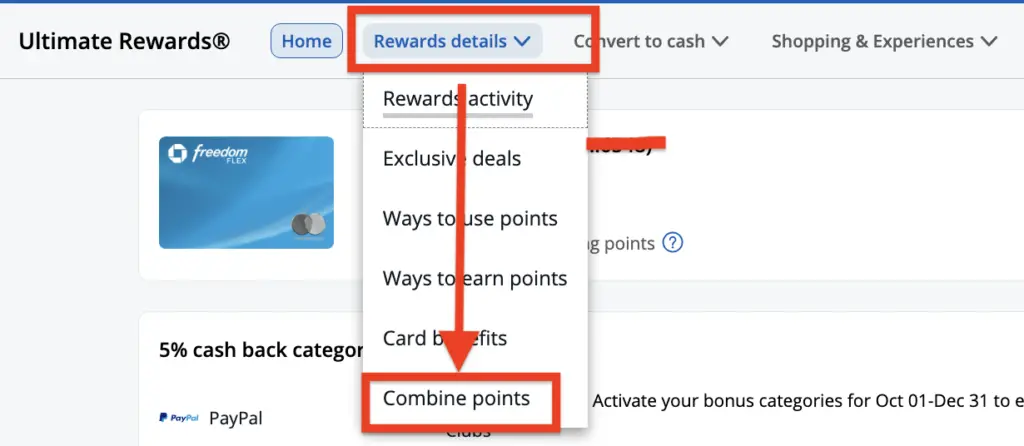

Next, click the “Rewards Details” dropdown arrow to find “Combine Points“.

If this is your first time combining Chase Ultimate Rewards Points, please continue reading for a step-by-step walkthrough.

As a general rule of thumb, I suggest transferring all of your no-annual-fee (cash back) Chase Ultimate Rewards Points to your premium cards, so you can have the ability to move your Chase Ultimate Rewards Points to travel partners, such as Singapore Airlines KrisFlyer anytime.

This transfer also significantly increases the worth of your Ultimate Rewards Points acquired from your no-annual-fee cards, making them all the more valuable.

What if my Personal and Business Credit Cards have Different Log-In Information?

Before transferring your Chase Ultimate Rewards Points between your personal and business credit cards, you must merge your personal and business accounts.

To do so, you can call Chase’s customer service using the phone number on the back of any of your Chase credit cards and request that your accounts be combined into one profile.

“Can you link my personal and business accounts so I only need one username and password?”

During the call, you will be required to provide your personal and business account information to verify your identity. After verification, the agent will then merge both accounts.

Once the accounts are linked, you’ll be able to access all of your accounts with one login and password.

This can save you time and make managing your finances and Chase Ultimate Rewards Points easier.

Whether you have questions about the linking process or need assistance with anything else, Chase’s customer support team is available 24/7 to provide help and support.

Steps for Combining Chase Ultimate Rewards Points (Desktop)

STEP 1:

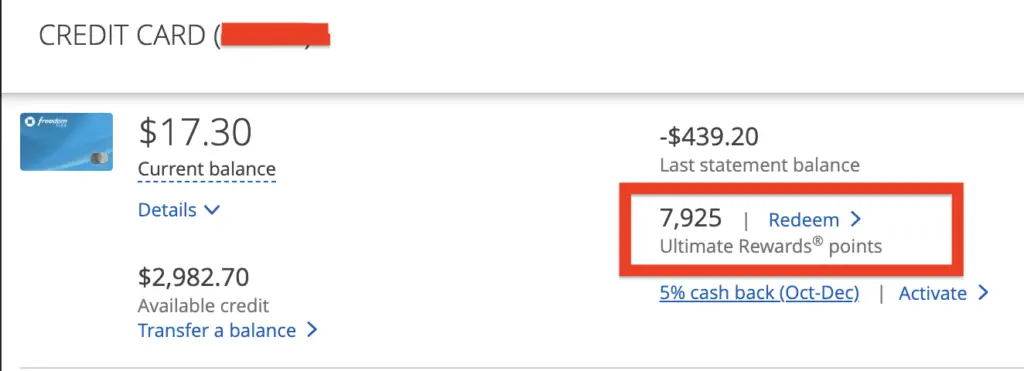

Log in to your Chase profile and select one of your Chase cards that earns Ultimate Rewards points.

In the image below, I selected my Chase Freedom Flex, which currently has 7,925 Chase Ultimate Rewards Points.

I then click “Redeem” in the Ultimate Rewards points section (inside the red box).

STEP 2:

Clicking “Redeem” will lead you to the “Ultimate Rewards” page.

Click the “Rewards Details” drop-down menu, then navigate to “Combine Points“.

STEP 3:

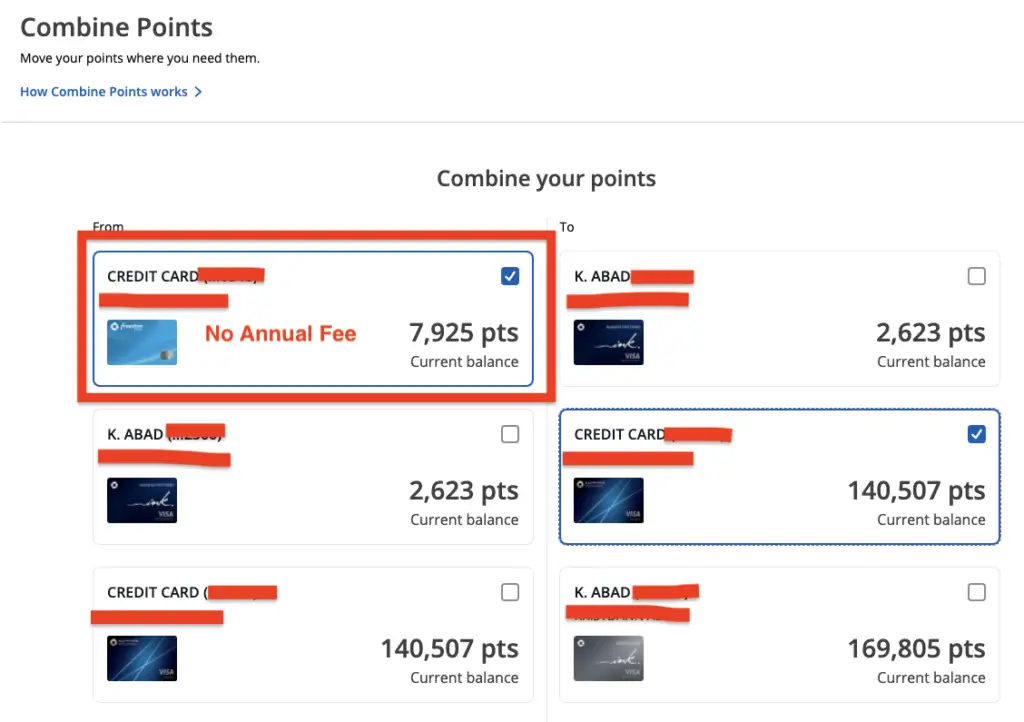

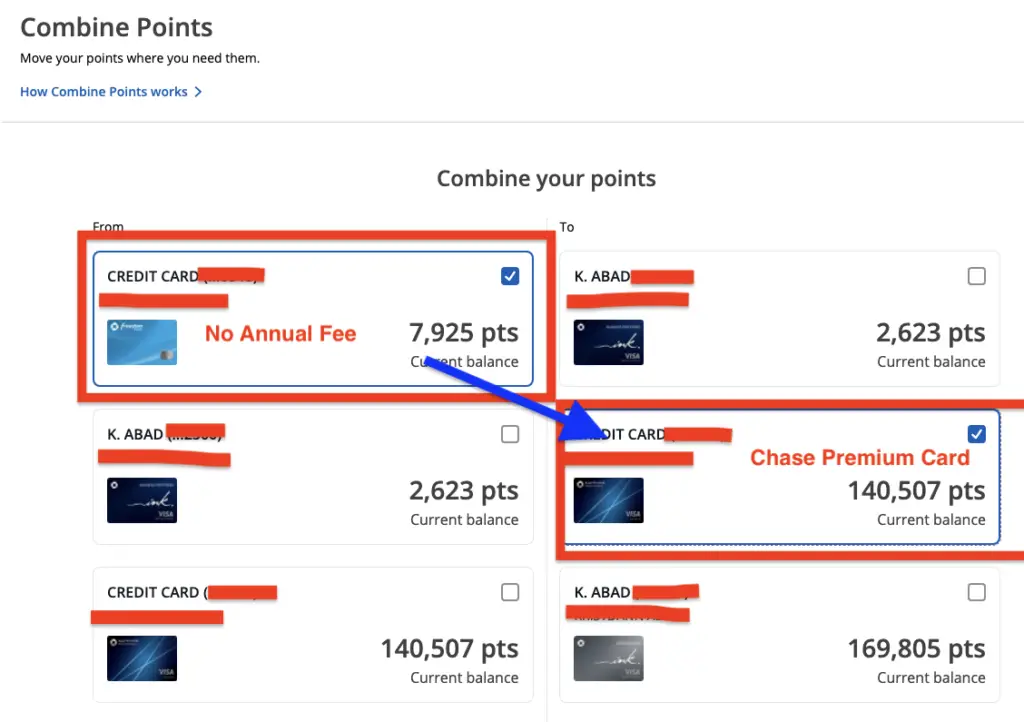

Click “Combine Points,” then select a no-annual-fee card under “From” on the left column.

In the example below, I selected my no-annual-fee Chase Freedom Flex.

This account will have the points you will transfer to a premium Chase card.

STEP 4:

Select a premium card under “To”, which is the Chase card where you want your points to go.

In the image below, I am moving points from my no-annual-fee Chase Freedom Flex to one of my premium cards, the Chase Sapphire Preferred® Card.

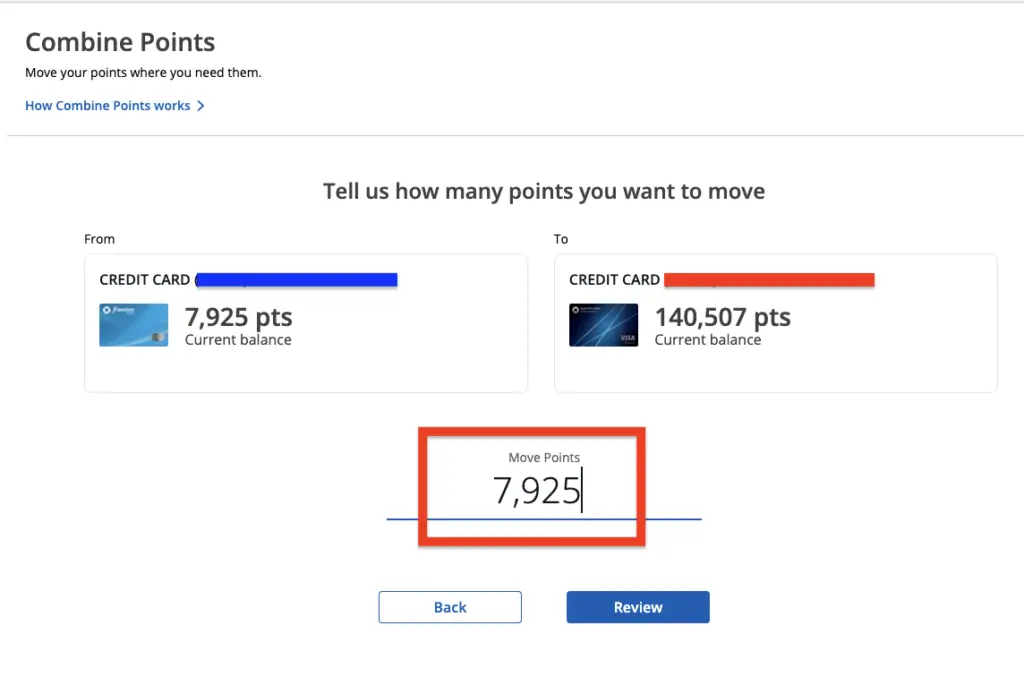

STEP 5:

Initiate the transfer by clicking “Continue.”

You will be directed to a page where you can indicate the number of points you would like to transfer to your premium card.

Since the value of your no-annual-fee Ultimate Rewards points significantly increases when transferred to a premium card, I highly suggest transferring all of your points.

Generally speaking, you would always want your Ultimate Rewards Points stored in one of your premium cards.

Click “Review” once you have made your selection.

If you have two premium cards that include the Chase Sapphire Reserve®, transfer all of your points to the CSR, as that provides the best redemption value among all the other Chase cards.

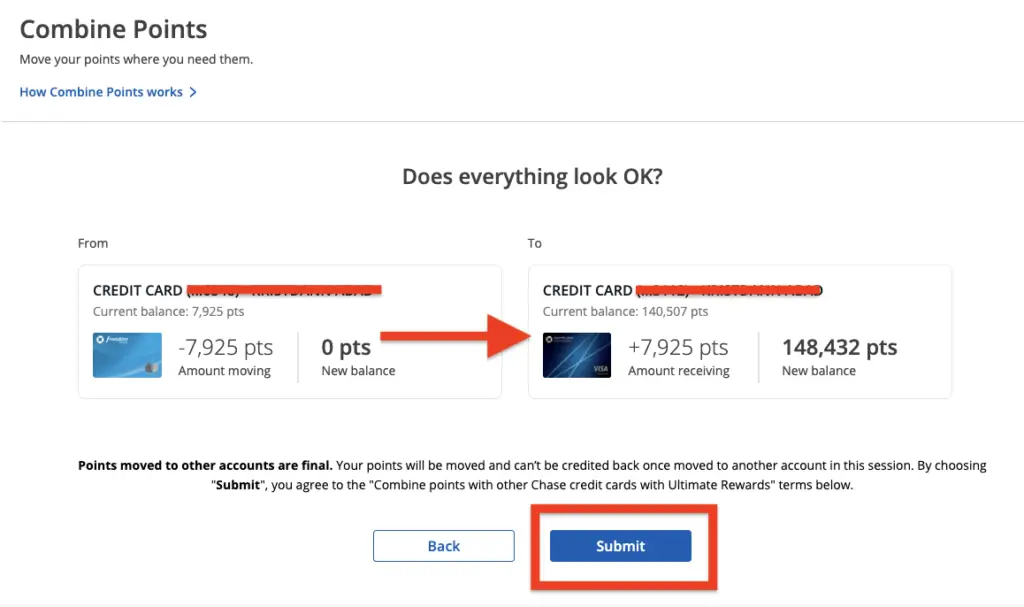

STEP 6:

Chase will give you another opportunity to review your selection.

You want to ensure that you transfer no-annual-fee Ultimate Rewards Points to a premium card and not vice versa.

In this example, I am moving my Ultimate Rewards Points from my no-annual-fee Chase Freedom Flex to the Chase Sapphire Preferred, a premium card.

Confirm & Submit.

STEP 7:

Once you have completed this transfer, you will be notified if the transfer was successful.

Once your points are in your premium card, you can now transfer your Chase Ultimate Rewards Points to your Singapore Airlines KrisFlyer Account (see next section).

Pro Tip: If you are part of a couple/family who lives in the same address, transferring Chase Ultimate Rewards Points between different individual accounts (between player 1 and player 2) is possible. Holding two premium cards is no longer necessary as long as you meet Chase’s criteria as a household member. One player can keep a premium card, and the other can continue accumulating no-annual-fee Ultimate Rewards Points that can be easily transferred to the owner of the premium card. You need to call Chase to initiate this transfer.

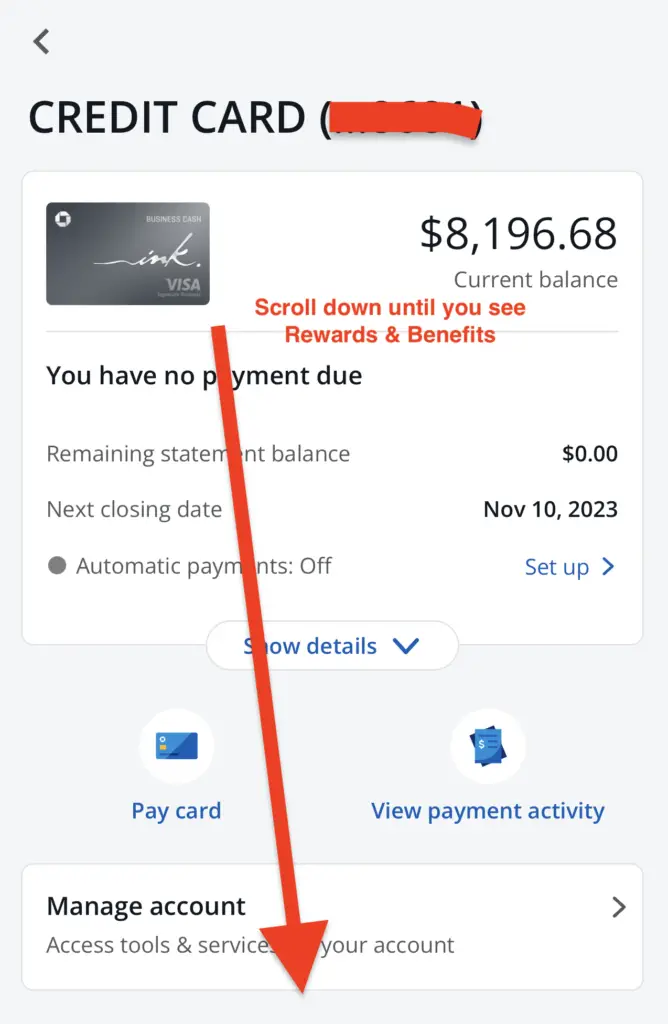

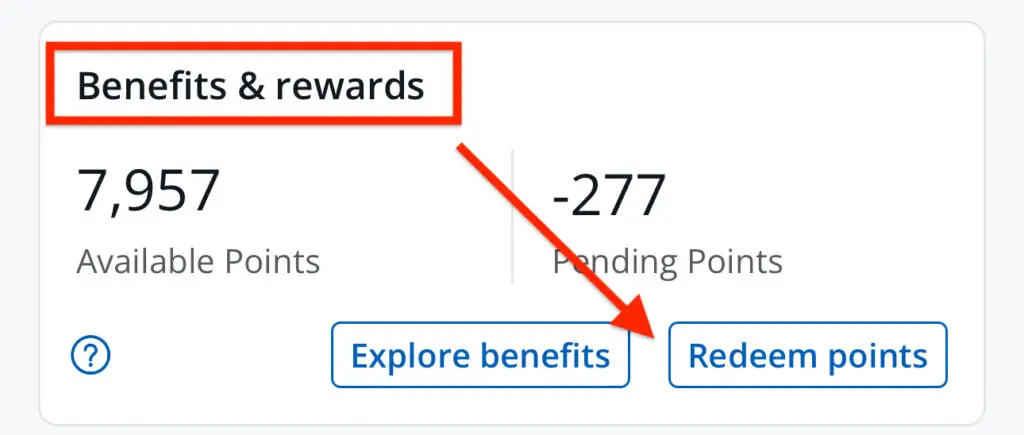

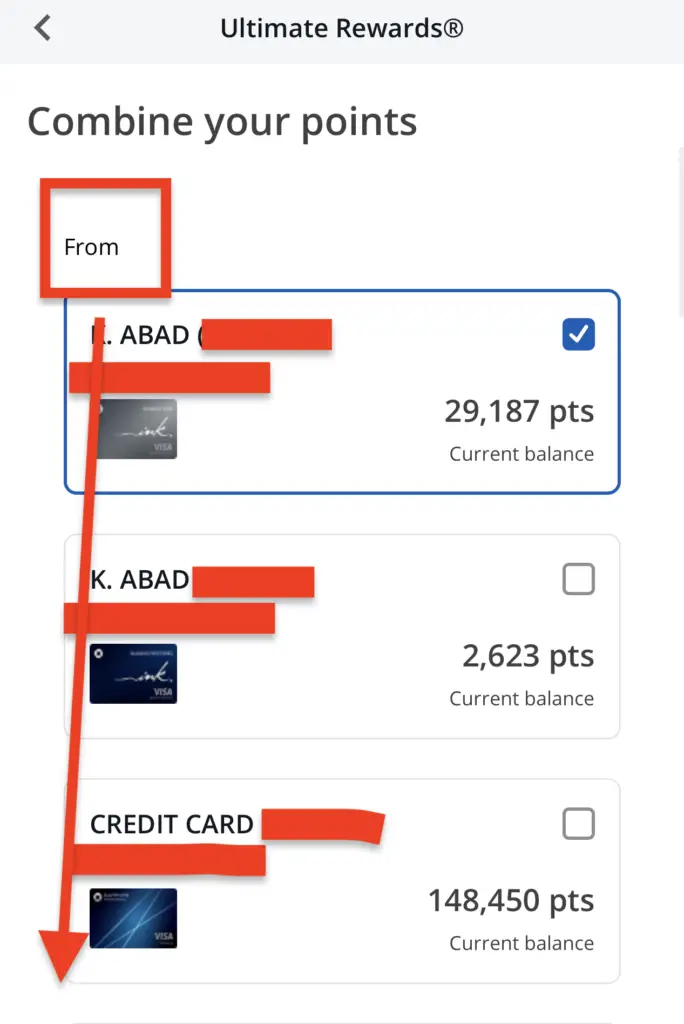

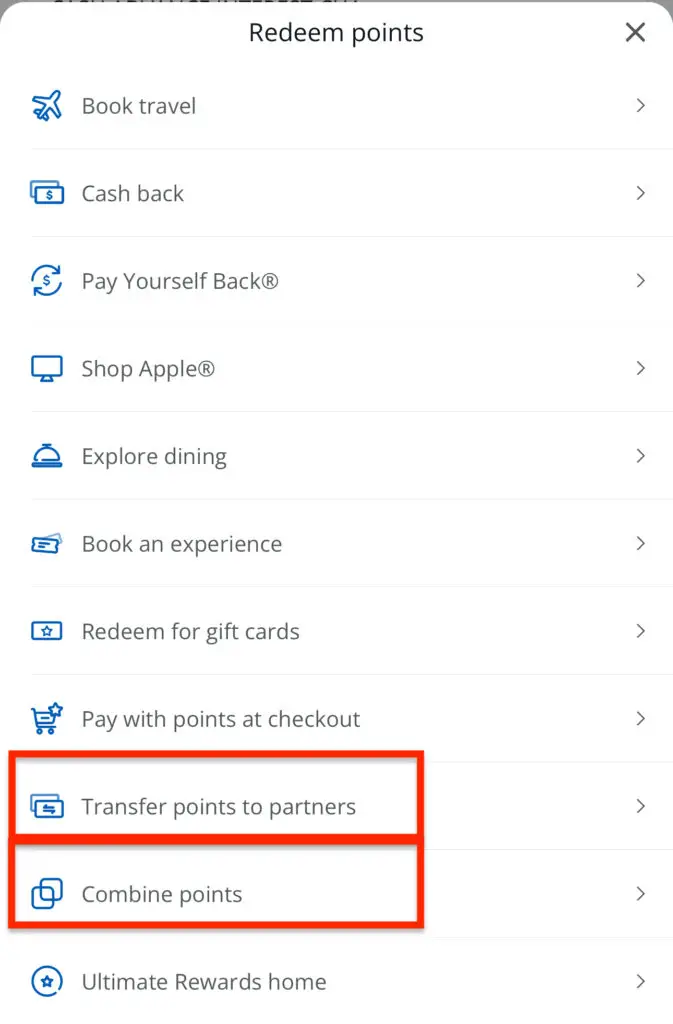

Steps for Combining Chase Ultimate Rewards Points (Mobile App)

STEP 1:

Log in to your Chase profile and select one of your Chase cards that earns Ultimate Rewards points.

In the image below, I selected my Chase Ink Business Cash card.

Scroll down until you see the “Benefits and Rewards” section.

Click the “Redeem Points“.

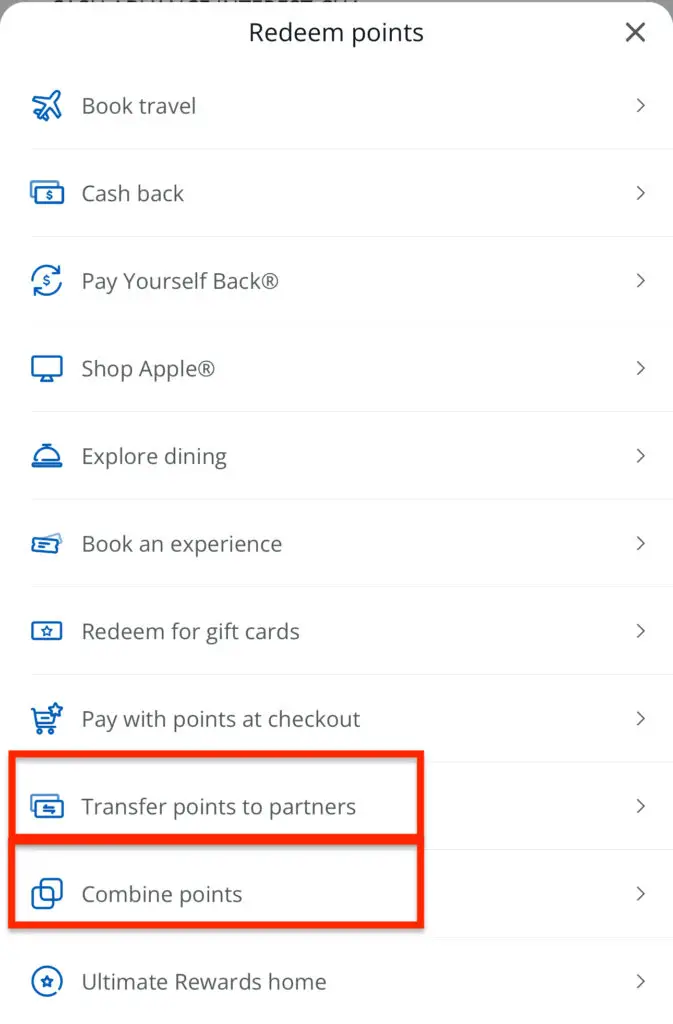

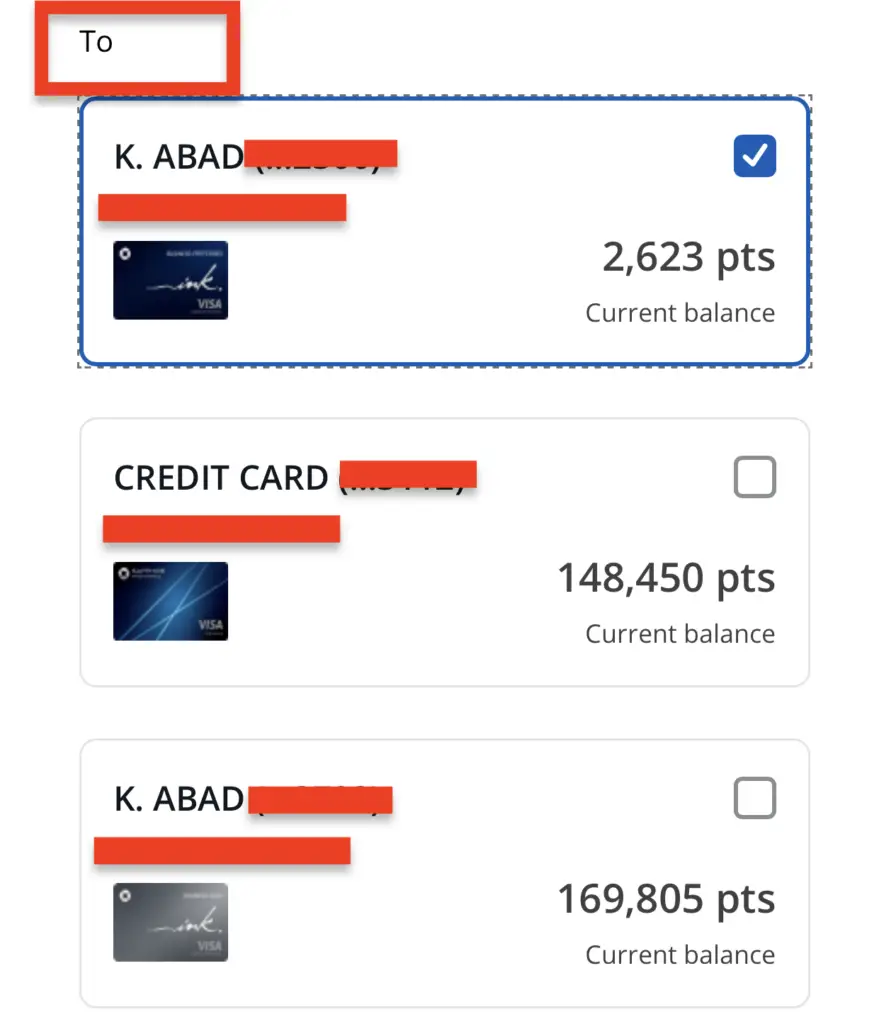

STEP 2:

Navigate down to “Combine Points“.

STEP 3:

Select your “No-Annual-Fee” Chase card under “From“.

Then, select a Chase premium card under “To“.

In the example below, I am moving Chase Ultimate Rewards Points from my no-annual-fee Chase Ink Business Cash card to my Chase Ink Business Preferred card, a premium card.

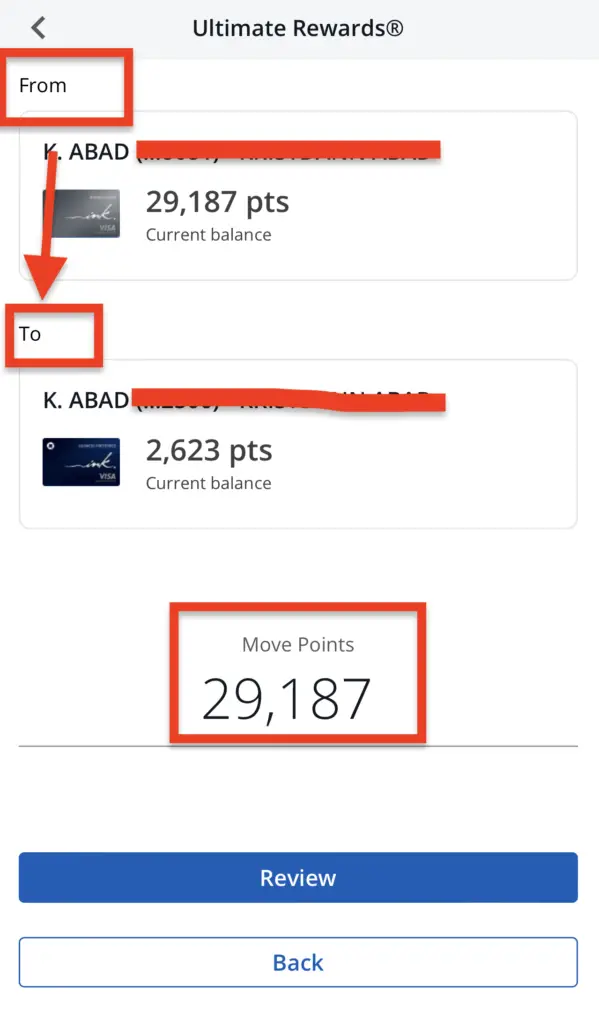

STEP 4:

You will be directed to a page where you can indicate the number of points you would like to transfer to your premium card.

Since the value of your no-annual-fee Chase Ultimate Rewards points significantly increases when transferred to a premium card, I highly suggest transferring all of your points.

Generally speaking, you would always want your Ultimate Rewards Points stored in one of your premium cards.

Click “Review” once you have made your selection.

If you have two premium cards that include the Chase Sapphire Reserve®, transfer all of your points to the CSR, as that provides the best redemption value among all the other Chase cards.

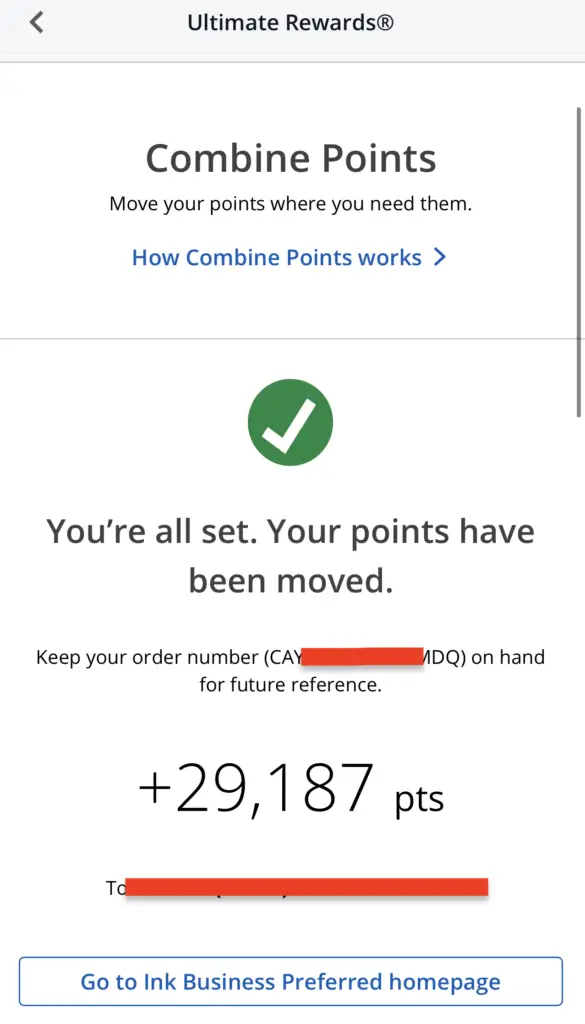

STEP 5:

Chase will give you another opportunity to review your selection.

Again, you should ensure that you are transferring no-annual-fee Ultimate Rewards Points to a premium card and not vice versa.

Confirm & Submit.

Congratulations! You are now ready to transfer your Chase Ultimate Rewards Points to Chase’s many travel partners.

Join Other Points Enthusiasts In Our Free Travel Miles & Points Facebook Group

Transferring Chase Ultimate Rewards to Singapore Airlines KrisFlyer (Desktop)

Transferring to Singapore Airlines KrisFlyer is simple, assuming you already have your Ultimate Rewards Points in one of your premium Chase cards.

STEP 1:

Make sure that you have a Singapore Airlines KrisFlyer Account.

Registering is free.

Once you have your KrisFlyer account number, write it down on paper, as we need it soon.

If you do not yet have a Singapore Airlines KrisFlyer account, click the button below to sign up.

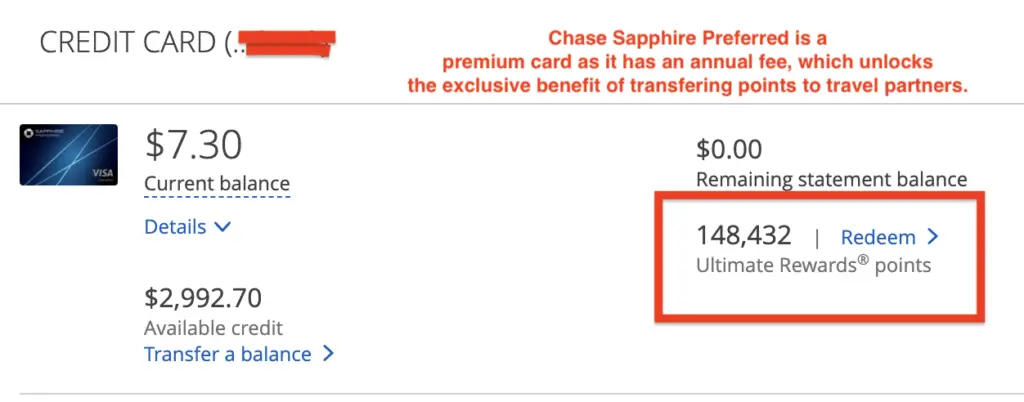

STEP 2:

Go to Chase.com, then Access One of Your Premium Cards.

Each premium card will give you the option to access Ultimate Rewards.

In the example below, the Chase premium card I selected was my Chase Sapphire Preferred card.

Click “Redeem Ultimate Rewards points.” This will lead you to the Ultimate Rewards page.

You can transfer points from your other no-annual-fee Chase cards to your premium card if you do not have sufficient points.

Please see the previous sections for steps on how to “Combine Points.”

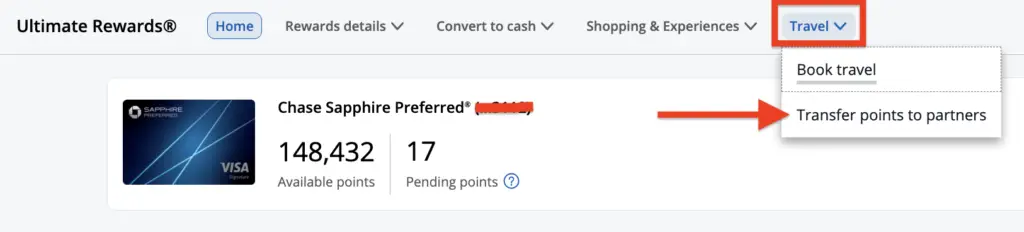

STEP 3:

Click the “Travel” drop-down arrow, then navigate to “Transfer Points to Travel Partners”.

Singapore KrisFlyer is one of Chase’s many travel partners.

STEP 4:

Look for Singapore Airlines KrisFlyer and click the right arrow to proceed with the points transfer.

STEP 5:

Enter your Singapore Airlines KrisFlyer account number.

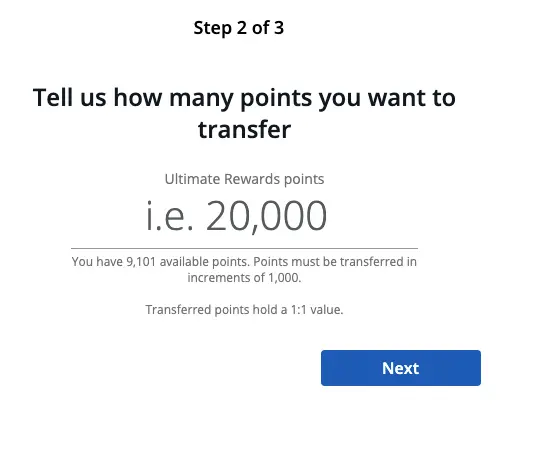

STEP 6:

Enter the Number of Points You Would Like to Transfer to Singapore KrisFlyer.

Type in the number of points you would like to transfer in 1,000 Ultimate Rewards Points increments.

The minimum amount that you can transfer is 1,000 Ultimate Rewards points.

The transfer ratio is 1:1, so 1 Ultimate Rewards Point = 1 Singapore KrisFlyer Mile.

STEP 7:

Verify if all the information you entered is correct, then click “Submit.”

STEP 8:

Wait for Singapore KrisFlyer Miles to Show Up In Your Account

How Long Does It Take for Ultimate Rewards Points to Transfer to Singapore KrisFlyer?

In my experience, Chase Ultimate Rewards points transfer within 24 hours to Singapore KrisFlyer.

However, Chase has stated that transfers may take up to 7 business days.

I suggest immediately checking your Singapore KrisFlyer online account after transferring to verify whether the transfer was completed.

STEP 9:

Book Your Singapore KrisFlyer Award Flight.

Book the award space once the points are in your Singapore KrisFlyer account.

You have 24 hours to cancel the award tickets if plans change.

Transferring Chase Ultimate Rewards Points to Singapore KrisFlyer on the Chase Mobile App

Using the Chase Mobile app to perform the above functions, such as combining points and transferring to travel partners, can initially be confusing.

Here are the steps to navigate the Chase Mobile App so you can quickly transfer your Chase Ultimate Rewards Points wherever you are.

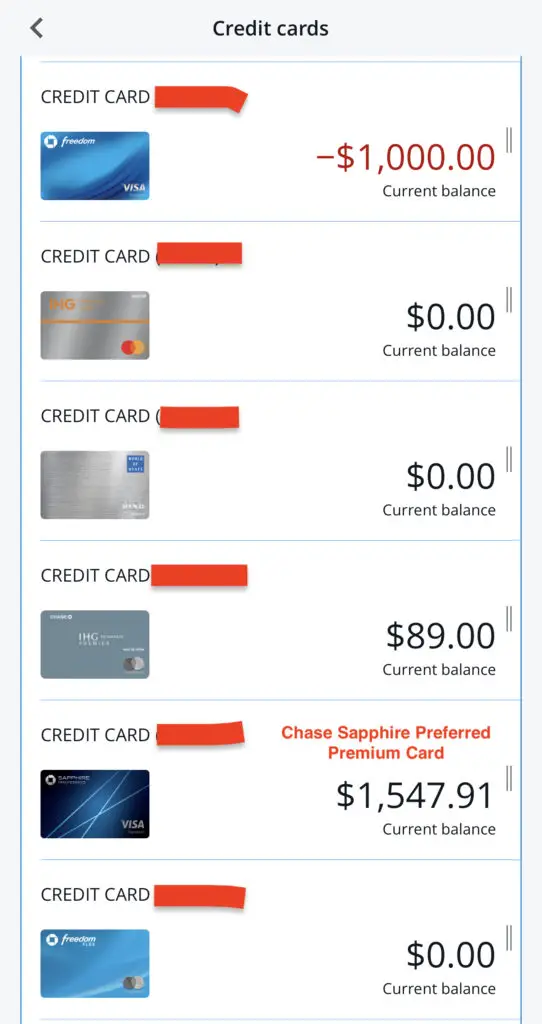

STEP 1:

Log in to your Chase account using your Chase Mobile App, then select a Chase Premium Card.

In this example, I will access my Chase Ultimate Rewards points through my Chase Sapphire Preferred® Credit Card.

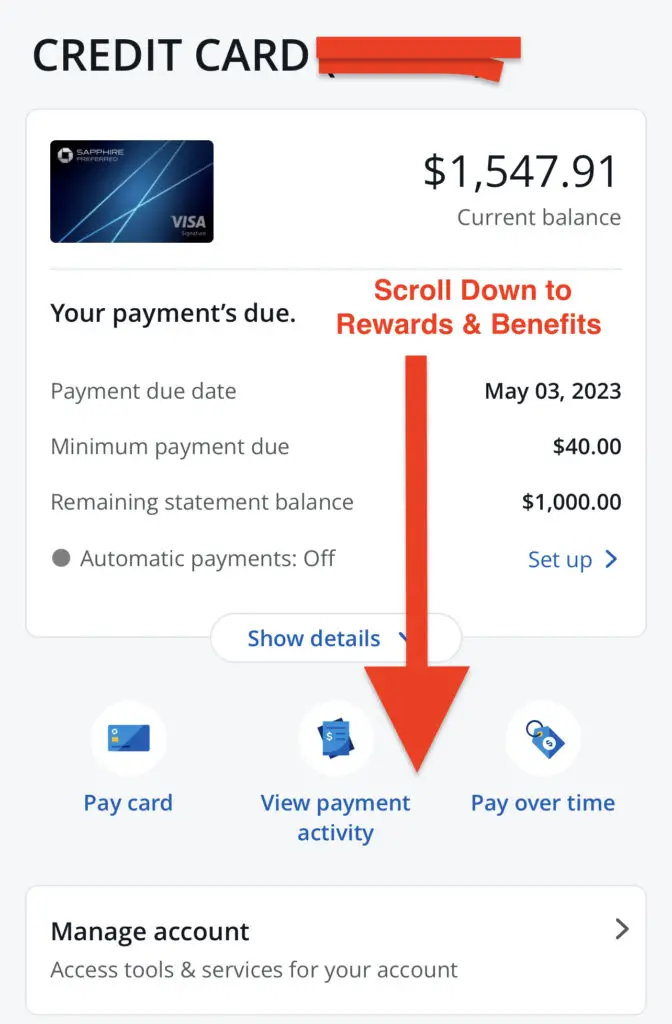

STEP 2:

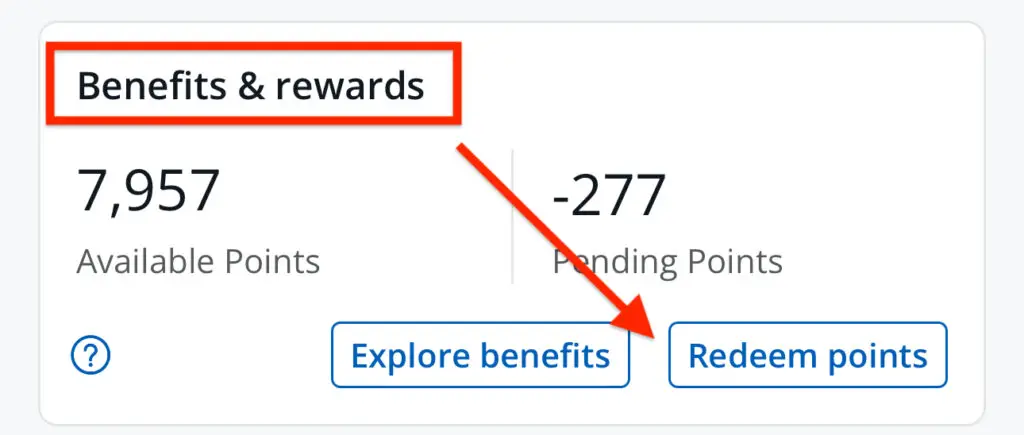

Under your premium card, navigate to the “Benefits and Rewards” section, then click “Redeem Points”.

STEP 3:

Navigate to “Transfer Points to Partners“.

STEP 4:

Select Singapore Airlines from the list of Chase’s travel partners.

Singapore Airlines Program Details:

- All Ultimate Rewards points transferred to your KrisFlyer account will be subject to KrisFlyer’s Terms and Conditions and cannot be transferred back to your Chase Ultimate Rewards account.

- Taxes, government-imposed fees, and applicable charges may apply on all KrisFlyer miles redemptions and upgrades, subject to your KrisFlyer program agreement.

- Individual restrictions may apply.

- Chase is not responsible for the availability of specific flights, routes, travel dates, or other promotions or considerations of the KrisFlyer program.

- Redemptions are subject to availability. Chase is not responsible for redeeming KrisFlyer miles.

- Visit singaporeair.com for more information, including full terms and conditions.

- Award flight bookings for household members should be booked through your nominated KrisFlyer Redemption Group, which may include up to 5 nominees.

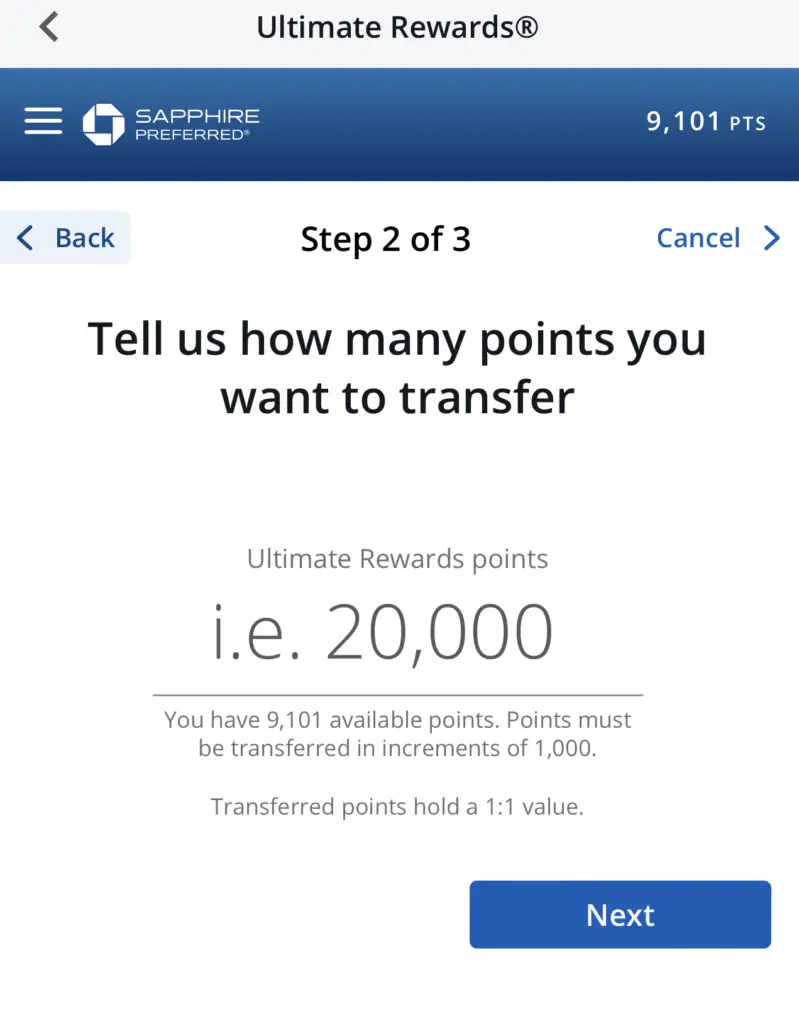

STEP 5:

Enter your Singapore KrisFlyer Account Number.

Before transferring your points, sign up for a Singapore KrisFlyer account, as Chase will require this information.

STEP 6:

Indicate the number of Chase Ultimate Rewards Points you would like to transfer to Singapore KrisFlyer.

Before you transfer, remember that this is a one-way street.

Any points transferred from Chase to Singapore KrisFlyer can not be reversed, so make sure the award space is available before proceeding.

After typing in the number of Chase Ultimate Rewards Points you would like to transfer, click “Next”.

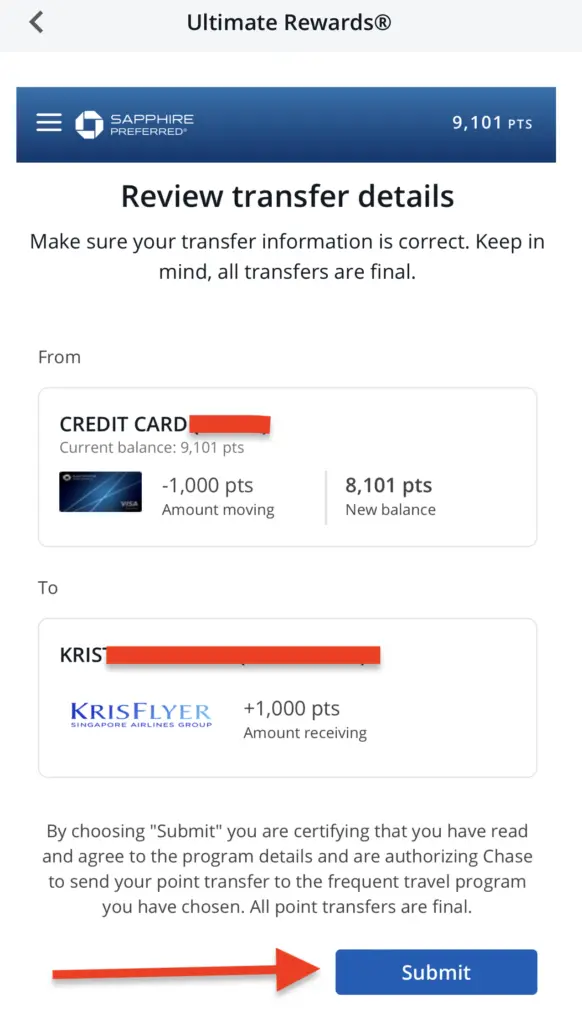

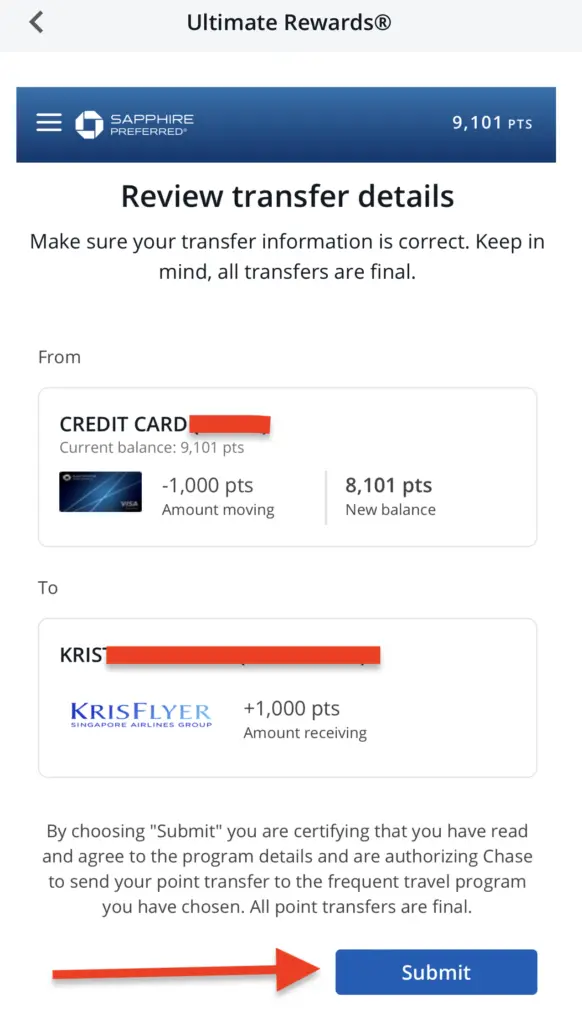

STEP 7:

Review transfer details, then “Submit.”

Reminder to only transfer points when you see award availability.

The transfer process is irreversible – you can not transfer Singapore KrisFlyer miles back to Chase Ultimate Rewards.

STEP 8:

Run your award search on Singaporeair.com.

If you are new to award searches, please check the section below.

How to Search for Award Space on Singaporeair.com

STEP 1:

Create a Singapore Airlines KrisFlyer Account

Log on to Singaporeair.com. If you do not have a Singapore KrisFlyer account, you can enroll by clicking the button below.

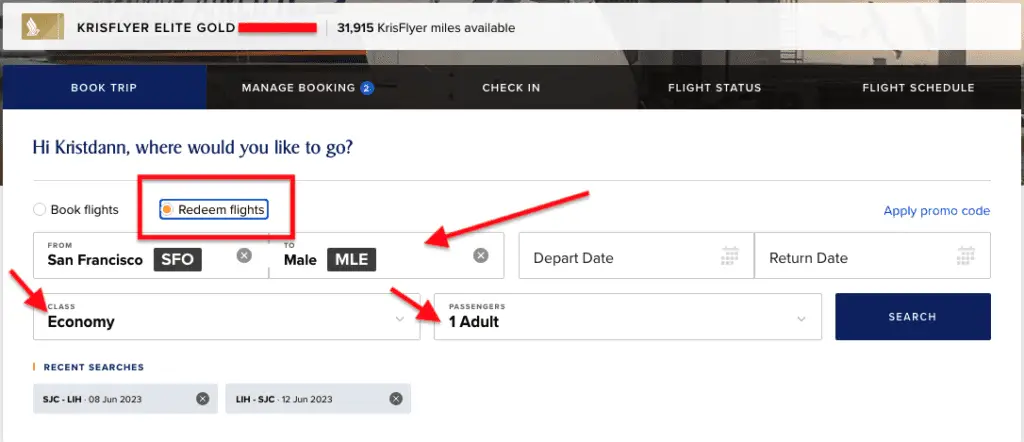

STEP 2:

Enter the Award Search Ticket Details

When booking an award ticket on Singaporeair.com, accurately fill out the following information:

- Click “Redeem Flights”

- Enter your departure city and destination

- Choose your cabin: Economy, Premium Economy, Business, or First

- Enter the number of passengers

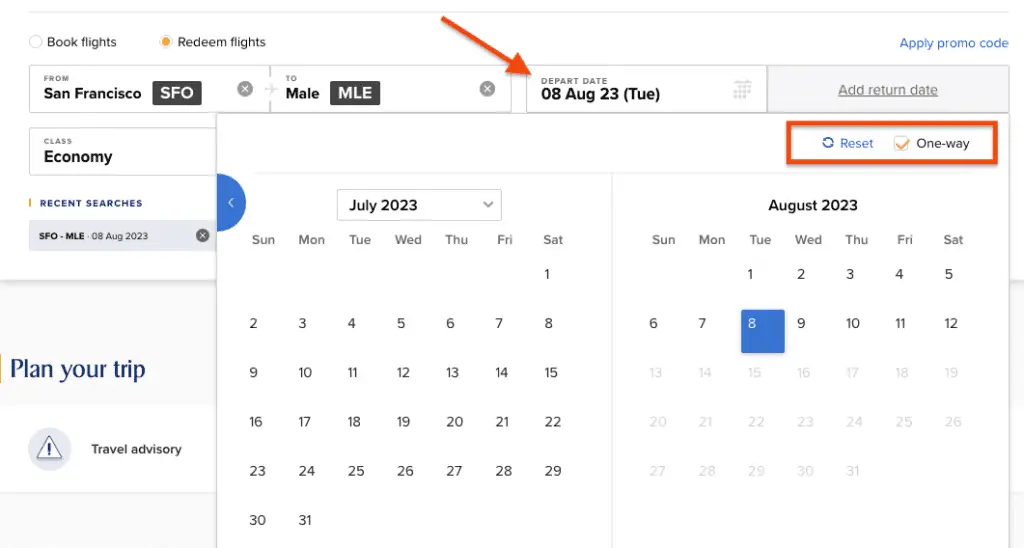

STEP 3:

Select One-Way or Round Trip

Enter your dates when flying round-trip. If booking a one-way itinerary, tap the “Depart Date” box to unlock the calendar feature.

Select “One-Way” on the upper right-hand corner of the calendar. See image.

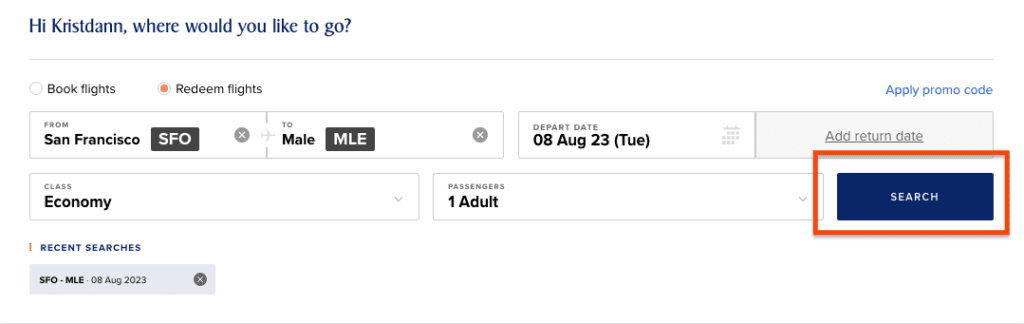

STEP 4:

Click Search

Once you enter the particular details of your preferred award ticket, click “Search.”

STEP 5:

Explore Partner Award Availability

| Singapore KrisFlyer Miles Can Be Used to Book The Following Flights |

|---|

| Singapore Airlines |

| Silk Air |

| Star Alliance Partners: United, Lufthansa, Swiss, Austrian, Thai, ANA, Asiana, EVA, and Air Canada. |

| Other Airline Partners like Alaska Airlines |

Singapore Airlines allows you to search for flights on Singapore Airlines/Silk Air, Star Alliance Partners, and other Airline Partners.

If your award search did not churn out decent award availability, you could click “Star Alliance” and/or “Other Partner Airlines” to see if award flights are available through Singapore Airlines partners.

I recommend comparing the various available awards and selecting the best flight for you.

STEP 6:

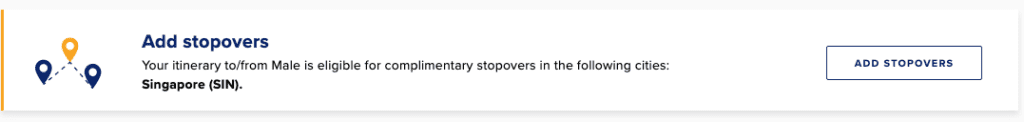

Determine if you are eligible for a stopover

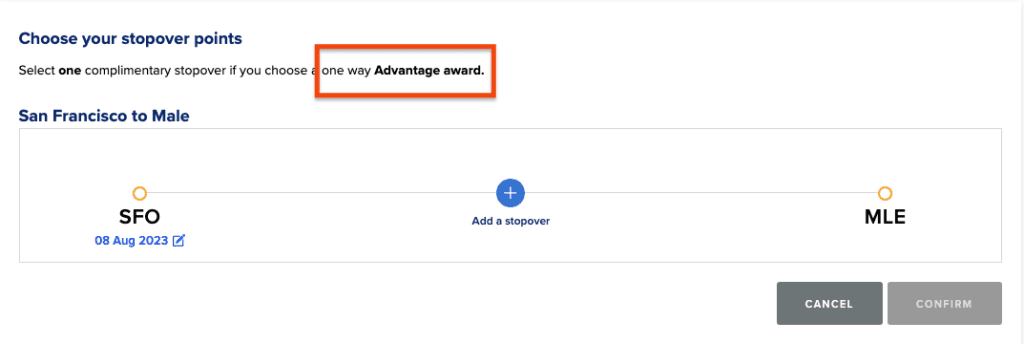

Select a complimentary stopover, if applicable. Stopovers are only available for flights booked on Singapore Airlines.

A one-way Advantage Award and a round-trip Saver Award are eligible for a free stopover.

Please review the related post below to determine if you can receive a complimentary stopover for up to 30 days.

| Singapore Airlines Stopover Rules |

|---|

| You can add two complimentary stopovers if you are redeeming a round-trip Singapore KrisFlyer Advantage Award. |

| You can add one complimentary stopover if you are redeeming a round-trip Singapore KrisFlyer Saver Award. |

| You can add one complimentary stopover if you are redeeming a one-way Singapore KrisFlyer Advantage Award |

STEP 7:

Select Your Flights

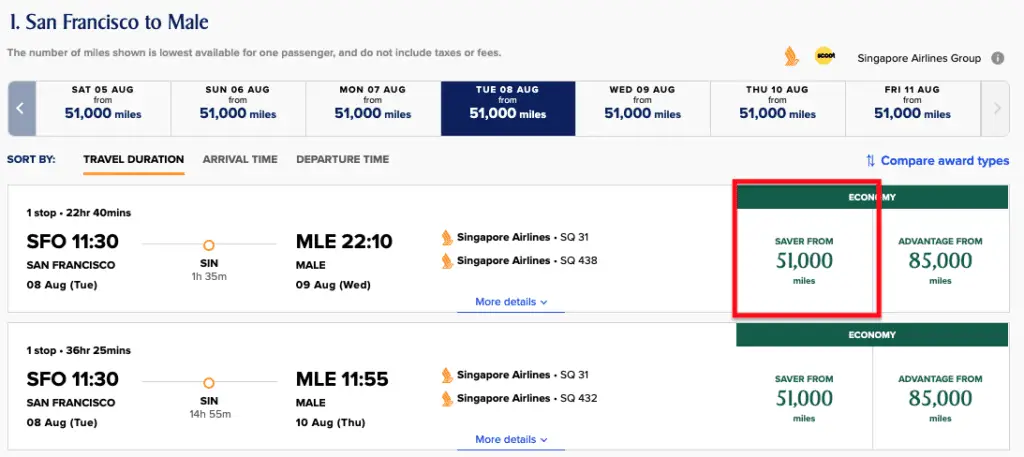

Before selecting your flights, be aware of Singapore Airlines’ two different award types: Saver Awards and Advantage Awards.

Saver Awards

These are capacity-controlled award seats that require fewer KrisFlyer miles. Since they are limited in quantity and highly in demand, my strategy for obtaining these inexpensive saver awards is to purchase them as soon as the Singapore Airlines award calendar opens up, typically around 355 days before travel.

Advantage Awards

Once saver awards are sold out, Advantage Award tickets will be your only alternative if you want to use your KrisFlyer miles. These tickets are considerably more expensive than Saver Awards, so I try to avoid booking them whenever possible. If you have some flexibility in your travel schedule, aim for Saver Awards instead of Advantage Awards.

Step 8:

Call Singapore Airlines to Verify That Award Space is Available Before you Transfer your Points

This is an essential step that I recommend you carry out before transferring Chase Ultimate Rewards Points to the Singapore Airlines KrisFlyer Program. Before transferring your Chase points, ensure there is available award space.

Pro-Tip: Sometimes, the award seats Singapore Airlines shows as available are actually phantom seats and are not really available to be booked.

When you see the award space available, follow the prompts until you reach the payment page. If you can get to the payment page without any issues, then that means that the award is available to book.

After verifying award space availability, you can initiate your transfer. Remember that you can no longer reverse the process once your Ultimate Rewards Points have been successfully moved to the Singapore Airlines KrisFlyer Program.

As of October 2022, Singapore Airlines KrisFlyer Program can no longer put award seats on hold.

STEP 9:

Wait for Chase Ultimate Rewards Points to Show Up In Your Singapore KrisFlyer Account

Call Singapore KrisFlyer again once your points appear in your KrisFlyer Account so that you can book your award flights or award seats online by following the steps outlined above.

Singapore Airlines Award Redemption Terms

Here are the general terms regarding this award chart as taken from the Singapore Airlines website:

- A round-trip award ticket requires twice the number of KrisFlyer miles shown on this award chart.

- Redemption is not permitted on Singapore Airlines codeshare flights operated on the aircraft of other airlines.

- Award tickets are subject to seat availability at the time of redemption, which may be capacity-controlled by the airline at its sole discretion.

- Singapore Airlines Suites and First Class are only available on selected Singapore Airlines flights.

- Singapore Airlines Premium Economy is only available on selected Singapore Airlines flights.

- A one-way Saver Award does not include a complimentary stopover. A round-trip Saver Award includes one complimentary stopover of up to 30 days. Stopovers may be added on singaporeair.com on eligible award redemption ticket types.

Frequently Asked Questions

How Fast/Long Does It Take For Chase Ultimate Rewards Points To Transfer to the Singapore Airlines KrisFlyer Program?

If you are doing this transfer for the first time, completing the process may take a few days.

Conversely, if you have already transferred Chase Ultimate Rewards Points to Singapore KrisFlyer in the past, then the transfer should take about 24-48 hours. This can change over time, though.

Do Singapore Airlines KrisFlyer Miles Expire?

Yes, Singapore Airlines KrisFlyer miles expire after 36 months and do not reset even with activity.

When Does Singapore KrisFlyer Make Award Tickets Available

355 days in advance.

Credit Cards that Earn Chase Ultimate Rewards Points

| Credit Cards | Details |

|---|---|

| Credit Cards that earn Ultimate Rewards (UR) Points | 1 Chase Ultimate Rewards. |

| Chase Sapphire Preferred® Card | Welcome Offer |

| Chase Sapphire Reserve® | Welcome Offer |

| Ink Business Preferred® Credit Card | Welcome Offer |

| Credit Cards that can convert into Chase Ultimate Rewards (UR) Points* | Steps to Convert |

| Chase Freedom Flex® | Welcome Offer |

| Chase Freedom Unlimited® | Welcome Offer |

| Ink Business Cash® Credit Card | Welcome Offer |

| Ink Business Unlimited® Credit Card | Welcome Offer |

Summary

Final Thoughts

Without a doubt, flying for free is my primary motivation for accumulating travel miles and points.

Whether you aim for premium cabins or discounted airfare, Chase Ultimate Rewards is a travel currency that I strongly encourage you to earn because of how flexible their points are. And they are relatively easy to earn too!

Aside from being a transfer partner of Hyatt – the frequent recipient of my Chase Ultimate Rewards Points transfers, Singapore Airlines KrisFlyer is another Chase travel partner that can potentially have rewarding redemption options.

Every so often, Singapore Airlines runs promotions where they offer specific routes for a discount. This can provide incredible value for those who want to get as much mileage from their points.

Lastly, I hope this blog post made the transfer process easier. Safe travels!

EDITORIAL DISCLOSURE – Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. The content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

hey i just called SA and they no longer hold flights over the phone

HI Ron, Thanks for the heads up. I will update the blog post.