ADVERTISER DISCLOSURE: The Frugal Tourist is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as MileValue.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Great news! You just received your brand new credit card in the mail, bringing with it an exciting opportunity to earn a well-deserved, generous welcome bonus.

The thrill of getting approved and receiving your new travel rewards credit card is exhilarating.

However, let’s be honest, meeting the minimum spend requirement can sometimes be a bit daunting.

But fear not!

In this blog post, I will share some tips and ideas to help you earn those amazing welcome bonuses so you can be on your way to your next vacation on miles and points.

What is Traveling Using Credit Card Points?

One of my favorite frugal travel strategies is having the banks and credit card companies pay for most of my travel expenses.

This hobby is called traveling with miles and points.

It is the art of using miles, points, and loyalty programs to travel for free or at a reduced cost.

I do this by responsibly applying for travel credit cards that give generous welcome bonuses, which I then use to redeem for discounted or free airfare or hotel stays.

But it is not as simple as it sounds.

Credit card companies (banks) will naturally expect something in return in exchange for those miles and points.

And that’s usually in the form of a minimum spending requirement or MSR.

This is the amount of money you must spend on your credit card before a specific deadline to earn the welcome bonus.

Meeting the required spend on or before the due date is crucial.

Unfortunately, if you miss it, you’ll lose your welcome bonus, so let’s ensure you don’t miss out!

Before diving in, it’s super important to fully grasp the ins and outs of any credit card offer.

Take a moment to evaluate and understand the terms so you are certain that the spending requirements match your lifestyle and budget.

What is a Minimum Spending Requirement (MSR)?

A Minimum Spending Requirement (MSR) is a rule that credit card companies and other financial institutions implement to ensure customers meet specific spending levels.

This requirement means customers must spend a certain amount within a given timeframe to be eligible for lucrative welcome offers or other rewards and benefits.

Generally, this is done to encourage customers to use their accounts more often so the credit card company can make more money while simultaneously rewarding the consumer with points or cashback.

Customers should read the fine print of any rewards program to ensure they meet all the requirements.

If you are unsure about bank rules and which credit cards to apply for next, feel free to reach out to us by filling out our free consultation form or by joining our free Travel Miles and Points Facebook Group.

How to Meet Your Minimum Spending Requirement?

Whether you are new to the hobby or a seasoned points enthusiast, an all-too-common dilemma is determining viable methods that can help you meet this spending requirement as quickly and efficiently as possible.

In this blog post, I will list out the various spending patterns I’ve utilized over the years to conquer this challenge while ensuring that my pocketbook remains intact.

Even though some of these tactics require a reasonable fee, you should be able to crunch your numbers and ensure that the value of the rewards you’ll receive outweighs the extra charges you will incur.

If it does not, proceed to the next strategy. The goal is to come out significantly ahead regardless of the circumstances.

Ways to Meet Your Credit Card Spending Requirements

1. Pre-Pay Utilities

Electricity

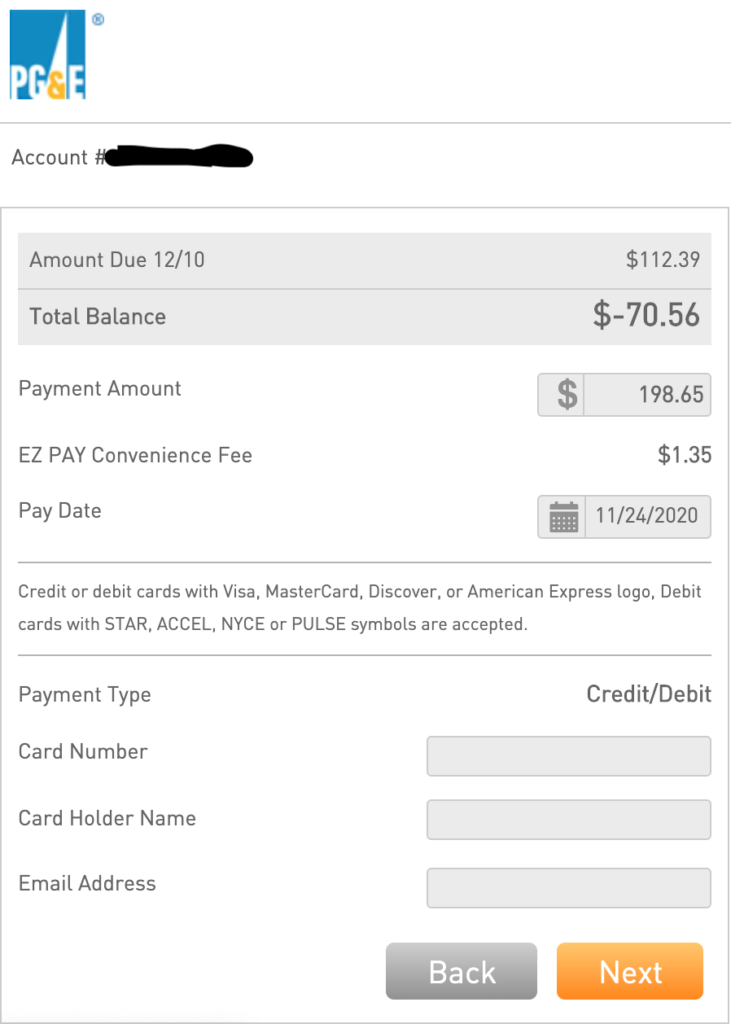

In California, I pay a flat fee of $1.35 when I use a credit card to prepay my electric bill of up to $10,000. The limit can change any day, though.

You can also pay your utilities through PayPal Bill Pay to avoid extra fees.

Water / Garbage / Cable / Internet / Mobile Phone

Check with your provider if they allow advanced payments with a credit card.

If your utility company charges an extra fee, try sending payments through PayPal Bill Pay.

2. Medical and Dental Bills

I have applied for new credit cards in the past to cover expensive medical bills.

Flexible Spending Accounts (FSA)

Instead of applying for an FSA debit card, I use my credit card to pay for co-pays, deductibles, and other medical expenses.

Then, I send my receipts to my FSA provider to reimburse them in cash.

3. Taxes

Property Tax

Whenever property tax season rolls around, I prepare myself to apply for about 2-3 new credit cards to accumulate a significant amount of points.

Despite the extra charges (approximately 2.85%), I still emerge ahead all the time.

Simply put, I am willing to pay an extra $100 in tax fees if that is equivalent to a $5,000 ticket later.

Federal/State/Local Taxes

Presently, it is possible to settle your tax bills using credit cards.

Practically any federal, state, and local tax can be paid with a points-earning card.

A somewhat advanced strategy is to purchase gift cards with your credit cards when they go on sale at grocery or office supply stores.

Since gift cards are considered debit cards, paying federal taxes or estimated taxes is charged a relatively lower fee than paying your federal taxes outright with your credit card.

However, you can not employ this method with American Express, as they frown upon this behavior and have been known to claw back points accrued from gift cards.

4. Organic Everyday Spending, such as Groceries, Dining, and Gas

With this straightforward approach, you can extinguish some of your required spending requirement by putting your routine daily organic purchases on your new credit card.

If you need to spend more, I recommend buying merchant gift cards from the physical or online merchants you frequently visit.

5. Gift Cards

Likewise, I suggest stockpiling gift cards of merchants you anticipate needing in the future, mainly when these gift cards go on sale.

Examples of gift cards that I periodically buy include Amazon, Uber/Uber Eats, Home Depot, Target, etc.

Office Supply Stores and groceries occasionally run promotions where Visa and Mastercard Gift Cards are sold for a discount.

Almost always, I take advantage of these sales.

Again, do not use American Express for this purpose.

6. Insurance

Auto

Insurance companies commonly offer incentives when you fully pay your auto insurance to cover the entire year.

I almost always pay my fees in full to kill two birds with one stone: take advantage of the annual perk and meet the minimum spending requirement.

Home

Since I also have a rental property, I can use new credit cards to settle these expenses for both houses, thus wiping out a significant amount from my credit card spending requirement.

Renter

When I was a renter, I used my travel-rewards credit card to pay for my renter’s insurance.

Health

Health insurance companies allow credit card payments for virtually all services.

7. Car Repair/Maintenance

Another great way to meet minimum spending is to use it at car repair shops whenever the car undergoes routine checks such as change oils, tire alignment, and periodic tune-ups or when it requires a significant overhaul.

8. Costco / Costco Gas

Costco only accepts Visa credit cards, which is precisely what we use when getting Costco gas or shopping at Costco.

However, you can use a Visa or a Mastercard when shopping at Costco.com.

You can purchase Costco gift cards online with your credit card and then use them to spend at Costco.

9. Amazon

You can load up your Amazon gift card balance with any credit card.

10. Charitable Contributions

Spread the wealth using your new credit card to donate to your favorite charitable organization.

Your generosity will benefit others and bring you closer to the trip you’ve wanted to book for nearly free.

Additionally, crowdfunding websites like GoFundMe.com customarily accept credit cards.

11. School Expenses (Tuition Fees, Housing, Etc.)

Use a credit card to pay for school expenses as long as they do not tack on extra fees when you use a credit card.

Alternatively, you can inquire if you can eradicate the fees by paying with a debit card instead.

If allowed, I would use the new credit card to buy Visa and Mastercard Gift Cards when they are on sale at grocery or office supply stores and use these cards to pay for these items.

12. Pay for Services

Whenever I hire a contractor, whether an electrician or a plumber, etc., I inquire if they accept credit cards as a mode of payment. When they say yes, I readily use my credit cards instead of writing a check.

When a contractor shares that they have to pay credit card fees if they accept credit card payments, I volunteer to pay the fees so they are guaranteed to receive their entire payment.

13. Car Purchase

Depending on your ability to negotiate, car dealers generally accept credit card payments as a deposit when you seal the deal on a car purchase.

14. Loan Money

Certain websites, such as Kiva.com, make it effortless to loan money to budding entrepreneurs who need extra cash to jumpstart their business ventures.

According to Kiva, 96% of borrowers can eventually repay their loans.

15. Pay Mortgage (Only for Mastercards)

Whenever I have a new Mastercard credit card, I use the service called “Plastiq”.

Plastiq allows Mastercard holders to send money to their mortgage companies with a small fee of 2.95%.

This is an excellent alternative for those who may be unable to meet their spending requirements on a new Mastercard.

Other Minimum Spend Strategies

1. Apply for New Credit Cards When Large Expenses Are Due

Every year, numerous significant expenses make their presence known like clockwork.

Think insurance, tuition fees, and taxes – these expenses present excellent opportunities to earn lucrative welcome offers.

However, it’s essential to plan and ensure you have enough time between applying for the card and your expenses, so you can promptly meet the minimum spend requirement.

Once again, failing to meet the minimum spend requirement of your new card puts your welcome bonus at risk.

It’s crucial to plan accordingly to avoid missing out on this valuable perk.

2. Apply for New Credit Cards When Unexpected Costly Events Occur

Life often throws us curveballs.

Sometimes, our houses, bodies, and cars require care and maintenance.

We may need to renovate the kitchen, repair the roof, buy a new car, or pay off a hefty medical bill.

These offer excellent opportunities to apply for a new credit card and make the most of the welcome bonus.

These costly events may even meet a few welcome bonuses from more than one credit card.

Pro-Tip: If you encounter an unforeseen and substantial expense requiring immediate payment, you can still apply for a new credit card. Certain issuers offer instant access to the card number upon approval, while others expedite card delivery upon request. Rest assured, there are options available to address your financial needs promptly.

3. Some Extra Fees Are Worth It

Using a credit card to pay certain huge expenses such as property taxes or income taxes will incur additional credit card surcharges.

Typically, I advise against paying these additional fees unless you are in danger of not meeting the minimum spending requirement for your new credit card.

Once more, it is worthwhile to consider paying the $100 or $200 credit card fee if the welcome bonus you’ll receive from your new credit card is $500 worth of free travel.

Hence, it is up to you to calculate whether additional credit card fees are justifiable.

4. Add Your Family Members As Authorized Users

If you expect challenges in meeting the minimum spending requirement of your new credit card, a viable option is to include your family members as authorized users.

By doing so, any expenses made on those authorized user cards can be counted towards fulfilling the spending requirement of your new credit card.

5. Prepay Regular Expenses

If you anticipate struggling to meet your new credit card’s minimum spending requirement, consider making advance payments to particular billers.

One approach is to prepay your utilities, such as electricity, water, garbage, internet, and mobile phone bills.

Another option is to purchase gift cards from stores you frequently shop at throughout the year, like Amazon.com or grocery stores.

Maintaining a sinking fund that you can readily use to pay off your bills when they become due is essential.

Avoid paying exorbitant interest fees to banks, as it’s not a wise financial decision.

Free Travel Miles and Points Facebook Group

If you have questions on which credit card to apply for or tips on how to get started with credit card points, feel free to join our free Travel Miles and Points Facebook Group.

Who Can Apply For Credit Cards?

While I highly recommend exploring the benefits of travel credit card rewards, as they have brought me to numerous places I would never have imagined seeing in this lifetime, they are sadly not for everyone.

Although anyone can capitalize on this valuable hobby, it primarily works with individuals with a particular financial profile.

Since this endeavor involves leveraging credit card debt for a specific purpose, banks will only ordinarily approve applicants they know will be responsible clients.

If you have an excellent credit score and an impeccable financial history, then kudos, as you can undoubtedly successfully optimize this strategy.

Here’s a litmus test to determine if your profile is compatible with leveraging travel miles and points:

Do you pay your credit card in full on or before the due date? If so, then you are ripe for maximizing travel credit card rewards.

Is paying your credit card promptly not your strongest suit yet?

Then, I suggest holding off on this activity until you have no hovering consumer debt.

Despite its generous rewards, this hobby can ruin anyone’s financial future.

Those steep bank interest charges can quickly compound and wreak havoc on your financial goals.

Lastly, paying additional fees defeats the purpose of frugal travel.

The collective goal of points enthusiasts is to redeem travel while shelling out as little cash as possible.

Final Thoughts

I am a huge fan of lucrative credit card welcome bonuses, and I try to take advantage of these offers whenever the opportunity arises.

However, this is a gentle reminder to only apply for credit cards you can comfortably pay once your statement comes around. It is never a good idea to pay those astronomical credit card fees.

A constant dilemma that points enthusiasts face is finding ways to efficiently meet the minimum spending requirement of the credit cards they have just applied for.

The bonus rewards may be lost if this condition is not entirely met within the allotted period.

I hope the strategies I have outlined in this blog post open up numerous avenues for you to meet your new credit card’s minimum spending requirement (MSR).

Please let me know if you have another recommended method or two, and I’d gladly add them to this list.

EDITORIAL DISCLOSURE – Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. The content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.