ADVERTISER DISCLOSURE: The Frugal Tourist is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as MileValue.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

One of the fastest methods to accumulate travel miles and points is to purchase gift cards (Visa Gift Cards or Mastercard Gift Cards) when they go on sale, either at office supply stores or grocery stores.

Whenever these promotions occur, you can rack up several thousand travel points, depending on the number of cards you buy and the number of times you visit these establishments.

This points-earning strategy involves using credit cards that generate spending bonuses at these aforementioned merchants when buying discounted gift cards.

These discounted gift cards can then be used to pay different types of taxes.

Whether you owe the IRS taxes come April 15th or prefer to send estimated taxes each quarter, anyone can use gift cards to pay their tax liabilities.

This blog post will walk you through the steps to using gift cards to send tax payments yourself.

Disclaimer: The following article is not tax advice. Please consult a tax professional to determine if the strategy outlined below is suitable for you.

Blog Updates

| Dates | Updates |

|---|---|

| Important | Do NOT use a new American Express Credit Card to purchase gift cards. |

| April 2024 | PayUSAtax is now the cheapest option for debit & gift cards and credit cards. |

| March 2024 | ACI/Official Payments and Pay1040 have started accepting Mastercard Gift Cards again. All 3 IRS payment processors are now accepting Visa and Mastercard Gift Cards. |

| Jan 2024 | PayUSAtax has reduced their debit card fees from $2.20 to $2.14. |

| Nov 2023 | |

| Oct 2023 | The IRS announced that interest rates will increase for the calendar quarter beginning Oct.1, 2023. |

Why Send Estimated Taxes?

As per the IRS:

The Internal Revenue Service today announced that interest rates will increase for the calendar quarter beginning Oct.1, 2023.

For individuals, the rate for overpayments and underpayments will be 8% per year, compounded daily. Here is a complete list of the new rates:

Internal Revenue Services

- 8% for overpayments (payments made in excess of the amount owed), 7% for corporations.

- 5.5% for the portion of a corporate overpayment exceeding $10,000.

- 8% for underpayments (taxes owed but not fully paid).

- 10% for large corporate underpayments.

Three IRS Payment Processors

The Internal Revenue Service (IRS) has approved three payment processors to accept and process online tax payments.

Each payment processor accepts a maximum of 2 payments each quarter, which means we can send 6 tax payments using gift cards every quarter (3 IRS payment processors X 2 payments per quarter = 6 payments using gift cards).

| Three IRS Payment Processors |

|---|

| ACI Payments/Official Payments Pay1040 PayUSATax |

If you do this yearly, you can potentially send up to 24 gift card payments to the IRS (6 gift cards each quarter X 4 quarters = 24 gift card payments).

This is a remarkable avenue to convert those gift cards to cash.

| IRS Payment Processor | Number of Payments Accepted |

|---|---|

| ACI Payments/Official Payments | 2 Each Quarter |

| Pay1040 | 2 Each Quarter |

| PayUSATax (Cheapest Option) | 2 Each Quarter |

Strategy: Use Gift Cards To Pay Taxes

Whether you are new to the hobby or a seasoned points enthusiast, the constant challenge is to determine effective ways by which you can effectively convert these gift cards into cash.

In this blog post, I will review the steps for using these gift cards to pay taxes, including income and estimated taxes.

Why Send Estimated Taxes?

The IRS encourages taxpayers to send money quarterly to avoid getting penalized for “underpaying” their taxes. These payments are called “Estimated Taxes”.

If you have a history of paying tax bills on April 15th, the strategy I will cover in this post may be a viable alternative to significantly reduce or even eliminate your tax liability come tax season.

With this approach, you will use Visa Gift Cards (VGCs) or Mastercard Gift Cards (MCs) to pay your estimated taxes 4X/year, chipping away some of your tax liabilities once taxes are due.

Since these gift cards were purchased using credit cards that earn travel points and miles, the rewards you accrue from these transactions can be ultimately redeemed for free or discounted travel in the future.

If you still owe the IRS on April 15th despite sending estimated taxes, I suggest using your remaining gift cards to settle what you owe. Frankly, I am not sure until when the IRS will accept gift cards, so I try to maximize this option as much as possible.

Summary of Steps

SUMMARY STEP 1:

Buy discounted gift cards from office supply stores and groceries using credit cards that offer category bonuses.

Occasionally, online gift card merchants, such as giftcards.com, also offer discounted gift cards, so make sure you take advantage of those as well.

I post these deals as I learn about them in our Travel Miles & Points Facebook Group. It is free to join.

SUMMARY STEP 2:

Use these gift cards (Visa Gift Cards or Mastercard Gift Cards) to pay your estimated taxes.

Since you’ve already accrued travel points when you purchased these gift cards, you are indirectly earning miles and points from settling your tax payments.

Note: In addition to Estimated Taxes, I have also used gift cards to pay my federal, state, payroll, and LLC taxes.

| Taxes | ACI | Pay1040 | PayUSA |

|---|---|---|---|

| Estimated Taxes | 2 per quarter | 2 per quarter | 2 per quarter |

| Federal Taxes | 2 per year | 2 per year | 2 per year |

SUMMARY STEP 3:

Since these gift cards are considered “debit cards”, the fees you incur are relatively lower than when you use a credit card, thus saving some cash.

Heads up: While the fees are not more than a few dollars, this payment option may not work for people who are naturally averse to paying extra charges, regardless of the amount.

This Strategy May Work If You….

- You currently have a stack of Visa Gift Cards (VGCs) and Mastercard Gift Cards (MCGCs) at home, and you are running out of ideas on how to spend them reasonably.

- Have enough funds to pay off your credit card bills entirely on or before the due date to stockpile these gift cards without paying exorbitant credit card fees.

- Constantly owe the IRS at tax time, and you are open to spreading out your payments throughout the year by sending estimated taxes quarterly.

- Do not mind shelling out the small fee for using debit cards for estimated tax payments.

This Strategy May Not Work For You If….

- The IRS usually owes you a refund at tax time.

- You risk not paying off your credit card bills on time, making buying these gift cards in bulk difficult.

- You are opposed to the likelihood of overpaying the IRS, even though the IRS will refund any overpayments.

Step-by-Step Guide on How to Use Gift Cards to Pay Estimated Taxes

IRS Guidelines (IRS.GOV)

- You can pay online or over the phone (see Payment Processor Contact Information below for phone payments)

- You can pay using digital wallets such as PayPal and Click to Pay

- A maximum number of card payments is allowed based on your tax and payment types.

- Employers’ federal tax deposits cannot be paid by card; see how to pay employment taxes.

- For card payments of $100,000 or more, special requirements may apply.

- No part of the card service fee goes to the IRS.

- You don’t need to send a voucher if you pay by card.

- Card processing fees are tax deductible for business taxes.

- You must contact the card processor to cancel a card payment.

- IRS will refund any overpayment unless you owe a debt on your account.

- Your card statement will list your payment as “United States Treasury Tax Payment” and your fee as “Tax Payment Convenience Fee” or something similar.

- Federal tax lien releases can take up to 30 days after we receive full payment; liens may remain for other individuals who haven’t fully paid their portion.

- When you pay while electronically filing your taxes, different card fees apply.

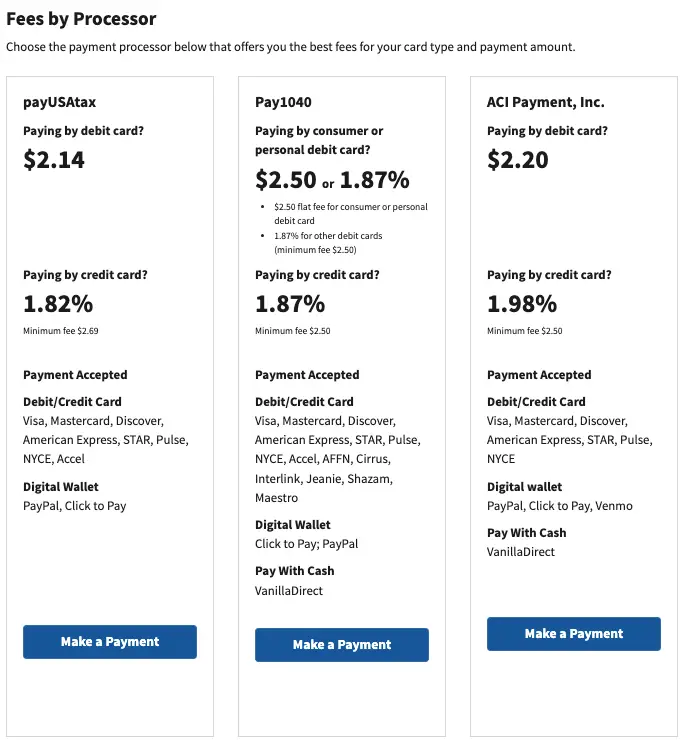

Fees Per IRS-Approved Payment Processor

As mentioned above, the IRS has approved three online payment processors that allow taxpayers to send tax payments electronically using a debit or credit card.

Current fees for each processor are posted on the IRS website.

However, fees change periodically, so click the button below for the most recent fee schedule update.

The IRS website also lists additional information for some frequently asked questions:

- The card service fee does not go to the IRS.

- There is no need to send a payment voucher if you pay by debit or credit card.

- Card processing fees are not tax-deductible unless they are associated with business taxes.

- Do not contact the IRS if you want to cancel a card payment. Contact the processor instead.

- IRS will refund any overpayment unless you owe the IRS money.

Gift Cards Are Considered Debit Cards

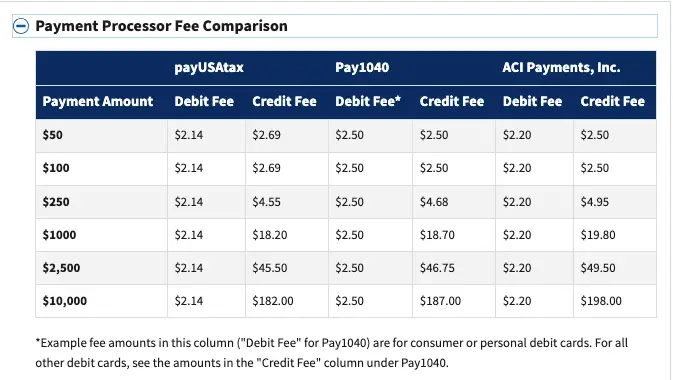

The image below illustrates how much money you can save when paying taxes using gift cards (debit cards) instead of credit cards.

For example, if you pay $10,000 worth of taxes using a debit card on ACI Payments, you will only be charged a flat rate of $2.20 per gift card.

Conversely, if you use a credit card with ACI, you will owe a staggering $198.00 when paying the same tax amount.

| Tips | Details |

|---|---|

| 1 | Buy gift cards using credit cards that give spending bonuses and use those gift cards to pay for estimated taxes to avoid the hefty credit card fees when using these IRS-approved payment processors. |

| 2 | Do not use an American Express Credit Card to purchase gift cards, especially when meeting a new card’s minimum spend requirement, as this is against the card’s terms and conditions. |

Estimated Taxes Due Dates

Set the alarm to remind you of the quarterly due dates of future estimated taxes.

| Payment Period | Due Date |

|---|---|

| 1st Quarter: January 1 – March 31 | April 15th |

| 2nd Quarter: April 1 – June 30 | June 15th |

| 3rd Quarter: July 1 – September 30 | September 15th |

| 4th Quarter: October 1 – December 31 | January 15th |

Processor #1: ACI Payments/Official Payments

| ACI Payments/Official Payments Summary |

|---|

| Debit Card/Gift Card Fee: $2.20 Credit Card Fee: 1.98% (minimum: $2.50) ACI Payments, Inc. fed.acipayonline.com Payment: 888-272-9829 Live Operator: 877-754-4420 Service: 877-754-4413 International Non Toll-Free Payment: 334-521-3842 |

| Dates | ACI/Official Payments Updates |

|---|---|

| Fees | Debit Card/Gift Card Fee: $2.20 Credit Card Fee: 1.98% (minimum: $2.50) |

| March 2024 | ACI/Official Payments have started accepting Mastercard Gift Cards again. Both Visa and Mastercard Gift Cards are now working on ACI. |

| March 2024 | Estimated Taxes for Q1 of 2024 are now accepted effective March 1st. |

| Nov 2023 |

STEP 1:

Official Payments/ACI Payments is the most popular among the three processors.

ACI/Official Payments charges $2.20 for tax payments of no more than $10,000 (as of January 2024) when using a debit or gift card.

Have a $1000 gift card? Send them to the IRS and only pay the flat fee of $2.20 when you pay through Official Payments/ACI Payments.

The table below illustrates the taxes you’ll pay minus the fee when using Official Payments/ACI Payments.

| Gift Card | Tax | Fee |

|---|---|---|

| $100 | $97.8 | $2.2 |

| $200 | $197.8 | $2.2 |

| $500 | $497.8 | $2.2 |

| $1000 | $997.8 | $2.2 |

STEP 2:

Create a profile with ACI Payments / Official Payments so your data is saved.

This expedites the process when you make future payments. They also keep receipts of all of your previous transactions.

Next, select the type of bill you want to pay – federal, state, or local.

I noticed that it is also possible to pay education-related expenses, although not all universities are listed.

Nevertheless, the list is comprehensive, so double-check that you are paying the correct “tax” category.

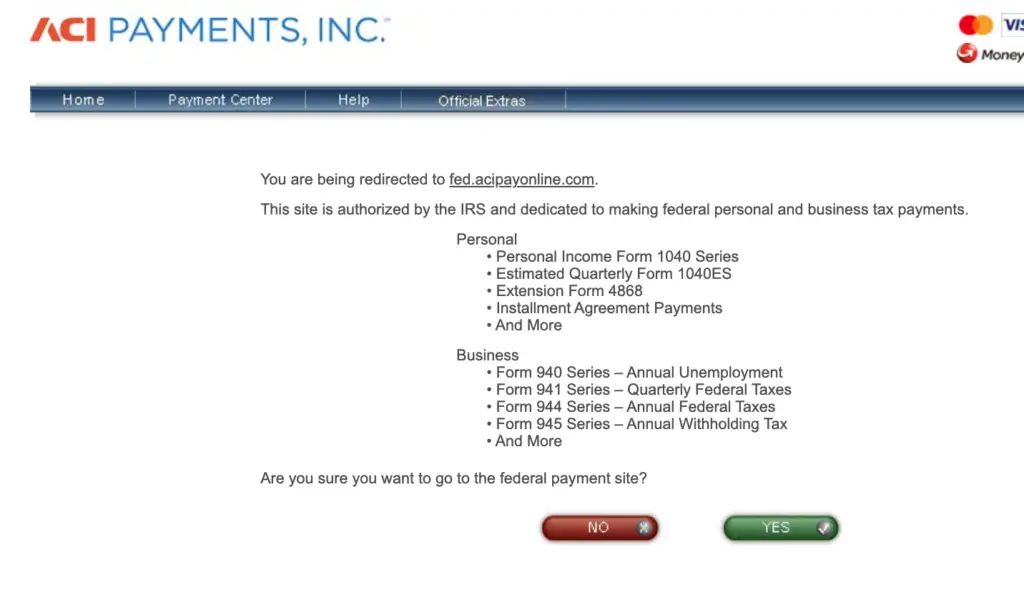

STEP 3:

Navigate through the website until you are required to indicate the specific type of tax bill you want to pay.

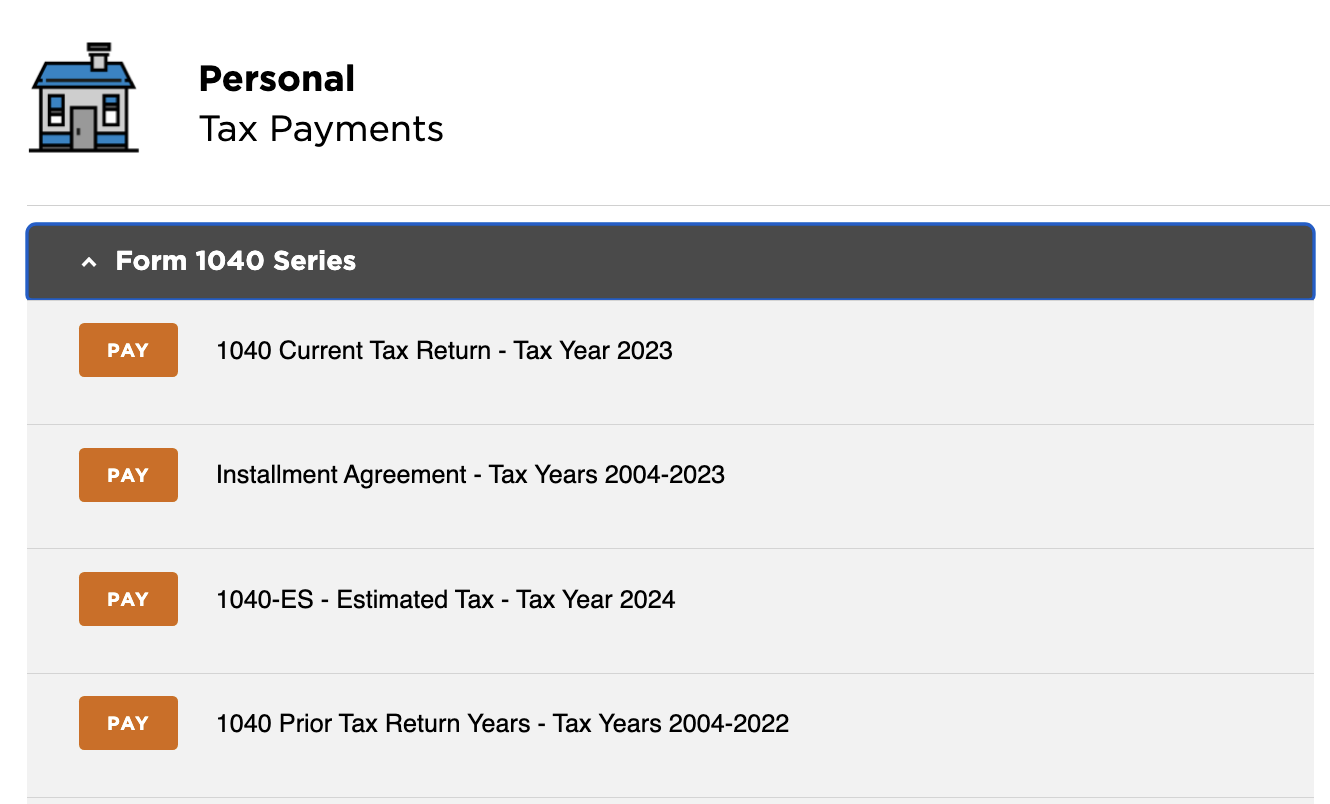

If you are paying Federal Estimated Taxes, click Federal IRS Payments.

You will then be directed to ACI Payment’s Federal Payment Site.

Next, select “Personal Tax Payments” and “Form 1040 Series.”

Choose the type of tax you intend to pay.

If you are sending Estimated Taxes, select “Estimated Tax- (tax year)” to send advanced payments to the IRS each quarter.

Don’t forget to check out the other potential tax bills you can pay with gift cards, as there are multiple options.

STEP 4:

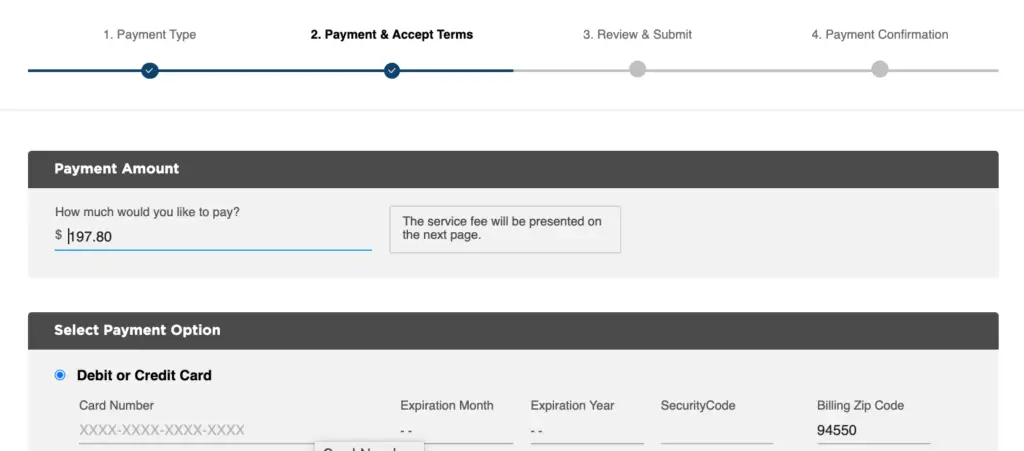

Fill out the necessary information, such as Payment Amount and Payment Option.

Make sure to deduct the debit card fee manually.

Pay close attention to the amount you’re subtracting, as the debit card fee varies across payment processors.

In the scenario below, I had to deduct the $2.20 debit card flat fee from the total value of my $200 gift card since I was using ACI Payments.

Therefore, I typed $197.80 to drain my gift card completely.

This crucial step must be carried out correctly; otherwise, your payment will either not go through since the payment amount exceeds the total value of your gift card, or you will have extra change remaining on your cards.

The goal is to wipe out the value of your gift cards entirely. Every penny counts.

The table below summarizes the taxes (minus the fees) you can pay with various gift card denominations for each processor.

| Gift Card | ACI Payments ($2.20 fee) | PayUSAtax ($2.14 fee) | Pay1040.com ($2.50 fee) |

|---|---|---|---|

| $100 | $97.8 | $97.86 | $97.5 |

| $200 | $197.8 | $197.86 | $197.5 |

| $500 | $497.8 | $497.86 | $497.5 |

| $1000 | $997.8 | $997.86 | $997.5 |

STEP 5:

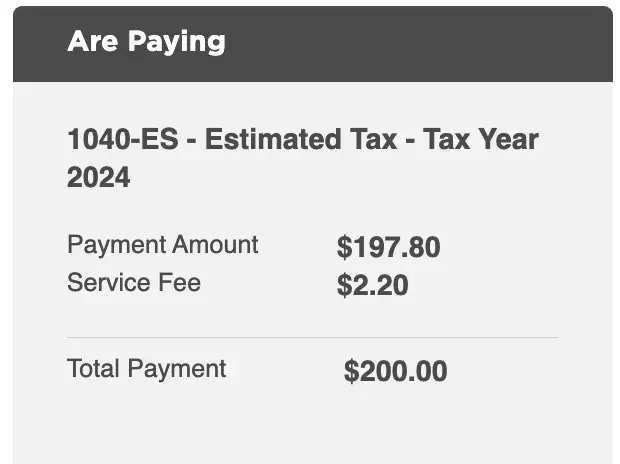

Proceed to the following payment steps.

In the image below, notice that Official Payment/ACI only charged me $2.20 because it automatically detected that I was using a debit card to pay.

Again, gift cards are processed the same way as debit cards; therefore, the service fees are considerably cheaper.

STEP 6:

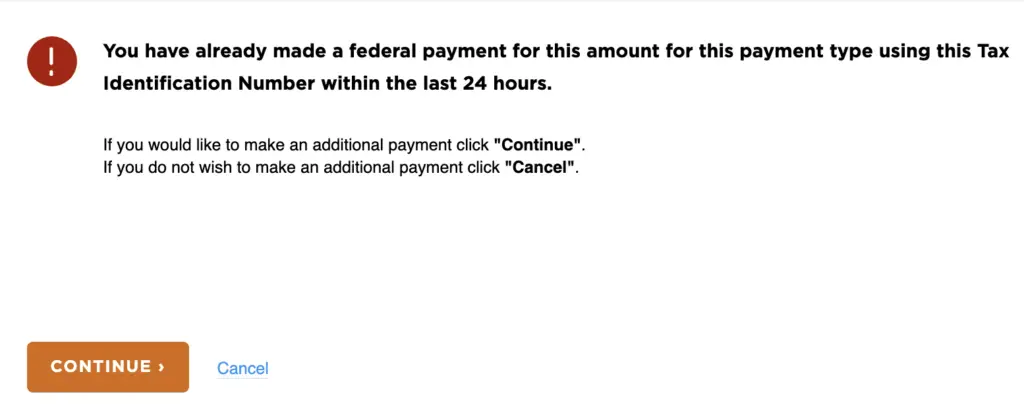

Next, you will be asked to review the information before submission.

Once you have verified that all the information is correct, click pay.

If you are sending the same amount twice, ACI Payments will verify if you actually intend to send two identical payments (refer to the image).

Proceed by clicking on “Continue.”

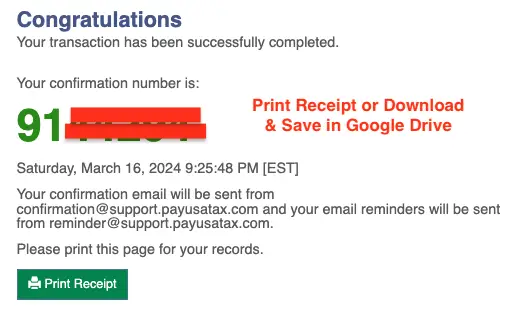

Afterward, you will receive confirmation that your payment has been successfully processed.

Note: These gift cards may be used even if they haven’t been registered online. After paying, I keep all my tax receipts and upload them to Google Drive. You can also print the receipts and attach the gift cards for documentation. Finally, I record all of my payments in a spreadsheet to keep track of how much estimated taxes I have sent to the IRS for the year.

STEP 7:

OfficialPayments.com (ACI Payments) will allow a maximum of 2 payments each quarter.

Should you need to liquidate more than two gift cards, you can utilize PayUSAtax.com ($2.14 fee) or pay1040.com ($2.50 fee).

The following sections will walk you through how to pay taxes using these payment processors.

As mentioned above, both processors will allow a maximum of 2 payments per quarter, similar to ACI Payments.

In short, anyone can send six separate gift card payments to the IRS each quarter!

Pro-Tip: Don’t worry about overpaying. The IRS will send you a refund if you do.

Processor #2: Pay1040.com

| Pay1040 Summary |

|---|

| Debit Card/Gift Card Fee: $2.50 Credit Card Fee: 1.87% (minimum: $2.50) Pay1040 www.pay1040.com Payment: 888-729-1040 Service: 888-658-5465 International Non Toll-Free Live Operator: 501-748-8507 |

| Dates | Pay1040 Updates |

|---|---|

| Fees | Debit Card/Gift Card Fee: $2.50 Credit Card Fee: 1.87% (minimum: $2.50) |

| March 2024 | Pay1040 has started accepting Mastercard Gift Cards again. Both Visa and Mastercard Gift Cards are now working on Pay1040.com. |

| Nov 2023 |

Step 1: Click Make a Payment on Pay1040.com

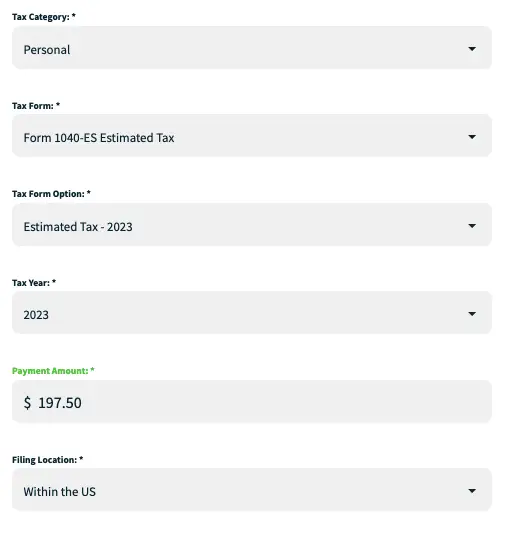

Step 2: Select the correct form and type in the correct amount

- Tax Category

- Tax Form: I chose Form 1040-ES Estimated Taxes

- Tax Form Option: I selected Estimated Tax-2024

- Tax Year: 2024

- Payment Amount: Deduct the $ 2.50 debit card fee from the gift card value. In my case, I liquidated a $200 gift card, so I typed in $197.50 as the payment amount.

- Filing Location: Within the US

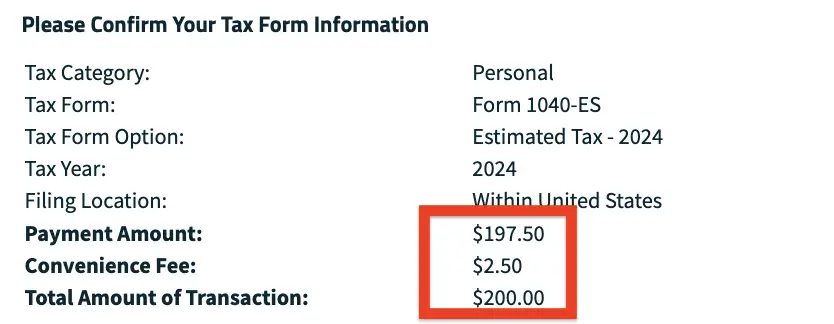

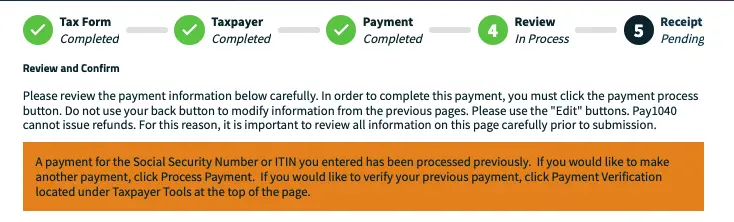

Step 3: Confirm that all the amounts are correct

Since my gift card has a total value of $200, I subtracted the Pay1040 debit card fee of $2.50.

This way, I will not have any money left on the gift card since I aim to liquidate it entirely in one fell swoop.

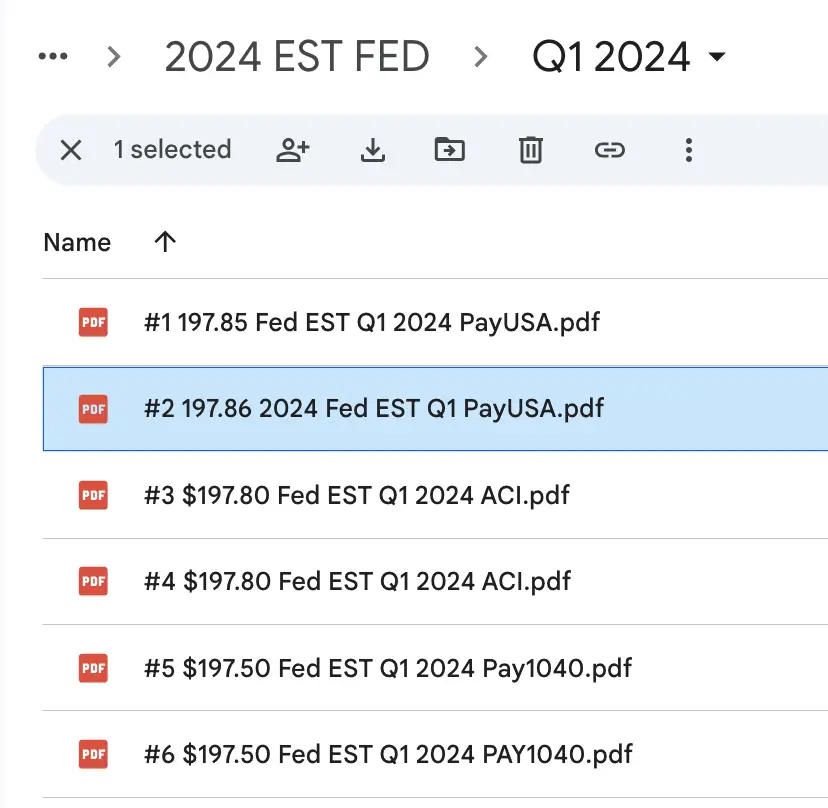

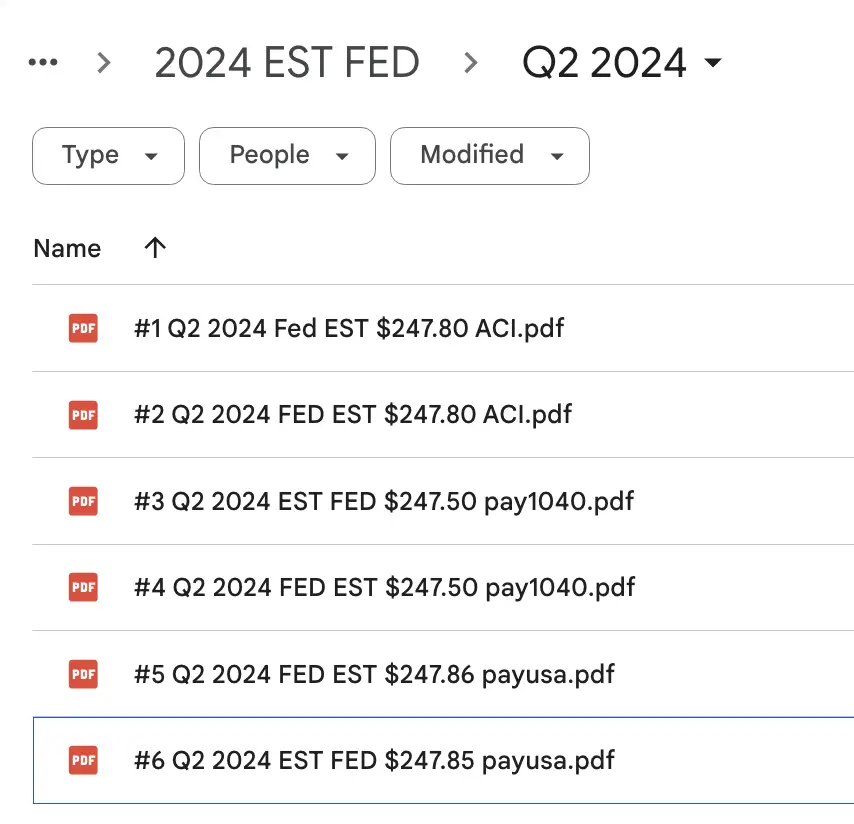

Step 4: Print out or save a PDF file in Google Drive for bookkeeping

To organize my receipts, I upload them to Google Drive labeled “2024 Fed Estimated Taxes” so it is easier to locate them during tax time.

Heads Up: Similar to ACI Payments, Pay1040.com allows taxpayers to send two identical payments. You will be notified to review and confirm the amounts you are sending and follow the prompts to “Process Payment“.

Processor #3: PayUSAtax.com (Cheapest Option in 2024)

| PayUSAtax Summary |

|---|

| Debit Card/Gift Card Fee: $2.14 Credit Card Fee: 1.82% (minimum: $2.69) payUSAtax www.payusatax.com Payment: 844-729-8298 Live Operator: 855-508-0159 Service: 844-825-8729 International Non Toll-Free Payment: 615-550-1491 Live Operator: 615-942-1141 Service: 615-550-1492 |

| Dates | PayUSA Updates |

|---|---|

| Fees | Debit Card/Gift Card Fee: $2.14 Credit Card Fee: 1.82% (minimum: $2.69) |

| March 2024 | Both Visa and Mastercard Gift Cards are currently accepted. |

| Jan 2024 | PayUSAtax has reduced their debit card fees from $2.20 to $2.14. |

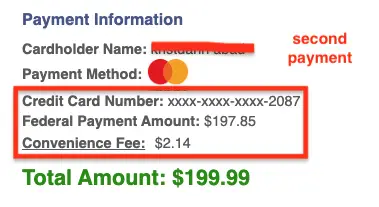

| June 2023 | When making two payments, ensure that the second payment is a different amount as this processor does not accept duplicate payments. You can change the amount by 1 cent (e.g., $197.86 & $197.85). |

Before Using PayUSATax: Register Your Cards

As an added layer of verification & security, PayUSATax requires the zip code in the gift cards to match the payer’s address.

Therefore, you must register your gift cards before using them on PayUSATax.

To register your gift cards, please visit the website on the back of your gift cards.

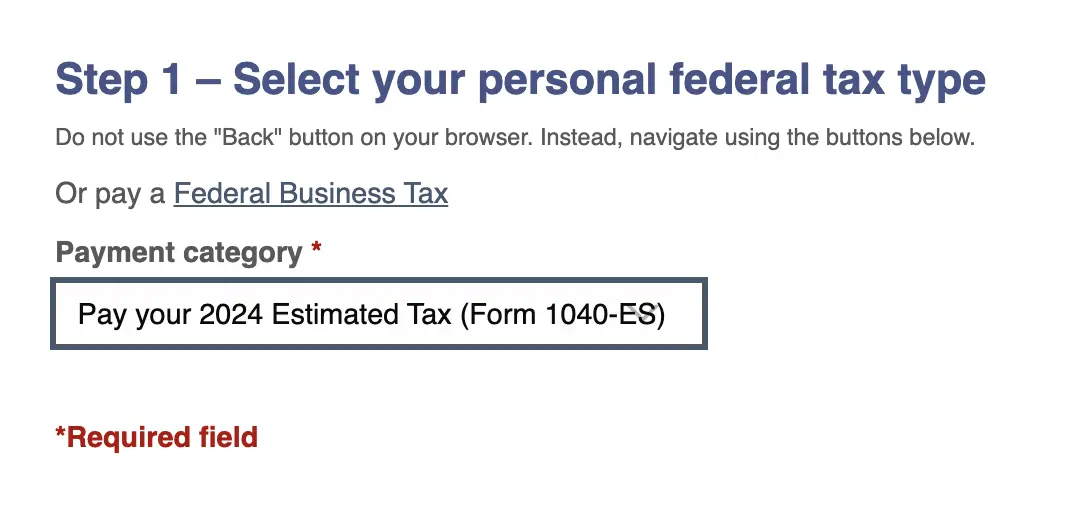

Step 1: Select the type of payment you would like to send to the IRS

The image below shows that I selected to pay my Personal Federal Estimated Taxes for the year (Form 1040-ES).

I can also use this service to pay my current tax returns as well as prior tax returns.

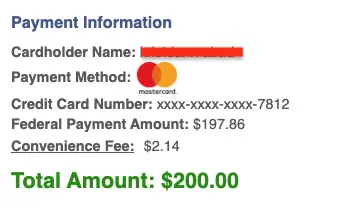

Step 2: Enter Payment Details

Since PayUSATax.com charges a flat rate of $2.14 when using debit cards, I deducted that amount from the total value of the gift card I was liquidating.

Because I had a $200 gift card, I typed in $197.86 as my payment amount.

This ensures that I completely redeem the entire amount on my gift card.

Step 3: Review the Information and Proceed with the Payment

I save the receipt on my Google Drive for easy access during tax time.

I also entered the amount on a spreadsheet to track the total estimated taxes I had sent to the IRS for the year.

Possible Issue on PayUSAtax.com: PayUSAtax.com will only allow one payment of the same amount. A way to get around this roadblock is to change the amount of the second gift card by one cent. In my case, I successfully used two $200 gift cards by paying $197.85 and $197.86, respectively. See the image below.

Frequently Asked Questions and Examples

1. Taxes Owed: $410

| I owe $410 in income taxes, and I only have two gift cards, each worth $200. What is your recommendation? |

|---|

| a. Use ACI Payments to pay $197.80 b. Send another $197.80 payment through ACI Payments c. Use a credit card to pay the remaining $4.40. |

2. Taxes Owed: $9000

| We owe $9000 worth of taxes. Any tips? |

|---|

| Credit Card Route: “Apply for 2-3 new credit cards and use them to earn generous welcome bonuses” Gift Card Route: “Send 5 gift card payments to the IRS, and the 6th payment can be a new credit card that earns a generous welcome bonus”. |

3. Can I use virtual cards purchased at Giftcards.com?

Yes, virtual cards and physical cards seem to currently work on all IRS payment processors as of May 2024.

Bookkeeping Strategy: Save in Google Drive

I upload my estimated tax receipts to Google Drive for easy access during tax season.

I inform my CPA of the total estimated taxes paid to the IRS and my state, so they can accurately deduct the amount from my overall tax liability.

Q1 2024: I liquidated my $200 gift cards purchased from Staples and Office Depot.

Q2 2024: I liquidated my $250 gift cards purchased from GiftCards.com during an American Airlines shopping portal promotion (earn 3 American Airlines miles per dollar).

Final Thoughts

I am a huge fan of gift card promotions, and I try to take advantage of them every opportunity I have.

However, this is a gentle reminder to purchase only the number of gift cards you can comfortably pay for once your credit card statement arrives.

A common dilemma that points enthusiasts face is determining sensible ways to spend these gift cards, as options have significantly dwindled in the past few years.

I hope the strategy I outlined in this blog post opens up another pathway for you to liquidate these gift cards into money.

Above all, I relish the notion that I can get a free flight or hotel stay from paying taxes, as it softens the blow of this financial burden.

Please let me know in the comments section if you were able to carry out this strategy too successfully.

EDITORIAL DISCLOSURE – Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. The content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

Have you tried to pay with gift card with pay1040.com or PayUSAtax? I tried and doesn’t work, they pop up a message saying the bank not allowed the transaction. ACI Payments, Inc. went through though.

I use them all. Make sure you factor in the processor fee in your calculation since that can make it exceed the value of your gift card. If that doesn’t work, then you may need to register your gift cards so the system can detect your billing address.

Same experience as with Ric. Tried PayUSATax it says billing zip code is not valid. Then tried ACI – that works. Did not try Pay1040 yet. Using a Vanilla Gift card of $500 – paid $495+service fee.

I see no way to register a Vanilla Gift card.

Safeway here used to sell Metabanks…but now all these cards are from a Sutton Bank or what not.

Another grocery store near here has US Bank debit cards…but I’ve read of issues with those (more easily hacked) — so avoid those.

Thank you for the DPs. Never had issues with PayUSATax, but will try again and update the post if things have changed.

This is bad. Payments failed using Vanilla VISA for PayUSATax.

So I went out to buy a Vanilla mastercard. and it still failed!

I have tried the “assignZip” tricks. Still failing.

Sorry, you are having issues. Just sent gift card payments through PayUSATax yesterday and they both sailed through smoothly. I edited the post and updated the screenshots. I also used Pay1040 and ACI and both processors are working well. Have you tried using another gift card other than Vanilla?

Thank you for such a detailed guide. It’s very helpful!

It seems like the processors are dropping more and more GCs as a payment method. Which GCs have you recently found success in paying with? I’m afraid to buy several GCs only to find out that they’re not accepted.

Also, I know Amex is a no-no for purchasing GCs, especially during the MSR period. What are some GC-friendly CCs—do all CCs on your list consider GC purchase as a qualifying spending, even during the MSR period?

Again, thank you for your contribution in this community, and I look forward to learning more from you!

Hi Nan, thank you for the kind words. I paid my Q2 Estimated Taxes about a couple of weeks ago and updated this post with screenshots of my successful payments. I plan to pay my Q3 Estimated Taxes later this month and hopefully the gift cards continue to work. I have used MCGCs and VGCs from Staples and Office Depot as well as gift cards purchased from giftcards.com and the Fluz Power Portal. The processors stop working after 2 payments per quarter so I wonder if that was the case for you. Additionally, make sure to subtract the debit card fee as suggested in the post. Please keep us posted with your DPs and thank you again for leaving a comment. By the way, I will address your Amex question on my next comment.

HI again, Nan. I’ve been using my Chase Ink Business Cash card to buy these gift cards when they go on sale at Staples and Office Depot. At this point, Chase cards are OK to use in moderation. And IME, GC purchases have counted towards my minimum spend requirement (MSR). Lastly, I won’t use a new Amex card when buying gift cards to meet the card’s MSR. They have strict anti-gaming terms and can clawback at anytime. Hope that helps!

Thank you for very detailed info.

How many GC cards you can use in one tax payment when you call to PayUSAtax.com or pay1040.com?

Hi Aks. Great question. Each payment processor allows 2 payments each quarter. Since there are 3 payment processors, you can send a total of 6 payments per quarter if you have the Visa Gift Cards. I included an update on the post that PayUSAtax.com does not accept Mastercards at this time, but the other 2 processors do. Please let me know if you have any other questions.

Are Mastercard gc’s still coding as CC on payusatax.com?

Debit cards. Please try and report back. I’m sending payments this week.

Hi The Frugal Tourist,

Just want to double check. In case my Visa Prepaid Card gets rejected, I will still keep the money right? I don’t know if my Visa Prepaid Card will be accepted because they were not accepted in Venmo or PayPal, but I wanted to try paying taxes with it.

Hi there. Your Visa Prepaid Cards should work. Just make sure you deduct the fees. If that does not work, you can also register your card and perhaps that can work too. And yes, you get to keep your money if it does not go through. Good luck and keep us posted.

Hi The Frugal Tourist,

I have not made any estimated tax payment this year. Is it ok that I make my first estimated tax payment in July just to spend my virtual prepaid visa card?

Yes, you can send payments now for Quarter 3. You can certainly use your virtual prepaid visa cards to pay estimated taxes. Just remember to subtract the fees from the total amount. For example, write $497.80 instead of $500 when sending payments via ACI/Official Payments.

How will this be entered when filing the tax return the following year? Is there a section to input the amount of estimated tax payments that was submitted this year?

Hi Gene, Yes, there is an item where you can type in the amount of estimated taxes you’ve sent to the IRS. Make sure to keep receipts – I upload them on Google Drive, year after year. If you end up owing the IRS at tax time, it is recommended that you send Estimated Taxes to avoid paying underpayment penalties. The IRS will refund any overpayment. Hope that helps and please keep us posted if this strategy worked for you. This is also not tax advice so I recommend consulting with your CPA/tax preparer.

I haven’t done any payments for Q4 2022 and for some reason both ACI Payments and Pay1040 say that I have exceeded the number of payment that the IRS allows. Anybody has tried recently if this still works? Any chance the processors are checking with the IRS database before trying the transaction?

Hi Sa! Thanks for reaching out. I believe that the Q3 payment deadline has been changed to October 15th, so if you had sent over payments for the previous quarter then the payment processors will show that you have already paid. I could be wrong on the date though but when I get this error, I wait for a few weeks then try again. Always works. Please try again after October 15th and let me know if it went through successfully. I need to send over some payments myself too. Good luck!

So happy I stumbled upon you – literally the best of maybe thousands of articles I’ve ever read regarding the points and miles game. You sir are a godsend – thanks so much for the super detailed step by step guide, this is an ingenious way to liquidate those prepaid GCs!

Thank you for the kind words! Glad to hear that you find the article useful.

you state 2 payments per quarter..but the IRS has a table:

Frequency Limit Table by Type of Tax Payment

for 1040 current tax due – says 2 per YEAR. For estimated tax does it say 2 per quarter.

what gives?

Hi, 2 payments per processor per quarter. If you exceed 2 per quarter, the processor will notify you that you have reached the maximum number of payments. You can send payments again in the next quarters.

I got this message when attempting to pay

“ Your transaction is declined by your issuing bank. Please contact your card issuer.To try again with a different card, please click the Edit Payment Details/Back button.”

Any advice? I even registered the card.

Thanks for reaching out. Can you check the balance on the card? Also please deduct the processor fee when using a gift card. Also, have you sent any prior payments recently (the past 2-3 months) by any chance?

I’ve had this w/ MCGC’s – same payment works with VGCs on same processors.

Can we send any gift cards of any denomination? Thanks!

Yes. Just make sure to deduct the processor fee when sending payments. I added a table in the blog post on how much fees to deduct per processor.

Some data points on using Staples Mastercard Blackhawk Gift Cards:

* Pay1040 did not work

* ACI did not work

* Pay USA Tax worked, but only after registering the card. Otherwise failed with zip code mismatch error.

I tried doing a second payment on Pay USA Tax, but it was blocked as they thought it was a duplicate because the info was too similar to the first one. I’ll need to re-try in a few days.

HI Jon. Thanks for sharing your DPs. Regarding your comment about PayUSA Tax, I did talk about this on the blog post – “Possible Issue on PayUSAtax.com: PayUSAtax.com may be reading Mastercard Gift Cards as credit cards, so the fees *may* show up as higher. PayUSAtax.com will also allow one payment of the same amount. A way to get around this roadblock is to change the amount of the second gift card by one cent. In my case, I was able to successfully use 2 $200 VGCs by paying $197.79 and $197.80, respectively. See the image below.” With regards to Pay1040 and ACI not working – the last time I tried these processors was back in May. I’m currently traveling so I don’t have access to my gift cards, but my suggestion is to try again. If you sent payments last quarter, it is possible that the processors are not yet accepting payments for Q3. Keep me posted, and thanks again!

Ah, you did address the duplicate payment issue, that’s what I get for not reading to the end of the article 🙂

Regarding ACI Payments and Pay1040, I tried an estimated tax payment again (I did not make one via these platforms the previous quarter) and I got the same payment authorization error on the Mastercard Blackhawk GC. It seems I’ll have to find another way to spend these for now.

Yep, just got these issues with ACI Payments too. Thought I was going crazy and my cards were just problematic. It worked for me back in May but not this time in July. Something definitely changed.

It appears that it’s now dead. I am sorry. Let me try them when I get back in town and will update the post. Thanks for the DP.

I was able to finally try MCGCs and you’re right about your experience. Thank you for sharing your DPs with us.

MCGCs are dead for me across all processors.

HI there. Have you tried this? June 2023 Update: As reported in the comments by Jon Y, Mastercard Gift Cards from Staples/Office Depot will need to be registered before they can be used on PayUSAtax. When making two payments, make sure that you change the second payment by 1 cent (e.g. $197.80 & $197.79).

Great news, MCGCs are accepted again across all 3 IRS payment processors.

hey John, great news. MCGCs are back working again across all 3 IRS processors.

Thanks so much for the detailed instructions! Processors 1 and 2 worked easily! Only Processor 3 required the GC to be registered.

Thank you for sharing your DP. Glad it worked!

ACI and 1040 did not require the GC to be registered but PayUSA did. This was helpful!

Thank you for sharing your DP. Glad this worked!