ADVERTISER DISCLOSURE: The Frugal Tourist is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as MileValue.com This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Additionally, the content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

PayPal’s new Bill Pay feature allows PayPal members to use credit cards to pay their bills without paying extra credit card fees.

Link your credit cards to PayPal Bill Pay, and you’ll earn points that can be redeemed for free or discounted travel whenever you pay your utilities, loans, taxes, insurance, etc.

If you would rather receive rewards like cash back or statement credits, you can choose to use those credit cards too.

You can use any credit card with PayPal Bill Pay as long as the credit card can be linked to your PayPal account. Some gift cards are also accepted.

In this blog post, we’ll show you how to set up PayPal Bill Pay so you can pay your bills using credit cards without any extra fees.

Updates

| Date | Details |

|---|---|

| February 2024 | PayPal has removed the majority of billers from their Bill Pay program. |

What is PayPal Bill Pay?

PayPal Bill Pay (PPBP) is a convenient service provided by PayPal that enables users to pay their bills online using a credit card without any additional charges.

PayPal Bill Pay is available to all PayPal account holders and can be accessed through the PayPal website or mobile app.

With this feature, users can make payments to a wide range of billers including utility companies, credit card companies, phone providers, property taxes, and more.

All you need is a linked bank account or credit/debit card to use PayPal Bill Pay.

PPBP is also particularly beneficial for individuals looking to meet the minimum spending requirements of their new credit cards or generate more travel reward points or cashback.

Normally, PayPal charges an additional fee of almost 3% of the charged amount when people use credit cards. However, we avoid this fee when we use PayPal Bill Pay.

With PayPal Bill Pay, you can easily settle almost all types of bills using a credit card, all without incurring any fees.

Why Use PayPal Bill Pay?

Many billers typically impose fees for credit card payments.

For instance, when paying our gas and electric utility company directly using a credit or debit card, our biller levies an additional $1.35 flat fee for every single payment.

These extra fees can add up month after month.

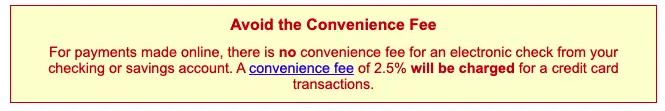

Another example is paying property taxes.

The county where I reside charges an additional 2.5% of the charged amount when I use a credit card.

That is equivalent to an extra fee of $25 for every $1,000 of taxes.

Arguably, paying these extra fees is unacceptable, especially if PayPal is giving us a fee-free option.

Not taking advantage of PayPal Bill Pay is essentially leaving money on the table.

Access PayPal Bill Pay Through PayPal

PayPal is everywhere.

You can see the PayPal button every time you are ready to complete a transaction.

However, it is important to underscore that using the PayPal button when checking out of an online store is NOT the same as PayPal Bill Pay.

This can be confusing, but in order to access fee-free PayPal Bill Pay payments, one must navigate directly through the PayPal website or app.

Feel free to continue reading to learn the steps on how to use PayPal Bill Pay.

Where is PayPal Bill Pay Accepted?

PayPal Bill Pay is accepted by thousands of billers across the United States.

It offers both security and unparalleled convenience, making it an excellent choice for hassle-free payments.

Setting it up is a breeze, requiring just a few simple steps that can be completed on your computer or through the PayPal App.

More billers and merchants are added frequently, so check again if you do not see a particular biller on PayPal Bill Pay today.

What Bills Can You Pay Using PayPal Bill Pay?

PayPal Bill Pay allows you to pay a variety of different bills, making it a versatile and convenient service. Some common billers that are eligible for PayPal Bill Pay include:

- Utilities such as electricity, gas, water, and sewage

- Credit card companies

- Phone providers (e.g. AT&T, Verizon)

- Cable or satellite TV providers

- Internet providers

- Mortgage or rent payments

- Property taxes

- Insurance premiums (e.g. car insurance, health insurance)

- Property Management

- Homeowners Associations

- Medical and Dental

- Memberships

- Student Loans

- and many more

What Types of Payment Methods Are Accepted By PayPal Bill Pay?

PayPal Bill Pay currently accepts the following payment methods:

- PayPal Balance

- Cash From Your Bank Account

- Debit Cards

- Credit Cards

- Certain Gift Cards

Which Billers Accept Credit Cards Via PayPal Bill Pay?

While a growing list of billers is added almost every day, not all of them accept credit cards.

For several months, I’ve been sending small trial payments to various billers using credit and gift cards.

I also gathered data points (DPs) from the Travel Miles and Points Facebook Group on what works and here are the results:

Accepted Credit Cards and certain Gift Cards* Through PayPal Bill Pay:

- Electricity

- Garbage

- Water

- Student Loans (data point from the Facebook group)

- Property Taxes (my particular county, but check yours periodically)

Did Not Accept Credit Cards:

- Home Mortgage

- Credit Card Bills

Accepted Debit Cards Through PayPal Bill Pay:

- All bills, including certain credit cards

*Gift Cards from giftcards.com have worked 50% of the time. Gift Cards from Staples and Office Depot did not. However, things can change anytime, so I encourage you to send small trial payments to various agencies using various gift cards yourself – they might just work!

Heads Up: The data points (DP) I presented above are limited to the particular billers I paid through this service. I have met people who were unsuccessful in sending electricity payments but were successful when they sent their credit unions mortgage payments. Each case is different, so I encourage you to gather your own DP.

How Long Does it Take for a Payment to Process with PayPal Bill Pay?

The time it takes for a payment to process with PayPal Bill Pay can vary depending on the biller and the payment method used.

In some cases, payments can be processed and delivered within 2-3 business days, while others may take up to 5-7 business days.

To ensure timely payments, it is crucial to schedule them in advance to account for possible delays.

Take into consideration bank holidays and weekends as they may extend the processing time by a day or two.

It is crucial to be mindful of these factors to ensure that payments are received prior to their due dates.

How Much is the Credit Card Fee When Using PayPal Bill Pay?

So far, the payments I’ve sent using my credit cards and gift cards through PayPal Bill Pay have not incurred any additional fees.

This is particularly important since certain billers often apply extra fees, usually a few percentage points, for credit card transactions.

By sending bill payments through PayPal Bill Pay, you can avoid these pesky transaction fees and save a good chunk of money in the process.

Which Credit Cards To Use?

There are a lot of different credit cards out there, and it can be hard to decide which one to use on PayPal Bill Pay.

But if you want to earn travel rewards or cash back when using PayPal BillPay, I recommend two types of cards.

- Credit Cards that earn a generous sign-up bonus (SUB), whether it is travel miles or cash back.

- Credit Cards that earn a category bonus when using PayPal.

Later in this post, I’ll review some recommended credit cards to use on PayPal Bill Pay.

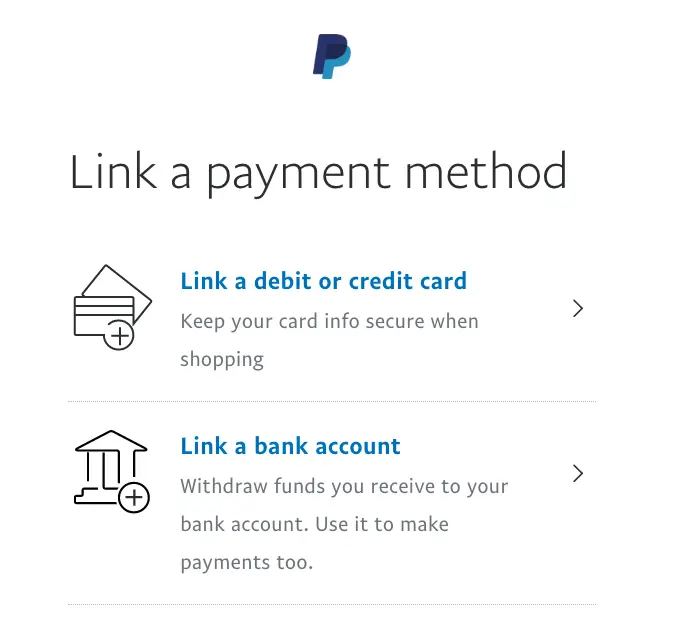

Important: Link Your Credit Card Before Using PPBP

To add a credit card as a payment method to your PayPal Bill Pay account, follow these steps:

- Log in to your PayPal account.

- Click on the “Wallet” tab.

- Select “Link a Card or Bank.”

- Enter your credit card details and click “Link Card.”

- Verify the link by following the instructions provided by PayPal.

Once your credit card is linked to your PayPal account, you can select it as a payment method when making payments through PayPal Bill Pay.

You can also add multiple cards if you prefer to use different ones for different bills or transactions.

Just be sure to keep track of which card you are using for each transaction and check with your credit card issuer for any potential fees.

| Before You Send PayPal Bill Pay Payments |

|---|

Make sure you have transferred all existing PayPal balances to your primary bank account unless you would like PayPal to draw payments from your PayPal balance first. |

Unlink your bank account to prevent PayPal from taking money from your bank. |

Set your credit card cash advance limit to “0” or close to “0” by calling the number on the bank of your card or secure messaging your bank. |

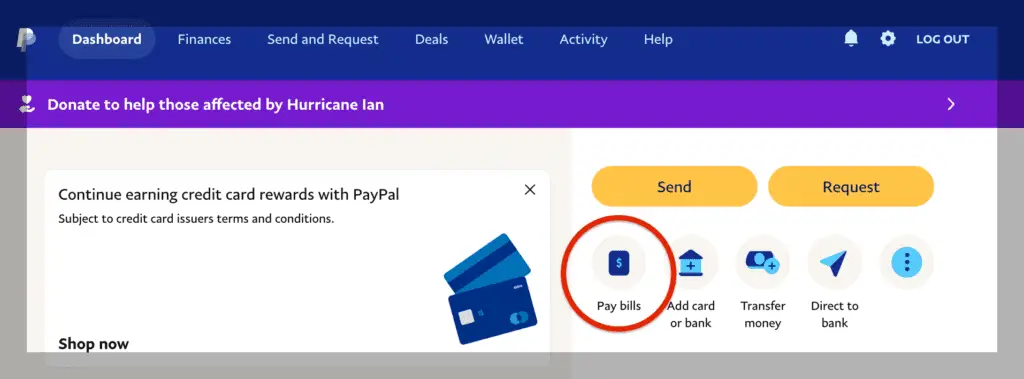

How To Use PayPal Bill Pay (Desktop)

STEP 1:

Log in to your PayPal account and click “Pay Bills” on your dashboard.

If this is your first time using PayPal Bill Pay, the option to “Pay Bills” may not automatically show up.

Click the three dots on the right (see image below) to open more options, including PayPal Bill Pay.

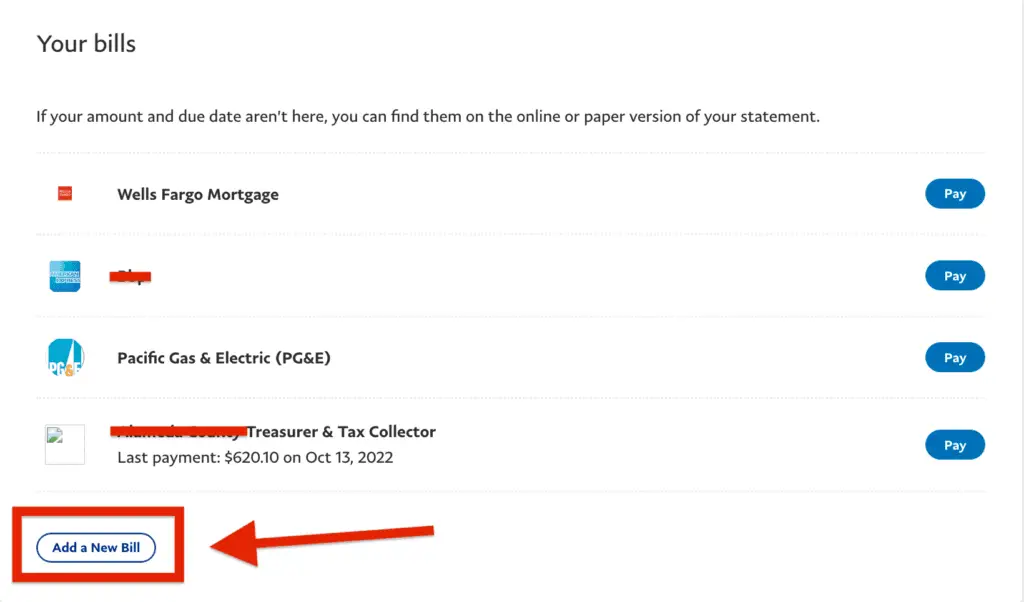

STEP 2:

Next, click “Add a New Bill” to PayPal Bill Pay.

STEP 3:

Search for the name of the agency or biller you would like to pay.

STEP 4:

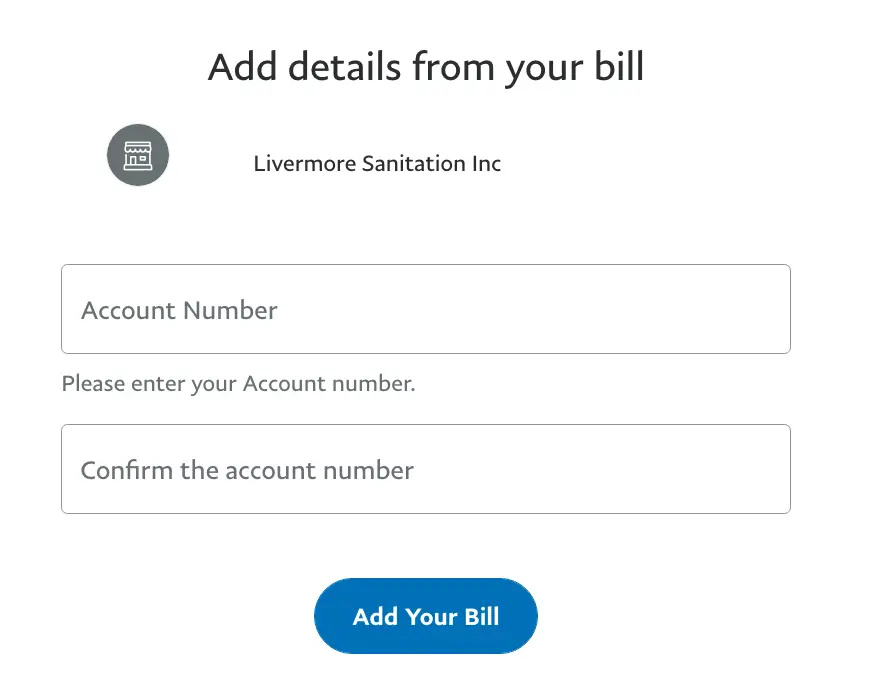

Add details from your bill.

Enter the account number on your bill exactly as you see it, including dashes or other symbols.

If the above does not work, try different formats — for example, use only alphanumeric characters and remove dashes and symbols.

STEP 5:

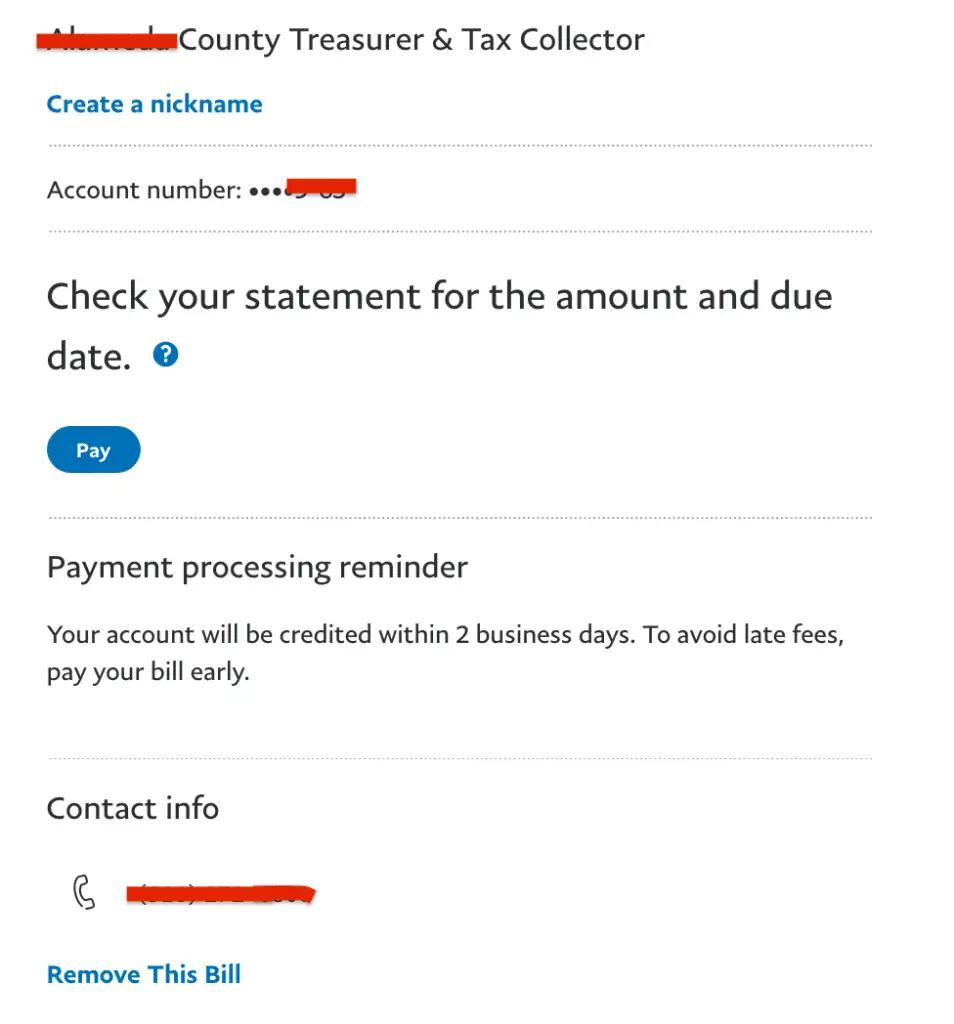

PayPal Bill Pay will notify you if the bill can be paid through the service. Click “Pay“.

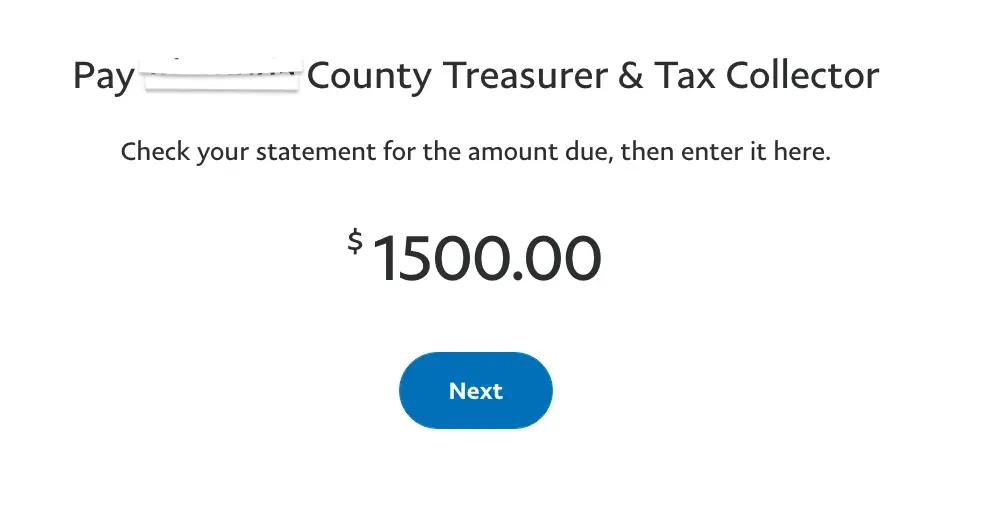

In my example below, I sent property tax payments to my county using PayPal Bill Pay.

STEP 6:

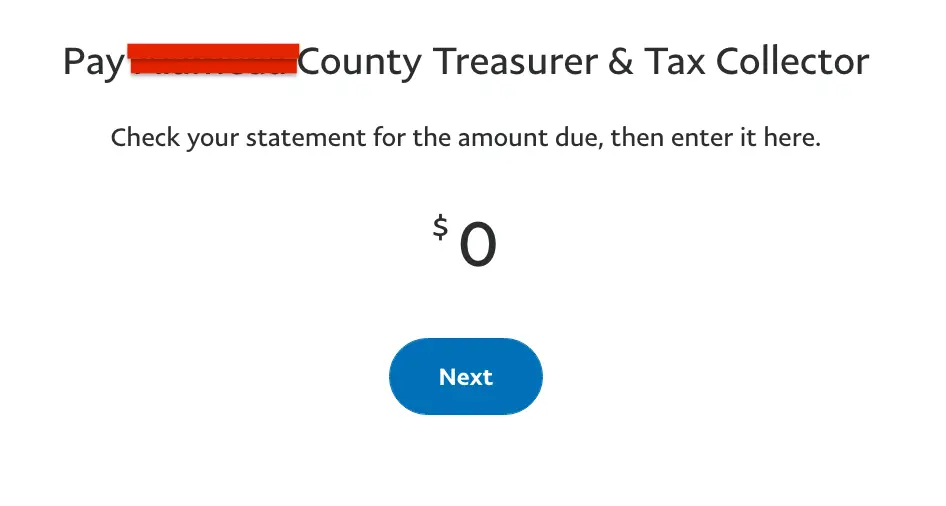

Enter the amount you wish to pay.

Pro-Tip: We recommend sending the full amount when sending property tax payments. If you need to send partial payments, please send all payments on the same day. That way, your county receives the full amount on the same day too. This will avoid confusion and unnecessary scrutiny.

STEP 7:

Type in the amount you want to send, enter your credit card details, and click “Pay.”

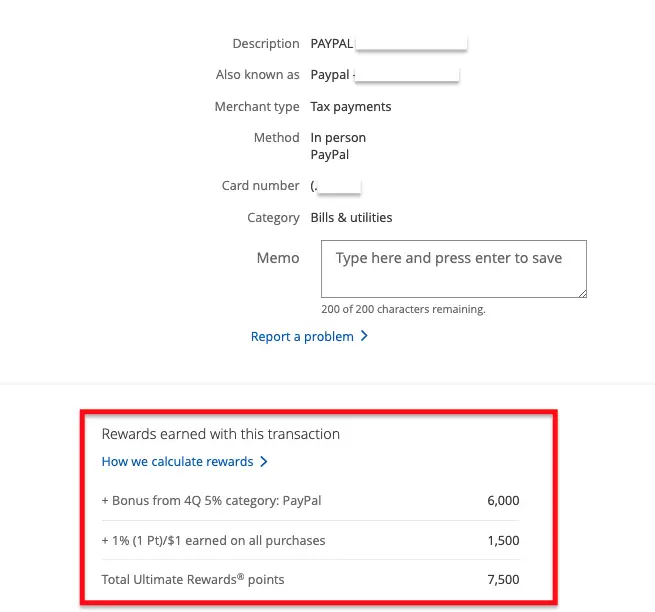

Since the Chase Freedom Flex℠ gives 5 points per dollar on up to $1,500 of spending this quarter (Q4, 2023), I sent the entire amount through Paypal to earn the maximum 7,500 Ultimate Rewards Points spending bonus for Quarter 4 (2023).

STEP 8:

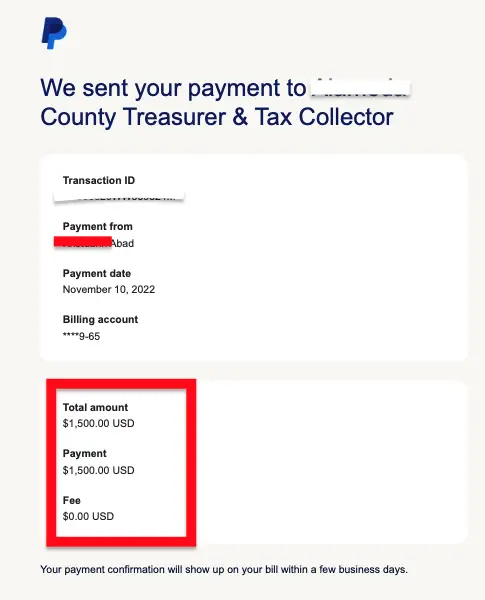

PayPal will email a confirmation that the payment went through successfully and that no additional fees were incurred. Sweet!

Compare that to the extra 2.5% fee my county charges when I pay my property taxes using a credit card through their website.

STEP 9:

My recommended last step is to check whether the transaction was posted to your credit card as a PayPal purchase and if the payment was received by the agency you are paying.

Since I used my Chase Freedom Flex℠, I earned 5 Ultimate Rewards Points per dollar from my property taxes because the transaction was posted as a PayPal purchase.

The Chase Freedom Flex℠ earns 5x per dollar in one quarter per year.

In 2023, PayPal earned 5x per dollar during Q4. Activation required.

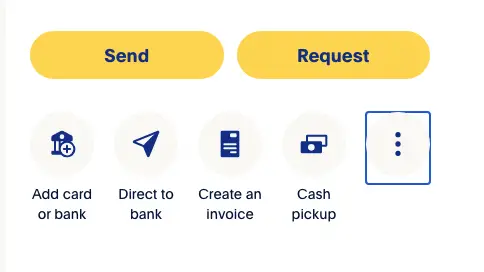

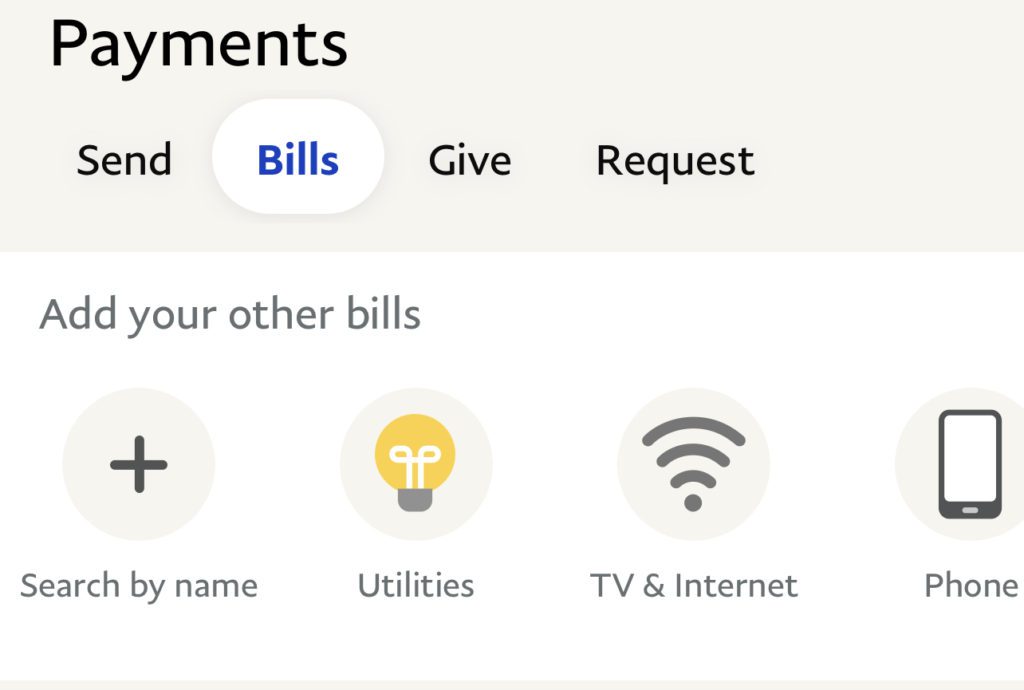

How To Use PayPal Bill Pay On the Mobile App

STEP 1:

Make sure to link your credit card first before sending PayPal Bill Pay payments.

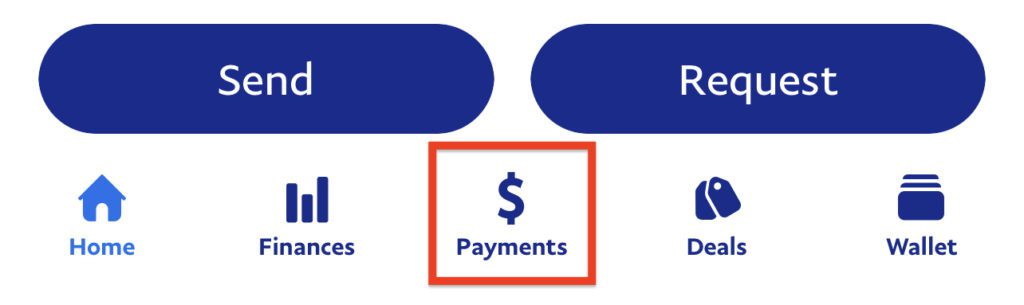

Once your credit card is linked, go to the PayPal App, then click “Payments” at the bottom of the page.

STEP 2:

Then, click “Bills“.

STEP 3:

Click the “+” sign (“Search by Name”) to find the biller/agency you would like to pay, then follow the same steps outlined above.

Recommended Credit Cards

Use Any New Credit Card To Earn The Sign-Up Bonus (SUB)

If you want a new credit card, I recommend applying for one with a generous sign-up bonus (SUB).

A SUB is a great way to earn many points quickly – which can be helpful if you want to book a last-minute trip or redeem for more luxurious travel redemptions.

To earn a SUB, credit card companies will require you to spend a certain amount of money (minimum spending requirement) before you can be awarded those travel points.

Therefore, you can use these new credit cards on PayPal Bill Pay.

If you need help determining which credit cards offer generous SUBs, I recommend contacting us at our free Travel Miles and Points Facebook Group, where members share their knowledge on their favorite travel rewards credit cards.

You can also fill out this credit card consultation form, and a member of our team will reach out to you shortly.

Use A Credit Card That Gives a Bonus When Using PayPal

For the past several years, the Chase Freedom Flex℠ credit card has been giving 5X points per dollar on PayPal purchases one quarter a year.

We announce this PayPal category bonus in the Travel and Miles Facebook Group. It is free to join!

Tips to Know Before Using PayPal Bill Pay

Not All Billers Are on PayPal Bill Pay

PayPal Bill Pay is a great way to pay your bills and earn rewards, but it’s essential to know that not all billers are currently in PayPal’s network.

This means you may be unable to use PayPal Bill Pay to pay some of your preferred billers.

To save time, check if your loan provider, utility company, or county treasurer’s office is in PayPal’s network before linking your credit cards.

Pro-Tip: PayPal regularly adds more billers to their Bill Pay service, so check the app periodically.

Not All Billers Will Accept Credit Cards

Sadly, not all billers will accept credit cards.

I tried to send money to pay my mortgage company, but my credit card was rejected.

However, as stated above, I successfully paid my property taxes and utilities through PayPal Bill Pay using my credit cards.

PayPal Bill Pay Does Not Charge Fees

Yes, you read it right.

As of March 2023, I could send property tax payments and pay my utilities without a fee using my credit cards through PayPal Bill Pay.

My county typically charges an extra 2.5% when using a credit card, but this fee is waived if paid through PayPal Bill Pay.

Let’s compare the fees incurred using the county website versus PayPal Bill Pay. Check out the table below.

| Payment ($2,000 Property Taxes) | % Fee | Amount |

|---|---|---|

| PayPal Bill Pay | 0 | $0 |

| Paying Using a Credit Card on the County Website | 2.5% | $50 |

You Have to Link the Correct Credit Card

PayPal allows its users to link several credit cards.

It is common to get overwhelmed or confused when selecting which credit card to use for PayPal Bill Pay, so check the last four digits of the card you intend to use before hitting the “PAY” button.

When using PayPal Bill Pay, make sure you use a new credit card or a card that offers a category bonus.

Make Sure Your PayPal Balance is $0

If you want to use your credit cards on PayPal Bill Pay, ensure no money is in your PayPal account.

If, by any chance, there is still money in your PayPal account, PayPal may deploy those funds first before using your preferred credit card.

Therefore, move all the remaining balance out of your PayPal account before using PayPal Bill Pay.

Unlink Your Bank Account

Occasionally, some merchants reject a credit card payment and instead require cash.

If you do not want PayPal to draw money from your bank account when a credit card payment fails, make sure to unlink your bank before paying your bills.

PayPal will draw money from your linked bank account whenever another form of payment falls through, so remove it from your PayPal wallet before using PayPal Bill Pay.

Set Cash Advance to $0 or As Close to Zero

Your bank may process credit card bill payments as cash advances.

Therefore, we suggest you set your cash advance limit to the minimum amount allowed or $0 if the bank allows it. Chase currently allows a minimum cash advance limit of $100.

You can modify your credit card cash advance limit by calling the number on the back of your credit card or sending your bank a secure message.

Some Gift Cards Work, But Some Won’t

While researching, I tried using several gift cards to see which ones would be accepted by PayPal Bill Pay.

As of this writing, certain payments using gift cards from giftcards.com and office supply stores appear to be processed successfully through PayPal Bill Pay, but that can change at any time.

I suggest sending a small trial amount using your gift cards to determine if PayPal Bill Pay will accept them.

Pay Early

Please remember that PayPal Bill Pay payments may take several days to reach your selected biller.

Submit your payment at least one week before the due date to avoid incurring late credit card payment fees.

Send a Small Payment

For new billers, it is recommended to send small payments of $1-$5 to determine if PayPal Bill Pay works with them.

Ensure the transaction is successful and the amount is reflected in your biller’s account before sending additional payments.

Once the test amount is processed, you may proceed to pay the remaining balance using Paypal Bill Pay.

Summary & Frequently Asked Questions (FAQs)

Can I use a credit card on PayPal Bill Pay?

As of this update (Nov 2023), PayPal Bill Pay accepts credit cards as a mode of payment.

The best part about using credit cards is that Paypal Bill Pay does not charge credit card transaction fees when paying bills such as property taxes, utilities, HOAs, etc.

This can save you money in the long run and make it easier to manage your finances.

Indeed, this money-saving tip may be discontinued at any time.

We highly recommend setting your cash advance limit to $0 or a minimal amount before utilizing your credit cards for PayPal Bill Pay.

This precautionary measure will give you peace of mind when using PayPal Bill Pay.

Is there a fee for using PayPal Bill Pay?

No, there is no fee for using PayPal Bill Pay.

However, if you choose to pay with a credit card, your credit card issuer may charge you a cash advance fee.

Before making payments through PayPal Bill Pay, it’s essential to check with your bank or credit card company for any potential fees.

Better yet, contact your credit card company and request for your cash advance limit to be set to $0 to avoid being charged extra fees.

Can I pay bills with PayPal Bill Pay without a credit card?

Yes, you can still use PayPal Bill Pay without a credit card.

You can make payments through PayPal Bill Pay if you have a linked bank account or debit card.

This option is particularly helpful for those who prefer not to use credit cards or do not have one.

How secure is PayPal Bill Pay?

PayPal Bill Pay uses top-of-the-line security features to protect your information and payments.

This includes encryption technology, multi-factor authentication, and fraud detection systems.

In addition, PayPal offers buyer protection for unauthorized or incorrect charges made through the service.

We recommend reviewing your transaction history regularly and immediately reporting any suspicious activity to PayPal.

As a precautionary measure, you can also set your cash advance limit to $0 or a minimal amount to avoid potential fees associated with paying bills through PayPal Bill Pay with a credit card.

By taking these steps, you can ensure the security and reliability of using PayPal Bill Pay for all your bill payments.

How do I view my payment history with PayPal Bill Pay?

To view your payment history with PayPal Bill Pay, follow these steps:

- Log in to your PayPal account.

- Click on the “Activity” tab or navigate to “Recent Activity”.

- You can filter by date, search by name or email, or view all payments made through PayPal Bill Pay.

- Click on a specific payment for more details and to access the transaction ID.

Is there a limit to how much I can pay with PayPal Bill Pay?

There is no set limit to how much you can pay with PayPal Bill Pay.

However, your credit card issuer or bank may have limits for transactions made through PayPal.

It’s best to check with them directly for any restrictions or fees associated with using PayPal Bill Pay as a payment method.

Generally, it’s always important to stay within your budget and avoid overspending on bills.

PayPal also offers payment reminders to help you stay on track with your payments and avoid any potential fees for late or missed payments.

Can I use PayPal Bill Pay internationally?

Yes, PayPal Bill Pay can be used internationally as long as the biller accepts PayPal as a valid form of payment.

However, keep in mind that additional fees, such as currency conversion fees, may be associated with international payments.

It’s important to check with your biller and PayPal for any potential charges before making an international payment through PayPal Bill Pay.

In addition, factor in the processing time for international payments, which may take longer than for domestic payments.

Can I pay bills with PayPal Bill Pay from my mobile device?

You can easily pay bills with PayPal Bill Pay from your mobile device by downloading the PayPal app.

The app offers the same features and security measures as the desktop version, allowing you to manage your bill payments on the go conveniently.

To pay, simply log in to your account, click the “Bills” tab, and follow the steps.

You can also view your payment history and set up automatic recurring payments through the app.

How do I cancel a payment with PayPal Bill Pay?

If you need to cancel a payment made through PayPal Bill Pay, follow these steps:

- Log in to your PayPal account.

- Go to “Recent Activity”

- Find the payment you want to cancel and click on it.

- Click on “Cancel Payment” at the bottom of the transaction details page.

- Confirm the cancellation and follow any additional prompts.

It’s important to note that you can only cancel a payment before the biller processes it.

Once it has been processed, you should contact the biller directly for any issues or discrepancies with the payment.

What happens if a payment I make with PayPal Bill Pay is rejected?

If a payment you make with PayPal Bill Pay is rejected, it could be due to insufficient funds in your linked account or an error with the biller’s information.

In this case, PayPal will send an email notification and request that you update your payment method or contact the biller directly for more information.

To avoid any potential issues, make sure to regularly review your payment information and update it if necessary.

You can also set up payment reminders to ensure timely payments and avoid any potential fees for rejected payments.

Can I pay bills with PayPal Bill Pay in other countries?

Yes, PayPal Bill Pay can be used to pay bills in other countries as long as the biller accepts PayPal as a valid form of payment.

However, remember that additional fees, such as currency conversion fees, may be associated with international payments.

It’s essential to check with your biller and PayPal for any potential charges before making an international payment through PayPal Bill Pay.

In addition, factor in the processing time for international payments, which may take longer than for domestic payments.

How does PayPal Bill Pay protect my personal information?

PayPal takes extensive measures to ensure the security and protection of your personal information when using PayPal Bill Pay.

All data is encrypted and stored on secure servers, and any sensitive information, such as bank account numbers, is only used for payment processing purposes.

In addition, PayPal uses advanced fraud detection technologies to monitor for any unauthorized or suspicious activity.

You can also set up two-factor authentication for an extra layer of security when logging into your PayPal account.

Why are gift cards from Giftcards.com accepted and those from Staples not?

This is due to the issuing bank. MetaBank issues gift cards from Staples or Office Depot, and Pathward issues gift cards from Giftcards.com.

PayPal may have hardcoded its system to reject gift cards issued by Metabank. This can change over time, though.

Update: we are receiving data points that not all gift cards from Giftcards.com are accepted by PayPal Bill Pay. I suggest sending a small trial amount first.

Update #2: we just received new data points that gift cards purchased from Staples work when paying utilities. Please see the comment section.

Can I split my payments using PayPal Bill Pay if I want to use two credit cards to pay my property taxes?

When sending property tax payments, we recommend sending the total amount.

If you need to send partial payments, please send all payments on the same day.

That way, your country receives the full amount on the same day too.

This will avoid potential scrutiny that can lead to shutdowns.

Final Thoughts

Paying your bills through PayPal Bill Pay is a great way to avoid incurring credit card fees when paying for bills.

When you use a credit card with a generous sign-up bonus, you can earn a significant amount of points when using PayPal Bill Pay to pay your bills.

Without a doubt, this PayPal Bill Pay strategy has the potential to generate a substantial amount of cash rebates or travel rewards when paying for expenses that traditionally charge extra fees when paid with a credit card.

Although this tactic may not work for everyone, anyone who likes earning something back from credit card purchases should consider PayPal Bill Pay.

While different promotions to accumulate cash back or travel rewards have sprouted everywhere lately, this new offering from PayPal has quickly become one of my favorites.

So, what are you waiting for? Why not give PayPal Bill Pay a try today?

EDITORIAL DISCLOSURE – Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. The content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

VGC from Staples worked for me when I paid my electricity bill.

Thanks for sharing your data point.

MCGs and VGCs from Staples worked for me too. I have used it several times in the past to pay for our PG&E bill, water bill, waste management bill, etc. From my experience, when I add a gift card, it sends a message that it can’t be added, but it always goes through when I click again the second time. Then PayPal asks for you to click on a link that sends a 4-digit code to MC or Visa. You need to get that code by checking the balance on your GC. You’ll see a $1.95 charge but you get that back in a couple of days. Once you have the code, go back to PayPal and type the code in.

This is so excellent, thank you for sharing your DP with us Farah!

thanks for this post – I can’t seem to add my property taxes on pp bill pay. Any tips?

Hi Cho, great question. Unfortunately, not all counties are on PPBP yet, but I recommend checking periodically as they seem to add more billers. Let’s hope your county shows up there soon.

Hey. When sending property taxes, do you typically send the full amount or will they accept partial payments? Also, have you had any luck with sending mortgage payments through PPBP?

HI Trent. We recommend sending the full amount. In the event that you need to send partial payments (using 2-3 credit cards to earn the SUB), then we suggest sending them on the same day so that your county receives it as a lump sum. This will reduce the likelihood of potential issues. With regards to mortgage payments, I have not had any success, but I’ll try again soon.

Thanks for this detailed article!

Does someone know how this looks like to the biller – is it like an ACH ?

I have used this in past to pay my county’s property taxes and some utility bills, but am always concerned what happens if it fails (could money get stuck, how to explain to them what is Paypal BillPay). Perhaps the biller has to specifically register on Paypal BillPay, not sure about that.

HI Ayush. Thanks for the comment. Great question. Sharing DP here from my county – they have no idea it is coming from PayPal Bill Pay. The payments are coming from a third-party bank that PP uses. Right now, we have no idea who is footing the transaction fees — I don’t think it’s the county since they are receiving it like it’s an ACH. With regards to your concern about failed payments – that’s a worry of mine too. Thankfully, PP will send a receipt if your bill payment is successful. If it is not successful, then you will be alerted by PP that the payment fell through so you can attempt to send another one. Hope that eases some of your concerns.

Hi, how do you recommend for us to check if the property tax payments went through successfully? Do you suggest reaching out to the county to double check?

Hi Shanti, you can easily verify if the payment went through by checking your credit card statement as well as your county treasurer’s website.