ADVERTISER DISCLOSURE: The Frugal Tourist is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as MileValue.com This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Additionally, the content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

While being a homeowner has many rewards, it also has some costly downsides. One of the significant contributors to this financial burden is having to pay property taxes annually.

Sad to say, there is no way to get around this hefty bill unless, of course, you are a renter or luckily living for free with family or with a partner.

Your tax bill will typically depend on the current assessed value of your property and the state where you reside.

Having lived and owned in California, this is a tax I dread because it does inflict a sizable dent in my savings. Thankfully, I have stumbled upon a strategy that effectively softens the financial impact of this expense.

Travel for Nearly Free with Miles and Points

This technique involves applying for 1 or more credit cards right before property tax season in order to generate generous sign-up bonuses that can be redeemed for free/discounted flights and hotels.

As a matter of fact, my goal is to primarily redeem the points I accrue from property taxes on premium cabins since those seats are practically unattainable for me to afford in this lifetime. Nevertheless, whether I get business class or coach, I am always grateful for whatever free flight I find from my property taxes.

Case in point, I flew on Etihad’s luxurious First Apartments in 2019 using the bonus points I earned from my property taxes the previous year.

The total cost for this seat was no more than $200 since the majority of the cost was covered by the points I earned from a couple of credit cards. It would have cost over $10,000 had I paid for it myself.

It goes without saying that with this approach, I am essentially guaranteed to almost always break even. Who in this world doesn’t want to be rewarded a bonus vacation as a result of paying taxes?

Last year, my property taxes in California cost an arm and a leg. Before property tax season arrived (September – March), I made sure that I have already done my due diligence by identifying credit cards that were offering massive bonuses.

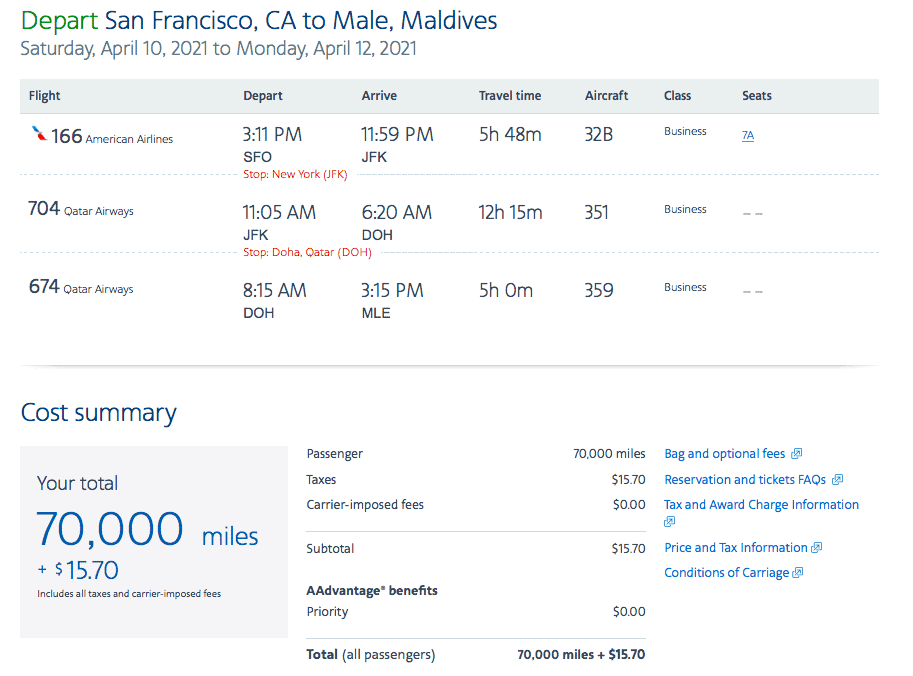

In fact, I just redeemed some of those points for a trip to the Maldives in Spring 2021, on Qatar Airways Business Class.

This has a price tag of over $6,000 one way, but I only paid $15.70 since the 70,000 American Airlines (AA) miles came from an AA credit card offer I applied for a few weeks before my property taxes were due.

My Strategy: I set a goal to redeem the points I’ll earn from property taxes on a product that I know will cost more than my property taxes – typically flights on premium cabins.

It is NOT completely free

I would like to underscore that even though the flight is FREE, taxes and airport fees are not waived. Moreover, a surcharge is usually associated with using a credit card to pay property taxes.

In my situation, if I choose to pay with a debit card or a credit card, the county where my home is located charges a 2.85 percent fee. Some jurisdictions allow you to pay using various payment methods, including split payments.

You may need to inquire about this directly with your county if they accept split payments. You can also use Visa Gift Cards or Mastercard Gift Cards purchased using a credit card that earns a category bonus.

In the grand scheme of things, these fees are relatively insignificant especially if you are getting a premium flight for a considerable discount. Alternatively, you can always elect to pay cash and forego this opportunity for a free vacation if you are not comfortable shelling out extra cash for these miscellaneous charges.

Can Anyone Do This?

Unfortunately, this tactic is not for everyone. Please read along to find out if this method is a suitable strategy for you.

This deal may work for you if…..

- You get a property tax bill yearly

- You have excellent credit

- You are debt-averse, meaning you don’t like debt – you pay off your credit card balance every month on or before the due date

- You are agreeable to paying a small interest charge (2-3%) for using a credit card to pay your property taxes

This deal may not work for you if…

- Your property taxes are in escrow

- You do not have excellent credit

- You are not able to pay your credit card balances in full on or before the due date

- You have a lot of outstanding credit card debt

- You are not comfortable paying a 2-3% credit card surcharge

If you are interested to participate in this travel strategy but currently have your property taxes in escrow, you can reach out to your mortgage lender to determine if you are eligible to have this set-up discontinued.

Every lender has different terms for removing escrow. In some cases, the loan has to be at least one year old with no late payments. Another requirement might be that no taxes or insurance payments are due within the next 30 days.

NOLO.com

6 Steps To Earn Nearly Free Travel From Property Taxes

STEP 1: Create a Sinking Fund. Divide your property tax by 12. Deposit this specific amount to another bank account so you will not accidentally spend it.

Search for a new bank that has a sign-up bonus. Transfer this amount every month so you are guaranteed to have the cash available when it is time to pay your credit card. Other available bank bonuses can be found here.

STEP 2: When property tax season rolls around, you have to identify which credit card/s to apply for.

While the selection of cards is plentiful and can be a bit overwhelming, there are typically only 2 or 3 cards that have lucrative offers at any given time.

Feel free to join us in our Travel Miles and Points Facebook Group where we talk about the current travel credit card deals.

STEP 3: Apply for 1 card around September or October and another card around December or January.

| California Property Tax | Due Date | Pay Before |

| 1st Installment | November 1st | December 10th |

| 2nd Installment | February 1st | April 10th |

STEP 4: Pay your property taxes using your new credit card before the due date in December. Repeat this step again before the second installment due date in April.

It bears repeating that you will incur a small fee (2-3%) for using your credit card whenever you pay property taxes. A strategy is to pay only the exact amount that will trigger the credit card sign-up bonus and pay the rest in cash. For example, if your property tax is $5,000 and your new credit card requires only a $3,000 spend, then use the card for $3,000 and pay the rest in cash. That way, you only incur a fee on the amount charged to your credit card. Alternatively, you can put the remaining amount on another credit card with a generous sign-up bonus (SUB)! A heads up though that not all counties accept split payments.

STEP 5: Use the money you have saved up in your sinking funds to pay your credit card bill before its due date. Do not skip this step. It is never a good idea to pay the bank hefty credit card interest rates.

STEP 6: Wait for the sign-up bonus to roll in and redeem your points for nearly free flights or hotels.

MY 2022-2023 PROPERTY TAX STRATEGY

Since I live in a 2-player household (2 people can apply for credit cards), we plan to apply for a total of 4 cards this property tax season in order to cover this year’s taxes. I apply for 4 credit cards because I also have a rental property that I pay property taxes for in addition to my primary residence.

Our credit card selection strategy is principally based on what cards are missing from our portfolio, and what offers currently provide the most profitable rewards.

| The Credit Cards We Currently Have Chase Sapphire Reserve Chase Sapphire Preferred Chase Freedom Flex Chase Ink Business Cash Chase Ink Business Unlimited United Business Card American Express Business Platinum American Express Business Gold American Express Business Blue Plus Citi Premier Capital One Venture X Hyatt Marriott Bonvoy IHG Premier Hilton Aspire Hilton Business |

If you are new to this hobby of earning miles and points, I suggest considering applying for the Chase Sapphire Preferred Credit Card. It is our favorite beginner travel credit card.

CARD 1

Since I am pretty maxed out with Chase and Amex cards, I have been thinking about diversifying my points currencies. A card that I have been considering adding to my portfolio is the CAPITAL ONE VENTURE CARD.

It currently gives 75,000 Capital One points after spending $4,000 in purchases within the first 3 months of account opening. These points can be used for free flights and hotel stays. Learn more about the Capital One Venture card here.

CARD 2: Citi Premier

Another card that I have been eyeing is the CITI PREMIER CARD. It currently earns 80,000 bonus ThankYou® Points after you spend $4,000 in purchases within the first 3 months of account opening. This will be my second Citi Premier. Citi allows another Premier if you have not received or canceled the card in the past 24 months.

Citi Application Rule: Bonus ThankYou® Points are not available if you received a new cardmember bonus for Citi Rewards+®, Citi ThankYou® Preferred, Citi ThankYou® Premier/Citi Premier® or Citi Prestige®, or if you have closed any of these accounts, in the past 24 months.

It also gives 3 points per dollar at restaurants, supermarkets, gas, flights, and hotels. You can read more about the terms and benefits of the Citi Premier Card here.

CARD 3: Chase Ink Business Cash or Chase Ink Business Unlimited

Since we have multiple side hustles (small businesses), I plan to take advantage of the increased bonus of the 2 no-annual-fee Chase Ink Business Cards.

Both the CHASE INK BUSINESS CASH® Credit Card and the CHASE INK BUSINESS UNLIMITED® Credit Card will give 75,000 Chase Ultimate Rewards points ($750 value) after spending $7,500 in 3 months.

The no-annual-fee Chase Ink Business Cash® Credit Card also gives 5 points per dollar at office supply stores, internet, phone, and cable.

Whereas the no-annual-fee Chase Ink Business Unlimited® Credit Card gives 1.5 points per dollar for all spending. You can read more about these cards here.

How Do I Answer a Business Credit Card Application?

Rule of Thumb: Be Truthful

Below are the typical questions included in a business credit card application and my cheat sheet on how to answer if you are a side hustler without an EIN (Employer Identification Number)?

| Question | Answer |

| Legal Name of Business | Your Full Name |

| Business Name on Card | Your Full Name |

| Business Mailing Address | Your Address |

| Tax Identification Number | Your SSN |

| Type of Business | Sole Proprietor |

| Annual Income | Your Annual Estimated Profit on your Business (at least $1) |

| Number of Employees | 1 |

CARD 4

AMERICAN EXPRESS® GOLD CARD: Earn 60,000 Membership Rewards® points after you spend $4,000 on eligible purchases with your new Card within the first six months. Terms Apply.

It earns 4X Membership Rewards® Points at Restaurants, including takeout and delivery, and at U.S. supermarkets (up to $25,000 per calendar year in purchases, then 1X).

It also earns 3X Membership Rewards® points on flights booked directly with airlines or on amextravel.com.

Final Thoughts

As Benjamin Franklin famously quoted, “In this world, nothing can be said to be certain, except death and taxes.”

Who does not want a silver bullet to magically defer or eliminate property taxes? That might just be wishful thinking.

This property tax bill will expectedly arrive come hell or high water, so better be prepared to face the music than be left high, dry, and broke.

I hope that the technique I described in this post is suitable for your financial situation so that you may be rewarded with a free holiday each year after paying your property taxes. You put out a lot of effort to pay those taxes, therefore, it’s only fair if you get rewarded with free travel.

Have you ever earned free travel from property taxes before?

DO NOT TRAVEL WITHOUT TRAVEL INSURANCE. GET A QUOTE HERE.

EDITORIAL DISCLOSURE – Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. The content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

I love hearing of your strategies in how to do this. I especially like the Sofi idea of where to put the money while waiting. In reality though the fee for paying taxes with the credit card should be added to the amount you paid for the ticket. So your ticket really cost 115.70 or $215.70. Still a very good deal, but it gets the real amount out front.

Dear Patty, I’m so glad you found the strategy useful. SOFI is a great travel debit card / ATM because it reimburses all the ATM fees you incur when you withdraw money anywhere. And, yes, thank you for pointing that extra surcharge out. I did include a statement at the bottom to address that but I’m certainly following your advice and added a few statements to let readers know that even though the flight is free, there are some extra fees to be paid. Thank you so much again for reading and for your valuable feedback!

That is a brilliant strategy! Thank you so much for sharing.

Thank you so much, Rena!

Yes, great post. I’ve taken numerous trips abroad to meet The Big Guy using reward miles. Great way to reduce the flight costs for sure.

Absolutely! If you are OK with paying the small fee on the taxes, I think this is a great way to earn a lot of miles for free travel in the future.

Our property taxes have been going up about $900 per year! This strategy would help take the sting out of that. I had thought about paying our property taxes by credit card before but as you mentioned, it is pretty much a wash due to the fee of paying by credit card. This is a clever way to deal with this necessary expense.

Hi Megan, thank you for stopping by! Sorry about the yearly tax increase. Certainly a bitter pill to swallow. While the 2.85% fee can be off-putting when using credit cards, I try to use the points I’ve accrued from the taxes on redemptions that costs so much more. This way, it doesn’t only soften the blow, it also makes it a bit rewarding in some odd sense 🙂