ADVERTISER DISCLOSURE: The Frugal Tourist is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as MileValue.com This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Additionally, the content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Knowing where to begin when you have a question about your credit card might be challenging.

Should you look up the answer on google, call the bank, or stop by a branch?

Fortunately, you have several options available to connect with your bank. One of the most secure and convenient ways is through the messaging center.

Chase Bank is one of those banks that provide the option of sending “secure messages” to their agents.

You Can Secure Message Chase

All Chase cards have a secure messaging option, including the very popular Chase Sapphire Preferred® and the Chase Sapphire Reserve®.

You can also send secure messages if you need assistance with other notable co-branded Chase cards like the Southwest Business Card or the World of Hyatt Credit Card.

The great thing about utilizing the secure message service is that you can contact the bank whenever it’s convenient for you.

The secure message system also allows you to solve almost any problem.

In this blog post, I will go over the steps on how to send a secure message to Chase Bank.

What is a Secure Message?

A secure message is a sort of encrypted communication that guarantees the privacy of the senders and receivers.

It’s typically utilized in applications where sensitive data must be transmitted.

Chase offers a secure message service for its cardholders.

This service can be used to send and receive messages about your account, make payments, or request customer support.

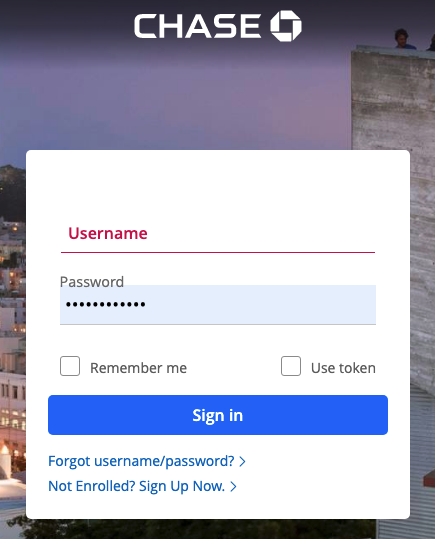

To use this service, you must create a login and password.

What Can I Do With Chase Secure Message?

Chase’s secure message center may be used to perform many of the same operations as phoning the bank directly, including the following:

- inquiring about charges

- setting up travel notifications

- requesting for balance transfers

- asking about points and rewards

- matching offers

- credit balance refund

- following-up on missing referral bonuses

- and many more

What Are The Pros and Cons of Using Secure Message

The secure messaging tool is usually more efficient than calling the bank, so I prefer to use it.

I love that I don’t have to wait on hold for a customer service representative with Chase. Agents typically respond promptly within 24 hours.

The secure message option on the Chase website is also a good choice for cardholders who would rather not speak to bank representatives over the phone.

Talking directly to someone about your finances can be nerve-wracking, so this may be a more relaxed way of getting the answers you need.

Plus, this written correspondence is a great way to document our requests.

That said, there are limits to the number of issues you can resolve via secure messaging.

Here are tasks that will require a call and can not be performed via secure messaging:

- dispute a charge

- change a credit card to another product

- ask for a retention offer

- negotiate a denied application through a reconsideration call (new data points indicate that you can now also send secure messages when requesting for your credit card application to be reconsidered)

Steps on How to Send a Secure Message

Step 1: Log in to your Chase Profile on Chase.com using your computer

Step 2: Click the Three Horizontal Lines on the Upper Left-Hand Corner of your Profile

Step 4: Tap “New Message”

Step 5: Select “I have a question about one of my accounts”

Step 6: Select the Account that You Have a Question About

Step 7: Write and Send Chase a Secure Message

Here’s an email I sent via secure message when I was trying to find out when I last received my Chase Sapphire Preferred bonus.

“Hello, I am wondering if you can help me figure out when I last received the bonus for my Sapphire card. Thank you very much.”

Sample Secure Message Scripts (Please Edit)

Inquiring When A Sign-Up Bonus Was Received

Hello,

I am wondering if you can let me know when I last received the sign-up bonus for my Sapphire Preferred card. Thank you!

Matching an Offer

CHASE INK CASH/UNLIMITED EXPIRING 90K OFFER

Hello,

I recently got approved for the Chase Ink Unlimited / Chase Ink Cash with the following terms: Earn 75,000 Chase Ultimate Rewards Points after spending $6,000 in 3 months.

I was informed that Chase has an existing offer of 90,000 points that will expire on March 21st.

I am just wondering if my offer could be updated to reflect the current higher bonus of 90,000 points.

Thank you so much!

IHG PREMIER CARD INCREASED OFFER TO 175,000 POINTS

Hello,

Chase has recently increased the sign-up bonus for the IHG Premier card to 175,000 IHG points.

I recently applied for this card not too long ago when the offer was 140,000 IHG points.

I am wondering if my welcome offer could be matched to reflect the higher bonus.

Thank you very much.

H/T: Rhea D., Facebook Group

CHASE SAPPHIRE PREFERRED INCREASED BONUS TO 80,000 POINTS

Hello,

I noticed that the Chase Sapphire Preferred card has recently increased their signup bonus to 80,000 Ultimate Rewards Points.

I applied for this card _____ days ago when the welcome bonus was 60,000 points.

I am reaching out to ask if my welcome offer can be matched to reflect the current increased offer of 80,000 points.

Thank you so much

Credit Balance Refund

As per Chase, if you have a credit on one of your accounts, you can simply spend it, using your card for everyday purchases.

or

Chase can send a refund.

Here are specific instructions when requesting a credit balance refund via secure message (Source: Chase.com):

- Chase may contact your personal email address within 2–3 business days to ask you to provide the U.S. checking or savings account where you’d like to receive an electronic deposit. Make sure your personal info is up to date.

- If you don’t receive an email or accept the funds electronically within the time period mentioned in the email, or if your home address is outside the U.S., a paper check will be mailed to the address we have on file for you within 7–10 business days.

- The actual refund amount may differ from what you currently see on your account activity because of open disputes, recent purchases, interest charges, or fees posted to your account.

Final Thoughts

If you’re looking for a more secure and efficient way to communicate with Chase Bank about your credit cards, I suggest using the secure messaging tool.

You can easily find this option on the Chase website. This may be a better choice if you’re uncomfortable discussing your finances with someone else over the phone.

Agents typically respond promptly within 24 hours, so you won’t have to wait long for an answer.

While not all functions can be done via secure messaging, basic tasks such as setting up travel notices, requesting balance transfers, matching offers, etc. can be conveniently performed via secure message.

Have you tried communicating with your bank this way? How was your experience?

EDITORIAL DISCLOSURE – Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. The content has not been reviewed, approved or otherwise endorsed by any of the entities included in the post.

When I send an upload to you—- how long before I receive an acknowledgment??

HI there, are you talking about sending a message to Chase?