ADVERTISER DISCLOSURE: The Frugal Tourist is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as MileValue.com This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Additionally, the content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

If you’re a sole proprietor looking to earn lucrative sign-up bonuses and travel rewards, then American Express business credit cards may be just what you need.

As one of the most reputable credit card providers, American Express offers a wide range of business credit cards specifically designed to help small business owners like you earn more rewards.

However, if you are just starting your side hustle, applying for your first-ever American Express business credit card may be a bit intimidating.

This article aims to clarify the application process for business credit cards, specifically for new sole proprietors or individuals just starting their side hustles.

I will also provide tips on answering an American Express Business Credit Card application so you can soon start earning travel rewards (or cashback) to bring you closer to your dream vacations.

I Do Not Have a Company or an EIN. Am I Eligible for an American Express Business Credit Card?

If you are an owner of a company or a self-employed full-time contractor, applying for a business credit card should be a walk in the park for you already.

But for part-time side hustlers who occasionally moonlight, filling out a business credit card application can be incredibly unnerving.

I could just imagine how it could get quite daunting to provide information, such as your company’s name and EIN (Employment Identification Number), when you do not have them.

It also does not help that there is a common misconception that seasonal side hustlers are not classified as business owners, thereby automatically disqualifying them from business credit cards altogether.

Nothing Can Be Further From The Truth

Regardless of the revenue, anyone who earns a profit from any type of venture is considered a sole proprietor and, therefore, eligible to apply for American Express business credit cards.

In this post, I aim to demystify the American Express business credit card application process so you can confidently answer the form even if you are a sole proprietor and do not have an EIN (Employer Identification Number).

Above all, I would like to increase your odds of getting approved for your first American Express business credit card as a sole proprietor.

Side Hustlers are Eligible to Apply for Business Credit Cards

Anyone who currently has a side hustle or is merely thinking of a future side hustle may be eligible to apply for a business credit card.

That’s right; you may be eligible even if you are just at the initial stages of your business!

Simply put, your side hustle does not need to be completely off the ground yet – you can also qualify while in the process of conceptualizing it.

Generally speaking, though, having an existing side hustle, regardless of income, fundamentally makes you a more qualified candidate, but it is not a requirement. Hence, any start-up is eligible.

What Businesses Qualify As a Side Hustle?

Any Side Hustle is Considered a Business.

Initially, I myself was skeptical if I would qualify for a business credit card when I first applied over a decade ago.

I was only “selling” junk on eBay and Craiglist periodically, and the income I received from it was inconsistent and barely enough to pay for gas.

When I got approved for my first-ever business card, I was beyond thrilled.

Do you mean I can get travel points to book business class tickets by selling random stuff online? Absolutely!

List of Popular Side Hustles

- buying and selling online (Facebook marketplace, Amazon, Etsy, eBay, etc.)

- tutoring

- driving for Uber/Lyft

- tour guide

- being an Airbnb host

- caregiving

- babysitting

- dog-walking

- instacarting

- door dashing

- coaching/consulting

- any manual labor you do on the side – plumbing, electrician, lawn mowing, etc.

- having your own blog/podcast/youtube channel

- having a rental property

- any freelance gig that yields a 1099 come tax time

- your side hustle!

In a nutshell, you don’t need to own a multi-million dollar company to qualify for a business card.

Nor would you need to have a physical office either – your business address can be your primary residence.

In fact, you also don’t need to work in your business full-time.

It can be part-time or seasonal, or a few hours throughout the year.

Any side hustle will do, regardless of the nature and structure of your venture.

As long as you are engaged in some form of activity to earn a profit, you are eligible to apply for an American Express business credit card.

Income And Credit Scores

How Much Income Do I Need When Applying for Business Credit Cards?

When I started my side hustles over a decade ago, the income I generated from them was nothing to write home about.

I endured many years of floundering ventures until I got to where I am now.

Even though my business endeavors were fumbling then, that did not impact my eligibility to get approved for business cards.

So, I continued applying and traveling for free despite having numerous downturns.

The point is that “income” is not the only factor banks will consider before approving.

Instead, banks will most likely focus on your entire financial history to determine your viability. Thus, it is a recommended practice to cultivate a stellar credit score.

How About My Credit Card Utilization Rate?

The banks will also certainly assess your credit utilization rate, which is simply the ratio of your debt to the total credit you have.

The following formula calculates this ratio: “What You Owe” divided by “Your Total Credit.”

The lower your credit utilization rate is, the higher the likelihood of approval.

At any rate, as long as you have a side hustle, you could potentially get approved regardless of your current earnings.

In fact, you don’t even need to have a steady revenue stream.

Of course, who doesn’t wish for consistency in our income sources?

But if you are concerned that not earning enough could adversely affect your application, it generally wouldn’t.

Am I a Good Candidate for an American Express Business Credit Card?

Since I value frugality and not frivolously spending on unnecessary expenses, I do not recommend applying for business credit cards if you are having a challenging time executing the following:

- Pay the bill on or before the due date

- Pay the bill in full

The goal is to fly for almost free.

So, paying finance charges inherently defeats the purpose of this strategy.

Therefore, if you have existing consumer debt, pay them off first before applying for an American Express business credit card.

Alternatively, if you have difficulty adhering to paying your credit card balances altogether, month per month, then I strongly suggest bolstering your savings account first by employing these heavyweight saving strategies.

Once you possess this new frugality habit and have saved up a decent emergency fund, you are more than ready to sign up for business credit cards.

Remember, paying banks ridiculously high-interest charges is never a good idea.

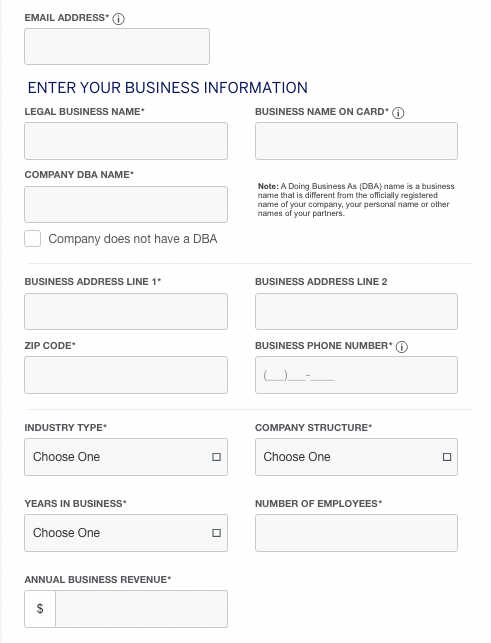

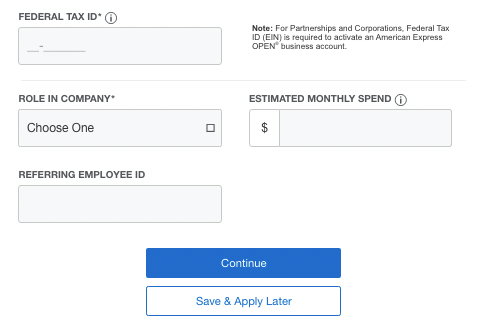

How Do I Answer an American Express Business Credit Card Application as a Sole Proprietor?

There are two components to a typical Business Credit Card Application.

- Business Information Section

- Personal Information Section

Rule Of Thumb: Be Truthful

Below are the typical questions included in an American Express Business Credit Card application and my cheat sheet on how to answer them.

How to Answer an American Express Business Credit Card Application

| Questions | Answers |

|---|---|

| Legal Business Name | Your Full Name (if Sole Proprietor) |

| Business Name on Card | Your Full Name (if Sole Proprietor) |

| Company DBA Name | None (Check Company does not have a DBA) |

| Business Address | Your Address |

| Business Phone Number | Your Phone Number |

| Industry Type | Choose One Retail Trade (if Facebook Marketplace) |

| Company Structure | Sole Proprietorship |

| Years in Business | At least one year (include the time you were conceptualizing the biz) |

| Number of Employees | One (1) if you are the only employee |

| Annual Business Revenue | At least $5,000 (estimated revenue for the next 12 months) |

| Federal Tax | Leave Blank for Sole Proprietors |

| Role in Company | Choose Any |

| Estimated Monthly Spend | At least $100 |

Recommended American Express Business Credit Cards

The Blue Business® Plus Credit Card from American Express

| The Blue Business® Plus Credit Card from American Express |

|---|

| Annual Fee: $0 |

| Foreign Transaction Fee: Yes |

| Earn: 15,000 American Express Membership Rewards® Points |

| Minimum Spend Requirement: $3,000 in eligible purchases on the Card within your first 3 months of Card Membership. Terms Apply. |

| Earn: 2X Membership Rewards® points on everyday business purchases regardless of category, up to $50,000 in spend per year (1x thereafter) |

American Express® Business Gold Card

| American Express® Business Gold Card |

|---|

| Annual Fee: $295 |

| Earn: 70,000++ after spending $10,000 on eligible purchases within the first 3 months of Card Membership. Terms Apply |

| Earn: 4X points in the 2 select categories where you spend the most each month on up to the first $150,000 in combined purchases from these 2 categories each calendar year. |

| Earn: 1x Membership Rewards® Points on all other purchases. |

The Business Platinum Card® from American Express

| The Business Platinum Card® from American Express |

|---|

| Annual Fee: $695 |

| Earn: 120,000 Membership Rewards® points after you spend $15,000 on eligible purchases with your Card within the first 3 months of Card Membership. |

| Earn: 5 Membership Rewards® Points on flights and prepaid hotels on amextravel.com |

| Earn: 120,000 Membership Rewards® points after you spend $15,000 on eligible purchases with your Card within the first three months of Card Membership. |

| Earn: 1x Membership Rewards® Points on all other purchases. |

What Are The Chances I Will Get Approved for an American Express Business Credit Card?

If this is your first business credit card application, there is an increased likelihood that you will not get instant approval.

But, please do not worry, this is quite common.

Typically, banks require some time to evaluate your application and assess your financial history & credit score, especially if this is your first time applying for a business credit card.

If you have a credit history that paints a picture of an individual who is financially responsible, then chances are, you will most likely receive an approval letter in the mail.

I cannot emphasize the importance of maintaining an immaculate credit score (740+).

Should you get a pending approval or a denial, it is not the end of the world.

Almost always, it is possible to reverse the decision by calling the bank’s “Reconsideration Line”.

Alternatively, please reach out to us at the free Travel Miles and Points Facebook group, and we can walk you through the next steps on how we can possibly reverse the bank’s decision.

You can also contact us through this credit card consultation form.

How Do I Meet The Minimum Spend Requirement (MSR)?

What is MSR (“minimum spend requirement”)?

To receive the above cards’ bonus rewards, you must meet a certain minimum spending requirement within a specific time frame.

Failing to complete these conditions will forfeit your reward.

So, how exactly can you meet this spending requirement if you have yet to get your business off the ground?

That’s a valid question!

Banks typically do not have a way of knowing which expenses are wholly for business or personal, and truthfully, sometimes, the boundaries between those two categories are blurred.

If you feel that you cannot meet the minimum spend requirement and are in danger of missing out on the bonus, the related post below lists the strategies to assist you in fulfilling the required spending.

What If I Do Not Have a Business? Start One!

Do not fret, you do have a couple of options.

As mentioned above, applying for an American Express business credit card is possible if you are still in the beginning stages of planning for a business.

As with all businesses, we all need initial capital to fund our “start-up” expenses, and sometimes the fund source can come from a credit card. Banks are aware of this.

Whether you plan to start a podcast or a dog-walking side job (or any of the examples above) soon, consider applying for business credit cards, as the sign-up bonuses can be truly rewarding.

Pro-Tip: Selling Stuff at Facebook Marketplace is an easy side hustle anyone can start anytime!

It also goes without saying that if the COVID-19 pandemic taught us something, the future is fundamentally unpredictable.

No one can foresee if our business will be a roaring success or an unfortunate letdown. Neither the bank nor you can foretell that.

Thus, viability is not a determining factor in getting approved.

Alternatively, if you do not plan to have a business in the future, I recommend exploring personal travel credit cards.

Final Thoughts

I am a huge fan of lucrative credit card sign-up bonuses, so I try to take advantage of these offers whenever the opportunity arises.

Having a side hustle or a business does not only multiply your earning potential, it also exponentially increases the variety of cards you can apply for, consequently propelling you closer to your next dream vacation.

With that said, a gentle reminder to only apply for credit cards that you can comfortably pay once your statement comes around.

Paying those hefty credit card fees is antithetical to the frugality principles I espouse in this blog.

I hope the tips outlined in this post can pave the way for you to acquire your first-ever American Express Business Credit Card.

Feel free to reach out anytime for questions!

Good luck!

EDITORIAL DISCLOSURE – Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. The content has not been reviewed, approved or o