ADVERTISER DISCLOSURE: The Frugal Tourist is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as MileValue.com This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Additionally, the content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

JP Morgan Chase Bank currently offers a range of business cards that might interest points enthusiasts and frugal travelers like myself.

One of these business cards, and a personal favorite, is the no-annual-fee Ink Business Cash® Credit Card.

This card currently gives 5 Chase Ultimate Rewards Points per dollar in the following categories:

- phone,

- cable,

- Internet and

- office supply store purchases.

It also earns 2 Chase Ultimate Rewards Points per dollar on gas & restaurants and 1 point on everything else.

Earn 5X on the Chase Ink Business Cash® Credit Card

The Chase Ink Business Cash® Credit Card is a points powerhouse for a no-annual-fee business card.

It allows cardmembers to earn 5 Chase Ultimate Rewards Points per dollar on $25,000 worth of combined purchases in the categories mentioned above each cardmember year.

That means a Chase Ink Business Cash cardholder can potentially accrue as many as 125,000 Chase Ultimate Rewards Points every 12 months.

These points can be redeemed in various ways, but my preferred method is to exchange them for free or discounted travel.

$25,000 worth of purchases* X 5 points = 125,000 Chase Ultimate Rewards Points (*Phone, Cable, Internet & Office Supply Stores)

This blog post will show you how to check your total annual card member spending on this card’s 5X categories.

This is particularly useful for heavy spenders who frequently use the Ink Business Cash to take advantage of gift card sales at office supply stores.

By following the steps that follow, you are guaranteed to earn the most out of these generous category bonuses.

$25,000 Cardmember Anniversary Limit on 5X Categories

As mentioned above, this no-annual-fee business credit card has a yearly limit of $25,000 on 5x categories that resets every cardmember anniversary.

| Chase Ink Cash Category | Category Bonus |

|---|---|

| Office Supply Stores | 5x per dollar |

| Phone | 5x |

| Cable | 5x |

| Internet | 5x |

| Gas | 2x |

| Restaurant | 2x |

| Everything Else | 1x |

Determining how much spending you have incurred on all 5X categories and your cardmember anniversary date will reduce the likelihood that you will exceed the $25,000 yearly threshold.

Sadly, purchases beyond the $25,000 cap on 5X categories will only earn 1X per dollar.

Therefore, I recommend that Chase Ink Business Cash cardholders pay attention when they are just about to max out this $25K amount so they can plan to utilize an alternative card that can give more than 1X per dollar.

Before I go over the steps, I would like to mention that the Travel Miles and Points Facebook Group members inspire this guide.

This is one of the group’s most frequently asked questions, so I am thrilled to complete this guide. I hope you find it valuable too.

Steps in Checking the Total 5X Spend on Your Chase Ink Cash (Desktop)

Step 1:

Log in to your Chase account.

Step 2:

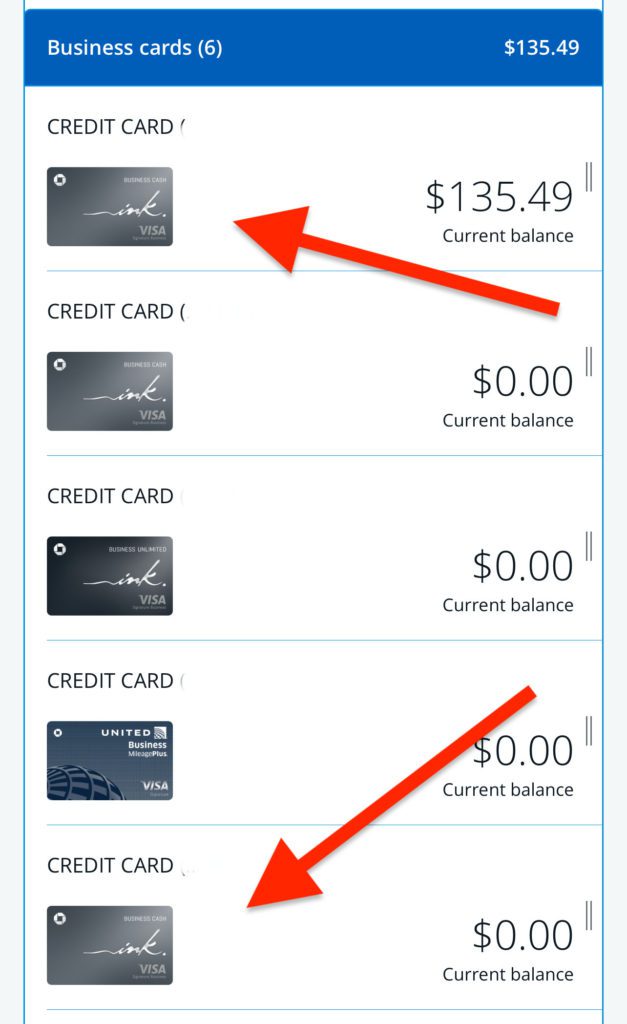

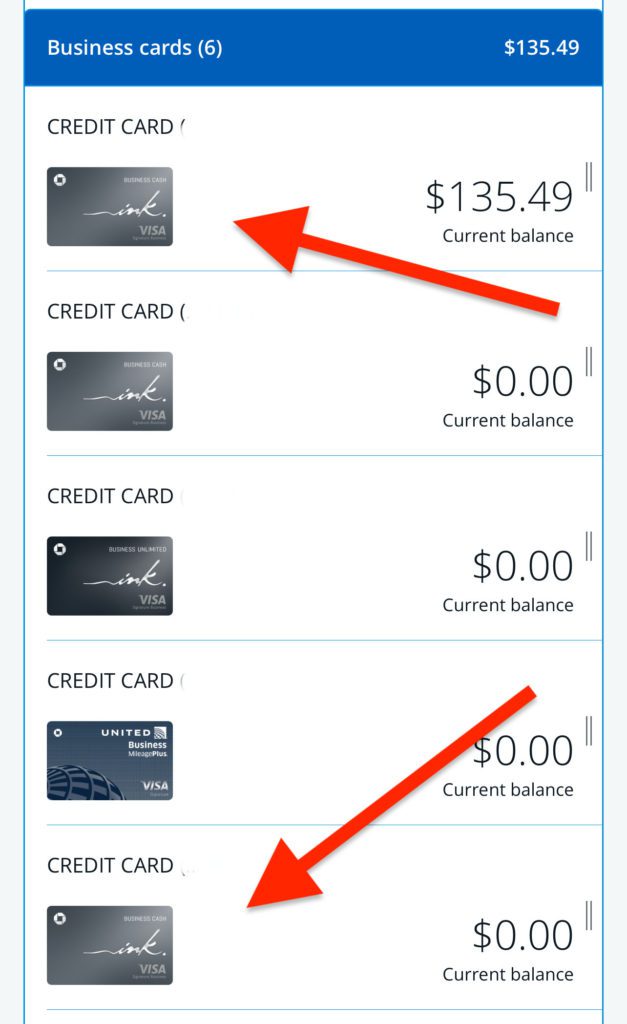

Click your Chase Ink Business Cash credit card.

In my case, I have a few Chase Ink Cash cards, so I click the particular card I want to check.

Step 3:

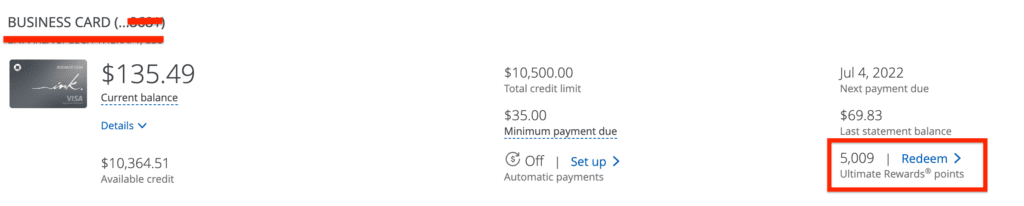

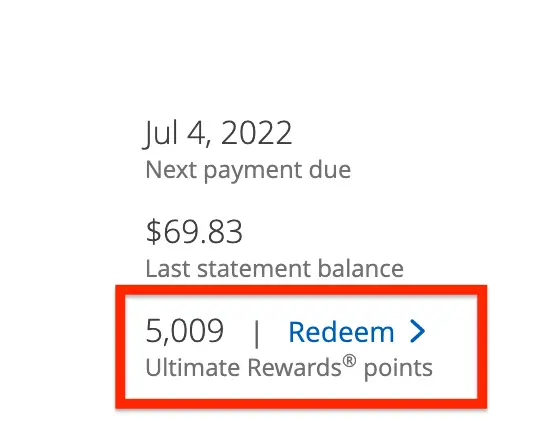

Each Chase Ink Business Cash card will have a corresponding Ultimate Rewards account.

Click “Redeem” above the words “Ultimate Rewards points.”

Step 4:

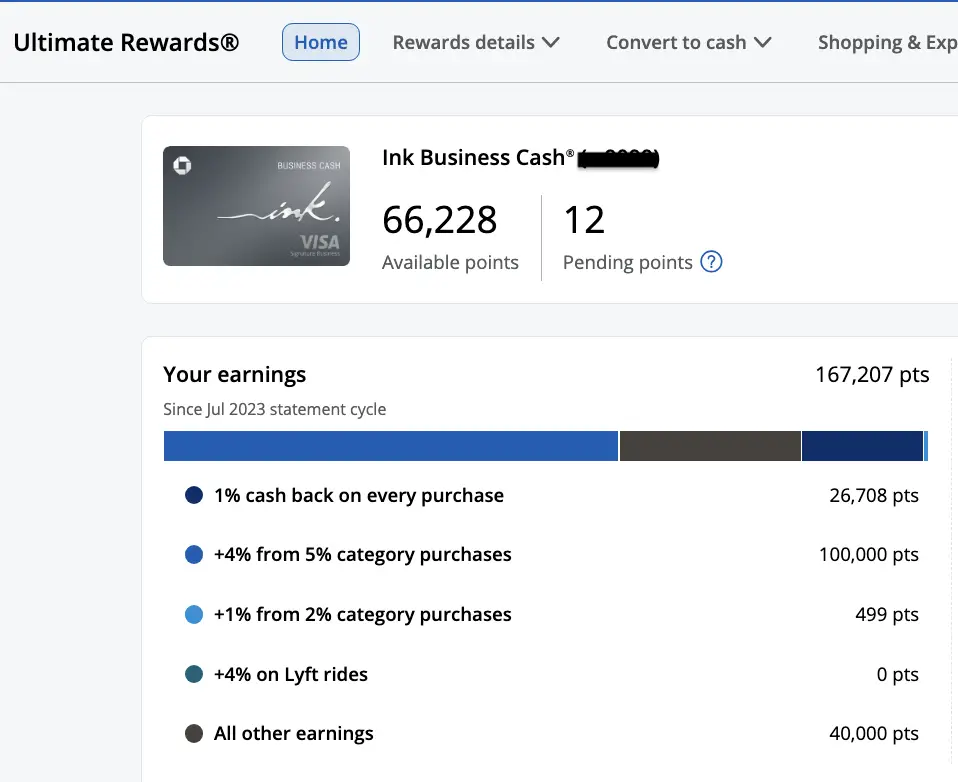

Clicking “Redeem” will lead you to the “Ultimate Rewards” page.

Step 5:

Look for the number of points indicated after “+4% from 5% category purchases“.

Step 6:

Divide this number by 4.

This will give you the money you’ve spent on the Chase Ink Business Cash 5X categories.

From the example above, 99,587 points have been earned so far.

The result will be the total amount of 5X category spend done since the card member’s last anniversary date.

We will go over where to find your “cardmember anniversary date” later in this post.

| 99,587 divided by 4 = $24,895.75 |

Step 7:

Subtract the dollar amount you got on Step 6 from $25,000.

| $25,000 minus $24,895.75 = $103.25 |

The difference is the amount of 5X category spend left on this particular Chase Ink Business Cash card.

In our example, 5X spend can still be earned from a total spend of $103, but any amount that exceeds this value will only generate 1x.

The $25,000 yearly cap will reset at the next cardmember anniversary date.

Step 8:

Again, once we have reached $25,000 worth of 5X spend on our Chase Ink Business Cash Cards, we will not earn 5X until after our next cardmember anniversary date.

Any purchase over and above $25,000 will only earn Chase Ultimate Rewards points at the base rate of 1X per dollar.

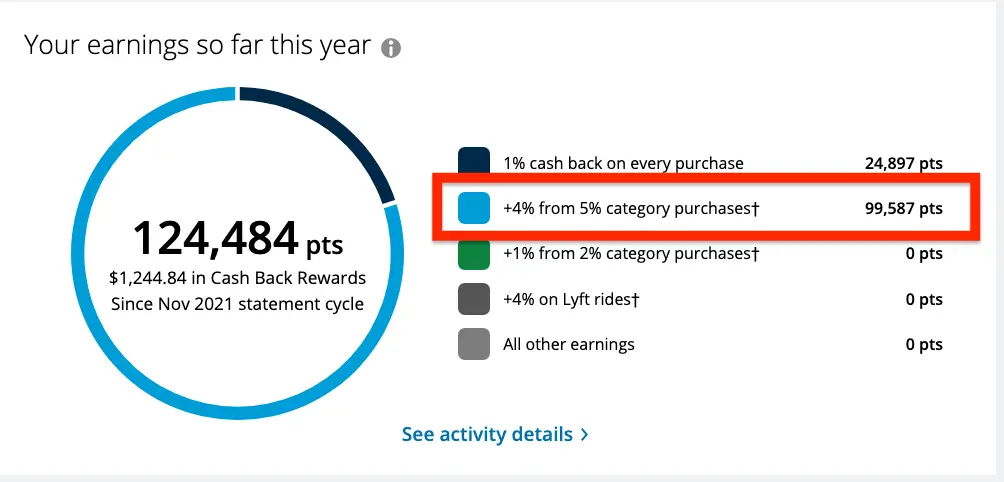

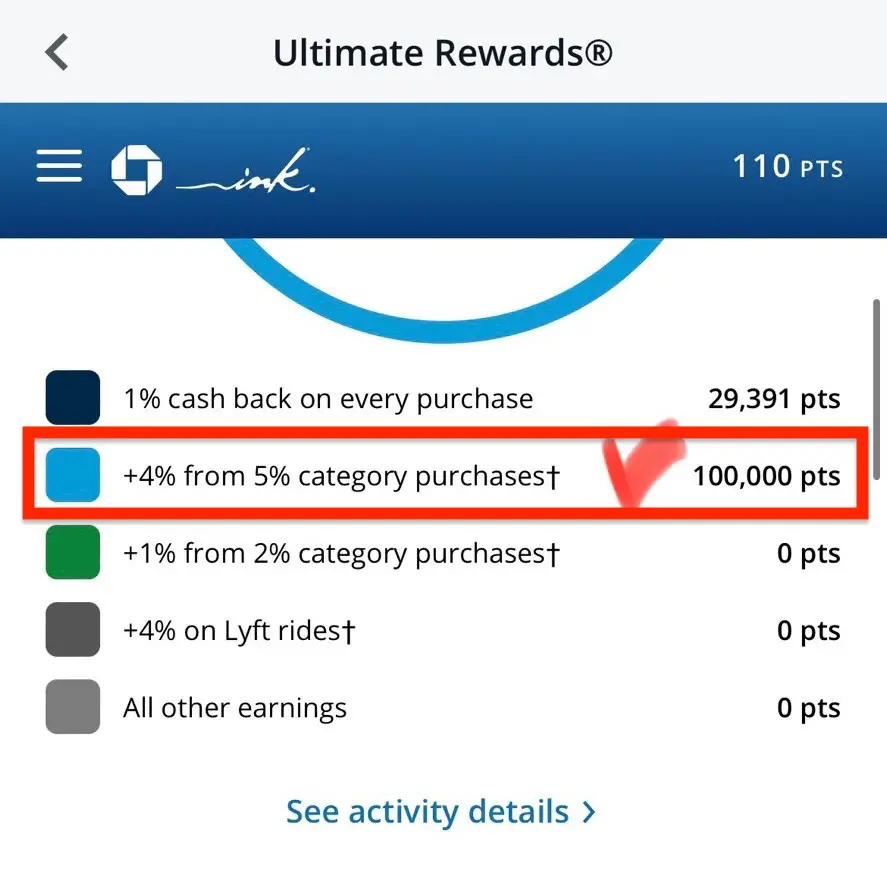

You will know that you have reached $25,000 when the amount you see after “+4% from 5% category purchases†” is 100,000. Using our formula, 100,000 divided by 4 = $25,000 (See image below).

How Do We Know Our Cardmember Anniversary Date?

Your dashboard will show the total number of points you have accrued since your last anniversary date.

Your last cardmember anniversary date is the month and year labeled below your total points earned.

In the example below, the last cardmember’s anniversary date was July 2023.

Therefore, the yearly allocation of $25,000 on 5X categories will reset the following year, around July 2024.

You will know that your $25K cap has reset when the number of points on your Ultimate Rewards profile changes to “0”.

Given this knowledge, I will try to maximize the remaining 5X spend on the $25,000 cap before my allocation resets.

Moreover, I will be mindful to stop using my Chase Ink Business Cash once I reach the $25,000 yearly spending cap on 5X categories.

1X for the base spend + 4X for the bonus spend = 5X total points per dollar

Steps in Checking the Total 5X Spend on Your Chase Ink Cash (Chase App)

Step 1:

Log in to your Chase account.

Step 2:

Click your Chase Ink Business Cash credit card.

In my case, I have a few Chase Ink Cash cards, so I click the particular card I want to check.

Step 3:

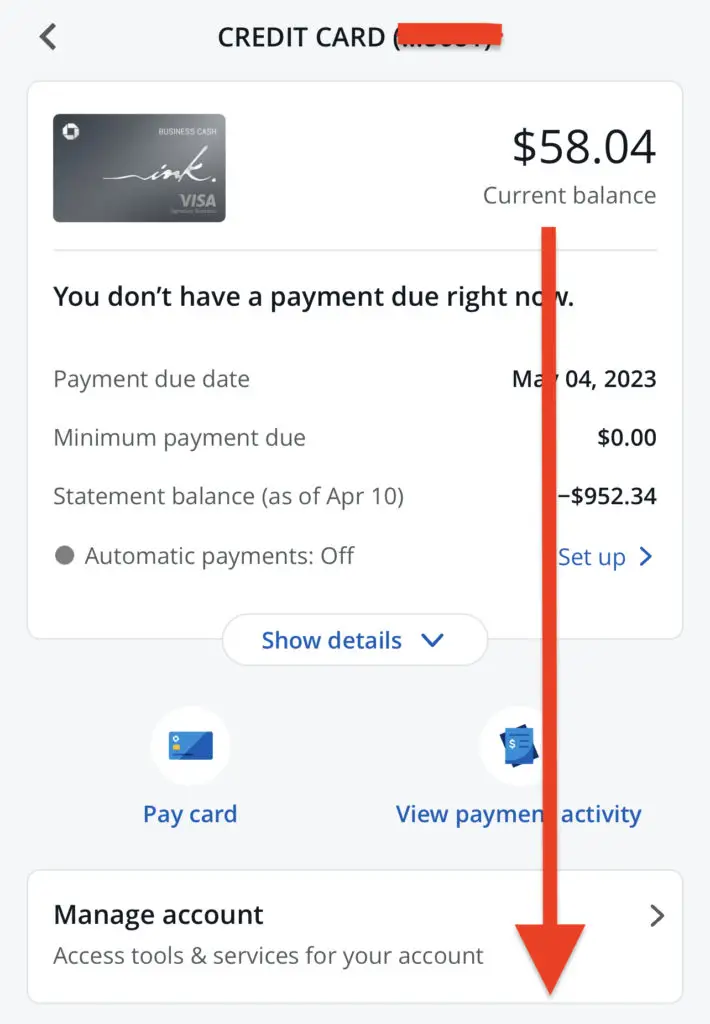

Each Chase Ink Business Cash card will have a corresponding Ultimate Rewards account.

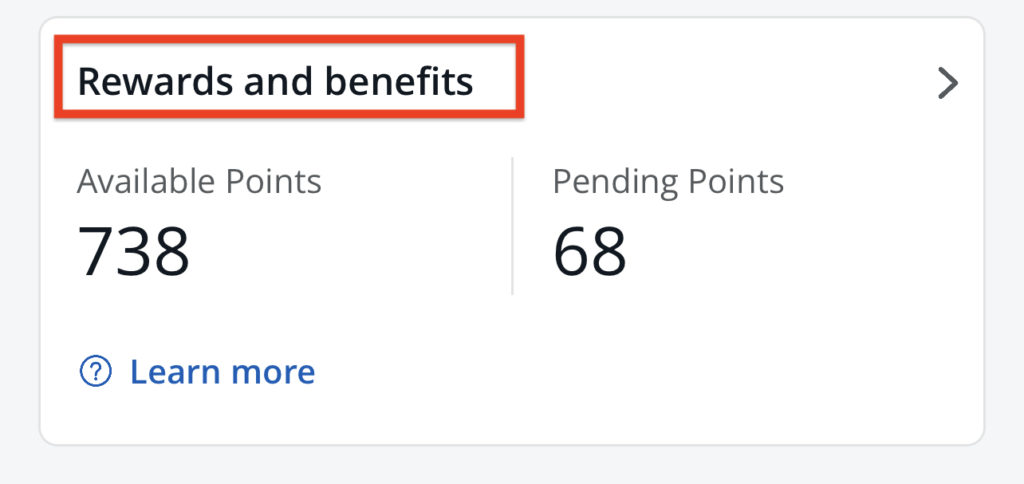

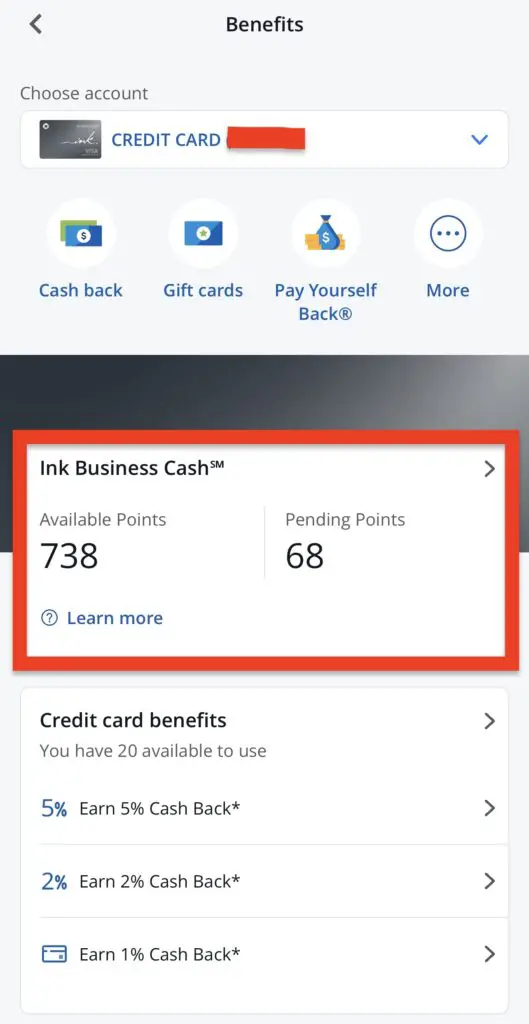

You can find this by scrolling until you see “Rewards and Benefits”.

Tap “Rewards and Benefits” to get to the “Benefits” page.

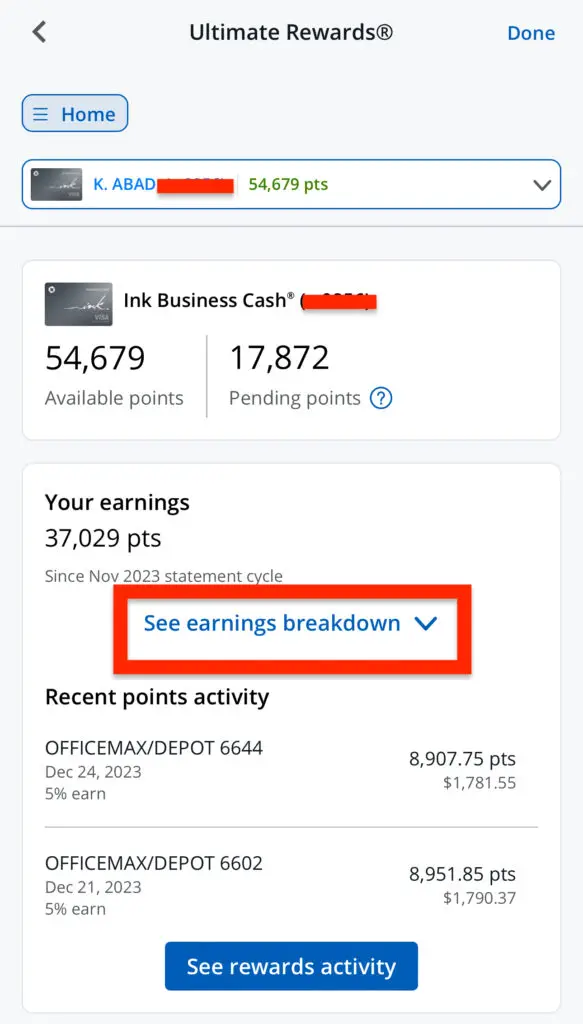

Step 4:

Once on the “Benefits” page, click “available points” to enter the Ultimate Rewards Portal.

Step 5:

Once on the Ultimate Rewards page, navigate to “Earnings Breakdown“.

Step 6:

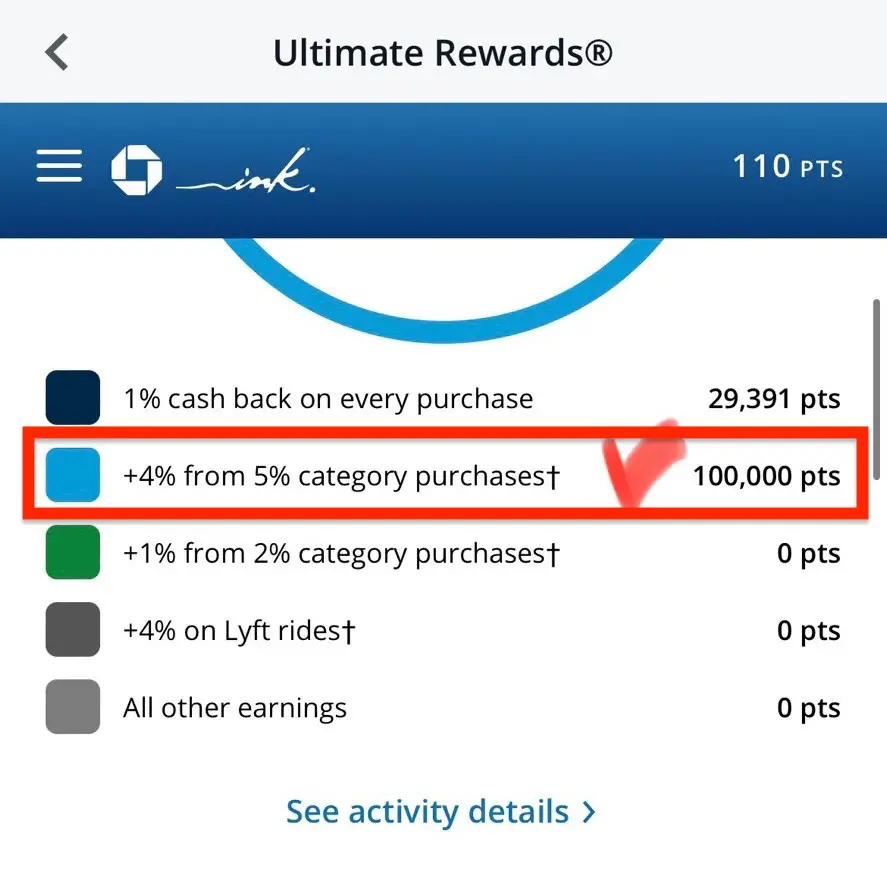

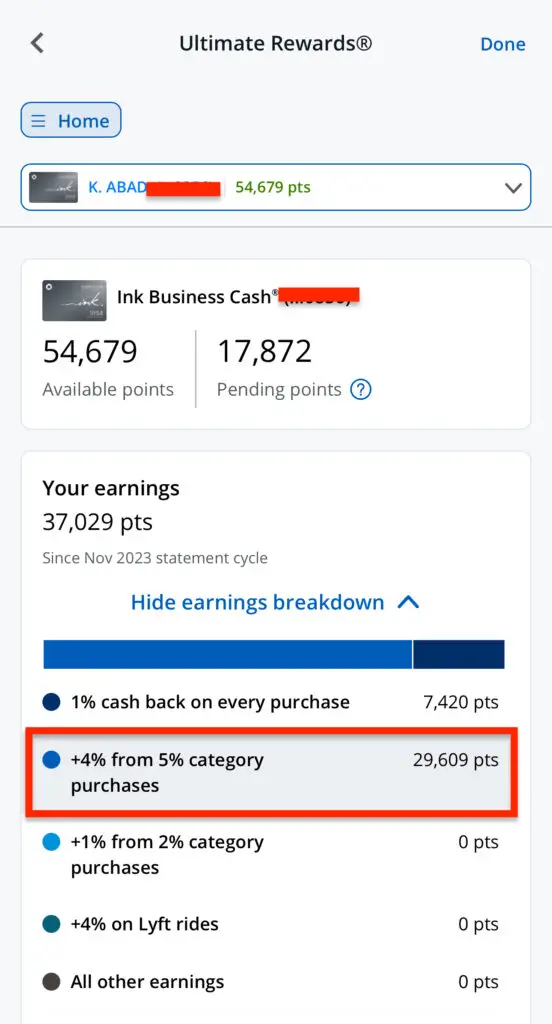

On the Earnings Breakdown section, look for the number of points indicated after “+4% from 5% category purchases.“

In this example, that number is 29,609 points earned since November 2023, which is this particular Ink Cash card’s anniversary date.

Step 7:

Divide this number by 4.

This will give you the money you’ve spent on the Chase Ink Business Cash 5X categories.

From the example above, a total of 29,609 points have been earned.

I will divide this number by 4.

The result will be the total amount of 5X category spend done since the last cardmember anniversary date.

| Total 5X Spend since the last cardmember anniversary date |

|---|

| 29,609 divided by 4 = $7,402.25 |

Step 8:

Subtract the dollar amount you got on Step 7 from $25,000.

| Total 5X Spend Left |

|---|

| $25,000 minus $7,402.25 = $17,597.75 |

The difference is the amount of 5X category spend left on this particular Chase Ink Business Cash.

In our example, 5X per dollar can still be earned on the next $17,597.75 of spending, but any amount exceeding this will only generate 1x.

Once the difference becomes “$0”, you cannot earn any more bonus points on your 5X category spend until it completely resets at your next cardmember anniversary date.

Step 9:

Again, once we have reached $25,000 worth of 5X spend on our Chase Ink Business Cash, we will not be able to earn 5X until after our next cardmember anniversary date.

Any purchase over and above $25,000 will only earn Chase Ultimate Rewards points at the base rate of 1X per dollar.

You will know that you have reached $25,000 when the amount you see after “+4% from 5% category purchases” is 100,000. Using our formula, 100,000 divided by 4 = $25,000 (See image below).

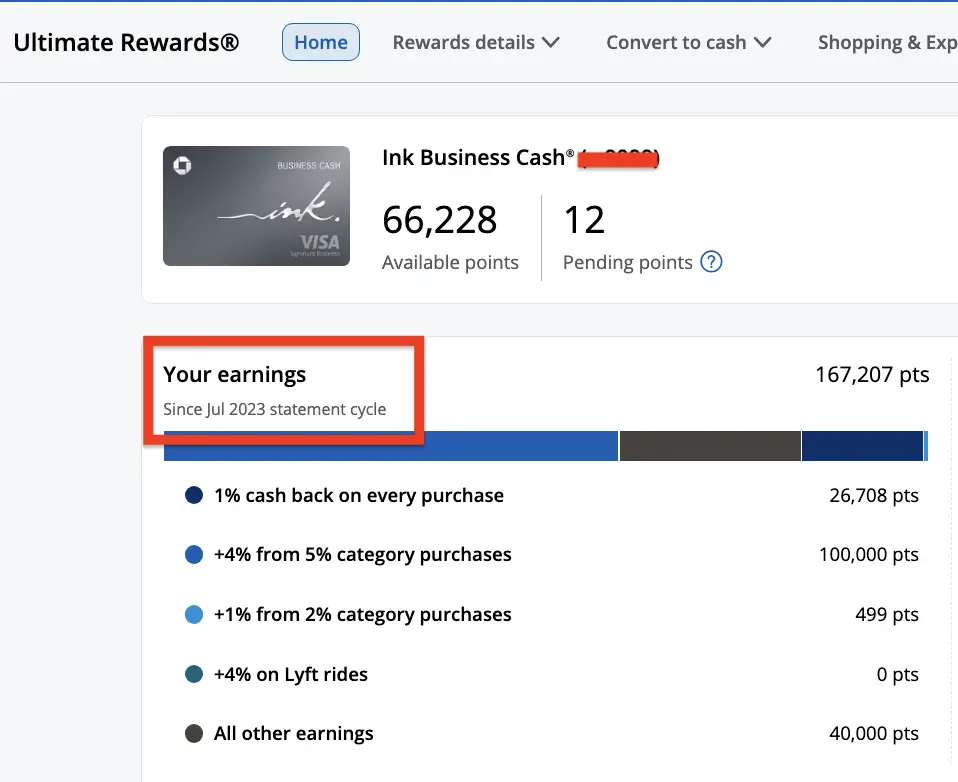

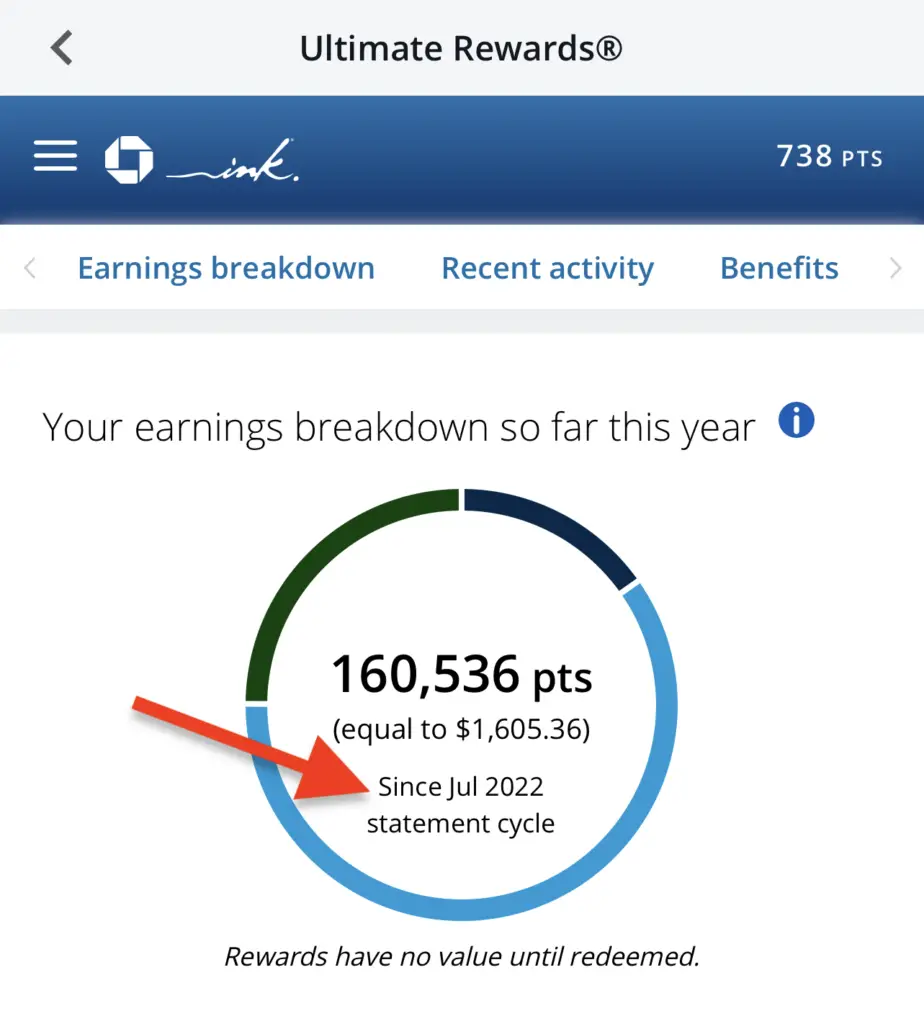

How Do We Know Our Cardmember Anniversary Date? (Review)

Your dashboard will show the total number of points you have accrued since your last anniversary date.

Your last cardmember anniversary date is the month and year labeled below your total points earned since your last anniversary date.

In the example below, the last cardmember anniversary date was July 2022.

Therefore, the yearly allocation of $25,000 on 5X categories will reset the following year, around July 2023.

You will know that your $25K cap has reset when the number of points on your dashboard has changed to “0”.

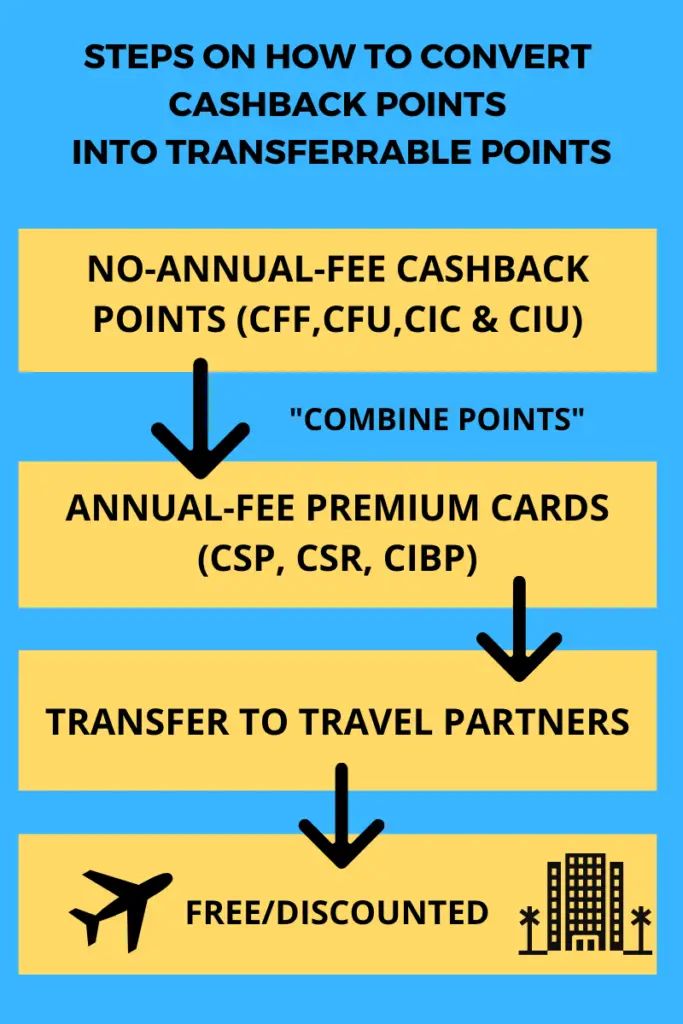

How Do I Convert Cash Back to Travel Points?

Even though the Chase Ink Business Cash generates cashback, there is a way to convert those cashback points into Ultimate Rewards “travel” points.

First, you would need a Chase premium card, such as the Chase Sapphire Preferred® Card or the Ink Business Preferred® Credit Card, to turn cashback into travel points.

The related article below will walk you through the steps.

Current Office Supply Store Deals

Final Thoughts

The Chase Ink Business Cash is a fantastic card because it offers 5 Ultimate Rewards Points per dollar on categories such as phone, cable, internet, and office supply stores.

This makes it one of the most generous no-annual-fee cards available in the market.

Chase Ultimate Rewards points are incredibly valuable and can be easily transferred to various airline and hotel partners.

This makes the Chase Ink Business Cash an excellent choice for anyone looking to earn cash back or travel rewards without paying an annual fee.

I hope this quick guide was helpful. If you have any questions or comments, please feel free to share them below.

And if you found this guide helpful, please share it with your friends and anyone who will benefit.

EDITORIAL DISCLOSURE – Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. The content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.