ADVERTISER DISCLOSURE: The Frugal Tourist is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as MileValue.com and Cardratings. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All information about the American Express Schwab Platinum has been collected independently by The Frugal Tourist.

EDITORIAL DISCLOSURE: Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities.

Saving and budgeting money are so popular that it is virtually impossible to find someone who is not remotely interested in socking away some extra funds for a specific goal or a rainy day.

I have yet to come across an individual who does not want to improve their financial situation substantially.

Thus, it is safe to conclude that amassing wealth is a universal need most humans crave in their lifetime.

Seriously, is there someone out there who doesn’t want to be financially free and fully liberated from the shackles of the 9-5? Almost everyone wants to be financially stable.

However, based on the 14.3 trillion dollars of consumer debt acquired in the United States alone – getting into the groove of saving or simply navigating the world of finances is much harder than it sounds for most of the populace.

Start Where You Are

Money appears simplistic to comprehend at face value.

An all too common advice is, “Just save more and spend less“.

But we know that adhering to this suggestion is easier said than done.

Optimizing money and finances can be challenging despite their straightforward facade, particularly if you’re learning the ropes.

The landscape constantly changes, and there is always a new layer that needs to be peeled.

Have you ever struggled to arrive at an answer to any of the following questions below?

- How much do I need to save now to retire at 65 optimally? Or earlier?

- How much emergency fund is considered enough?

- Should I contribute in an IRA or a 401K? Or both?

These are all too familiar questions that have frequently swirled in my mind.

Sadly, I will not have answers to these questions in this blog post as they each require an individual post; the answers vary considerably per individual anyway.

Instead, this article will offer some incredibly simple techniques that aim to at least assist you in jumpstarting saving right now.

You can practically start this journey wherever you are financially at this very moment.

Saving doesn’t have to be that convoluted, complicated, and unattainable.

But it will involve some temporary sacrifice.

Snowball Effect

Without further ado, let me share five heavyweight saving strategies that have consistently helped me achieve virtually every financial goal I’ve set—from paying off debt to raising a down payment for my first house to travel and, most importantly, saving for retirement.

I hope that this article can enlighten you on a few basic saving strategies that you can personally find useful.

While you test drive these tactics, it is crucial to note that these methods will not get you rich quickly.

However, I can confidently assure you that these simple strategies can propel you on the right financial trajectory.

Even though the initial results from these new habits are imperceptible, if you are persistent and determined to stay on the path, they will all ultimately add up to something substantial.

At any rate, these wallet-friendly tactics are guaranteed to move the needle toward asset accumulation and can be utilized by anyone to bolster one’s net worth.

A fundamental characteristic of saving is that once you have started the “saving” ball rolling – regardless of the amount – you’ll be surprised at how it exponentially multiplies like a snowball over time.

Let’s start the ball rolling, but first, let’s talk about the “sacrifice” part so we can get that out of the way.

No Pain, No Gain

A caveat, though… the adage “no pain, no gain” rings true in some of these tried and tested techniques.

So, if you are not accustomed to momentarily sacrificing creature comforts and delaying gratification to attain a financial objective, this post may not work for you.

Nevertheless, I encourage you to consider some or all of these recommended behaviors.

I’ve successfully utilized these frugal hacks to achieve my financial goals, including getting out of waist-deep debt, as I started this journey with a negative net worth.

At 23, I embarked on a journey from the Philippines with a $3000 debt, determined to make a new life for myself. As an international student, I resorted to using credit cards to pay for my education, inevitably leading to an uncontrollable debt accumulation. However, after graduating, I devoted myself tirelessly to work and save, gradually freeing myself from this financial burden. Today, I share the strategies that helped me navigate this challenging situation and emerge stronger than ever.

5 Heavyweight Saving Strategies:

1. Housing

Housing can be expensive, but it allows you to save tons of cash.

When I was on saving hyperdrive, I had opted to live in dormitories and rented rooms with housemates while I finished graduate school.

Staying in a dorm and having roommates surely lowered my expenses while supporting myself through school and my first few years in the workforce.

This housing strategy allowed me to immediately pay off all of my credit card debt accrued from school instead of shelling out huge amounts of cash toward rent.

If you can “temporarily“ live with family or roommates to save, I would highly recommend it.

After entirely obliterating my student debt, the amount I saved from housing became the strongest contributor to my ability to save up for a house downpayment.

After purchasing my first home, I rented out one of the bedrooms for many years, consequently helping pay my mortgage and saving for other financial goals such as travel and retirement.

This housing strategy is also called “house-hacking.”

This first house purchase eventually became a rental property. If you can figure out a way to save or earn from your housing situation by house-hacking, by all means, go for it!

2. Drive a Used Car or Not Drive at All

A new car’s value depreciates precipitously when you drive it out of a dealer’s lot.

It is certainly not a good investment in the truest sense of the word.

Unless you need one for your daily commute to work, I’d think a few times before purchasing a new one.

I’ve driven a used car for 16 of the 19 years I’ve lived in America. My next car will most likely be a used car again!

In the United States, transportation costs account for at least a quarter of monthly expenses (e.g., insurance, fuel, maintenance, etc.).

To drastically reduce these transportation-related expenses and their accompanying carbon footprint, it may also be a good idea to consider riding a bike to work/run errands, carpool, take public transportation, walk, work from home, or use Uber/Lyft.

Avoiding your waking hours behind the wheel can also benefit your mental sanity.

Those long, grueling daily drives on clogged freeways can certainly affect one’s quality of life.

3. Pull the Plug On Unnecessary Expenses

Opportunities to save up present themselves multiple times daily.

Refining our ability to pay attention to these forks in the road will go a long way toward transforming and unlearning our habituated spending patterns into saving habits.

These seemingly minuscule daily financial choices collectively pack a big punch at the end of the day. Or the year.

If saving a dollar a day yields $365 at the end of the year, imagine how much $10/day or more saved can get you after 365 days.

If invested properly, this amount can also grow exponentially because of compound interest.

I am not a huge TV person, so I do not recall subscribing to a cable company. That’s at least $100 savings per month or $1,200/year!

This post has an extensive list of cheaper alternatives to cable.

I only shop when items are deeply discounted, usually around holidays like Black Friday.

I intermittently fast and have no sensitivities around consuming leftovers.

I maximize the perks of my public library.

Most importantly, I never upgrade to the latest technological fad unless my devices teeter towards biting the dust.

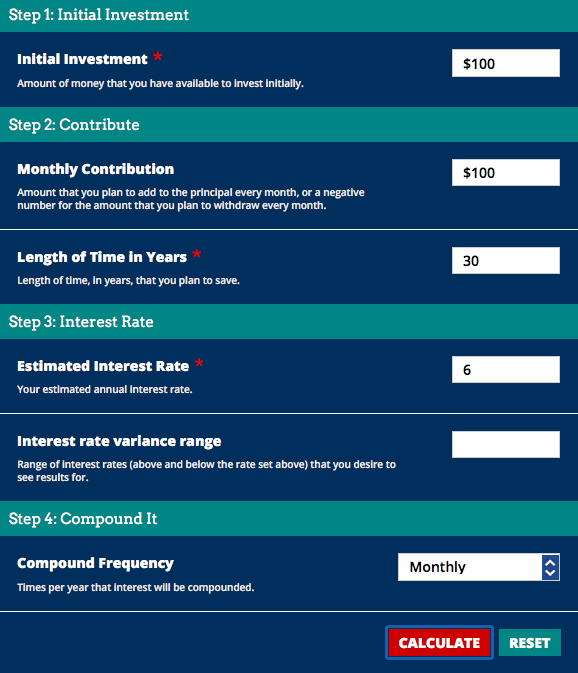

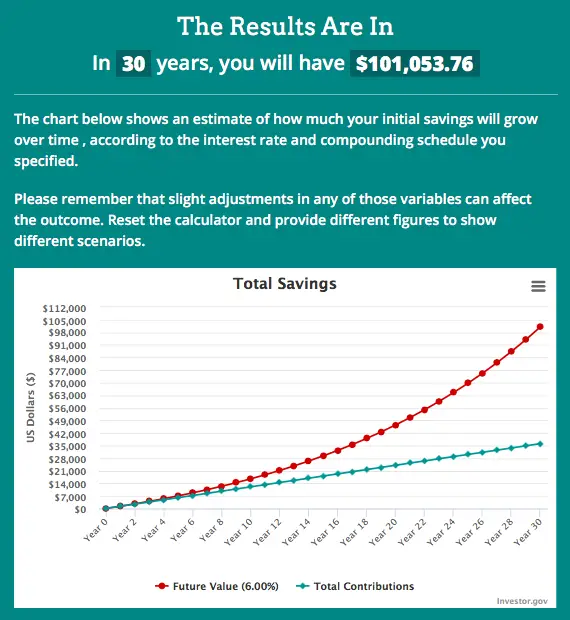

The images below illustrate the amount of money you would have saved if you decided to cut the cord.

Assuming the monthly subscription fee is $100/month, and you hypothetically save that monthly amount for 30 years, your savings would equal $101,053.76!

Imagine saving $1000/month, you’ll be a millionaire in 30 years! That’s the power of compound interest!

4. Eliminate Consumer Debt

I am not talking about mortgages or student loans here.

I am referring to consumer debt from credit cards typically accumulated from not-so-mindful shopping.

Credit card companies invariably charge astronomical interest rates, which should be eliminated as soon as possible.

This can be a monumental barrier to financial freedom and should be aggressively addressed head-on.

When I was paying off my debt, I frequently sold stuff I no longer found useful to reduce this insidious obstacle.

I also recommend resisting the urge to add on to any existing debt.

Presently, I only use credit cards to accrue valuable points, which I redeem for free travel and hotels.

I religiously pay off these cards in full before the due date to avoid paying hefty bank charges.

If you cannot pay off your cards every month, I suggest strictly sticking to using cash until you can develop the discipline to keep those extra charges at bay.

5. The Side Hustle

This is my favorite because it differs fundamentally from the first 4 methods.

There are typically two paths to augmenting one’s savings rate, which inevitably increases one’s net worth: SPEND LESS or EARN MORE.

The four preceding recommendations focus on preventing excessive spending (“spend less”), whereas this final step is all about increasing your income stream (“earn more”).

It is all about capitalizing on your innate talents and utilizing your human potential to earn more by taking on additional work.

Since the age of 16, I have worked at least two jobs, so having a part-time job is now second nature to me.

If you can supplement your income by enhancing your earning potential via a side hustle, I won’t think twice about doing it.

Here are some examples of side hustles I’ve done in the past: pager operator, fast food worker, buy-and-sell, caregiver, babysitter, tutor, cellphone salesperson, typist, focus group attendee, Craigslist/eBay seller, etc.

Right now, my side hustle involves my private practice (I am a Speech-Language Pathologist) after my full-time job or on the weekends. I also manage a rental property and this blog.

Avoid Lifestyle Inflation at All Costs

- Live way below your means

- Widen the gap between what you earn and what you spend

- Accumulate assets and avoid liabilities

- Increase your savings rate

To optimize the revenue stream from your primary income source and side hustle/s, avoiding succumbing to the temptation of lifestyle inflation at all costs is critical.

After settling your basic monthly necessities, commit to siphoning off the remainder of your income towards your dedicated travel fund, retirement buckets, or any account earmarked for your specific financial goals.

I remember that saving now increases my chances of paying for future travels.

Since I also would like to retire early, boosting my savings rate will ultimately translate to freedom from work sooner rather than later.

If you are comfortable with implementing this hybrid approach of spending less and earning more, then huge congratulations to you.

Executing both simultaneously will certainly catapult you on the expedited path to FI (Financial Independence), which also means more opportunities for future travels when you have the energy and time. Kudos!

Automate Savings

I can not overemphasize the importance of this crucial strategy enough. Automating your savings is a gift to all of us savers.

Imagine getting richer without you knowing – everything plays out on behalf of your financial freedom behind the scenes.

Set it up once initially and let this game-changing strategy run its course. It would be a significant missed opportunity not to participate in this FREE service almost all financial institutions offer.

I have set up my bank to automatically direct funds to three accounts every first of each month.

Each account represents an important financial goal for me to support and sustain.

- Emergency Funds saved in a high-interest savings account

- ROTH IRA contributions

- Travel fund at Charles Schwab

I also use all my work-related retirement options and health programs to optimize my taxes and expand my net worth.

- Flexible Spending Account (FSA)

- Health Savings Account (HSA)

- 401K, 403b, and 457b for employees

- SEP IRA or Solo 401K for business owners

Pay Yourself First

You can create as many accounts as you wish, but always remember to PAY YOURSELF FIRST before paying anyone else.

It does not have to be a lot. You can start with $10 and gradually increase by $5 every month or so.

Whatever amount works as long as funds are automatically transferred monthly toward your dedicated accounts.

Paying yourself first also guarantees that the employee who deserves to be compensated the most gets paid first — YOU!

It also goes without saying that for this strategy to succeed, you will need to resist the impulse to tap into these funds unless necessary; otherwise, your savings will spiral back to square one.

Your Money or Your Life

If you are new to saving, I recommend this incredible classic about financial independence – YOUR MONEY OR YOUR LIFE.

My grandest takeaway from this book was the authors’ proposition to start viewing money as what it is – your finite LIFE ENERGY.

We earn money by devoting our precious time and life energy to work, and this irreplaceable finite resource can never be taken back once it is gone.

The choice is ours.

If we save our money or life energy, it has the potential to grow and multiply over time.

The more life energy (money) we save, the faster we will achieve freedom from work and thus recapture our time by retiring early.

Conversely, if we wish to spend it mindlessly, it will be equivalent to our life energy vanishing forever, keeping us tethered for an extended period of toil.

Every fork in the road offers an opportunity to preserve or squander your life energy.

Exchanging time for money is a vicious cycle. Accumulating Assets And Avoiding Liabilities helps you break free.

www.financialfreedomcountdown.com

Money = Life Energy

Reading this book radically shifted my perspective on spending and saving.

Additionally, it dramatically altered my relationship with money. I do not think I will approach money the same way ever again!

You can borrow this revolutionary book from the public library for free, purchase the audiobook at Audible.com, or order at Amazon.com.

Travel & Money

Travel appears to occupy the same plane as money as a universal goal.

I could argue that finding someone who would not instantly jump on an offer to head out on a beach vacation or a safari would be challenging.

If given this opportunity, many people I know, myself included, will impulsively grab those trips in a milli-heartbeat.

Particularly now, after experiencing months of lockdown, the urge to embark on a journey away from home has never been more intensely palpable.

Almost everyone wants to travel.

Even though travel generates many positive emotions, it can drag anyone into bankruptcy in one fell swoop if it is not planned carefully.

That’s where travel using credit card points comes into play.

How to Travel for Nearly Free

All of my trips over the past decade had been ALMOST FREE via travel miles accrued from specific credit cards.

Being obsessed with travel was a challenge initially since I was, and still am, an avid saver. I was reluctant to spend a lot of money on my trips.

Thankfully, I discovered the path of using travel rewards credit cards. As mentioned above, I do not recommend this tactic if you have difficulties paying your cards in full monthly.

Once you have developed the discipline to control your credit card payments—meaning pay in full before the due date 100% of the time—I highly suggest exploring this remarkable strategy for free travel.

I’ve visited over 90 countries using miles and points from credit card rewards and bonuses. Some of these credit cards can be found here.

Are you also a Frugal Tourist?

Join our private Facebook Group, where we discuss frugal travel strategies, including using miles and points—my favorite topic.

We would love for you to join us there.

While Assets increase your net worth, liabilities are leeches draining your hard-earned money. In an ideal world, we would only accumulate assets and avoid liabilities. However, that would be a miserable existence. The trick to enjoying life is to sin a little with liabilities, but not too much.

www.financialfreedomcountdown.com

Bottom Line

Saving and budgeting do not have to be overwhelmingly paralyzing.

Sometimes, we have to start where we are and decide to act, even if it means saving only a small amount.

Committing to valuing your finite life energy and time by saving money will certainly get you on the right path.

Additionally, expect your mind to tell you that you cannot be financially free and should just quit it.

Or, it might tempt you to think about “living in the present moment” and not worry about the future.

It may also lure you into comparing your journey with others who appear to have it all together.

Acknowledge those limiting beliefs as merely “noise” and commit to the plan.

Sometimes, it is normal (and human) to feel discouraged but keep plugging ahead.

It is not a perfectly paved road; everyone is allowed to fall off the wagon and encouraged to get back on it.

Lastly, I hope these actionable strategies benefit your financial journey.

If you have another simple strategy that you have found to be exceedingly valuable, please let me know so I can add it.

Thank you so much for reading! And cheers to our future financial freedom!

ADVERTISER DISCLOSURE: The Frugal Tourist is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as MileValue.com and Cardratings. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All information about the American Express Schwab Platinum has been collected independently by The Frugal Tourist.

EDITORIAL DISCLOSURE: Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities.

USER-GENERATED CONTENT DISCLOSURE: The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.

That book you mentioned towards the end sounds interesting and makes a very good point! People always ask us how we get to travel so much and it basically boils down to what you want more. We cut corners and have used some of these strategies, especially the side hustle and no cable or satellite tv.

Hi Amber, I am so glad you resonated with the post. If you can borrow this book from the library, it is certainly an eye-opener! Really changed how I view money. I’m so glad that you’re also enjoying the fruits of travel hacking. It’s such a gift to those who are motivated to play it. Keep on traveling!