ADVERTISER DISCLOSURE: The Frugal Tourist is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as MileValue.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

With the Schwab debit card, you have the freedom to withdraw cash from any ATM worldwide while enjoying the added benefit of receiving 100% refunds on all ATM fees incurred.

Traveling can be an incredible experience, but it can also cost a lot of money.

Between accommodations, transportation, and attractions, it’s easy for expenses to add up quickly.

One cost that many travelers overlook is the fees associated with withdrawing money from foreign ATMs or using their debit cards overseas.

No one likes getting hit with unexpected fees or unfavorable currency exchange rates.

And this is why having the best international fee-free ATM/debit card for travel is a must.

Fortunately, there’s a solution: the Charles Schwab Debit Card/No-Fee ATM Card.

In this blog post, we’ll explore why this card is the best international fee-free ATM/debit card for travel.

Do Not Carry a Lot of Cash When Traveling

Currently, it’s impractical for savvy travelers to carry excessive amounts of cash.

Carrying excessive cash while traveling poses potential risks that can be easily eliminated by opting for alternative payment methods like debit and credit cards.

By doing so, one can ensure a safer and more convenient travel experience, while minimizing possible vulnerabilities.

Not only is there an increased risk of loss, but amounts exceeding $10,000 must also be declared at customs.

Furthermore, in the unfortunate event of theft, you run the risk of losing everything.

That’s why debit cards and credit cards exist, they protect us from these kinds of problems.

In this blog post, I will discuss a reliable debit card that provides secure access to your funds, ensuring peace of mind against potential theft, particularly during travels.

This debit card is the Charles Schwab Debit Card.

But first, let’s talk about what a debit card is, for those who are not familiar with them.

What is a Debit Card?

A debit card is a plastic payment card that deducts money directly from a consumer’s checking or savings account to pay for goods and services.

Debit cards are used in place of cash, checks, or credit cards when making purchases.

When you use your debit card, the amount of the purchase is deducted immediately from your bank account balance.

It’s important to keep an eye on your bank account balance and ensure you have enough money in it before making a purchase.

When paying by debit card, you’ll need to provide your PIN number for authorization.

Additionally, some merchants may require that you sign for the transaction or allow them to verify your identity.

Debit cards also give us access to withdraw money at ATM machines worldwide.

The Charles Schwab Debit Card

Although many debit cards impose additional fees for using ATM machines outside of the bank’s network, the Charles Schwab debit card takes a different approach.

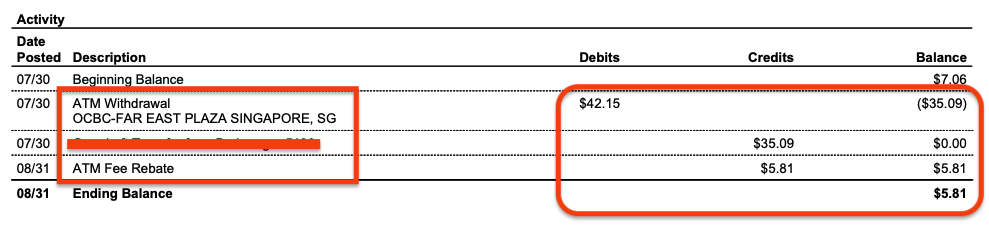

Instead of charging you a fee, the Charles Schwab debit card reimburses any ATM fees that you incur while traveling, in the form of a rebate.

When you make an ATM withdrawal anywhere, you initially cover the full cost, including the withdrawal amount and the ATM fee.

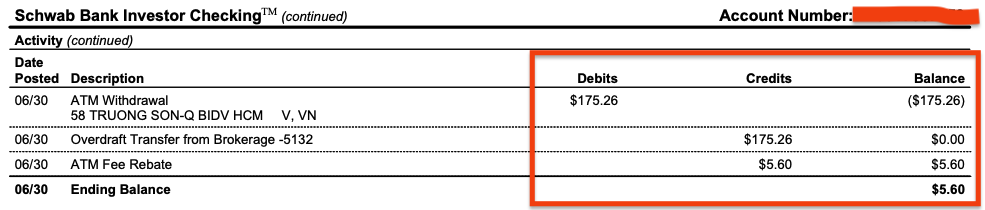

However, Charles Schwab will later refund you the total amount of all ATM fees incurred during the month.

You will notice a deposit into your checking account from Schwab when you review your bank statement on the last day of each month.

The Charles Schwab debit card also has no foreign transaction fees, making it ideal for international travel.

With the Charles Schwab debit card, you can be sure that you will have access to your money wherever you go, without having to worry about paying extra fees.

The Benefits of a Charles Schwab Debit Card/No-Fee ATM Card

1. No Foreign Transaction Fees

“Does the Charles Schwab debit card incur a foreign transaction fee?“

When you’re traveling overseas, you’re already spending a lot of money on airfare, food, lodging, and activities.

The last thing you need is to get hit with more fees for withdrawing money from ATMs in foreign countries.

Luckily, with the Charles Schwab ATM/debit card, you won’t have to worry about paying any foreign transaction fees, as they’re waived for all customers.

This means that you’ll get the best possible rates when withdrawing cash from ATMs in foreign countries.

| Travel Pro-Tip When Using Your Charles Schwab Debit Card |

|---|

| When asked to select the type of currency you’d like to pay with, always choose the local currency. This will help to avoid additional fees caused by currency conversion charges. Plus, it may even give you a better rate than if you were using a card from your own country. With that said, be sure to check the exchange rate before making your purchase online so that there are no surprises when you get your statement. |

2. No ATM Fees

“Does the Charles Schwab debit card charge ATM fees?”

In addition to waiving foreign transaction fees, Charles Schwab doesn’t charge any ATM fees.

This is amazing news for any type of traveler, as you can conveniently withdraw money from any ATM around the world and not have to worry about incurring extra fees.

But this perk is best for frugal tourists, as these fees can quickly add up, especially if you’re withdrawing money frequently.

Here’s how it works: when you make a withdrawal, you’ll be charged the ATM fee upfront.

However, don’t worry as Charles Schwab will reimburse you for any ATM fees incurred at the end of the month.

This can save anyone a significant amount of money in the long run, especially if you’re traveling for an extended period.

| Travel Pro-Tip When Using Your Charles Schwab No-Fee ATM Card |

|---|

| The Charles Schwab Debit card reimburses ATM fees from anywhere in the world, so you won’t have to seek out specific ATMs or worry about finding a bank that won’t charge extra fees. As long as the ATM machine has a Visa logo – which is almost all ATMs – you are guaranteed to have your ATM fees reimbursed at the end of the month. |

| |

In the example below, I incurred an ATM fee of $5.60 when I used the Charles Schwab Debit Card in Vietnam. This fee was refunded at the end of the month.

3. No Minimum Balance or Monthly Fees

“Does the Charles Schwab debit card have a required minimum balance?”

Another great feature of the Charles Schwab debit card is that it has no minimum balance requirement or monthly fees.

This is especially beneficial for long-term travelers who may not have a steady income or quick access to their home bank account.

You can deposit as much or as little money into the account without worrying about incurring additional charges.

This is also excellent news for budget-conscious travelers who don’t want to incur additional expenses.

You can keep your account open and active without having to pay any fees.

It’s a win-win situation.

4. Competitive Exchange Rates

Another perk of using a Charles Schwab ATM/debit card for travel is that they offer competitive exchange rates.

This means you’ll get the best possible rate when converting your dollars into the local currency.

When you’re traveling, every dollar counts, and this can be a significant benefit when trying to stretch your budget.

5. Easy Access to Funds

One issue many travelers face with traditional debit cards is limited access to funds.

If you run out of money while traveling, transferring and moving funds over can be difficult and costly.

However, the Charles Schwab debit card has a feature that allows you to link it to another bank account for easy fund transfers.

This comes in handy if you need to transfer money from a savings account or a family member’s account while abroad.

The transfers are usually processed within one to two business days, making it a quick and convenient option.

Currently, I have linked my Charles Schwab account to 2 savings accounts, so I always have access to more than one source of funds while traveling.

6. Fraud Protection

Another benefit of the Charles Schwab debit card is its security features.

The card comes with a microchip, providing an extra protection against fraud.

Additionally, Charles Schwab also offers excellent fraud protection and customer service.

If your card is lost or stolen, you can quickly report it and receive a new one within a few business days.

If your account is charged unauthorized amounts, they will be reversed, and you will not be held liable.

7. Excellent Customer Service Support

When traveling, it’s crucial to have reliable customer service support in case of any issues with your banking or card.

Thankfully, Charles Schwab offers 24/7 customer service support for any questions or concerns you may have while using their card.

This is especially beneficial for travelers in different time zones and needing assistance at odd hours.

Lastly, this level of support is crucial while traveling in case of emergencies or unexpected situations.

| Case In Point |

|---|

| My friend’s Charles Schwab Debit card was stolen in Cape Town and was used numerous times by the thieves as a credit card. My friend called Charles Schwab immediately and reported the incident. Charles Schwab refunded the full amount the thieves had charged to his card. |

8. Additional Benefits for Investors

For those who are also interested in investing, Charles Schwab offers various investment services that can be linked to your debit card.

This allows you to easily access and manage your investments while traveling without worrying about additional fees or restrictions.

By linking your debit card to an investment account, you can also earn compound interest on your account balance, making it a great way to save money while traveling.

This added bonus makes the Charles Schwab debit card even more appealing to those who want to maximize their finances while on the road.

In other words, not only can you save money on ATM fees, but you can also potentially earn money through your investments with Charles Schwab.

| Case In Point |

|---|

| I have both ROTH and SEP IRAs with Charles Schwab. When I have extra funds from my travels, I choose to invest a portion of the surplus into my IRA. The Charles Schwab website and app offer a seamless experience for these deposits and investments. Their customer service is exceptional and promptly resolves any inquiries. They have even guided me through using the app effortlessly. |

9. Supporting Financial Literacy

In addition to providing excellent banking services, Charles Schwab prioritizes financial literacy and education.

They offer a variety of resources and workshops to help individuals learn about investing, budgeting, and managing their finances.

By using the Charles Schwab debit card and taking advantage of these resources, you not only save money but also improve your financial knowledge and skills too.

10. Other Considerations

While the Charles Schwab debit card has many benefits for travelers, there are a few things to remember before applying for one.

First, you will need to open a Charles Schwab brokerage account to get the debit card.

I’ll walk you through the steps to do this in the next section.

Applying for a brokerage account may not be ideal for those who don’t want multiple banking accounts or are not interested in investing.

Additionally, the card does have a daily withdrawal limit of $1,000 and a purchase limit of $3,000.

While this may not be an issue for most travelers, it’s essential to plan accordingly if you know you will need more funds during your trip.

Steps on Applying for a Charles Schwab Debit Card/No-Fee ATM Card

Step 1: Visit the Charles Schwab Website

Go to the official Charles Schwab website and find the ‘Open an Account‘ button.

The above link is not an affiliate or referral link. We do not earn a commission for recommending Charles Schwab. We love the product so much!

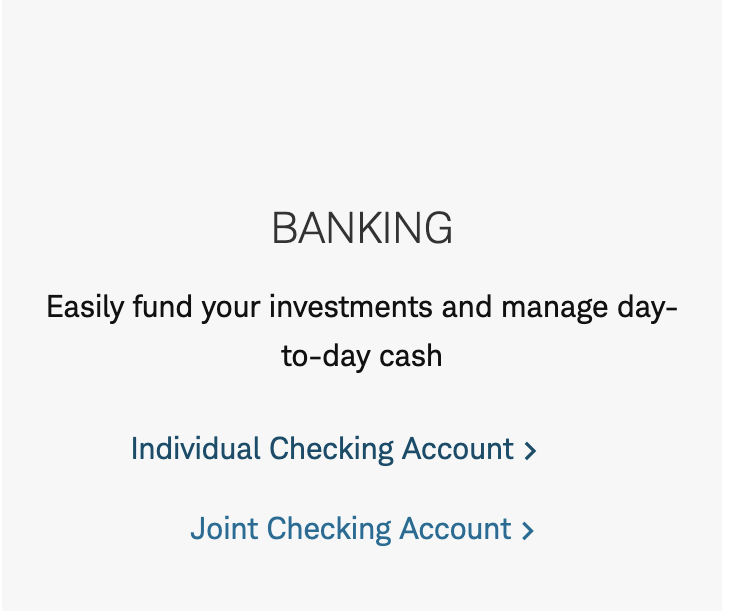

Step 2: Choose Account Type

Under Banking, select ‘Individual Checking Account‘ as the account type you want to apply for.

This specific account comes with a no-fee ATM Debit Card.

Step 3: Open the Account

Before filling out the application, you will be prompted to review the product that you will be signing up for.

During the application process, you’ll also be required to open a Charles Schwab brokerage account alongside your checking account, but there’s no obligation to use it or maintain a balance.

Both these accounts are connected, and opening a brokerage account is currently required as per Charles Schwab’s policy.

Again, don’t worry. Both of these products are entirely free.

| Frequently Asked Questions (Schwab.com) |

|---|

| What can you do with these linked accounts? |

| Conveniently fund your investments and manage your day-to-day cash. Unlimited ATM fee rebates. Free online bill pay. Deposit checks from anywhere with Schwab Mobile. |

| What are the costs of opening and linking these accounts? |

| $0 monthly service fees $0 account minimum No foreign transaction fees |

| What do you need to open these accounts? |

| Your Social Security or Tax Identification Number Your employer’s name and mailing address (if applicable) Your email address and mobile phone number |

Step 4: Fill Out the Application

Provide the required personal information such as name, address, Social Security Number, and phone number.

If you are a new Charles Schwab customer, you must create a unique username and password.

Step 5: Verify Identity and Agree to the Terms

During the application process, you will be asked several verification questions.

They may also ask for proof of identity, such as a driver’s license or passport.

Be sure to answer the essential questions thoroughly and honestly in order to ensure a smooth sign-up process.

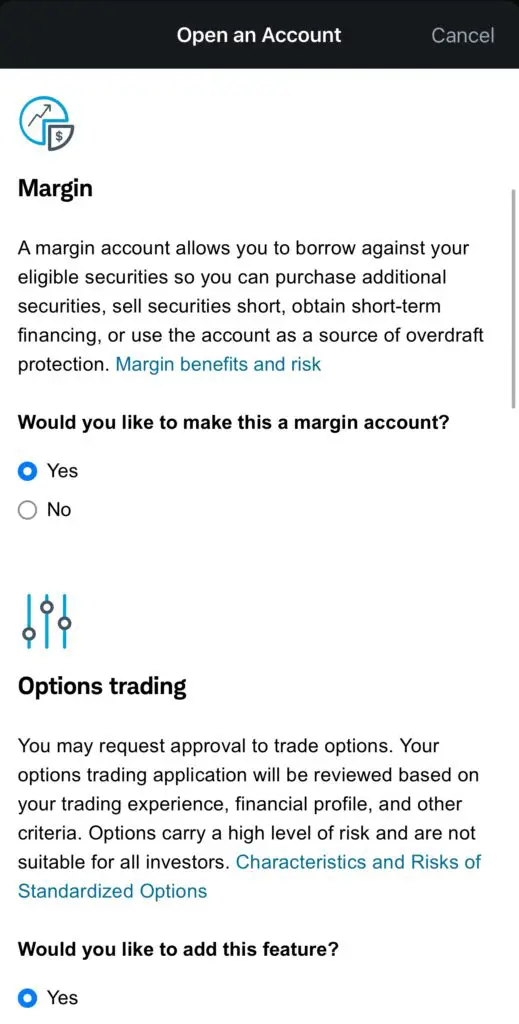

When prompted, consider selecting “YES” if you plan to use this account for retirement or investments with Charles Schwab in the future.

After providing your information, you will need to agree to the terms and conditions associated with the account.

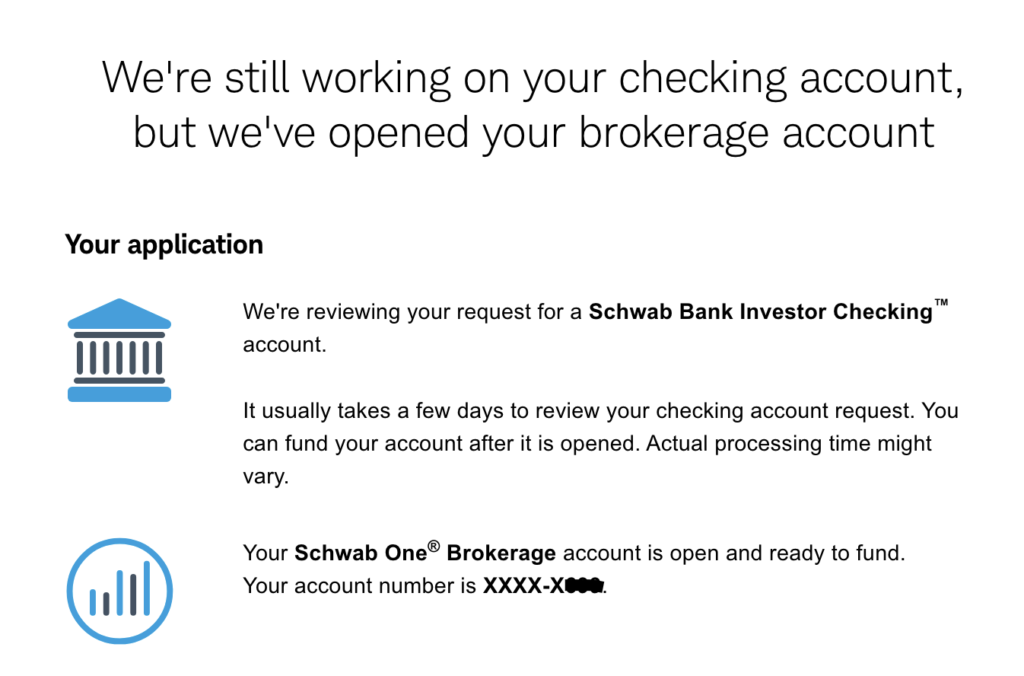

The Schwab Bank Investor Checking is approved in a few days, but the Schwab One Brokerage account is typically available instantly and ready to be funded.

Step 6: Fund Your Account

After your application is approved, fund your account with the initial deposit via a transfer from another bank account, mail a check, or set up a direct deposit.

Step 7: Wait for Your Debit Card

Once your account is funded, Charles Schwab will mail your debit card to the address provided during the application process.

This usually takes 5-10 business days.

We advise opening your account well in advance to ensure timely delivery of your debit card before your trip.

Given the time limitations involved, it is recommended that you initiate the account opening process at least 3-4 weeks before the start date of your journey.

If you are pressed for time, you can request for Charles Schwab to expedite the delivery of your debit card.

Reach out to their customer support team and tell them you need the card urgently due to upcoming travel.

Step 8: Set-Up Automatic Transfers

Effortlessly fund your travel card without you lifting a finger by setting up automatic transfers.

Setting up automated withdrawals and transfers on the Charles Schwab app is a breeze.

Since my Charles Schwab account is currently my designated “travel bank“, I ensure it always has sufficient funds.

To ensure that my debit card is adequately funded, I transfer a small amount from my primary bank to my Charles Schwab Checking Account each month through automatic transfers.

This way, I do not have to remember to do it. It just happens behind the scenes every single month, even while I am asleep.

This guarantees that I will have money whenever I use my Charles Schwab debit card at ATMs worldwide.

With no foreign transaction fees and free ATM withdrawals worldwide, it’s the perfect solution for frugal travelers.

Travel Miles and Points Facebook Group

Additional Tips When Using the Charles Schwab Debit Card

Alert Your Bank Whenever You Have Travel Plans

The Charles Schwab debit card can be used to withdraw at ATMs in most countries around the world.

However, you should always make sure to alert Charles Schwab that you will be traveling so they don’t freeze your card if they see unusual activity.

Call Charles Schwab to let them know you have travel plans before departure.

Save the Charles Schwab Phone Number in your contacts: 1 (800) 435-4000

Bring Multiple Methods of Payment

Travelers should always ensure they have multiple payment methods with them.

Carrying more than one debit or credit card can help prevent any issues with accessing cash while on the road.

It is crucial to be prepared with alternative payment options when the situation calls for it.

Having multiple options will help ensure that you are able to pay for whatever you need while traveling.

Being stranded in a foreign land without any means of accessing cash or credit cards can be incredibly frustrating, so make sure you have several sources of travel funds.

Bring Some Cash

Although we advise against carrying excessive amounts of cash while traveling, we highly recommend having access to a reasonable amount available.

This is particularly crucial for international trips, as not all merchants accept credit/debit cards or may charge additional fees for their use.

Furthermore, it’s wise to keep some cash readily available in case of emergencies.

Just remember to store your money securely.

With a modest amount of cash on hand, you can effectively manage your trip expenses and have the flexibility to make payments in any method when necessary.

Keep Track of your Account Balance

Before using your debit card for purchases or withdrawals, make sure you have adequate funds available for purchase or withdrawal.

When To Use Your Charles Schwab Debit Card

I only use my Charles Schwab debit card in two instances:

a. Withdrawing money from ATMs worldwide

b. When a particular merchant does not accept credit cards, and I do not have the cash to complete the transaction. For example, some train station kiosks in Europe do not accept credit cards but will readily accept debit cards.

Thus, I do not use my Charles Schwab debit card as my primary payment method when traveling.

Limiting your debit card usage during travel also decreases the probability of encountering fraudulent activities.

Despite the advanced security measures provided by Charles Schwab debit cards, the risk of fraud remains, and it is crucial to avoid being stranded in a foreign country with a compromised card and no means to access your funds.

Therefore, we recommend utilizing your travel credit cards instead of the Charles Schwab debit card for all other situations.

Credit cards offer valuable fraud and purchase protections, making them an excellent choice for travelers.

Credit cards also provide the convenience of quick card suspension in the event of hacking attempts, safeguarding your accounts from unauthorized access.

Our recommended travel credit cards, which do not charge foreign transaction fees, are the Chase Sapphire Preferred® Card and the Capital One Venture X Rewards Credit Card.

Frequently Asked Questions

What is the Charles Schwab no-fee Debit Card?

The Charles Schwab no-fee ATM/debit card is a financial product offered by the Charles Schwab Corporation, a leading brokerage and banking services provider.

The no-fee ATM/debit card allows customers to access their checking account funds without worrying about additional fees or charges.

This means that customers can withdraw cash from any ATM worldwide without having to pay high transaction fees.

Who is eligible for the Charles Schwab Debit Card?

The Charles Schwab no-fee ATM/debit card is available to all Charles Schwab brokerage account holders.

This includes individual investors, joint account holders, and business owners who have opened a brokerage account with Charles Schwab.

Customers must also open a linked High Yield Investor Checking account to be eligible for the no-fee ATM/debit card.

What are the primary benefits of having a Charles Schwab Debit Card?

The main benefit of the Charles Schwab no-fee ATM/debit card is the ability to access cash from any ATM in the world without incurring additional fees.

This can be especially beneficial for frequent travelers, as they no longer have to worry about finding an ATM that is part of their bank’s network or paying high international transaction fees.

What are the limitations of a Charles Schwab Debit Card?

While the Charles Schwab no-fee ATM/debit card offers many benefits, there are some limitations to consider.

The no-fee feature only applies to ATM withdrawals and does not cover any fees charged by merchants for debit card purchases.

The Charles Schwab no-fee ATM/debit card is only available for US-based accounts. Customers with international accounts may not be eligible for this product.

How long does it take for the Charles Schwab Debit card to be delivered?

The Charles Schwab no-fee ATM/debit card is typically delivered within 5-10 business days of the account being successfully opened and funded.

Customers can also request expedited delivery for an additional fee. Once received, customers must activate their card before use by following the instructions provided in the welcome package.

How do I apply for a Charles Schwab Debit Card?

To apply for a Charles Schwab no-fee ATM/debit card, individuals must open two accounts together: a brokerage account and a checking account.

This can be done online or by visiting one of their branch locations.

Where can I use my Charles Schwab Debit Card?

Customers can use their Charles Schwab no-fee ATM/debit card at any ATM worldwide that accepts Visa.

This includes both domestic and international ATMs. Customers can also use their debit card for purchases anywhere Visa is accepted.

It’s important to note that while the no-fee feature applies to all ATMs, customers may still be subject to currency conversion fees when using their debit cards internationally.

Is the Charles Schwab Debit Card free?

Yes.

How does the Charles Schwab Debit Card compare to other debit cards?

Compared to other debit cards, the Charles Schwab no-fee ATM/debit card stands out for its lack of fees and worldwide accessibility.

Most traditional banks charge a fee for using ATMs outside of their network, and these fees can quickly add up.

With the Charles Schwab debit card, customers can save money while still having access to their funds anywhere in the world.

Some debit cards also charge foreign transaction fees for international purchases, while the Charles Schwab card does not.

This makes it an excellent option for frequent travelers or those who frequently purchase in different currencies.

How do I make purchases using my Charles Schwab Debit Card?

To make purchases using your Charles Schwab no-fee ATM/debit card, simply swipe or insert your card at any merchant that accepts Visa.

You can also use your card for online purchases by entering the card number, expiration date, and CVV code.

How do I withdraw money from an ATM using my Charles Schwab Debit Card?

To withdraw money from an ATM using your Charles Schwab no-fee ATM/debit card, simply insert your card and follow the prompts on the screen.

You may need to enter your PIN or select the type of account you wish to withdraw funds from.

When do I get the ATM fee refunded?

The refund for ATM fees is usually credited back to your account at the end of each month.

It’s essential to remember that you may only see the ATM fee refunds on your monthly statements and not in real time when making transactions.

How do I check the balance of my Charles Schwab Debit Card?

Customers can check the balance of their Charles Schwab no-fee ATM/debit card by logging into their account online, using its mobile banking app, or contacting customer service.

It’s crucial to regularly monitor your account balance to ensure you have enough funds for any potential purchases or withdrawals.

How do I add money to my Charles Schwab Debit Card?

There are a few different ways to add money to your Charles Schwab no-fee ATM/debit card:

- Direct deposit: You can set up direct deposit with your employer or other income sources to have funds automatically deposited into your account.

- Online transfer: If you have another bank account, you can transfer funds electronically to your Charles Schwab account.

- Mobile check deposit: You can use a mobile banking app to deposit checks into your account by taking a picture of the front and back of the check.

- In-person deposits: You can also deposit at one of Charles Schwab’s physical branch locations.

Please note that bank transfers usually take approximately 2-3 business days to process and complete.

To ensure the timely availability of funds, it is advisable to regularly monitor your Charles Schwab account and plan bank transfers well in advance. Our transfers from Chase to Charles Schwab have consistently been seamless and fast.

Is there a limit to how much money I can withdraw from an ATM using my Charles Schwab Debit Card?

Yes, there may be daily withdrawal limits set by Charles Schwab or the ATM provider.

These limits vary and are usually based on security measures to protect your account from fraud.

It’s important to check your account terms and conditions or contact customer service to determine your withdrawal limit.

Is my Charles Schwab Debit Card secure?

Yes, the Charles Schwab no-fee ATM/debit card is secure. The company has various security measures in place to protect customers’ accounts and personal information.

This includes fraud monitoring, encryption technology, and FDIC insurance for deposits up to $250,000.

Customers can also take steps to further enhance their account security by regularly checking their account activity, setting up alerts for suspicious activity, and keeping their card and PIN secure.

If there is any suspected fraudulent activity, customers should immediately contact Charles Schwab’s customer service.

Customers are not responsible for unauthorized and fraudulent charges on their Charles Schwab no-fee ATM/debit card as long as they immediately report the activity to the company.

It’s important to regularly review your account statements and notify Charles Schwab immediately if you notice any suspicious or unauthorized charges.

How do I report a lost or stolen Charles Schwab Debit Card?

If your Charles Schwab no-fee ATM/debit card is lost or stolen, it’s essential to act quickly to protect your account and funds.

You can report a lost or stolen card by contacting customer service immediately. They will cancel the old card and issue you a new one.

It’s also important to regularly monitor your account activity for any unauthorized transactions and report them to Charles Schwab’s customer service as soon as possible.

With their fraud monitoring and quick response, customers can have peace of mind knowing their accounts and funds are secure.

How much money should I keep in my Charles Schwab checking account?

The amount of money to keep in your Charles Schwab checking account will vary depending on your financial situation and how frequently you plan to use your debit card in your travels.

It’s generally recommended to maintain a balance that can cover all of your trip expenses, with an additional amount available in case of emergencies or unexpected expenses.

Please note that this is merely a suggestion, and the final decision rests with you as a traveler. It is important to remember that you can always transfer additional funds too, if necessary.

How do I cancel my Charles Schwab Debit Card?

If you no longer wish to use your Charles Schwab no-fee ATM/debit card, you can cancel it by contacting customer service.

They will guide you through the cancellation process and may ask for a reason for canceling.

It’s important to note that canceling your card does not automatically close your account.

You will still have access to any remaining funds in the account and will need to transfer or withdraw them accordingly.

Cancelling your card may also affect any automatic payments or subscriptions linked to it.

Be sure to update your payment information with those companies if necessary.

Is there customer support available for my Charles Schwab Debit Card?

Yes, customer support is available for the Charles Schwab no-fee ATM/debit card.

You can contact their customer service team via phone, email, or live chat with any questions or concerns about your card.

Additionally, customers can access resources and information through the Charles Schwab website, including frequently asked questions and user guides.

This can help troubleshoot issues or learn more about the card’s features.

What other products offer no-fee ATM debit cards other than Charles Schwab?

While Charles Schwab offers a highly popular and well-known no-fee ATM/debit card, other financial institutions also offer this feature. Some examples include Ally Bank, SoFi, and Betterment.

These companies may have different eligibility requirements or account features, so it’s important to do your research and compare options before deciding on the best no-fee ATM/debit card for your needs.

Some credit unions and online banks may also offer no-fee ATM/debit cards.

It’s always a good idea to explore different options and their associated benefits to make an informed decision that suits your financial goals.

Final Thoughts

The Charles Schwab Debit card is the best international fee-free ATM/debit card for travel, especially for frugal tourists like myself.

Between no foreign transaction fees, ATM fee reimbursements, easy access to funds, and excellent customer service support, it’s a no-brainer for travelers looking to save money and conveniently access their funds while abroad.

The Schwab Debit Card also offers many additional benefits, such as fraud protection and excellent customer service.

So, if you’re planning on traveling soon, I highly recommend opening a Charles Schwab account and getting your hands on their no-fee debit card.

Trust me, your budget will thank you!

EDITORIAL DISCLOSURE – Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. The content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

Hi Kris! It’s Nanette Baltazar! Over the 2-week break, I read Ramit’s book, I Will Teach You To Be Rich. What an eye opener! I wanted to ask you, what credit cards do you recommend that have cashback or travel rewards and no annual fee? How about savings accounts – do you have a high yield savings account that Ramit mentioned as well?

Hi Nanette! I’m glad you found Ramit’s book valuable! He has lots of fantastic recommendations. As far as savings account, my “emergency fund” is in a high-yield savings account (HYSA), I currently bank with marcus.com. It currently yield 1.7% interest rate so not too high. You can check your local credit union and see if they have a better interest rate. Do you have TMobile? TMobile offers 4% for the first $3K in their savings account. That’s a good option too. With regards to a credit card, all of the travel rewards card I like do charge an annual fee but there’s definitely a plethora of cashback cards that are fee-free! Let me know if you have any other questions!