The blog may receive a commission when you use any of the links in this post at no extra cost to you. Opinions stated are the author’s alone, based on his personal experiences using these products & services. Thank you so much for supporting the blog! (See our Disclosures below)

Receiving bank bonuses is one of my favorite ways of earning passive income.

In simple terms, you put your saved money to work by capitalizing on these bank promotions, so your cash multiplies without much effort from you.

Your money then becomes your employee and generates an additional revenue stream for you.

Deals offered by banks ordinarily involve no more than a couple of hours to set up. Yet the returns are significantly more favorable than keeping your hard-earned cash trapped in your current savings account.

Given our current economic climate, it is unusual to find savings accounts that offer over 1% interest.

General Steps in Optimizing Bank Bonuses

If you are not familiar with how bank bonuses work, below is a rough framework of the steps involved.

STEP 1:

You scour the web for profitable bank offers. I periodically refer to Doctor of Credit’s Bank Bonuses Page for the latest deals.

Alternatively, I post about great bank bonuses and travel rewards information in our FREE Travel Points and Miles Facebook Group. Join us.

STEP 2:

Thoroughly read the fine print of the bank deal you plan to participate in. Particularly pay attention to specific requirements, deadlines, and expirations. I do not want you to overlook a step or two, as those missteps can forfeit your bonus.

Bank bonuses will typically require an amount deposited by a certain date. Usually, the transferred funds need to stay in this new account for a specified length of time. Oftentimes, the money needs to originate from a direct deposit, but not always.

STEP 3:

Perform the required tasks completely.

Whether it is direct deposit or use of the bank’s debit card, it is recommended that you accomplish the action items on or before the due date, so you’re guaranteed to be rewarded.

Then, I’d set up an alarm for the day you expect to get your bonus.

STEP 4:

Check your bank account once the time has come. As soon as the bonus shows up, you can either decide to keep your money in your new account or loop back to Step 1 to repeat the process with another bank.

Now that you are already familiar with how bank bonuses work, I’d like to go over the steps involved in obtaining the $600 bonus from HSBC. This current deal is quite lucrative since bonuses of this magnitude traditionally require a considerable cash deposit.

Steps in HSBC’s Share the Experience Promotion to Earn the $600 Bonus.

STEP 1:

Call HSBC at 1-866-788-5583. Hours are from Monday to Friday, between 9 am – 5 pm Eastern Standard Time. It is also possible to stop by the branch to apply for this promotion. Click the link below to find the branch nearest where you live.

People and businesses that currently have an HSBC account or previously owned an account within the past three years are not eligible to participate in this promotion.

STEP 2:

Choose the option for “New Accounts”. Let the agent know that you are interested in opening a Share the Experience Premier Checking Account if you prefer the take advantage of the $600 bonus.

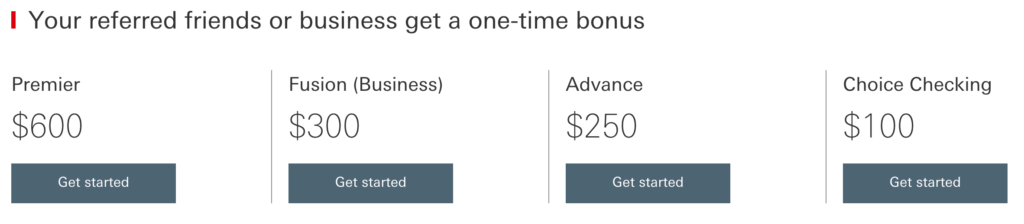

Alternatively, three other deals are available to new applicants with lesser rewards (see below) if you find the Premier requirements somewhat challenging to attain.

STEP 3:

You will be transferred to another banker who can assist you with your application. This is when you let the banker know that you have a Share the Experience referral code that you want to use to become eligible for this offer.

Length of calls may vary as bankers will ensure that they have thoroughly verified your identity and eligibility for this promotion before initiating the application. Prepare to provide your Drivers License information and answer security questions as well.

STEP 4:

The banker will either ask for the referral code over the phone or request for the code to be sent via email. I was requested to do the latter, which I preferred, so I could have additional proof that I applied for the Share the Experience promo.

If you do not have a friend or family member who can refer you to this deal, you are more than welcome to use the referral code below (Thank you very much in advance!).

Name: Kristdann Abad / Share The Experience Referral Code: S015314927

STEP 5:

The banker will explain in full details the terms and conditions of the promotion you had chosen. Take note of the particular stipulations for the specific deal you had selected.

For the Premier Checking Account, I was informed that I needed to complete a monthly $5,000 direct deposit for 2 consecutive months in order to trigger the bonus. Below is a table that illustrates a couple of scenarios that anyone can employ to meet this condition.

| Direct Deposit Options | Month 1 Day 15 | Month 1 Day 30 | Month 2 Day 15 | Month 2 Day 30 | Total |

| Bi-monthly | 2,500 | 2,500 | 2,500 | 2,500 | 10,000 |

| Monthly | 5,000 | 5,000 | 10,000 |

Data Points (DP): Reports indicate that the bonus is showing up in accounts after the first $5,000 direct deposit but it varies widely per individual.

STEP 6:

It takes about a day or two for the account to be entirely set-up, and an email will be sent out once your profile is up and running.

While waiting for your HSBC account to get activated, contact your work’s payroll department to inquire how you can modify the recipient of your direct deposit. Of course, it will be quicker if you can make the change yourself.

STEP 7:

After several days, you will be granted a Share the Experience referral code that you can provide to family or friends who might be interested in partaking in this lucrative offer.

Even though the banker will say that your personalized code will come out within 14 days, mine was released after 2 days. I suggest checking for your code daily by clicking the button below.

Feel free to share this article, but don’t forget to give them your personalized referral code. Each approved referral nets $100.

Anyone can potentially earn up to $2,000 worth of referral bonuses (20 approved referrals), so make sure to spread the news, so you get rewarded as well.

STEP 8:

Each account charges a monthly maintenance fee if prerequisites are not fully met. Ensure that you have clearly understood your promotion’s terms, as well as the conditions that can waive the fee.

With the Premier account, the monthly fee of $50 is waived as long as the $5,000 direct deposit criterion is met. Therefore, I do not plan to terminate the direct deposits until my cash award has been generated.

At any rate, my banker informed me that I have 60 days to set up direct deposit, so any fees incurred during that period will be reversed.

To qualify for an HSBC Premier relationship, you need to open an HSBC Premier checking account and maintain: Balances of $75,000 in combined U.S. consumer and qualifying commercial U.S. Dollar deposit and investment accounts; OR Monthly recurring direct deposits totaling at least $5,000 from a third party to an HSBC Premier checking account(s); OR HSBC U.S. residential mortgage loan with an original loan amount of at least $500,000, not an aggregate of multiple mortgages. Home Equity products are not included. The Annual Percentage Yields (APYs) and balances for eligible interest-bearing HSBC Premier checking accounts which are accurate as of 12/20/2020 is 0.01% APY on balances of $5.00 or more. APY is variable and subject to change after opening. Charges and fees may reduce earnings.

HSBC.com

Here are a few options to avoid this monthly maintenance fee:

- Continue with direct deposit and transfer the amount immediately to your primary bank. Or use the direct deposit amount to pay your monthly bills (mortgage, rent, utilities, credit card balances, etc.)

- Close the account as soon as the bonus is earned. This makes you eligible for another HSBC bank bonus approximately 3 years after closure.

Again, it bears repeating that all monetary rewards generated from these promotions and referrals are taxable. Therefore, expect a 1099 from HSBC by year-end.

Final Thoughts

Whether you are a casual saver or an avid deal hunter like myself, this current bonus from HSBC is hard to ignore.

First off, it’s rare that a bank would want to part ways with $600 in exchange for such a small investment. Secondly, HSBC does not make us jump through multiple hoops just to obtain this bonus.

Unlike other banks that require a certain number of debit transactions per month on top of the direct deposit specification, HSBC evidently wants this process to be less effortful so a lot of people can conceivably receive this generous offer.

In short, once you’ve successfully set up direct deposit, you can put this promotion on the back burner until such time that you’re ready to collect the income your money has generated by itself.

Indeed, there is no denying that this current $600 bank bonus is pretty generous, particularly during this pandemic when every dollar earned counts.

Do you plan to participate in this promotion?