ADVERTISER DISCLOSURE: The Frugal Tourist is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as MileValue.com and Cardratings. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All information about the American Express Schwab Platinum has been collected independently by The Frugal Tourist.

EDITORIAL DISCLOSURE: Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities.

PayPal Key Has Been Discontinued By PayPal and Replaced by PayPal Bill Pay

Traveling has been one of my life passions for as long as I can remember.

As a natural saver, this poses a constant dilemma – do I spend on travel or fund my nest egg instead?

We all know that travel has the potential to get ridiculously expensive. Whether you’re in the initial planning stages or already in your destination, staying within budget is a perpetual challenge.

So, how do I achieve that healthy balance of following my heart to explore the world without putting a sizable dent in my wallet?

That’s where leveraging miles and points for travel comes in. It is the perfect union of frugality and the love for travel.

In a nutshell, it is the practice of applying for specific credit cards that provide generous bonuses that can be redeemed for flights and hotel stays.

When you strategically spend using certain credit cards, you have the potential to earn a boatload of miles and points. As your points accumulate, your options for discounted travel multiply.

However, not all expenses can be paid off with a credit card.

Bills like rent, student loans, tuition fees, car payments, and home mortgages can typically only be paid using cash, preventing us from earning credit card rewards from these huge expenses.

Technically, using credit cards to pay for the aforementioned bills is possible via Plastiq.com. Plastiq is an online bill-pay service that allows customers to pay their expenses for a fee. Sadly, they charge a whopping 2.85% when you use a credit card. However, this fee significantly drops to 1% when using a debit card. We will explore this particular option below.

In this blog post, I will outline a strategy that can help you generate these credit card points when paying bills while avoiding the 2.85% surcharge.

This points-earning tactic allows you to use your credit cards as debit cards, reducing the fee to 1% by using PayPal Key and Plastiq.

If you are averse to paying the 1% surcharge on these expenses, this strategy may not work for you.

What is PayPal Key?

PayPal Key is a virtual Mastercard debit card that you can sign up for free if you have a current PayPal account.

You can use this debit card to pay for online purchases anywhere Mastercard debit cards are accepted, even when a PayPal button is unavailable.

Think of it as just another debit card that you can use to pay for your online expenses.

As per PayPal, a foreign transaction fee applies to cross-border and cross-currency transactions. Usage fees charged by merchants or other entities besides PayPal may also apply. You can not use it to withdraw money or send money to another person.

How Do I Earn Points from a Debit Card?

PayPal allows their PayPal Key Mastercard Debit Card to be linked to any credit card.

The strategy is to link your points-earning credit card to your PayPal Key and use your PayPal Key to pay for purchases and bills where debit cards are accepted.

In essence, the merchant (e.g. Plastiq) will detect that a debit card is being used even though the transaction is actually being charged to your credit card.

Therefore, the merchant will charge you the debit card surcharge – which is normally cheaper – even if you’re genuinely using your credit card.

Do not use this strategy if you have existing credit card debt. This process will only work if you pay off your credit card balances religiously on or before the due date.

How Does PayPal Key Work?

STEP 1: Register for PayPal Key. You need to have an active PayPal account.

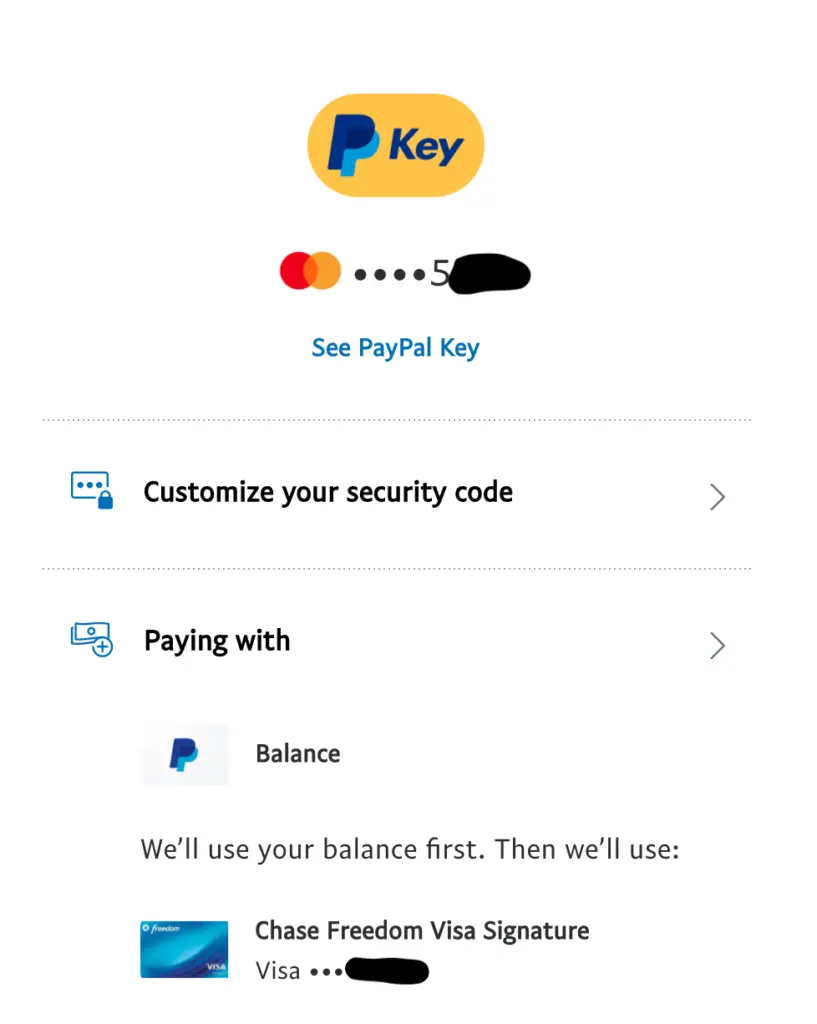

STEP 2: Link your PayPal key to a credit card with a PayPal bonus or a card you’re trying to meet a spending requirement for. I will list some card ideas later.

STEP 3: A virtual Mastercard debit card will be generated as your PayPal Key. Whether the credit card you are linking is a Visa or Mastercard, your PayPal key will always be a Mastercard debit card.

Effective January 4, 2021, American Express Credit Cards can not be linked with PayPal Key. You can still use Visa and Mastercard Credit Cards.

STEP 4: Write down your debit card number, expiration date, and security code. You can also take a screenshot of your card details. Your PayPal account will also have this information.

STEP 5: Now, you can use your PayPal key to pay bills online, where Mastercard debit cards are accepted.

STEP 6: Ensure your PayPal balance is zero so your charges will go directly to your PayPal Key. You can also customize your security code.

How to Pay Your Mortgage Using Your PayPal Key?

As of 11/27/2020, PayPal Key will no longer work at Plastiq.com for mortgage payments. You can still go directly to Plastiq.com to pay your mortgage using a Mastercard, but it will charge a credit card fee. Lastly, PayPal Key linked to a Visa or Mastercard can still be used to pay other merchants, such as utilities, online purchases, etc. Feel free to skip to the next section.

STEP 1: Register for Plastiq.

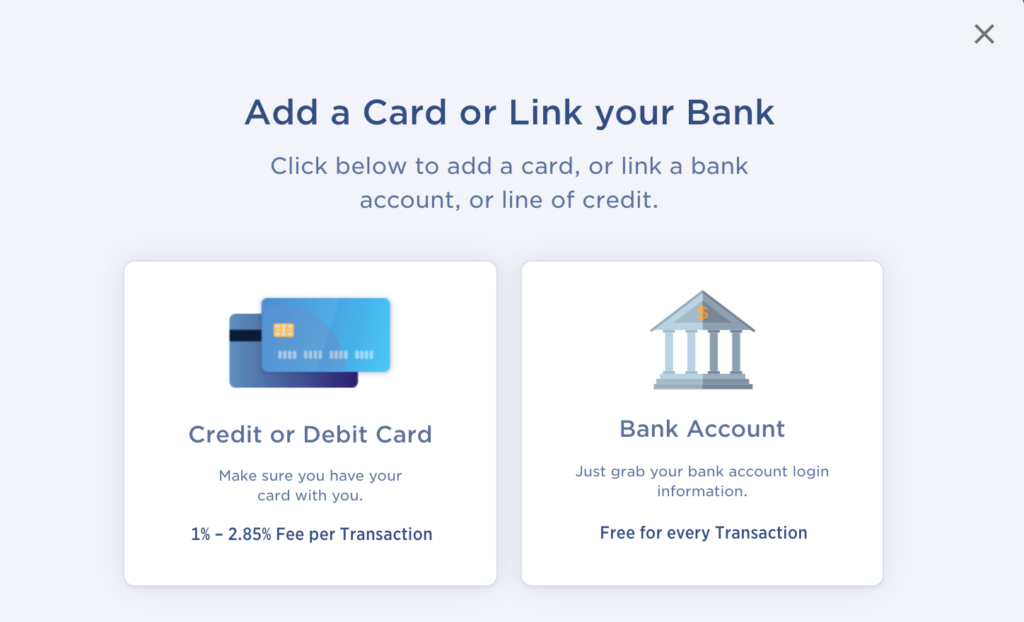

What is Plastiq? Plastiq is an online bill-pay service that allows people and small businesses to use their debit or credit cards to pay merchants that generally will not accept those payment methods. Plastiq makes it possible to pay bills like student loans, rent, or mortgage payments using a credit or debit card. Since your PayPal Key is considered a Mastercard debit card, you will avoid the 2.85% credit card fee and pay only the 1% fee Plastiq charges for debit card payments.

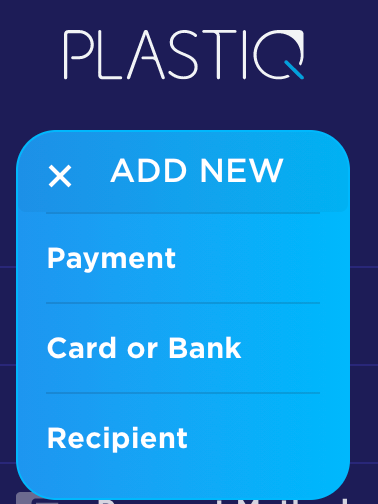

STEP 2: Add a new payment method.

STEP 3: Select “Credit Card or Debit Card”. Enter your PayPal Key information and label it “PayPal Key” to avoid confusion later.

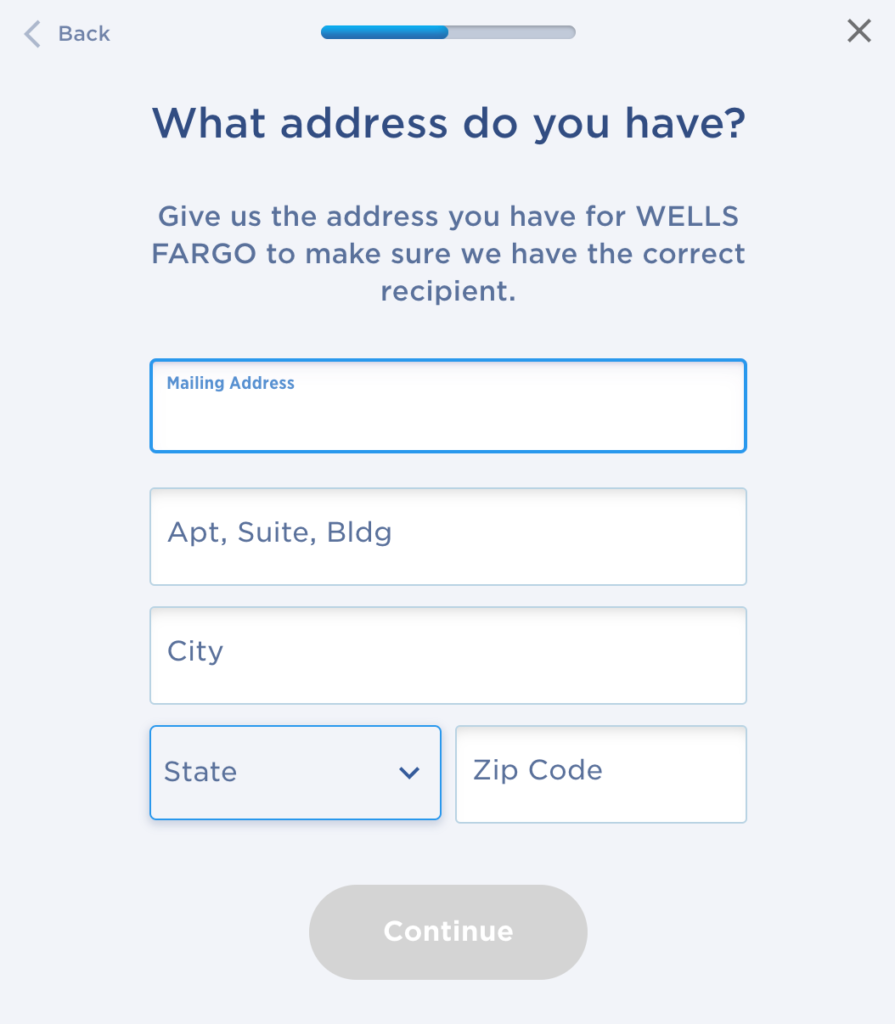

STEP 4: Add a new recipient. Enter the required information about your recipient and your account number. Prepare your statements so all the information can be easily gleaned.

STEP 5: Select how you want to send your payment – wire, ACH, or check. Ensure that you schedule your payments several days in advance to avoid a late fee. Sending a check usually takes about a week, but wire transfers and ACH are much faster.

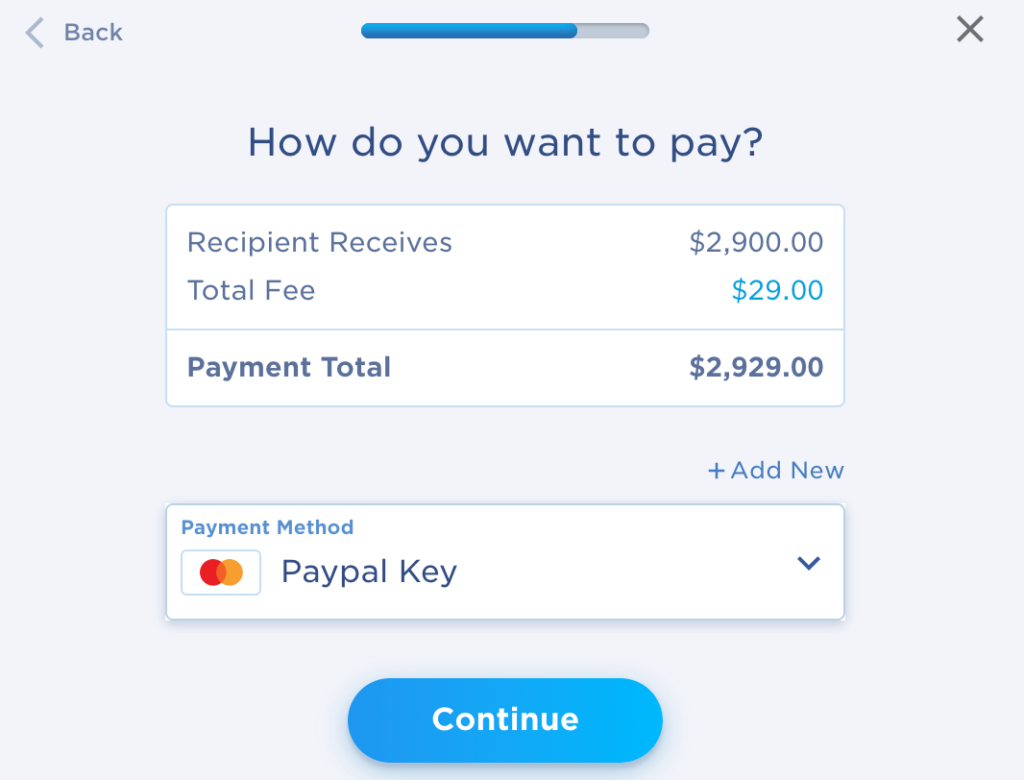

STEP 6: Initiate a new payment and make sure you select your PayPal Key number as your payment method. Plastiq will detect that your PayPal Key is a debit card and thus only charge your account 1%. If it charges more, review the steps from the beginning.

Pro-Tip: Plastiq sometimes declines payments if the delivery date is too soon. Give them adequate time to fulfill your request by adding a few extra days when scheduling your payment. This will increase the likelihood of your request getting approved.

Can I Change the Credit Card Linked to my PayPal Key?

Yes. I could link my PayPal Key to 3 different credit cards, which all worked without issues.

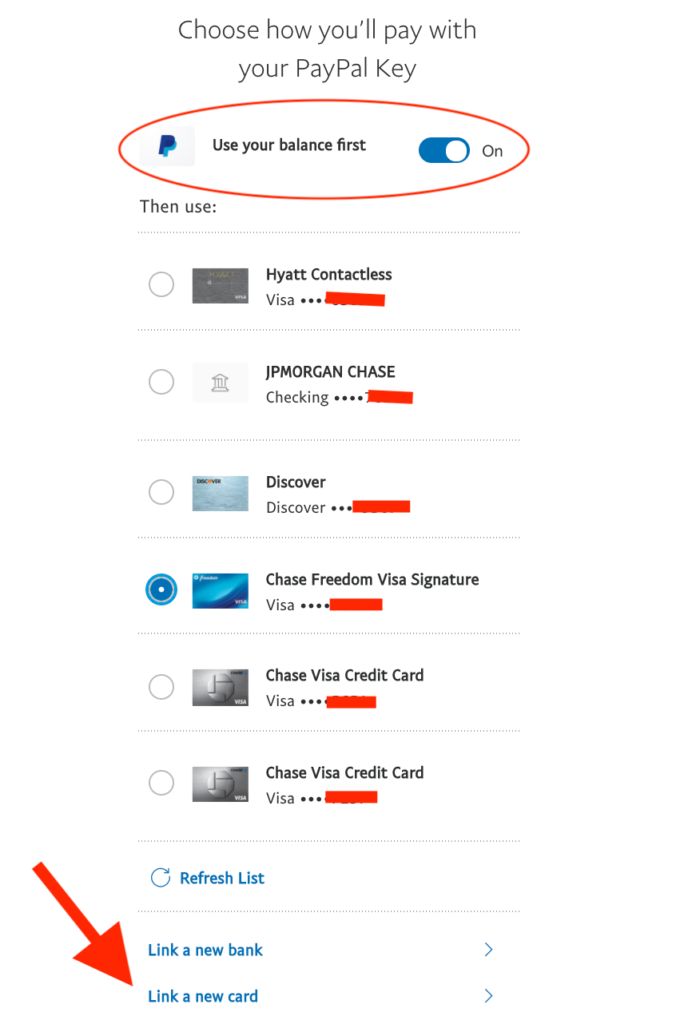

Log on to your PayPal account, select PayPal Key, and choose the “Link a New Card” option at the bottom.

Again, make sure you turn OFF “Use your balance first” or keep your balance to zero so your PayPal Key will charge your assigned credit card.

Before logging out of PayPal, check again if the correct credit card is linked to your PayPal Key debit card.

When is it a Good Idea to Use PayPal Key to Pay Your Bills?

1. When your linked Credit Card earns a category bonus when using PayPal.

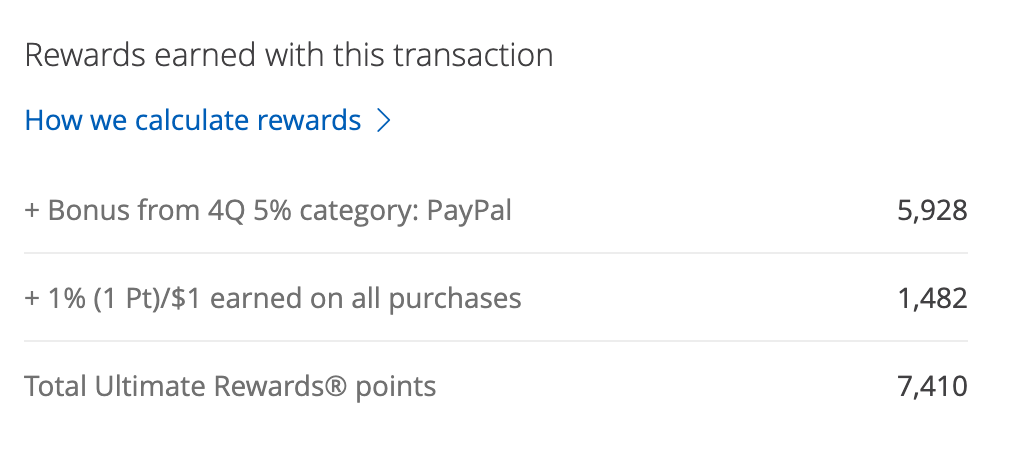

Periodically, the Chase Freedom Flex® earns 5X per dollar for PayPal spending up to a maximum of $1,500. Check if PayPal will earn a category bonus for this quarter here. If it does, register your card for this promo here.

In the example above, I earned a total of 7,410 Chase Ultimate Rewards (UR) points after paying $14.82 in fees (1% of $1482). If 1 Chase UR = 1 cent, then 7,410 UR is equivalent to $74.10. If you have the Chase Sapphire Preferred® Card or Chase Sapphire Reserve®, the value increases to 1.25 and 1.5, respectively.

2. When you must meet the minimum spending requirement for a NEW credit card you just got approved for.

3. Your Credit Card gives a certain reward or status after meeting a specific threshold.

The World of Hyatt Credit Card and Hilton Honors American Express Surpass® Card both give a free night after spending $15,000 within a calendar year (Hyatt Free Night is up to a Category 4 hotel, whereas the Hilton Free Night can be any category as long as a standard award is available).

4. When your credit card earns more than 1% per dollar in either cash back or travel rewards.

5. When the merchant gives a generous discount when using a debit card, you still want to earn credit card travel rewards.

It is undoubtedly an option to connect a credit card that earns a category bonus to PayPal Key so you can maximize both the debit card discount and the spending multiplier associated with your credit card.

Case in point, Verizon gives a discount when you schedule autopay using a debit card.

If you link the Ink Business Cash® Credit Card to PayPal Key to send automatic monthly payments to Verizon, you will get the Verizon debit card discount and earn 5 Chase Ultimate Rewards points per dollar since this credit card provides this category bonus.

What Else Can You Pay in Plastiq with Your PayPal Key?

According to Plastiq, you can practically pay any business, organization, or individual for goods or services provided within the U.S. or Canada, even if they don’t accept credit card or debit card payments.

- Rent or mortgage

- Tuition

- Utilities

- Car payments

- Homeowners Association

- Country clubs

- Insurance

- Taxes

- Home Improvement

- Insurance

- Childcare

- Contractors

PayPal Key is no longer accepted at Plastiq.com. You can still pay for these expenses at Plastiq.com using your credit card (2.85% fee) or debit card (1% fee).

What Else Can You Pay Using Paypal Key?

Practically any online purchase that accepts PayPal can be paid with PayPal Key except for mortgage payments.

Additionally, only Visa and Mastercard linked to PayPal Key will work.

Effective January 4th, American Express Credit Cards can no longer be connected to PayPal Key.

Since PayPal Key is considered a Mastercard Debit Card, It should work across all merchants that accept Mastercards.

Here are examples of the most common expenses that can be paid using PayPal Key.

- Utilities

- Groceries

- Taxes

- Online Purchases

Final Thoughts

The strategy I outlined above has the potential to generate a significant amount of points and miles when paying for expenses that traditionally did not accept credit cards.

Although this tactic may not work for everyone, anyone who wants to travel for free using miles and points should thoughtfully consider this opportunity.

While different promotions to accumulate miles and points have been sprouting everywhere lately, this new offering from PayPal is one of my favorites.

Frankly, the 1% surcharge is a small price to pay, considering the number of points that can be accrued month after month.

Do you plan to take advantage of PayPal Key?

ADVERTISER DISCLOSURE: The Frugal Tourist is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as MileValue.com and Cardratings. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All information about the American Express Schwab Platinum has been collected independently by The Frugal Tourist.

EDITORIAL DISCLOSURE: Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities.

USER-GENERATED CONTENT DISCLOSURE: The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.