ADVERTISER DISCLOSURE: The Frugal Tourist is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as MileValue.com and Cardratings. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All information about the American Express Schwab Platinum has been collected independently by The Frugal Tourist.

EDITORIAL DISCLOSURE: Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities.

This blog post walks you through how to transfer Chase Ultimate Rewards Points to Flying Blue (Air France/KLM).

Chase Ultimate Rewards Points is popular among points enthusiasts and frugal tourists like myself.

The reason? They offer the opportunity to redeem points for discounted flights across multiple airlines and free hotel stays.

Since Flying Blue (Air France/KLM) is a transfer partner of Chase, you can essentially accumulate Flying Blue miles by earning Chase Ultimate Rewards (UR) points.

Earning Ultimate Rewards Points is relatively easy and straightforward – it is typically accumulated through generous welcome bonuses and regular spending using any of the credit cards below:

| Chase Personal Credit Cards That Earn Ultimate Rewards Points | Chase Business Credit Cards That Earn Ultimate Rewards Points |

|---|---|

| Chase Freedom Unlimited® | Ink Business Cash® Credit Card |

| Chase Freedom Flex® | Ink Business Unlimited® Credit Card |

| Chase Sapphire Preferred® Card | Ink Business Preferred® Credit Card |

| Chase Sapphire Reserve® |

Important: You Need A Chase Premium Card

To have the ability to transfer Chase Ultimate Rewards Points to the Flying Blue Program (Air France / KLM), you need to have access to at least one of Chase’s premium cards.

Again, only one of these cards is needed to unlock the exclusive benefit of transferring to Chase travel partners such as Flying Blue.

| Chase Premium Credit Cards |

|---|

| Chase Sapphire Preferred® Card Chase Sapphire Reserve® Ink Business Preferred® Credit Card |

Pro Tip: Without one of these three Chase premium cards, you cannot transfer your Chase Ultimate Rewards points to Flying Blue (Air France/KLM) or any of Chase’s Travel Partners. In my opinion, the Chase Sapphire Preferred is the best of the three.

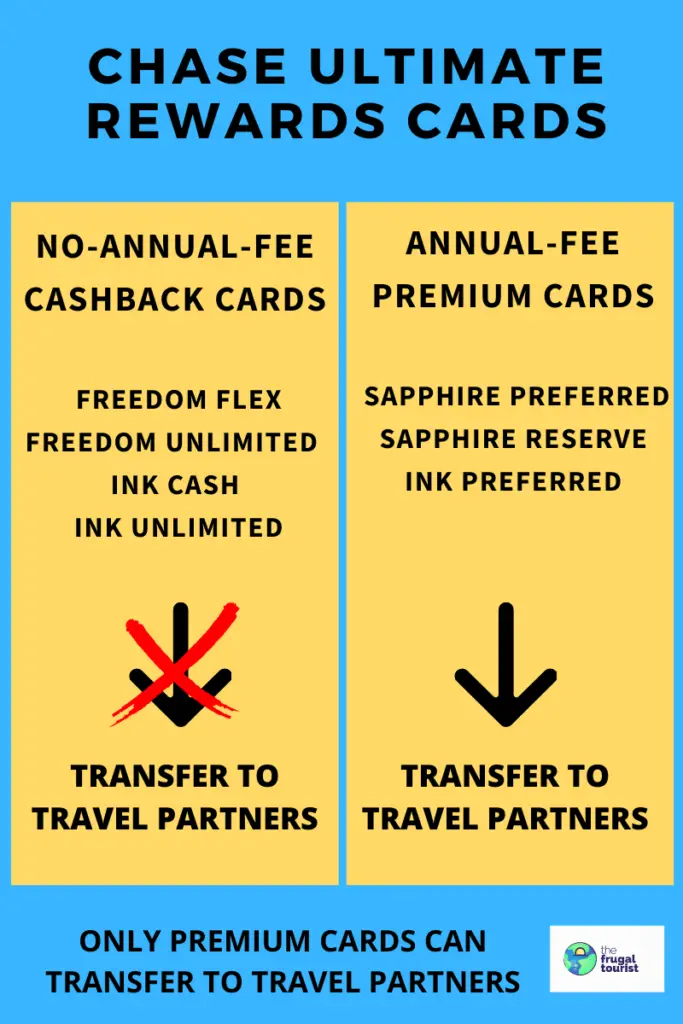

Deep Dive on Chase Credit Cards: No-Annual-Fee Cashback Cards Versus Premium Cards

Before we proceed with the steps involved in transferring Chase Ultimate Rewards points to Flying Blue (Air France / KLM), we must understand the difference between no-annual-fee cashback cards and premium Chase cards.

The table below illustrates which category each card belongs in.

| No-Annual-Fee Cards | Premium Cards (AF=Annual Fee) |

|---|---|

| Chase Freedom Flex | Chase Sapphire Preferred ($95 AF) |

| Chase Freedom Unlimited | Chase Sapphire Reserve ($550 AF) |

| Chase Business Ink Cash | Chase Ink Business Preferred ($95 AF) |

| Chase Business Ink Unlimited |

To soften the blow of the steep annual fees on Chase’s premium cards, the bank provides additional benefits to premium cardholders that are not available to those who only have no-annual-fee cards.

One of these valuable premium Chase card benefits is having access to my all-time favorite Chase Ultimate Rewards (UR) redemption option – TRANSFER TO TRAVEL PARTNERS.

Redemption Options for Chase No-Annual-Fee Cashback Cards and Premium Cards

Let’s compare the redemption options of “no-annual fee” cashback cards versus premium cards.

Redemption Options for No-Annual-Fee Cards

| No-Annual-Fee Chase Card Redemption Options |

|---|

| Travel Pay Yourself Back Gift Cards Chase Dining Cash Back Pay With Points |

At first glance, you might think that the choices are pretty generous for no-annual-fee cards, specifically, the cashback and gift card options.

But if you want to maximize the value of your Chase Ultimate Rewards Points, it is recommended that you explore redemption methods other than cashback, especially if you also have a premium card.

In my opinion, unless you have an emergency and are in dire need of cash, exchanging your hard-earned points for cash or gift cards will not generate the best bang for your buck.

Redemption Options for Premium Chase Cards

| Premium Chase Card Redemption Options |

|---|

| Travel Pay Yourself Back Gift Cards Chase Dining Cash Back Pay With Points Transfer to Travel Partners |

The table above shows that “Transfer to Travel Partners” became an available redemption option for Chase premium cards.

This exclusive “transfer benefit” will appear on your Chase Sapphire Preferred, Chase Sapphire Reserve, or Chase Ink Business Preferred accounts because they are all premium cards but not in your no-annual-fee cards.

Transfer Chase Ultimate Rewards to Travel Partners Such As Flying Blue

It is essential to underscore that each Chase Ultimate Reward point is not created equal.

The value of each Chase Ultimate Reward point will depend on whether they originate from a premium card or a no-annual-fee card.

Even if no-annual-fee cards generate Chase Ultimate Reward points, you cannot transfer them to partners, including Flying Blue, unless you have one of Chase’s premium cards.

Therefore, I strongly recommend owning at least ONE premium Chase card because this incredibly fantastic redemption benefit would not be possible without one.

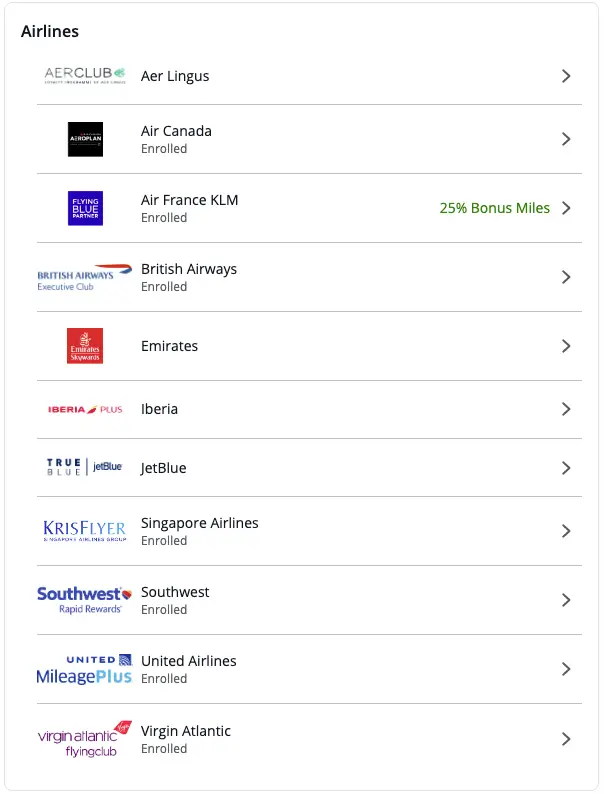

Chase Travel Partners

The chart below lists all the Chase travel partners.

Please check their website regularly.

It is not unusual for Chase to initiate new relationships (Aer Lingus) and terminate old ones (Korean Air).

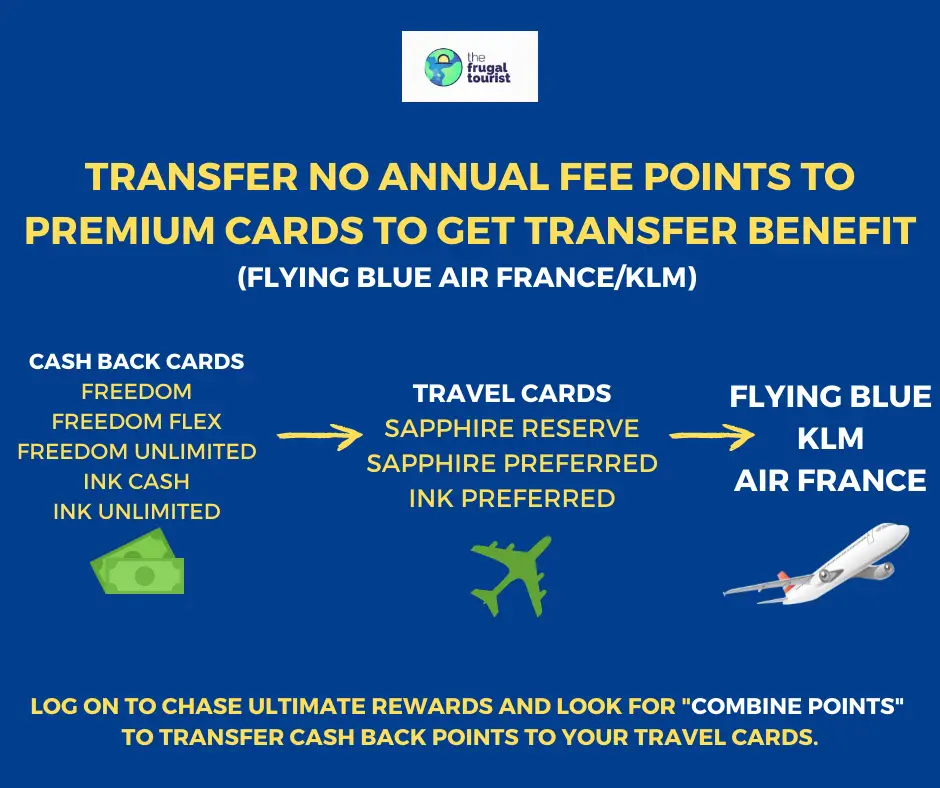

What if my Ultimate Reward Points are in my No-Annual Fee Cashback Cards?

Should you find most of your points in a no-annual-fee card, do not worry.

Chase allows the transfer of points between Chase Ultimate Rewards credit cards.

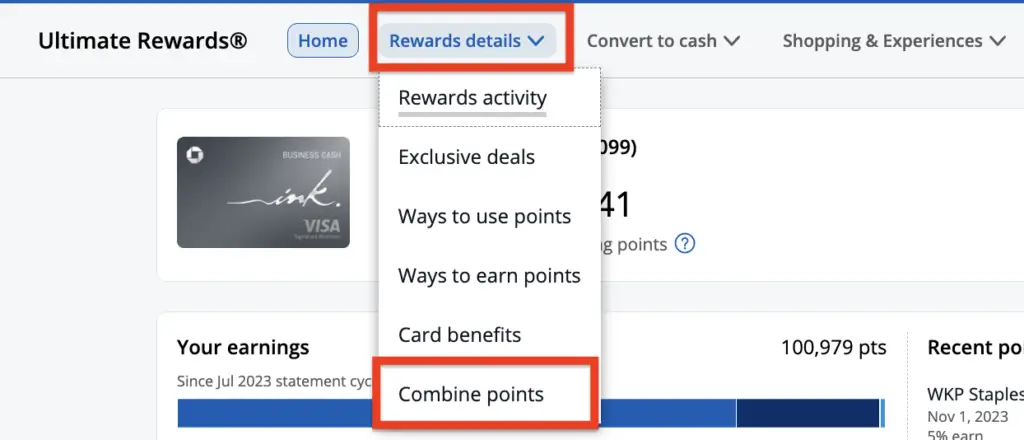

Log in to your Chase account and navigate to any of your Ultimate Rewards-earning credit cards.

Look for the “Ultimate Rewards Points” button, then click “Redeem” to access your points.

Next, click the “Rewards Details” dropdown arrow to find “Combine Points“.

If this is your first time combining Chase Ultimate Rewards Points, please continue reading for a step-by-step walkthrough.

As a general rule of thumb, I suggest transferring all of your no-annual-fee (cash back) Chase Ultimate Rewards Points to your premium cards, so you can have the ability to move your Chase Ultimate Rewards Points to travel partners, such as Air France/KLM anytime.

This transfer also significantly increases the worth of your Ultimate Rewards Points acquired from your no-annual-fee cards, making them all the more valuable.

What if my Personal and Business Credit Cards have Different Log-In Information?

Before transferring your Chase Ultimate Rewards Points between your personal and business credit cards, you must merge your personal and business accounts.

To do so, you can call Chase’s customer service using the phone number on the back of any of your Chase credit cards and request that your accounts be combined into one profile.

“Can you link my personal and business accounts so I only need one username and password?”

During the call, you will be required to provide your personal and business account information to verify your identity. After verification, the agent will then merge both accounts.

Once the accounts are linked, you’ll be able to access all of your accounts with one login and password.

This can save you time and make managing your finances and Chase Ultimate Rewards Points easier.

Whether you have questions about the linking process or need assistance with anything else, Chase’s customer support team is available 24/7 to provide help and support.

Steps for Combining Chase Ultimate Rewards Points (Desktop)

STEP 1:

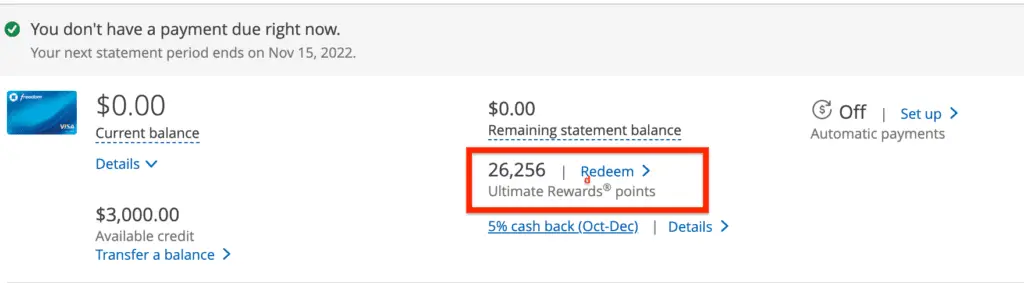

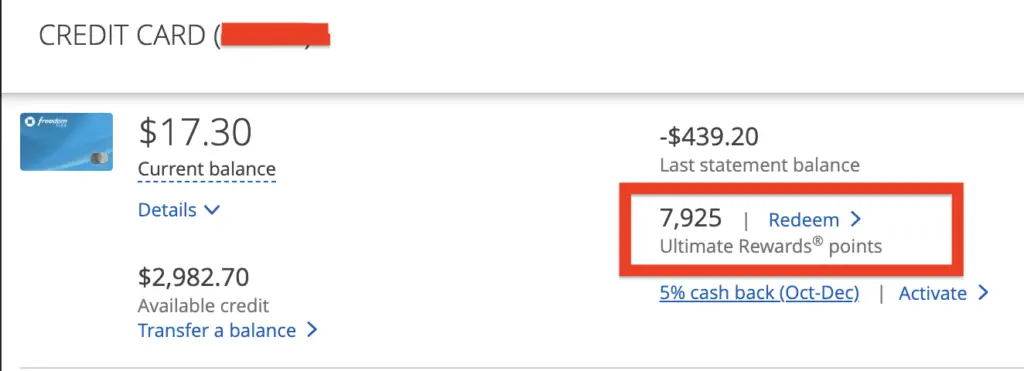

Log in to your Chase profile and select one of your Chase cards that earns Ultimate Rewards points.

In the image below, I selected my Chase Freedom Flex which currently has 7,925 Chase Ultimate Rewards Points.

I then click “Redeem” in the Ultimate Rewards points section (inside the red box).

STEP 2:

Clicking “Redeem” will lead you to the “Ultimate Rewards” page.

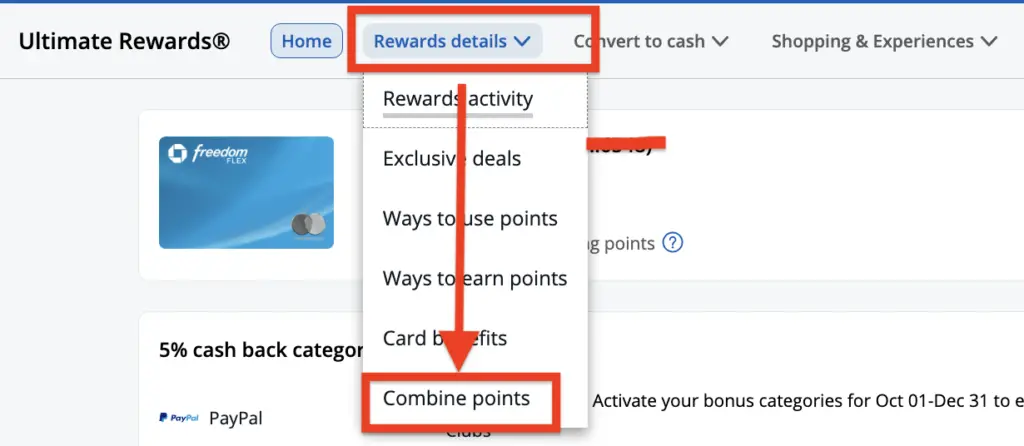

Click the “Rewards Details” drop-down menu, then navigate to “Combine Points“.

STEP 3:

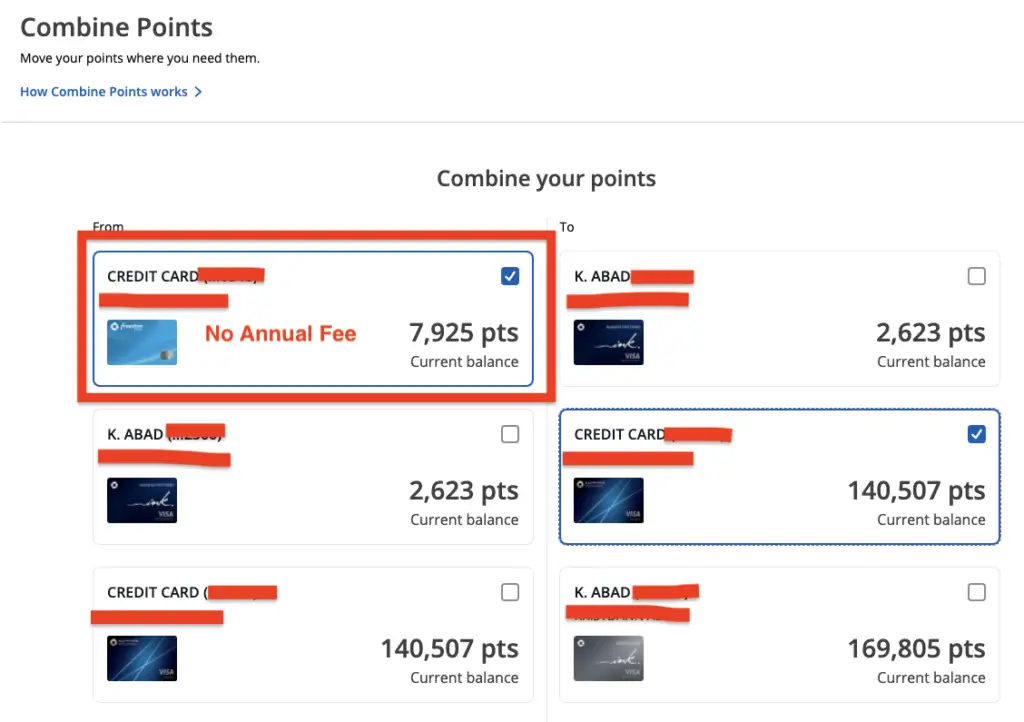

Click “Combine Points,” then select a no-annual-fee card under “From” on the left column.

In the example below, I selected my no-annual-fee Chase Freedom Flex.

This account will have the points you will transfer to a premium Chase card.

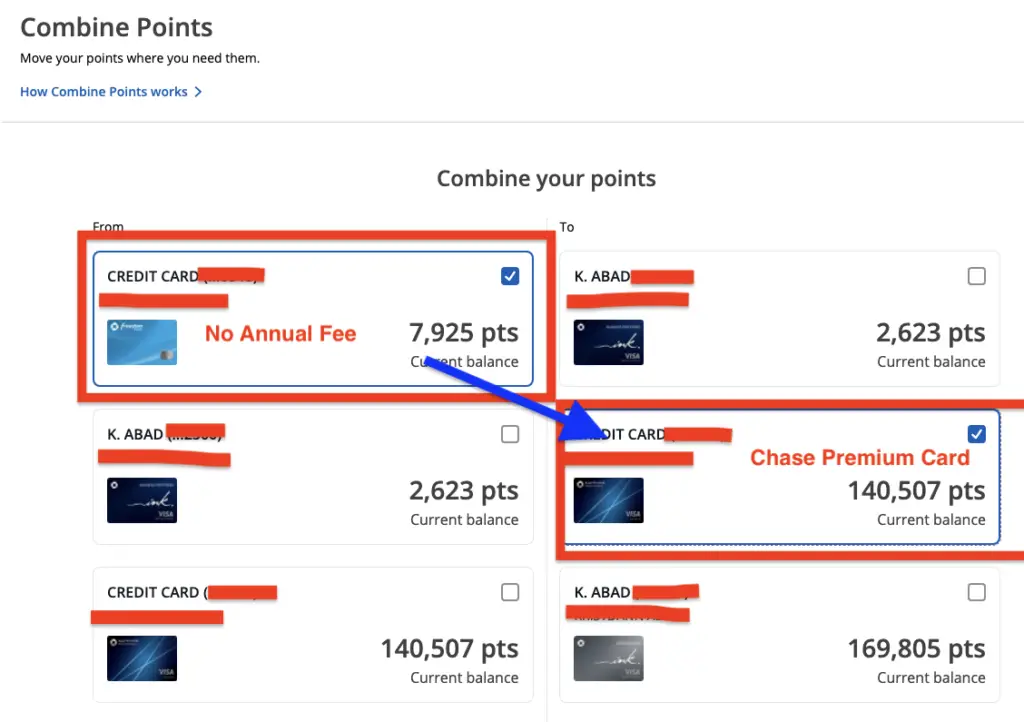

STEP 4:

Select a premium card under “To”, which is the Chase card where you want your points to go.

In the image below, I am moving points from my no-annual-fee Chase Freedom Flex to my premium card, the Chase Sapphire Preferred® Card.

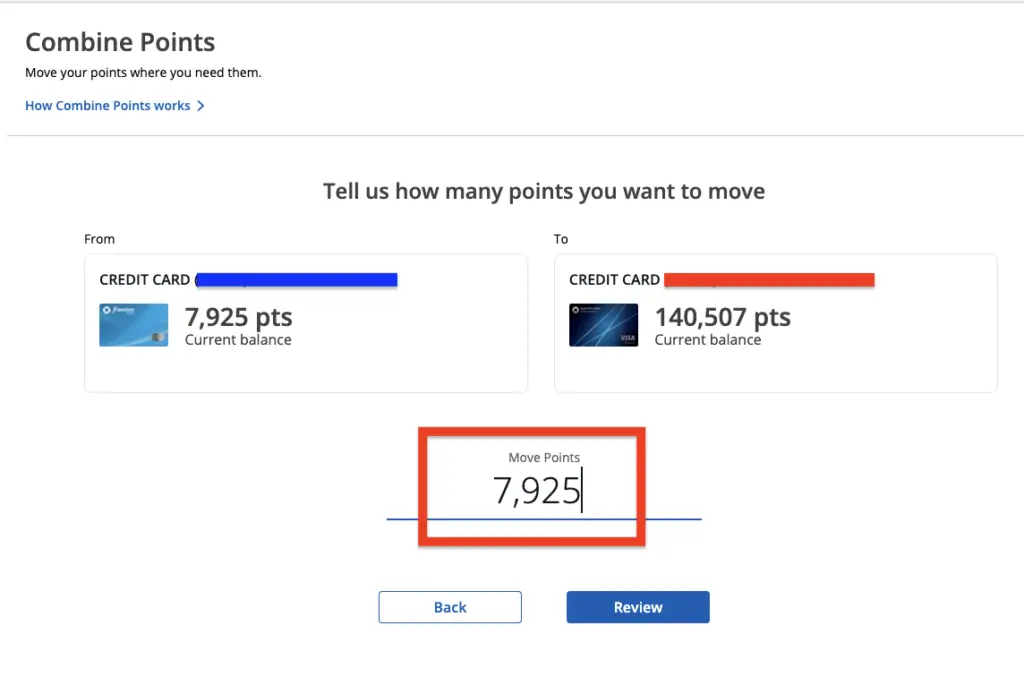

STEP 5:

Initiate the transfer by clicking “Continue.”

You will be directed to a page where you can indicate the number of points you would like to transfer to your premium card.

Since the value of your no-annual-fee Ultimate Rewards points significantly increases when transferred to a premium card, I highly suggest transferring all of your points.

Generally speaking, you would always want your Ultimate Rewards Points stored in one of your premium cards.

Click “Review” once you have made your selection.

If you have two premium cards that include the Chase Sapphire Reserve®, transfer all of your points to the CSR, as that provides the best redemption value among all the other Chase cards.

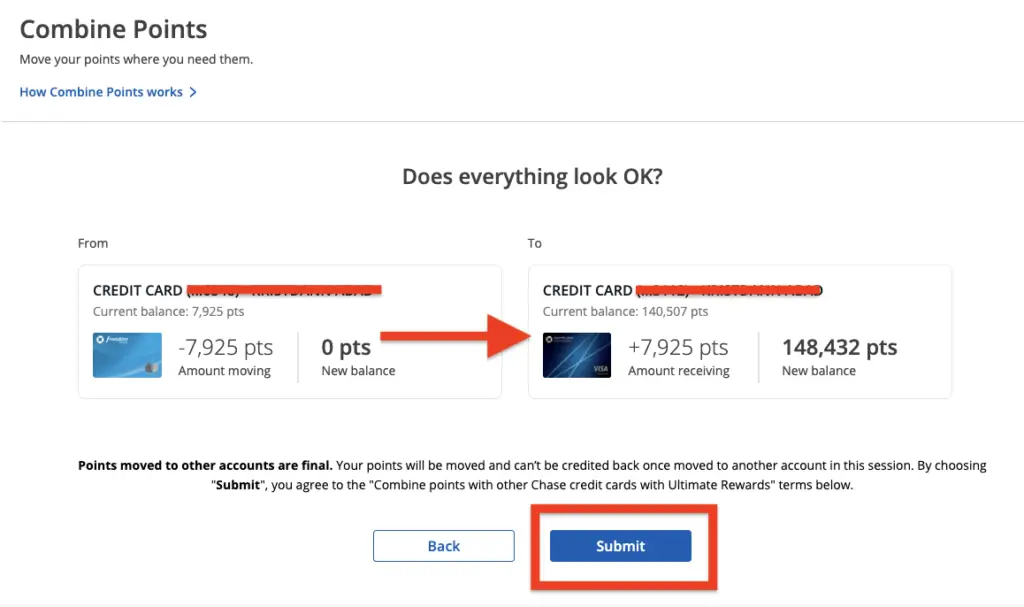

STEP 6:

Chase will give you another opportunity to review your selection.

You want to ensure that you transfer no-annual-fee Ultimate Rewards Points to a premium card and not vice versa.

In this example, I am moving my Ultimate Rewards Points from my no-annual-fee Chase Freedom Flex to the Chase Sapphire Preferred, a premium card.

Confirm & Submit.

STEP 7:

Once you have completed this transfer, you will be notified if the transfer was successful.

Once your points are in your premium card, you can now transfer your Chase Ultimate Rewards Points to your Flying Blue (Air France/KLM) Account (see next section).

Pro Tip: If you are part of a couple or family that lives in the same address, transferring Chase points between different individual accounts (between player 1 and player 2) is possible. Holding two premium cards is no longer necessary as long as you meet Chase’s criteria as a household member. One player can keep a premium card, and the other can continue accumulating no-annual-fee Ultimate Rewards Points that can be easily transferred to the owner of the premium card. You need to call Chase to initiate this transfer.

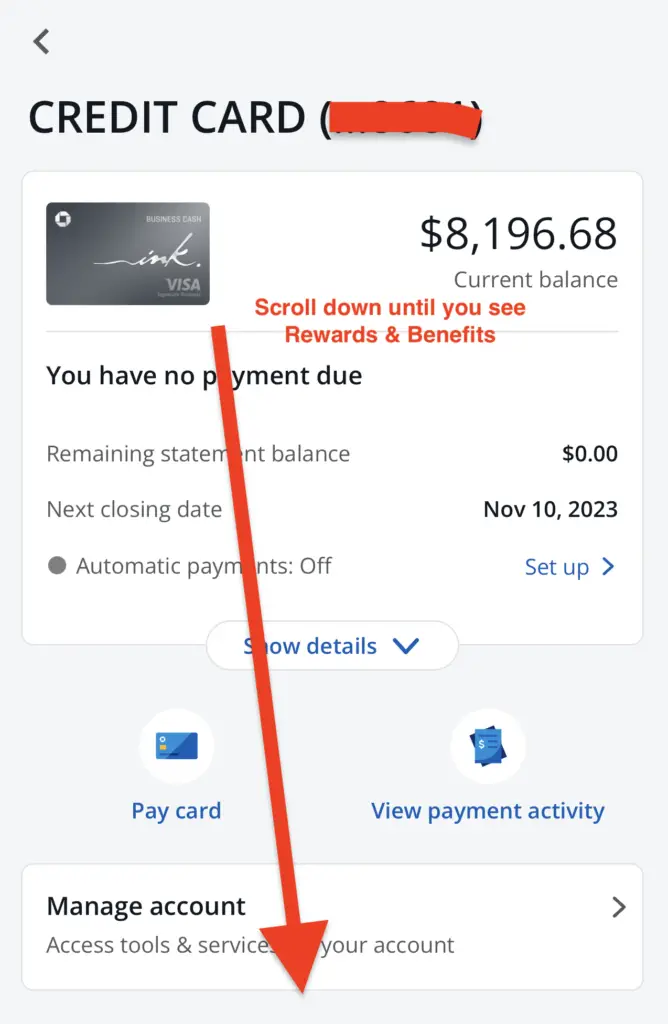

Steps for Combining Chase Ultimate Rewards Points (Mobile App)

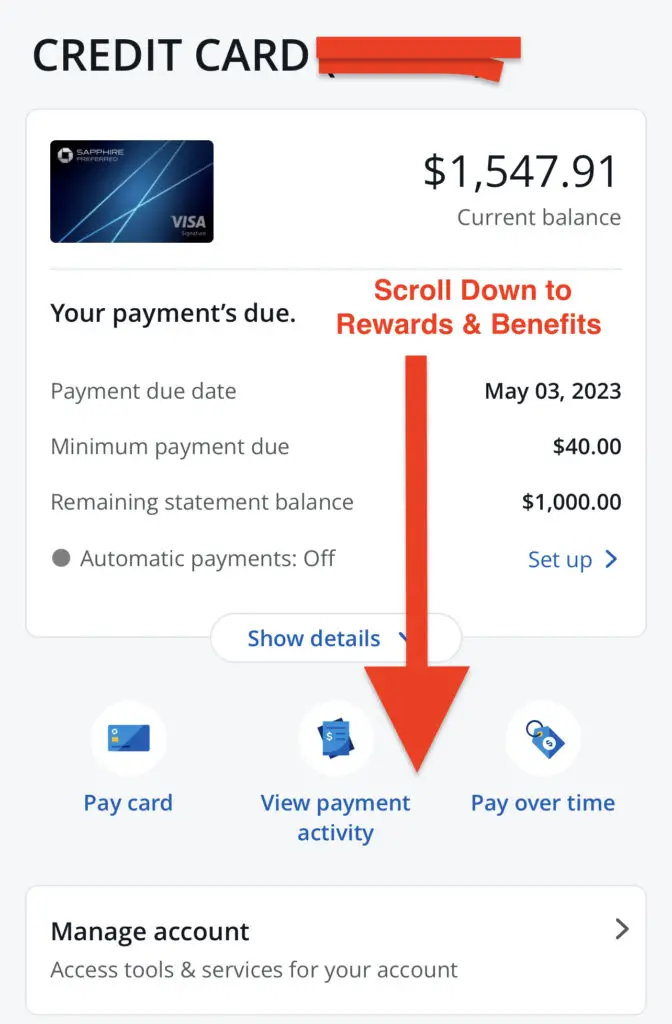

STEP 1:

Log in to your Chase profile and select one of your Chase cards that earns Ultimate Rewards points.

In the image below, I selected my Chase Ink Business Cash card.

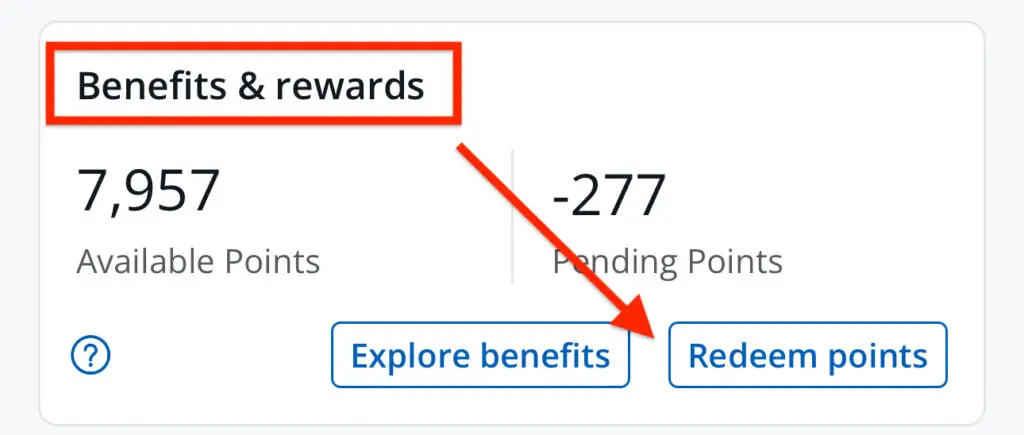

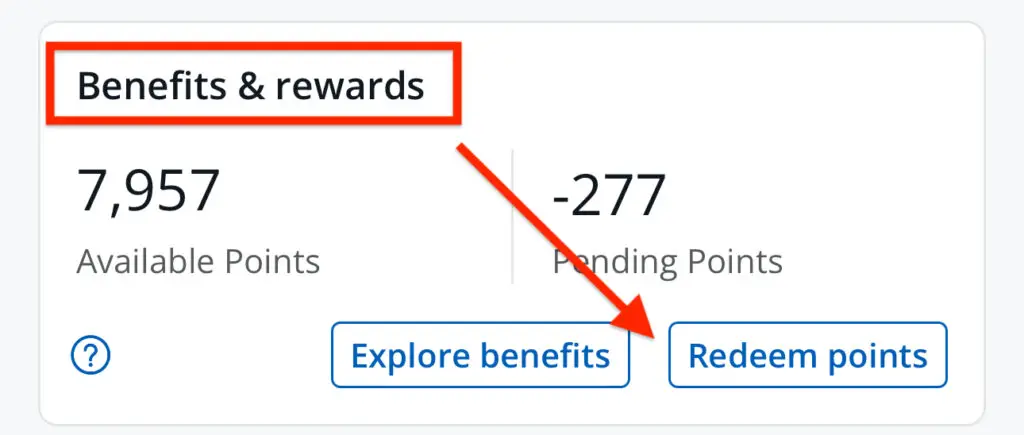

Scroll down until you see the “Benefits and Rewards” section.

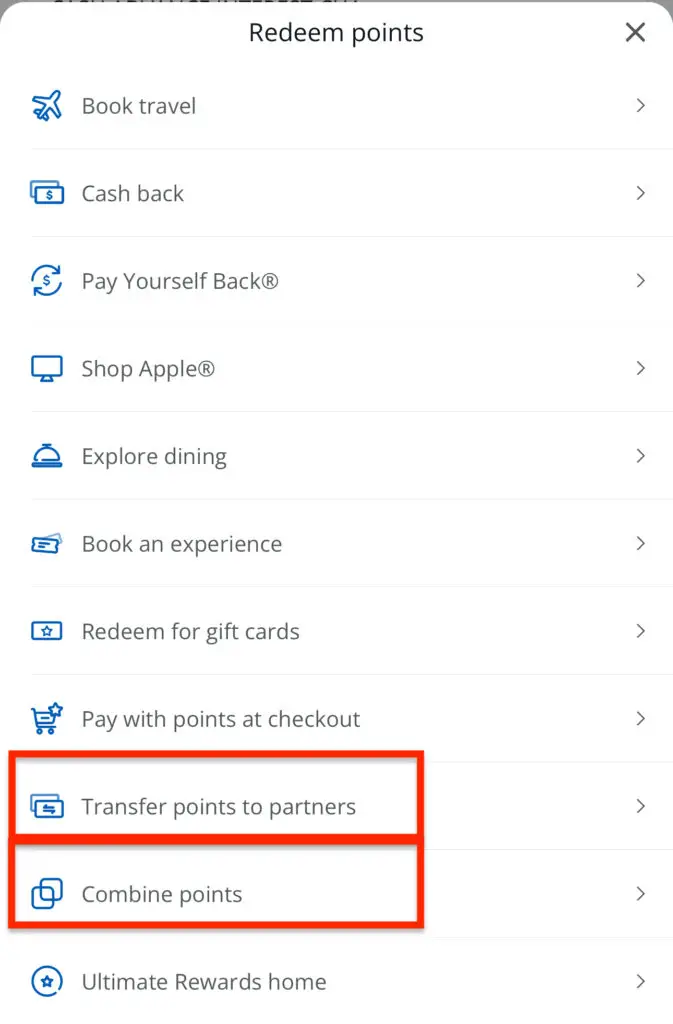

Click the “Redeem Points“.

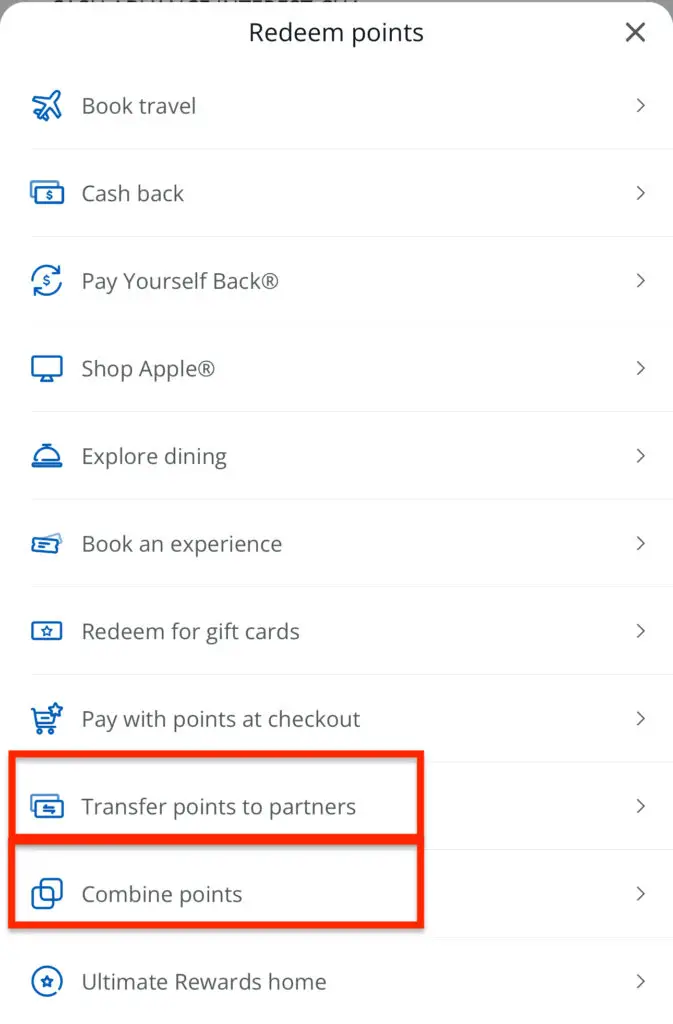

STEP 2:

Navigate down to “Combine Points“.

STEP 3:

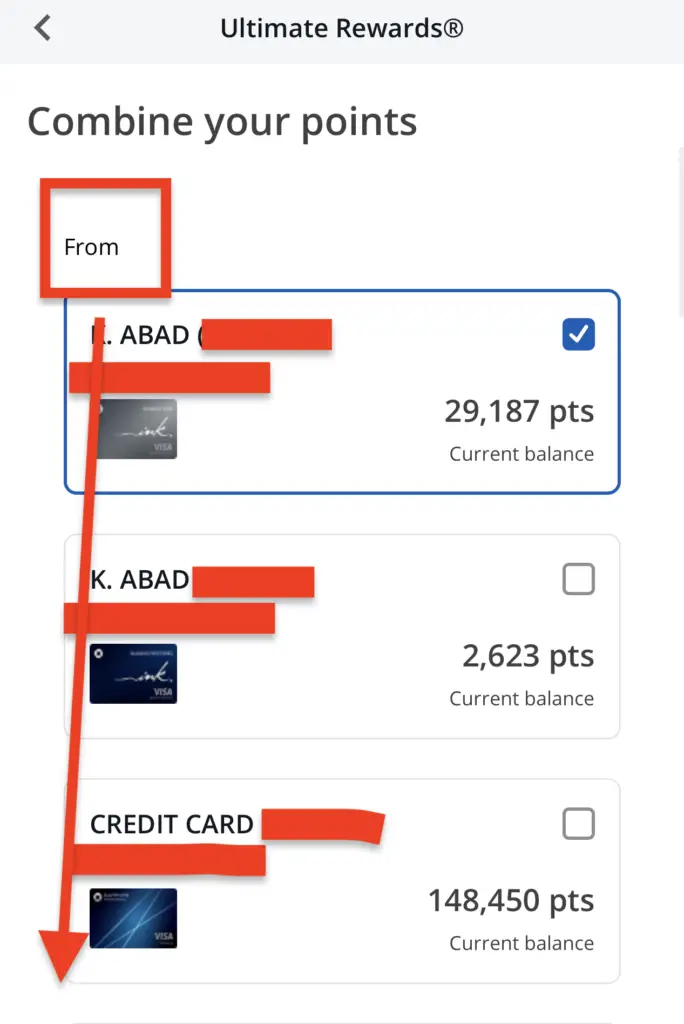

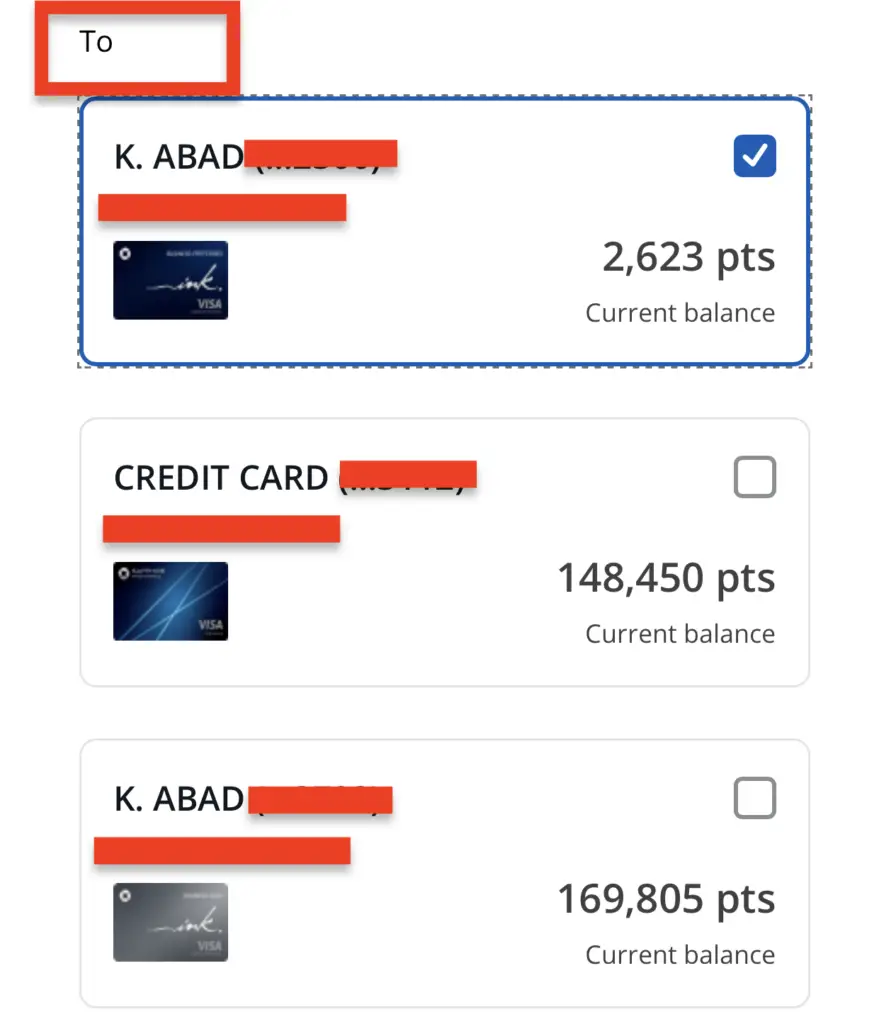

Select your “No-Annual-Fee” Chase card under “From“.

Then, select a Chase premium card under “To“.

In the example below, I am moving Chase Ultimate Rewards Points from my no-annual-fee Chase Ink Business Cash card to my Chase Ink Business Preferred card, a premium card.

STEP 4:

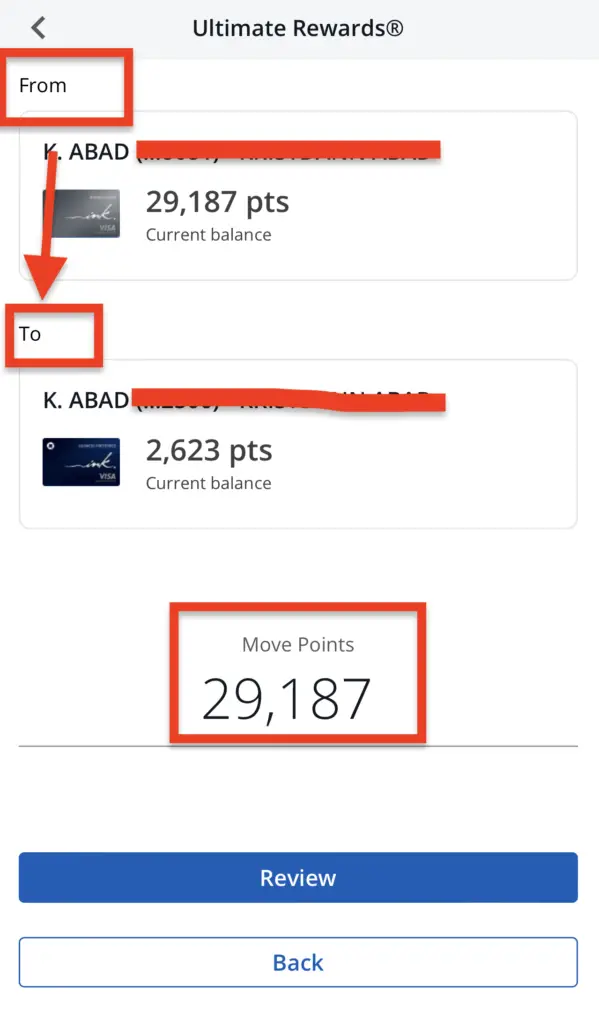

You will be directed to a page where you can indicate the number of points you would like to transfer to your premium card.

Since the value of your no-annual-fee Chase Ultimate Rewards points significantly increases when transferred to a premium card, I highly suggest transferring all of your points.

Generally speaking, you would always want your Ultimate Rewards Points stored in one of your premium cards.

Click “Review” once you have made your selection.

If you have two premium cards that include the Chase Sapphire Reserve®, transfer all of your points to the CSR, as that provides the best redemption value among all the other Chase cards.

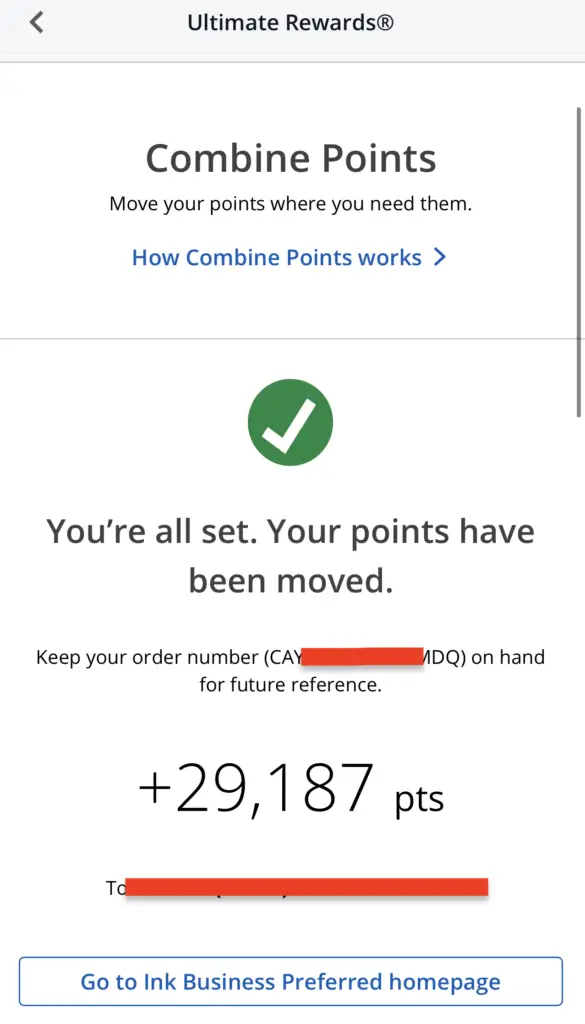

STEP 5:

Chase will give you another opportunity to review your selection.

Again, you should ensure that you are transferring no-annual-fee Ultimate Rewards Points to a premium card and not vice versa.

Confirm & Submit.

Congratulations! You are now ready to transfer your Chase Ultimate Rewards Points to Chase’s many travel partners.

Join Other Points Enthusiasts In Our Free Travel Miles & Points Facebook Group

What is Flying Blue?

Flying Blue is KLM and AirFrance’s frequent flier loyalty program.

Unbeknownst to many it also has a few other member airlines:

- Air France

- KLM

- Kenya Airways

- Transavia

- TAROM

How Do You Earn Flying Blue Miles?

You can earn Flying Blue Miles by flying with any of its member airlines.

Yet, you are probably wondering how to earn Flying Blue miles when you haven’t heard of most of these airlines.

You are not alone. Thankfully, there are two other ways to accrue Flying Blue miles.

First, since Air France and KLM are members of Sky Team, you can technically earn Flying Blue Miles whenever you fly with an alliance partner.

Just indicate your Flying Blue account number when flying with any Sky Team alliance carrier so your points will be credited to Flying Blue.

Sky Team carriers as of February 2021

- Aeroflot

- Aerolineas Argentina

- Aeromexico

- AirEuropa

- Air France

- ITA

- China Airlines

- China Eastern

- Czech Airlines

- Delta

- Garuda Indonesia

- Kenya Airways

- KLM

- Korean Air

- MEA

- Saudia

- Tarom

- Vietnam Airlines

- Xiamen Air

Transferring Bank Points to Flying Blue (Air France/KLM)

Transferring points from travel credit cards is the second and arguably easiest method to accumulate Flying Blue Miles.

Chase Ultimate Rewards, American Express Membership Rewards, Bilt Rewards, Citi ThankYou Points, and Capital One are Flying Blue transfer partners.

In this blog post, I will walk you through the steps to transfer Chase Ultimate Rewards points to Flying Blue so that you can be on your way to your next vacation.

Before You Transfer Your Chase Points: Check For Flying Blue Award Space Availability

Before starting the transfer process, you want to ensure that actual award space on your specific dates is available.

The more flexible your travel dates are, the more likely you’ll be able to find award availability that can be booked on points.

My recommended steps are as follows:

STEP 1:

First, you must create a Flying Blue Account, which should take less than 5 minutes.

STEP 2:

Keep your login credentials handy once you have signed up for your Flying Blue account.

You will need them when searching for award space on Air France’s and KLM’s websites.

STEP 3:

Using your Flying Blue account, initiate your search on AirFrance’s or KLM’s website.

I like using the Air France website and will use their search engine as an example in this post.

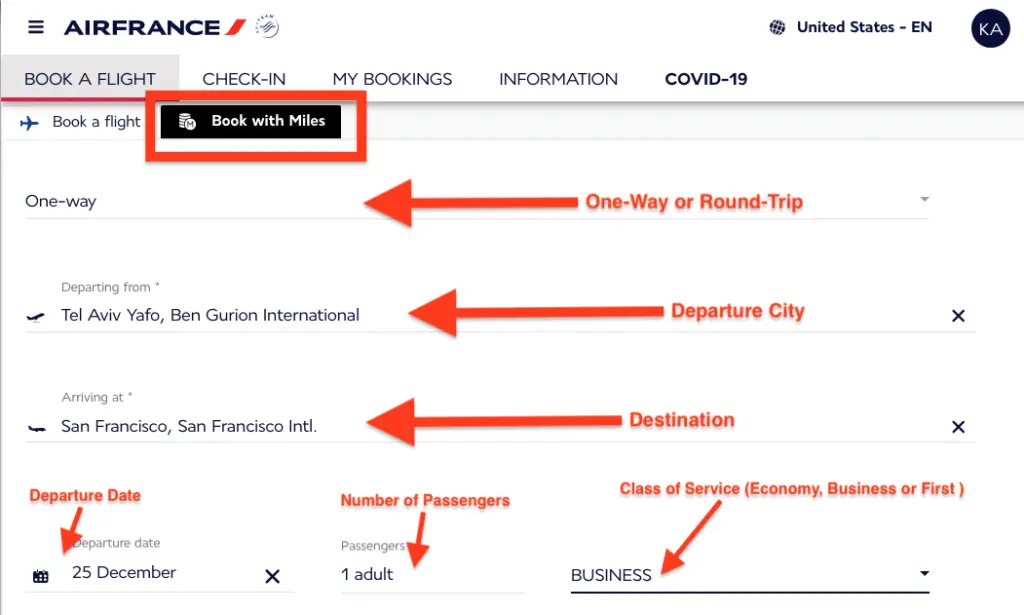

Please refer to the image below to guide you in performing an award search on Air France’s website.

Make sure you fill out the following details correctly:

- Select “Book With Miles“

- Indicate whether you are searching for One-Way or Round-Trip. Making multi-city award redemptions with free stopovers is possible by calling Flying Blue.

- Plug in your departure city and destination.

- Indicate the departure date, number of passengers, and your preferred class of service.

- Click “Search“

Flexibility is critical if you would like to find the lowest-priced award seat on the calendar.

Since Flying Blue generates dynamic pricing, expect significant mileage/price variability across dates and airlines.

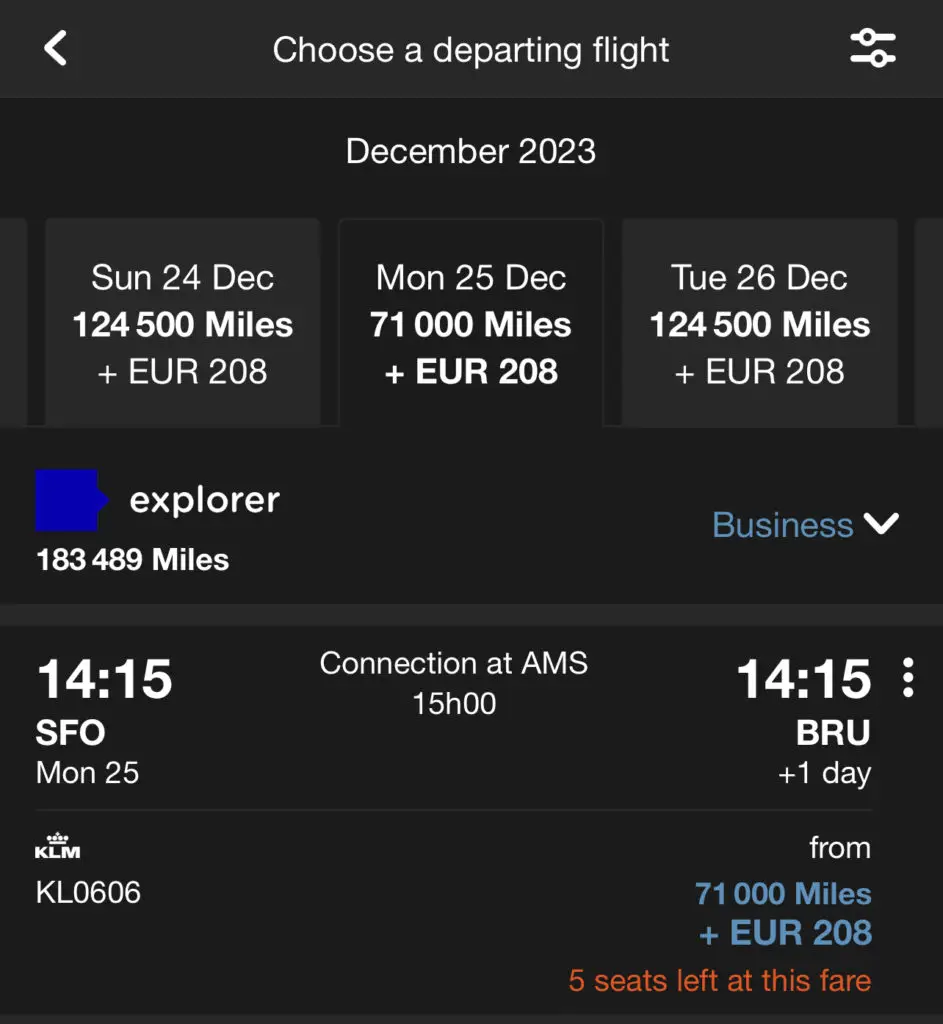

It is still quite unclear to me what exactly drives a price up or down dramatically between carriers. Let’s look at the image below to illustrate this fact.

As you can see, the difference in miles required for the flight between Tel Aviv and San Francisco on the same day is absurd: 72K, 265K, and 375K.

STEP 4:

Select your preferred flights and write down the information on paper or spreadsheet, or take a screenshot.

Afterward, you can do any of these two options:

a. Call Flying Blue to put this ticket on hold before you jumpstart your transfer. Calling also eliminates the risk of transferring points to Flying Blue prematurely.

b. Transfer your points and hope the award space does not disappear while your points are in transit.

While Flying Blue can hold Air France and KLM tickets for 72 hours, they can only guarantee a 24-hour hold for partner airlines like Virgin Atlantic.

Pro-Tip: Websites periodically show phantom award space that disappears as soon as you are ready to book, so speaking with an agent to confirm availability and putting the seat/s on hold are suggested steps before transferring points. Alternatively, you can also take the risk of transferring without calling. Fingers crossed that the points transfer instantly so you can book those award flights immediately. Both options have worked for me.

STEP 5:

Once you have the ticket on hold, initiate the transfer process by following the steps below.

Steps on How to Transfer Chase Ultimate Rewards to Flying Blue (Desktop)

Transferring to Flying Blue is simple, assuming you already have your Ultimate Rewards Points in one of your premium Chase cards.

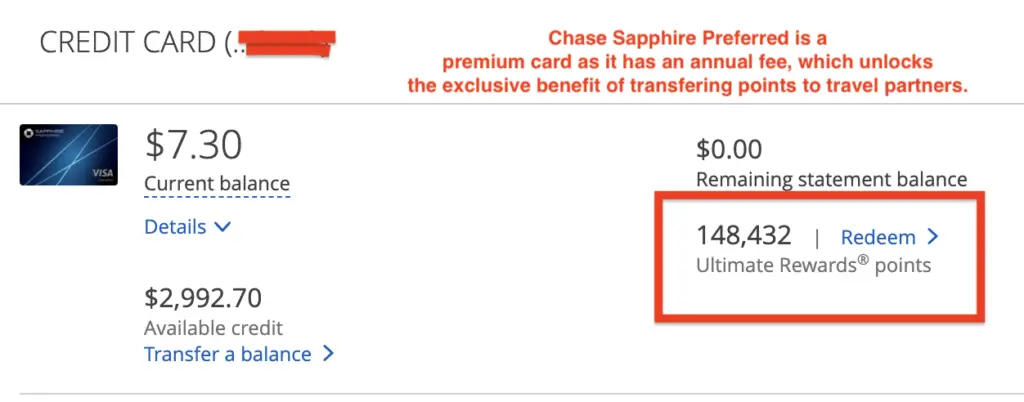

STEP 1:

Go to Chase.com, then Click One of Your Premium Cards.

Each premium card will give you the option to access Ultimate Rewards.

In this example, I transferred Chase Ultimate Rewards Points from my Chase Sapphire Preferred Card, a premium card.

Click “Redeem Ultimate Rewards points.” This will lead you to the Ultimate Rewards page.

You can transfer points from your other no-annual-fee Chase cards to your premium card if you need more points.

Please see the previous sections for steps on how to “Combine Points.”

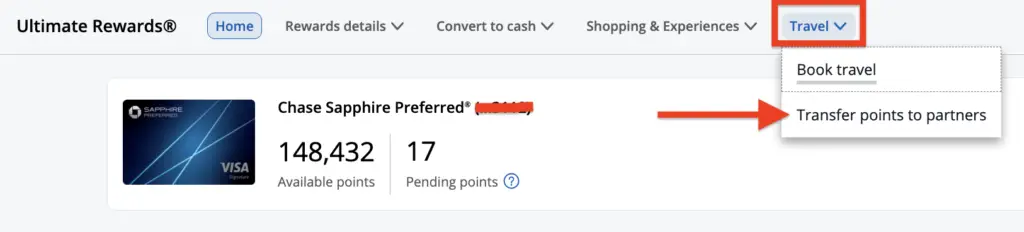

STEP 2:

On the Ultimate Rewards page, click the “Travel” drop-down arrow, then navigate to “Transfer Points to Partners”.

Flying Blue (Air France/KLM) is one of Chase’s many travel partners.

STEP 3:

Look for Flying Blue (Air France / KLM) and click the right arrow to proceed with the points transfer.

STEP 4:

Enter your Details and Flying Blue Member account number.

STEP 5:

Enter the Number of Points You Would Like to Transfer to Flying Blue.

Type in the number of points you would like to transfer in 1,000 Ultimate Rewards increments.

The transfer ratio is 1:1, so 1 Ultimate Rewards Point = 1 Flying Blue Mile.

The minimum amount Chase allows for transfers is 1,000 Ultimate Rewards points.

STEP 6:

Confirm if all the info is correct, then click Submit.

STEP 7:

Wait for your Chase Ultimate Rewards Points to appear in your Flying Blue account.

How Long Does It Take for Ultimate Rewards Points to Transfer to Flying Blue?

In my experience, Chase Ultimate Rewards points transfer instantly to Flying Blue (Air France / KLM).

However, Chase has stated that transfers may take up to 7 business days.

I suggest immediately checking your Flying Blue online account to verify whether the transfer was completed.

STEP 8:

Book the award space immediately once the miles are in your Flying Blue account.

You have 24 hours to cancel the award tickets if plans change.

Pro-Tip: Since the transfer is usually instantaneous, executing the transfer while on the phone with a Flying Blue agent and waiting for the points transfer to be completed is also an alternative.

STEP 9:

Write down the confirmation numbers and/or record locators for your flights.

If you are flying multiple carriers, each airline will have a different confirmation code, so take note of each.

You will need this information when you call those airlines to select seats.

To identify which seats are the best ones to select, you can use the following free resources:

a. Seatguru.com

b. Aerolopa.com

Transferring Chase Ultimate Rewards Points to Flying Blue on the Chase Mobile App

Performing the above functions, such as combining points and transferring to travel partners, using the Chase Mobile app can initially be a bit confusing.

Here are the steps to navigate the Chase Mobile App so you can quickly transfer your Chase Ultimate Rewards Points to the Flying Blue program wherever you are.

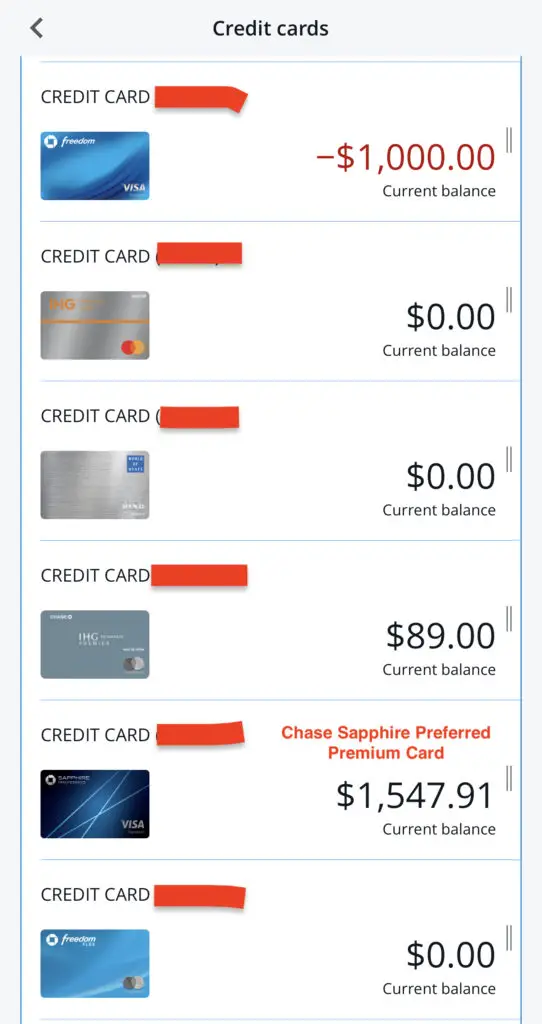

STEP 1:

Log in to your Chase account using your Chase Mobile App. Select a Chase Premium Card.

In this example, I will access my Chase Ultimate Rewards points through my Chase Sapphire Preferred® Card.

STEP 2:

Under your premium card, navigate to the “Benefits and Rewards” section, then click “Redeem Points”.

STEP 3:

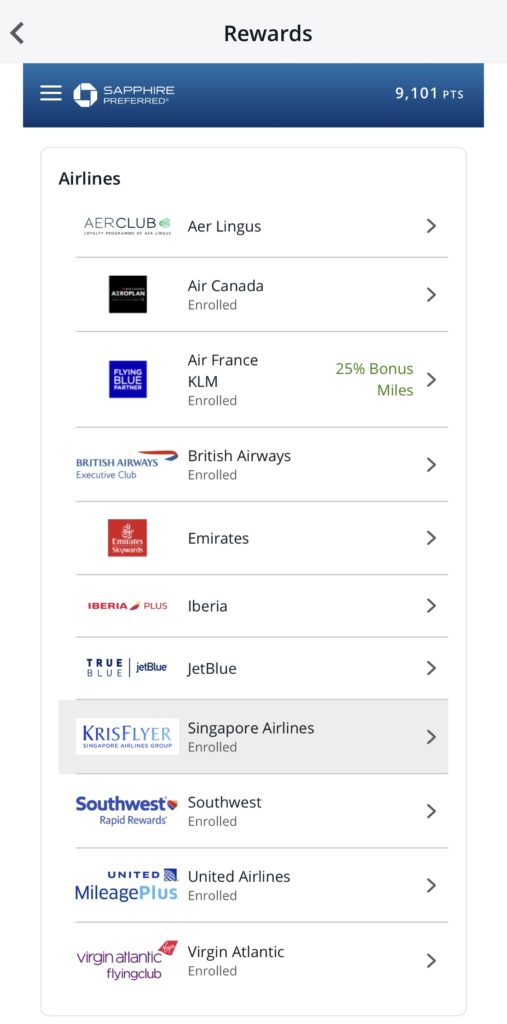

Navigate to “Transfer Points to Partners“.

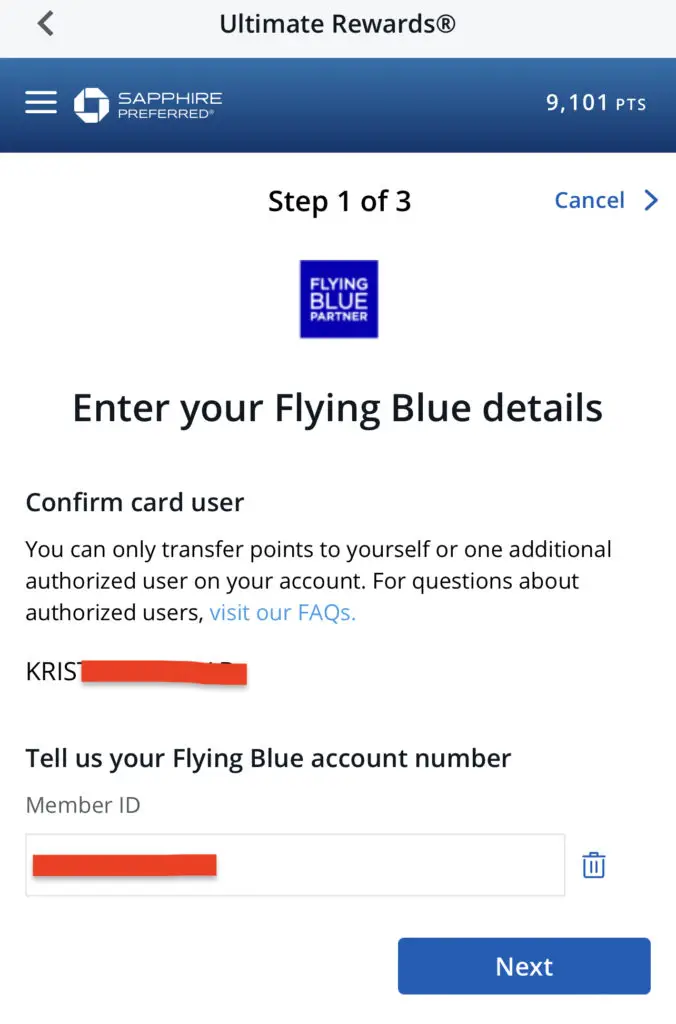

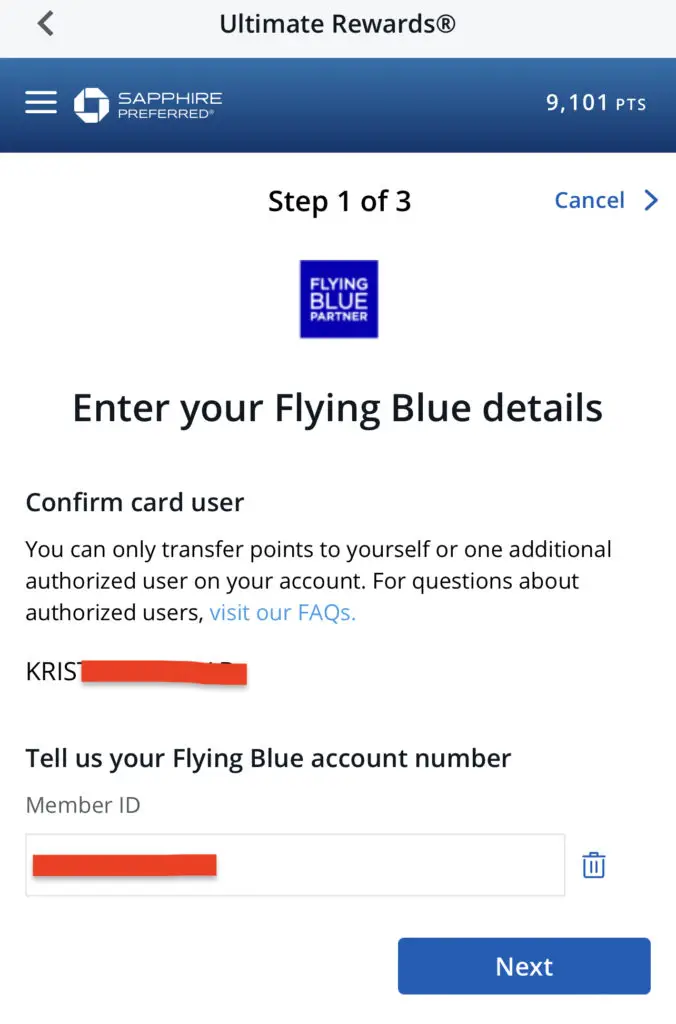

STEP 4:

Select Air France / KLM from the list of Chase’s travel partners. Chase occasionally offers transfer bonuses.

Chase periodically gives a 25% transfer bonus when you transfer Chase Ultimate Rewards Points to the Flying Blue Program (Air France/KLM).

STEP 7:

Enter your Flying Blue Account Number.

Before transferring your points, sign up for a Flying Blue account, as Chase will require this information.

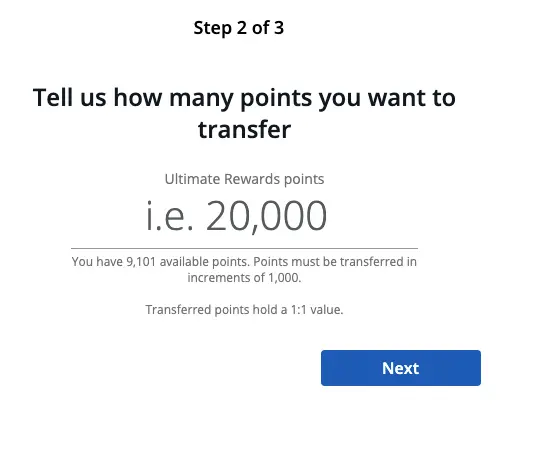

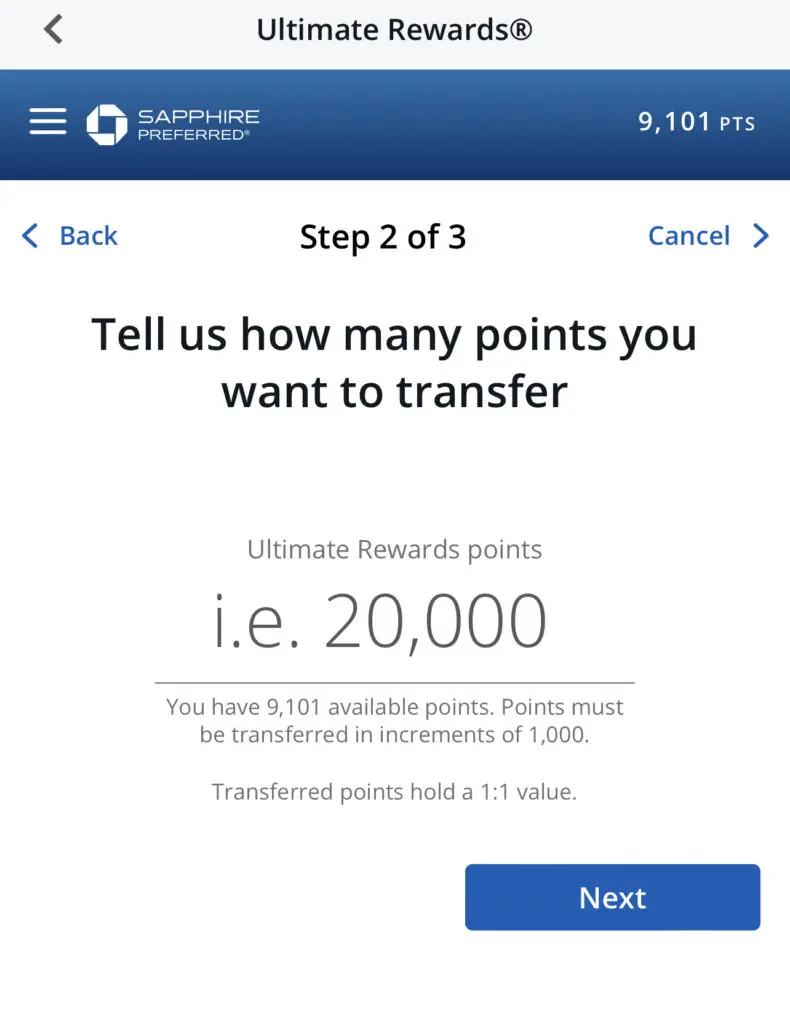

STEP 8:

Indicate the number of Chase Ultimate Rewards Points you would like to transfer to Flying Blue.

Before you transfer, remember that this is a one-way street.

Any points transferred from Chase to Flying Blue can not be reversed, so make sure the award space is available before proceeding with this transfer.

After typing in the number of Chase Ultimate Rewards Points you would like to transfer, click “Next”.

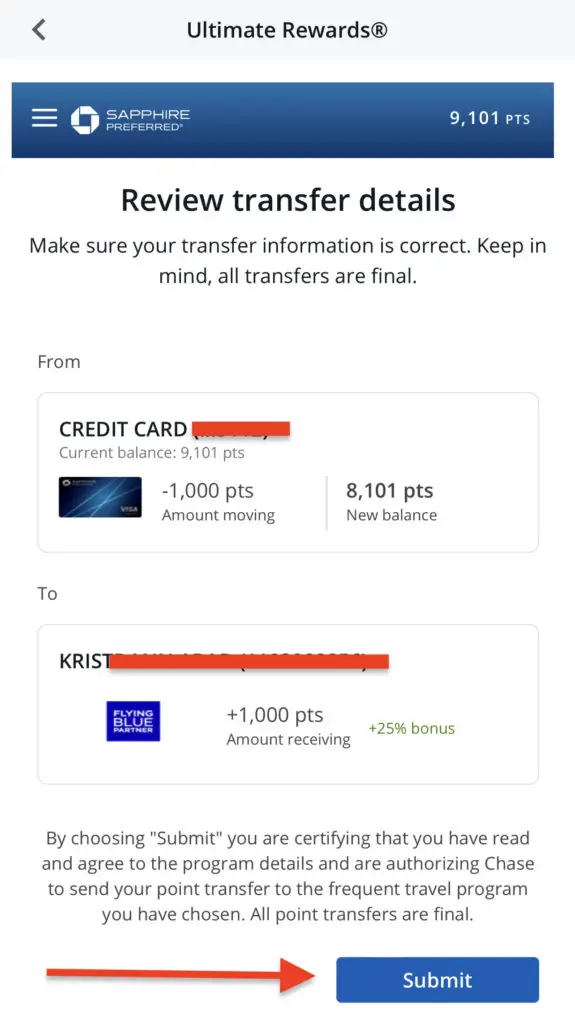

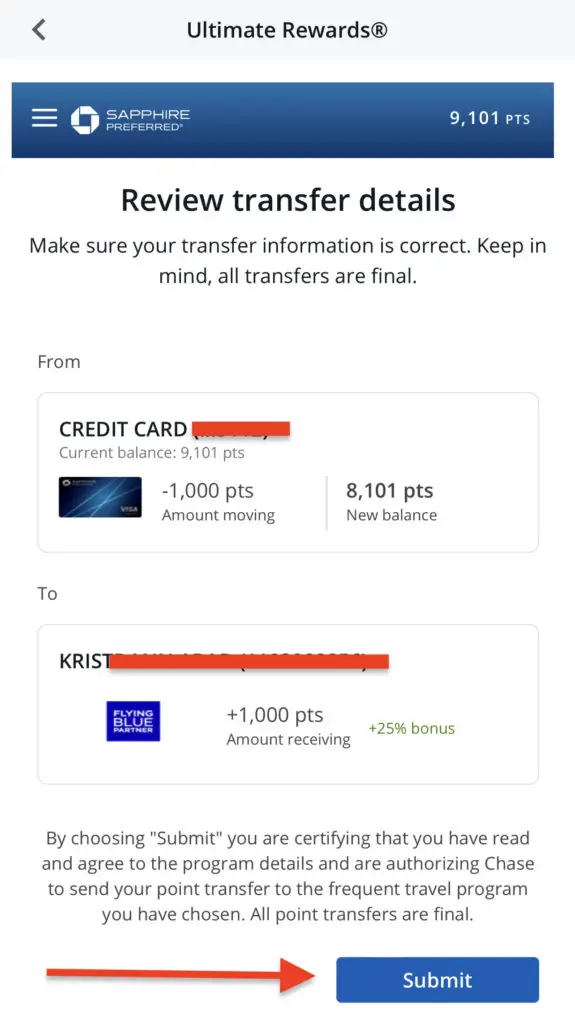

STEP 9:

Review transfer details, then “Submit.”

Reminder to only transfer points when you see award availability.

Again, the transfer process is irreversible – you can not transfer Flying Blue miles back to Chase Ultimate Rewards.

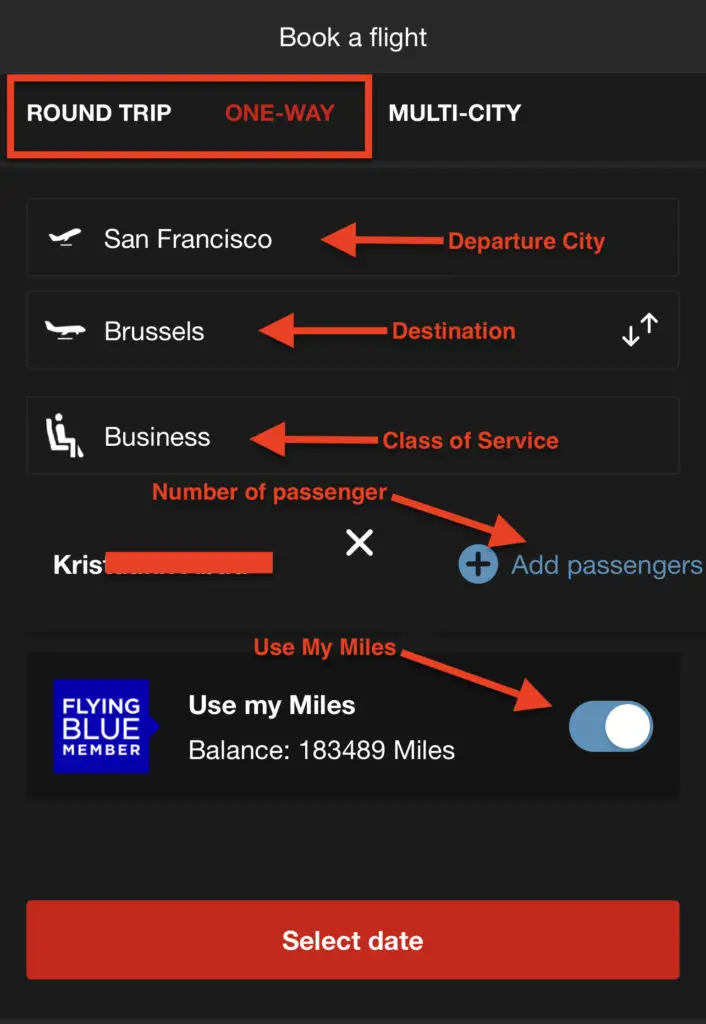

STEP 10:

Run your award search. I prefer using the Air France app when searching for Flying Blue award flights.

- Select either round-trip or one-way. The multi-city award search feature cannot yet run on the app.

- Indicate your departure city, destination, and class of service.

- Add the number of passengers.

- Toggle “Use My Miles“

- Click Select Date.

STEP 11:

Select your flight and book when you find a fantastic deal. You can always cancel within 24 hours.

Chase Transfer Bonus

Deal: Transfer Chase Ultimate Rewards Points to the Flying Blue Program (Air France/KLM).

Date: Check here to see if there is an ongoing Chase transfer bonus.

Bonus: 25% Extra Flying Blue Miles

Example: When you transfer 10,000 Chase Ultimate Rewards Points to the Flying Blue Program, you will receive 12,500 Flying Blue miles with this 25% transfer bonus.

Limit: No limit on the number of points you can transfer.

Sample Flying Blue Redemptions

As mentioned earlier, you can redeem your Flying Blue miles to fly on a variety of Sky Team carriers:

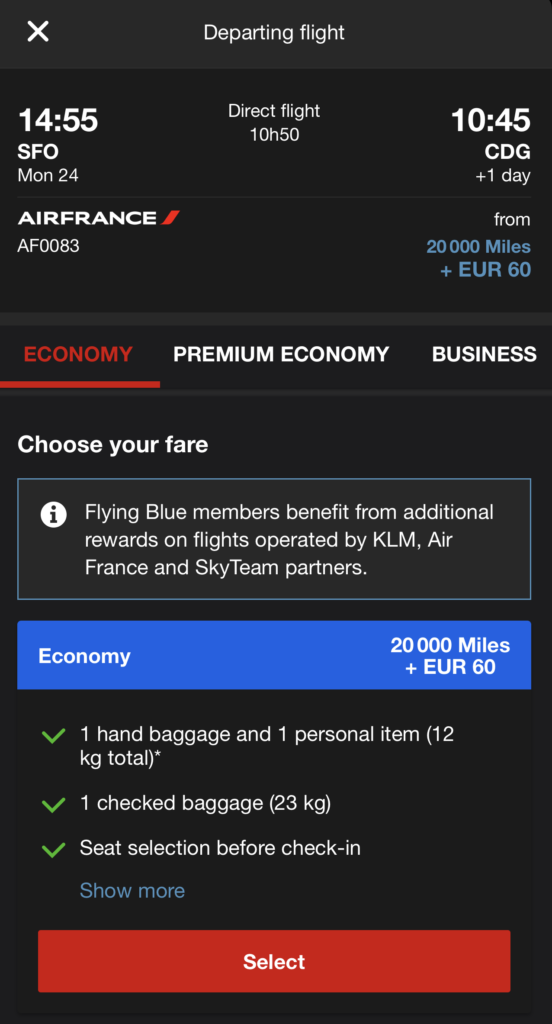

A. Flying on Air France / KLM between San Francisco (SFO) and Paris (CDG)

Economy: 20,000 Flying Blue miles and 60 Euros

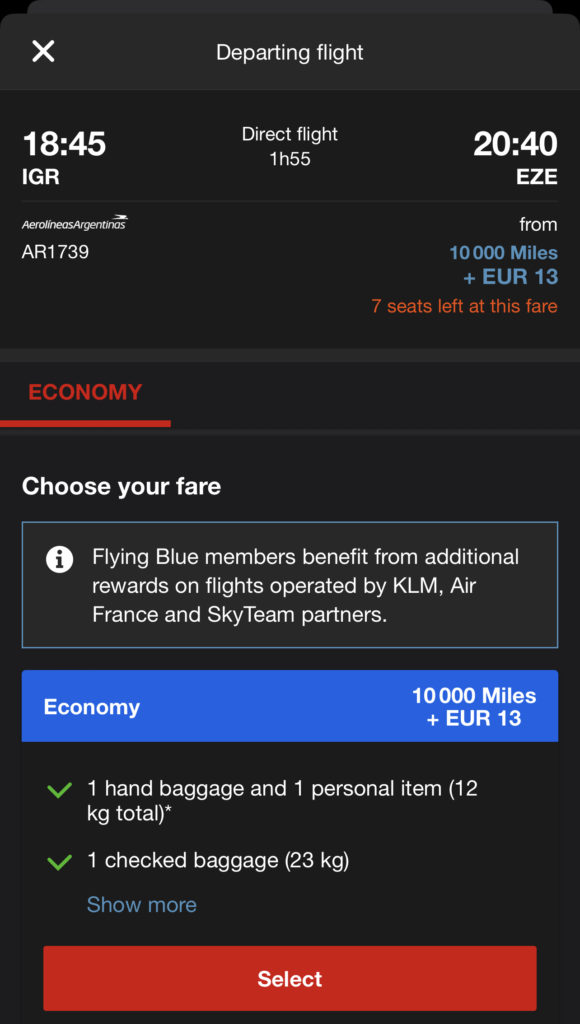

B. Flying on Sky Team partner Aerolineas Argentina between Iguazu Falls (IGR) and Buenos Aires (EZE)

Economy: 10,000 Flying Blue miles and 13 Euros

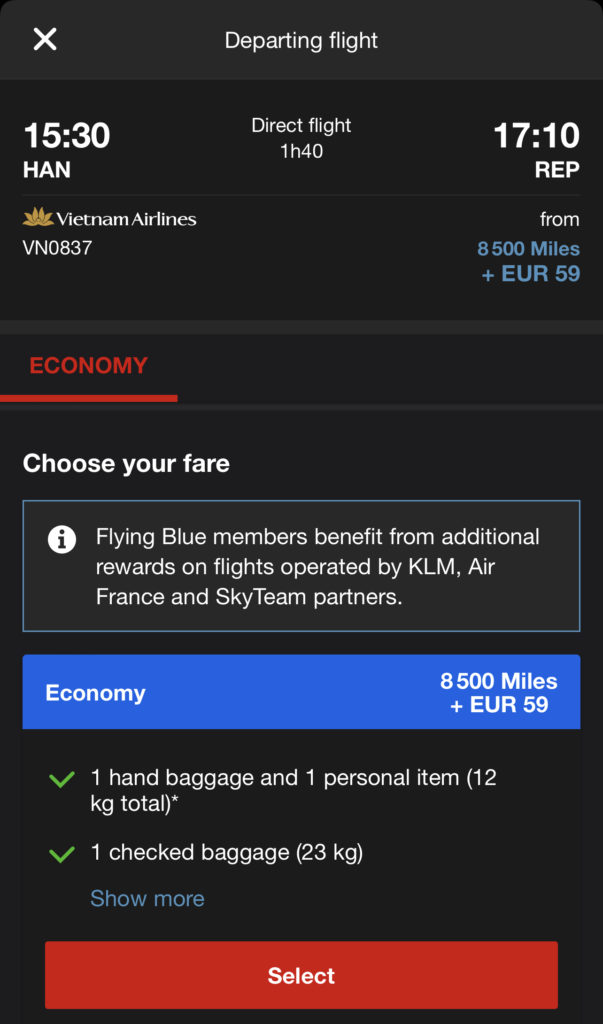

C. Flying on Sky Team partner Vietnam Airlines between Hanoi (HAN) and Siem Reap, Cambodia (REP)

Economy: 8,500 Flying Blue miles and 59 Euros

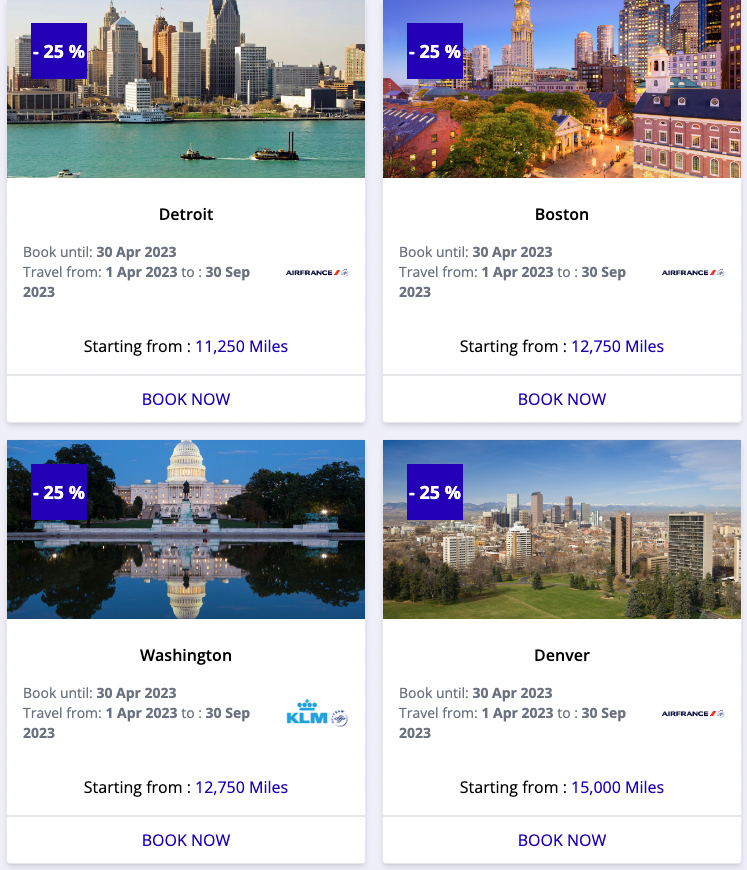

Stack With Flying Blue Promo Rewards

Flying Blue Promo Rewards is a special promotion that allows travelers to redeem their Flying Blue miles for flights at a discounted rate.

These promotions are available for a limited time, allowing travelers to save up to 50% on flights to select destinations worldwide.

To maximize your Flying Blue Promo Awards, here are some tips to keep in mind:

- Plan: Flying Blue Promo Rewards are announced a few months in advance, so it’s a good idea to plan your travel accordingly. Check the Flying Blue website or sign up for their newsletter to stay informed about upcoming promotions.

- Be flexible: Promo Awards are available for a limited number of seats on select flights, so it’s essential to be flexible with your travel dates and destinations. If you’re open to traveling during off-peak times or to less popular destinations, you may have a better chance of finding available seats.

- Check the fine print: Read the Promo Awards terms and conditions before booking your flight. Some restrictions, such as blackout dates or limited availability on specific routes, may apply.

- Compare prices: While Promo Awards can offer significant savings, comparing prices with other airlines and booking sites is always a good idea to ensure you get the best bang for your mile.

- Use your miles wisely: Flying Blue miles can also be used for upgrades, hotel stays, car rentals, and other travel expenses. Consider your travel goals and how to use your miles to maximize your overall travel experience.

- Lastly, be open to taking a positioning flight to where a Promo Award is currently offered. For example, if the promo award is offered in Dallas or Atlanta, you can fly from your home airport to those cities a day or two before to take advantage of these deeply discounted flights.

Take A Positioning Flight

Taking a positioning flight is essential when stacking Chase Transfer Bonus and Flying Blue Promo Rewards because the discounted rates are usually only available for specific routes and destinations.

You may need to fly to a different airport or city to take advantage of the promotion.

For example, if the Promo Reward is only available for flights departing from Atlanta, but you live in New Orleans, you may need to take a positioning flight to Atlanta before you can use the discounted rate.

A positioning flight can be a cost-effective way to access the promotion and save money on travel expenses.

Positioning flights can also help you take advantage of more favorable flight times or connections.

Arriving in the departure city a day or two in advance ensures you won’t miss your flight due to delays or other unforeseen circumstances. Plus, you get to visit another destination in the process.

However, it’s important to note that taking a positioning flight does add additional costs and logistics to your trip, so it’s essential to weigh the potential savings against the extra time and expenses involved.

It’s also vital to ensure you have enough time between flights to avoid missing your connections.

In summary, taking a positioning flight can be a fantastic strategy for maximizing Chase transfer bonuses and Flying Blue Promo Awards, but it should be carefully considered based on your individual travel needs and budget.

Benefits of Transferring Chase Ultimate Rewards Points to Flying Blue Miles

Flying Blue is a rewarding program for frequent flyers, offering numerous benefits to its members.

With the ability to transfer Chase Ultimate Rewards Points to Flying Blue, you can unlock even more advantages.

One of the primary benefits of choosing Flying Blue is accessing more destinations with partner airlines, allowing you to explore new destinations around the globe.

Additionally, Flying Blue offers enhanced award availability, making using your points easier and earning even more rewards.

Whether you’re a seasoned traveler or simply looking to maximize your points, transferring Chase Ultimate Rewards Points to Flying Blue is the perfect choice to elevate your travel experience.

Credit Cards that Earn Chase Ultimate Rewards Points

| Credit Cards | Details |

|---|---|

| Credit Cards that earn Ultimate Rewards (UR) Points | 1 Chase Ultimate Rewards. |

| Chase Sapphire Preferred® Card | Welcome Offer |

| Chase Sapphire Reserve® | Welcome Offer |

| Ink Business Preferred® Credit Card | Welcome Offer |

| Credit Cards that can convert into Chase Ultimate Rewards (UR) Points* | Steps to Convert |

| Chase Freedom Flex® | Welcome Offer |

| Chase Freedom Unlimited® | Welcome Offer |

| Ink Business Cash® Credit Card | Welcome Offer |

| Ink Business Unlimited® Credit Card | Welcome Offer |

Summary

Final Thoughts

Flying for free is my ultimate motivation for accruing travel miles and points.

Whether you aim for premium cabins or discounted airfare, Chase Ultimate Rewards is a currency I highly recommend you accumulate because of its flexibility.

Aside from being a transfer partner of Hyatt and United – the two most common recipients of my Chase points, Flying Blue (Air France / KLM) is another travel partner that can be an alternative when searching for good deals.

Every so often, Flying Blue runs promotions where they offer specific routes for a discount. This can provide incredible value for those who want to get as much mileage from their points.

Lastly, I hope this blog post made the transfer process much easier to follow. Safe travels!

ADVERTISER DISCLOSURE: The Frugal Tourist is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as MileValue.com and Cardratings. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All information about the American Express Schwab Platinum has been collected independently by The Frugal Tourist.

EDITORIAL DISCLOSURE: Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities.

USER-GENERATED CONTENT DISCLOSURE: The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.