ADVERTISER DISCLOSURE: The Frugal Tourist is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as MileValue.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All information about the American Express Schwab Platinum has been collected independently by The Frugal Tourist.

EDITORIAL DISCLOSURE: Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities.

For travel miles and points enthusiasts, credit card transfer bonuses to airlines and hotels are a great way to get more value from their rewards.

These bonuses, often offered as limited-time promotions by credit card issuers, can significantly boost the points or miles you receive when transferring to travel partners.

Capitalizing on these transfer deals allows you to book multiple flights instead of just one or two.

It could also get you closer to luxurious travel experiences, like flying business class or staying at fancy hotels, without spending a fortune.

In this blog post, I will list the current transfer bonuses available from credit card issuers so you can also take advantage of them.

Maximizing Transfer Bonuses

Transfer bonuses can range anywhere from 20% to 50% or more, depending on the credit card issuer and the travel partner involved.

For instance, transferring points from a travel rewards credit card, such as the Capital One Venture X Rewards Credit Card, to an airline program during a 30% bonus period means 10,000 points could become 13,000 miles.

This bonus could be the deciding factor between flying economy and upgrading to a premium cabin, making travel more comfortable and convenient.

Moreover, strategically utilizing transfer bonuses allows for greater flexibility in travel planning.

Points and miles fans can diversify their portfolios by spreading their points across different programs, allowing them to snag award space and deals as they become available.

Join Other Points Enthusiasts in Our Free Travel Miles & Points Facebook Group

Current Transfer Bonuses

Chase Ultimate Rewards®

| Transfer Partner | Bonus Details |

|---|---|

| British Airways Avios | 20% ends on 03/31/2026 |

| Iberia Avios | 20% ends on 03/31/2026 |

| Aer Lingus Avios | 20% ends on 03/31/2026 |

American Express Membership Rewards®

| Transfer Partner | Bonus Details |

|---|---|

Avianca Lifemiles | 15% ends on 3/28/2026 |

Citi ThankYou® Rewards

| Transfer Partner | Bonus Details |

|---|---|

| Wyndham | 25% ends on 3/21/2026 |

Capital One Rewards

| Transfer Partner | Bonus Details |

|---|---|

| Preferred Hotels & Resorts I Prefer | 30% ended on 03/31/2026 |

Expired Transfer Bonuses

Expired Chase Transfer Bonuses

| Transfer Partners | Bonus Details |

|---|---|

| Virgin Atlantic Flying Club | 40% ended on 02/28/2026 |

| Marriott Bonvoy | 50% ended on 02/28/2026 |

| IHG | 70% ended on 01/15/2026 |

| Air Canada Aeroplan | 25% ended on 01/05/2026 |

| Virgin Atlantic | 30% ended on 12/05/2025 |

| Marriott Bonvoy | 70% ended on 11/30/2025 |

| Virgin Atlantic | 30% ended on 11/30/2025 |

| Southwest Rapid | 25% ended on 11/06/2025 |

| IHG | 80% ended on 10/22/2025 |

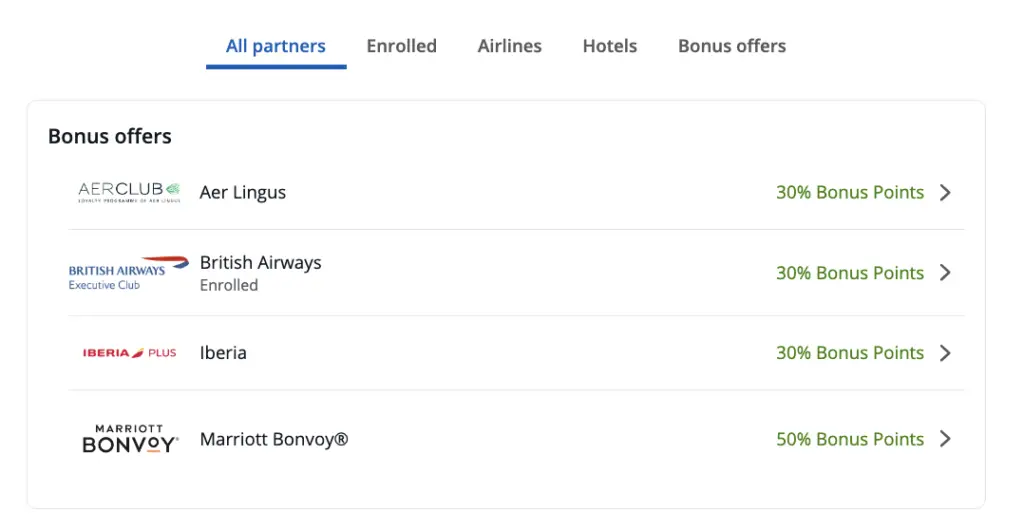

| British Airways Avios | 30% ended on 10/31/2025 |

| Iberia Avios | 30% ended on 10/31/2025 |

| Aer Lingus Avios | 30% ended on 10/31/2025 |

| Air France KLM Flying Blue | 20% ended on 9/30/2025 |

| Marriott Bonvoy | 50% ended on 8/15/2025 |

| Aeroplan/Air Canada | 20% ended on 7/17/2025 (30% for cardholders) |

| Marriott Bonvoy | 65% ended on 6/30/2025 |

| Virgin Atlantic | 25% ended on 6/15/2025 |

| Air France/KLM (Flying Blue) | 25% ended on 5/31/2025 |

| IHG | 80% ended on 4/30/2025 |

| Marriott Bonvoy | 30% ended on 3/31/2025 |

| British Airways, Iberia & Aer Lingus Avios | 30% ended on 3/31/2025 |

| Virgin Atlantic | 30% ended on 2/17/2025 |

| IHG | 70% ended on 15 Jan 2025 |

| British Airways, Iberia & Aer Lingus Avios | 20% ended on 15 Jan 2025 |

| Virgin Atlantic | 40% ended on 11/30/2024 |

| Marriott Bonvoy | 50% ended on 11/15/2024 |

| British Airways, Iberia & Aer Lingus Avios | 30% ended on 10/31/2024 |

Expired American Express Transfer Bonuses

| Transfer Partners | Bonus Details |

|---|---|

| Virgin Atlantic Flying Club | 40% ended on 12/31/2025 |

| Avianca LifeMiles | 15% ended on 11/30/2025 |

| Marriott Bonvoy | 30% ended on 11/30/2025 |

| Air France KLM Flying Blue | 20% ended on 10/31/2025 |

| Hilton | 25% ended on 9/20/2025 |

| British Airways, Iberia & Aer Lingus | 30% ended on 7/15/2025 |

| Marriott Bonvoy | 20% ended on 7/14/2024 |

| AeroMexico Club Premier | 20% ended on 4/30/2025 |

| Hilton Honors | 25% ended on 3/14/2025 |

| Qatar Privilege Club | 20% ended on 3/31/2025 |

| Avianca Lifemiles (bonus will come from Avianca) | 15% ended on 2/28/2025 |

| Virgin Atlantic Flying Club | 40% ended on 12/31/2024 |

| Avianca LifeMiles | 15% ended on 12/31/2024 |

| Marriott Bonvoy | 35% ended on 11/30/2024 |

| Cathay Pacific | 15% ended on 11/30/2024 |

| Flying Blue (Air France/KLM) | 20% ended on 11/10/2024 |

Expired Capital One Transfer Bonuses

| Transfer Partners | Bonus Details |

|---|---|

| JAL (Japan Airlines) Mileage Bank | 30% ends on 02/28/2026 |

| Avianca LifeMiles | 15% ended on 02/11/2026 |

| British Airways Avios | 30% ended on 11/30/2025 |

| JAL (Japan Airlines) | 30% ended on 10/22/2025 |

| Virgin Atlantic | 30% ended on 10/01/2025 |

| Avianca | 15% ended on 8/31/2025 |

| Qantas | 20% ended on 5/31/2025 |

| British Airways Avios | 20% ended on 12/01/2024 |

| Flying Blue (Air France/KLM) | 20% ended on 9/29/2024 |

Expired Citi Transfer Bonuses

| Transfer Partners | Bonus Details |

|---|---|

| Qantas | 20% ended on November 8th |

| Turkish | 50% ended on October 18th |

| Avianca | 25% ended on October 18th |

| Virgin Atlantic | 30% ended on October 18th |

| Qatar | 40% ended on October 15th |

| Wyndham | 25% ended on 9/20/2025 |

| Leading Hotels of the World | 25% ended on 8/23/2025 |

| Accor Live Limitless | 50% ended on 7/19/2025 |

| Wyndham | 25% ended on 6/21/2025 |

| Qatar Avios | 30% ended on 5/31/2025 |

| Virgin Atlantic | 30% ends on 5/17/2025 |

| Qatar Avios | 20% ended on 3/15/2025 |

| Wyndham Rewards | 20% ended on 11/16/2024 |

| Virgin Atlantic | 30% ended on 11/16/2024 |

| Avianca LifeMiles | 25% ended on 10/19/2024 |

| Leading Hotels of the World | 25% ended on 10/19/2024 |

| Qatar Avios | 35% ended on 10/31/2024 |

| Etihad Guest | 40% ended on 10/31/2024 |

Before You Transfer Your Credit Card Points

When there’s a transfer bonus, it’s essential to act with clear intention.

Avoid transferring speculatively.

Don’t jump on transfer bonuses unless you have a specific plan for using your points later down the road.

You do not want to end up with orphaned miles in your accounts.

On the other hand, if you know you’ll be traveling soon, it’s wise to take advantage of a transfer bonus quickly.

Some transfer bonuses are rare, and when they occur, they always have expiration dates.

The trick is knowing your travel goals and determining whether transfer bonuses align with your future travel plans and overall points strategy.

How to Transfer Credit Card Points to Travel Partners

As you become more familiar with travel credit cards, it is crucial to know how to transfer points and miles to travel partners, especially when a transfer bonus is available.

The table below lists the credit cards that offer the ability to transfer to travel partners.

| Credit Cards | Transfer Steps |

|---|---|

| Chase Ultimate Rewards: Chase Sapphire Preferred® Card Chase Sapphire Reserve® Ink Business Preferred® Credit Card | Transfer Chase Ultimate Rewards Points to Travel Partners |

| American Express Membership Rewards: American Express® Gold Card American Express® Business Gold Card The Platinum Card® from American Express The Business Platinum Card® from American Express The Blue Business® Plus Credit Card from American Express | Transfer American Express Membership Rewards Points to Travel Partners |

| Capital One Rewards: Capital One Venture Rewards Credit Card Capital One Venture X Rewards Credit Card Capital One Venture X Business Capital One Spark Miles for Business Capital One VentureOne Rewards Credit Card | Transfer Capital One Miles to Travel Partners |

| Citi ThankYou Rewards: Citi Strata Premier℠ Card Citi Strata Elite℠ Card | Transfer Citi ThankYou Points to Travel Partners |

| Bilt Bilt Blue Card Bilt Obsidian Card Bilt Palladium Card | Transfer Bilt Points to Travel Partners |

Frequently Asked Questions

1. Can points be transferred back to your credit card?

Unfortunately, once you transfer points to an airline or hotel partner, you can’t transfer them back to your credit card.

So, ensure the transfer fits your travel plans before proceeding, as you can’t reverse the transfer process.

2. Do transferred points and miles expire?

The travel points and miles you transfer can expire, depending on the loyalty program.

Many airlines and hotels have rules on expiration based on account activity.

To avoid losing points, regularly check your program’s expiration terms and try to use your transferred points before they expire.

3. Can I transfer points to another person?

The ability to transfer points to another person depends on the policies of the specific credit card or loyalty program.

Some programs, like Hilton Honors and the World of Hyatt, allow free point transfers to family members or nominated individuals.

Always check the rules of your program to see if and how you can transfer points to another person.

4. Are there any fees associated with transfers?

Transferring points to an airline or hotel loyalty program will usually not incur fees.

Except for American Express, which charges an excise fee when moving points to U.S. frequent flier programs.

Be sure to calculate whether the value you’ll gain from the transfer is worth any potential costs.

5. How long does it take for transferred points to appear in my loyalty account?

The time it takes for transferred points to show up in your airline or hotel loyalty account can differ based on the program and the credit card issuer.

While some transfers are almost instantaneous, others can take several days or weeks.

Plan accordingly and transfer points well before your travel booking to avoid delays.

6. What happens to my points if I cancel a credit card?

If you cancel a credit card, any points associated with that card may be lost unless they’ve already been transferred to a loyalty program.

Before canceling a credit card, consider transferring your points to your program of choice to keep them safe.

Always check with your credit card issuer to understand the specific rules regarding point retention after cancellation.

7. Can points be redeemed for cash or gift cards?

Yes, many credit card and loyalty programs offer the option to redeem points for cash back or gift cards.

The value of points when redeemed for cash or gift cards can vary, but they usually do not provide good value.

Hence, we recommend that you compare all redemption options before deciding to transfer your points.

8. Is there a limit to how many points I can transfer?

Some credit cards cap the points you can transfer, but most programs have generous limits, so you shouldn’t have any issues.

With that said, always read the terms and conditions of your credit card to be aware of any transfer limits.

9. Can I combine points from different loyalty programs?

Combining points from different loyalty programs is not always possible, as most programs operate independently.

However, some programs, like British Airways, Iberia, Finnair, Aer Lingus, and Qatar, share the same currency (Avios), so you can freely move points between programs.

10. Is it possible to buy additional points?

Many loyalty programs offer the option to purchase additional points, which can be beneficial if you’re close to a reward redemption but lacking enough points.

However, buying points is generally more expensive than earning them through spending, so consider this option carefully and compare the cost to the value of the reward before proceeding.

Final Thoughts

Boost the value of your points and miles by taking advantage of credit card transfer bonuses.

Occasionally, credit card issuers offer these bonuses, letting you earn extra miles or points when transferring to specific airline or hotel programs.

These credit card transfer bonuses are an excellent strategy for points and miles fans, allowing them to enjoy more exciting travel experiences without breaking the bank.

Have you ever transferred points during a transfer bonus before? How was your experience?

ADVERTISER DISCLOSURE: The Frugal Tourist is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as MileValue.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All information about the American Express Schwab Platinum has been collected independently by The Frugal Tourist.

EDITORIAL DISCLOSURE: Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities.

USER-GENERATED CONTENT DISCLOSURE: The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.