ADVERTISER DISCLOSURE: The Frugal Tourist is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as MileValue.com and Cardratings. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All information about the American Express Schwab Platinum has been collected independently by The Frugal Tourist.

EDITORIAL DISCLOSURE: Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities.

In this blog post, I will explain how to fund and use United’s TravelBank.

Since some credit cards provide travel credits that expire within a year, depositing money in United’s TravelBank is a viable option to utilize those credits so they won’t go to waste.

Funds diverted into United’s TravelBank have a 5-year lifespan, offering some level of longevity and a lot of flexibility, especially since travel is picking up again after the pandemic.

Whether you have plans this year or in the near future, funding your United TravelBank with free cash from your credit cards is a wallet-friendly strategy that can potentially save you a few hundred dollars when the time comes that you need to book your next flight.

United TravelBank

According to United, your TravelBank funds can either be used alone or in combination with select forms of payment only when booking United or United Express flights.

Therefore, we are unable to use United TravelBank to purchase flight itineraries that include segments on partner airlines such as Air Canada, Lufthansa, etc.

I was also unsuccessful in tapping my TravelBank reserves to pay for taxes when booking an award ticket or paying additional fees to cover the airfare difference when redeeming a voucher or rebooking a travel credit.

However, I did not encounter any roadblocks when I booked paid United tickets, even if the airfare was Basic Economy.

Terms and Conditions

The information below was taken from United.com

- Passengers can select from six purchase amount options. Once purchased, the value remains valid for five years from the date it is deposited in their TravelBank account.

- Purchases are not refundable and are limited to $5,000 per day per MileagePlus account.

- This purchase is also subject to all of the TravelBank terms and conditions.

- United has the right to terminate this promotion or to change the promotion’s terms and conditions, rules, regulations, policies and procedures, benefits, and/or conditions of participation, in whole or in part, at any time, with or without notice.

- United TravelBank purchased using certain IHG Credit Cards has a shorter lifespan. Please check the terms of your IHG Credit Cards for the most current UnitedTravel Bank policy.

Guide on How to Fund United’s TravelBank

STEP 1:

You can Access United TravelBank by clicking the button below.

To make the purchase, you must log in to your United Mileage Plus Account.

Do not have a United membership yet?

It is free and easy to register. Click the button below to enroll in United’s Mileage Plus Program.

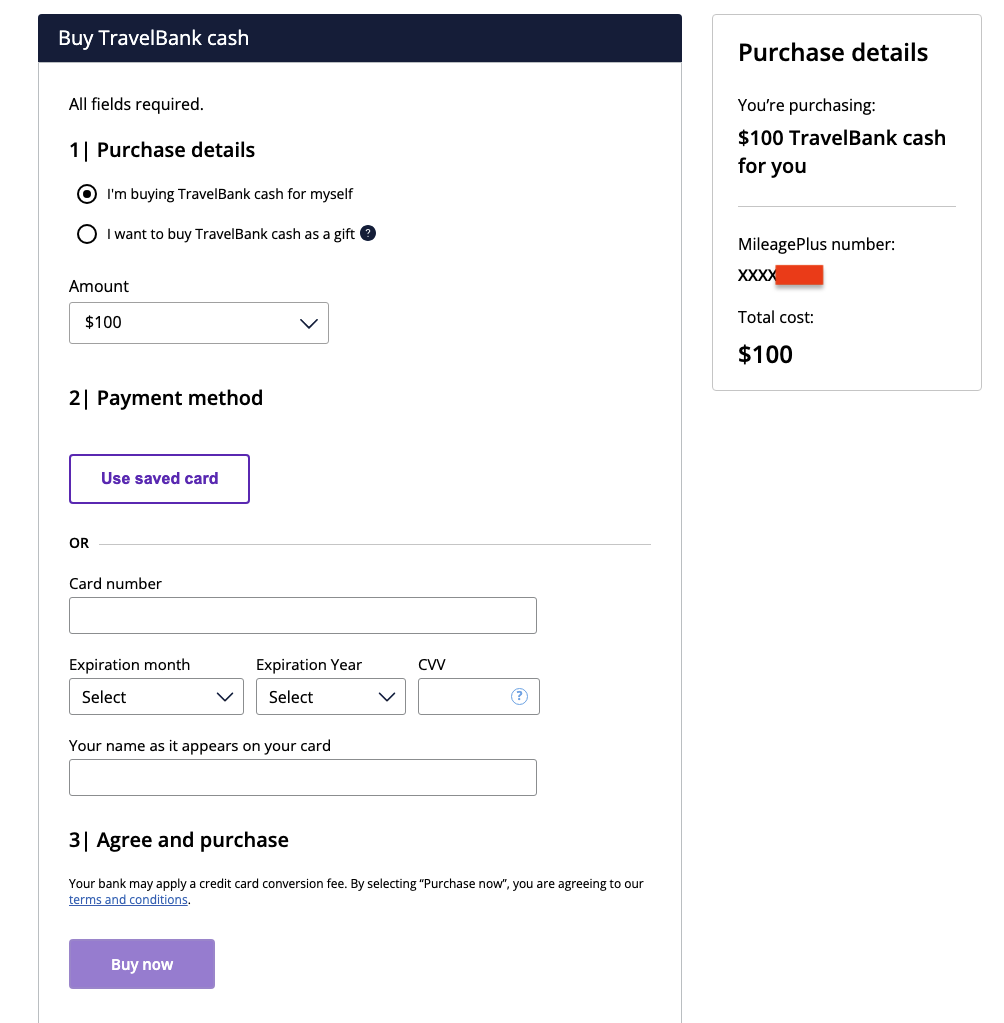

STEP 2:

After logging in, you will be instructed to indicate whether you’d like to buy the TravelBank cash for yourself or gift it to others.

STEP 3:

Select the amount of travel cash you want to purchase.

As previously stated, there are six possible amounts that you can elect to deposit to your TravelBank.

STEP 4:

The next section will ask you to type in your payment information.

In this case, you would want to use a credit card that provides an Airline Credit.

I will list these credit cards in one of the sections below.

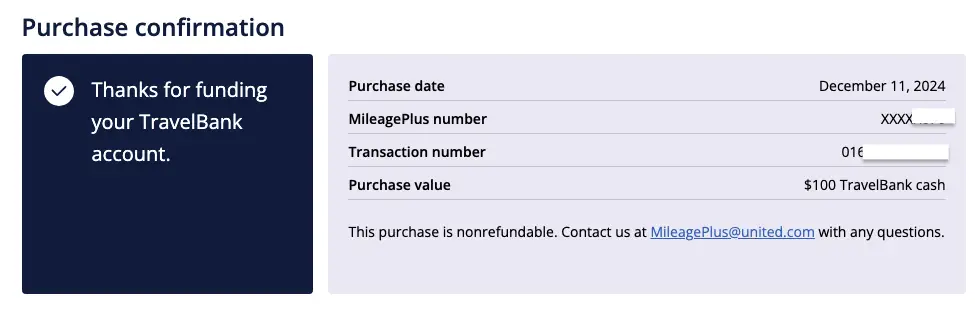

You will then receive confirmation that your purchase was successful. A receipt will also be emailed immediately afterward.

In this example, I used my The Business Platinum Card® from American Express to buy $100 worth of travel cash in United’s TravelBank.

Guide on How to Use Your United Travel Bank Cash

STEP 1:

Thankfully, we are generously given five years to spend our travel cash.

Once you are ready to book your flight, log back on to your United.com profile and enter your travel details.

United TravelBank purchased using certain IHG Credit Cards has a shorter lifespan. Please check the terms of your IHG Credit Cards for the most current UnitedTravel Bank policy.

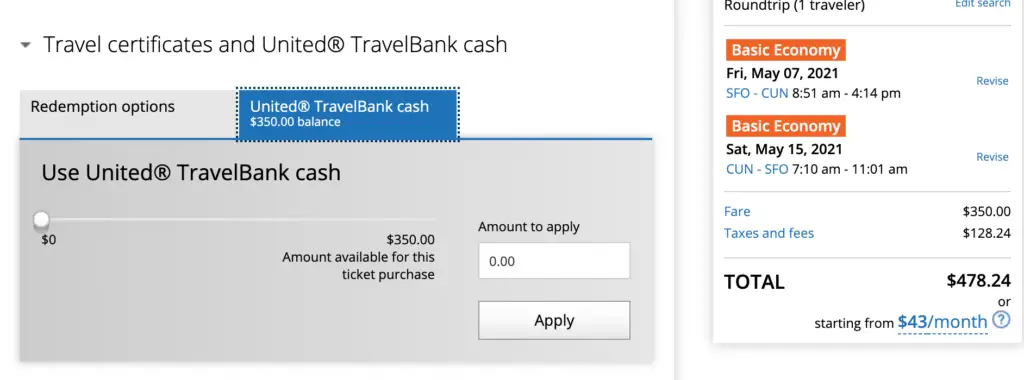

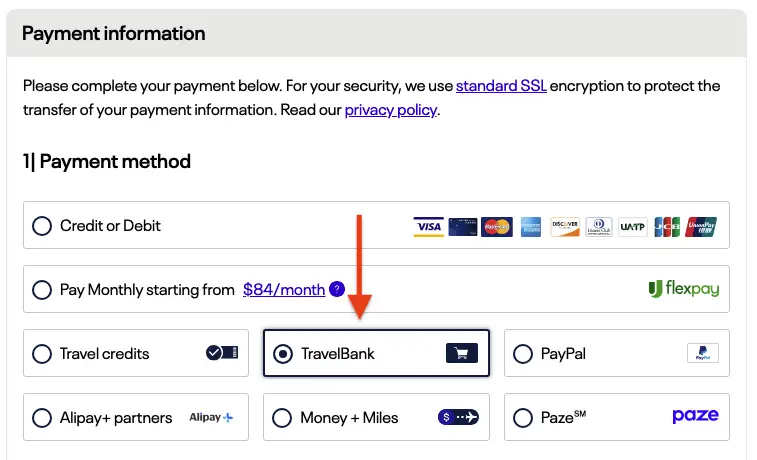

STEP 2:

Select your particular flight, verify your personal information, and pick your seat.

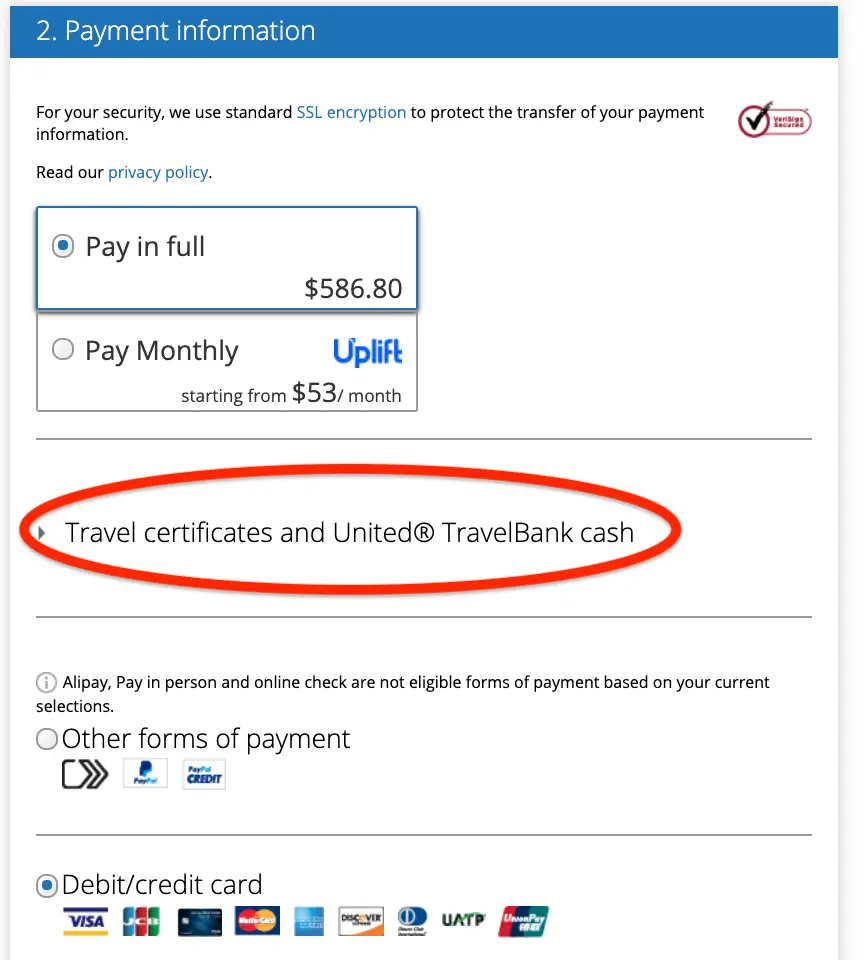

Afterward, you will be directed to the Payment Page.

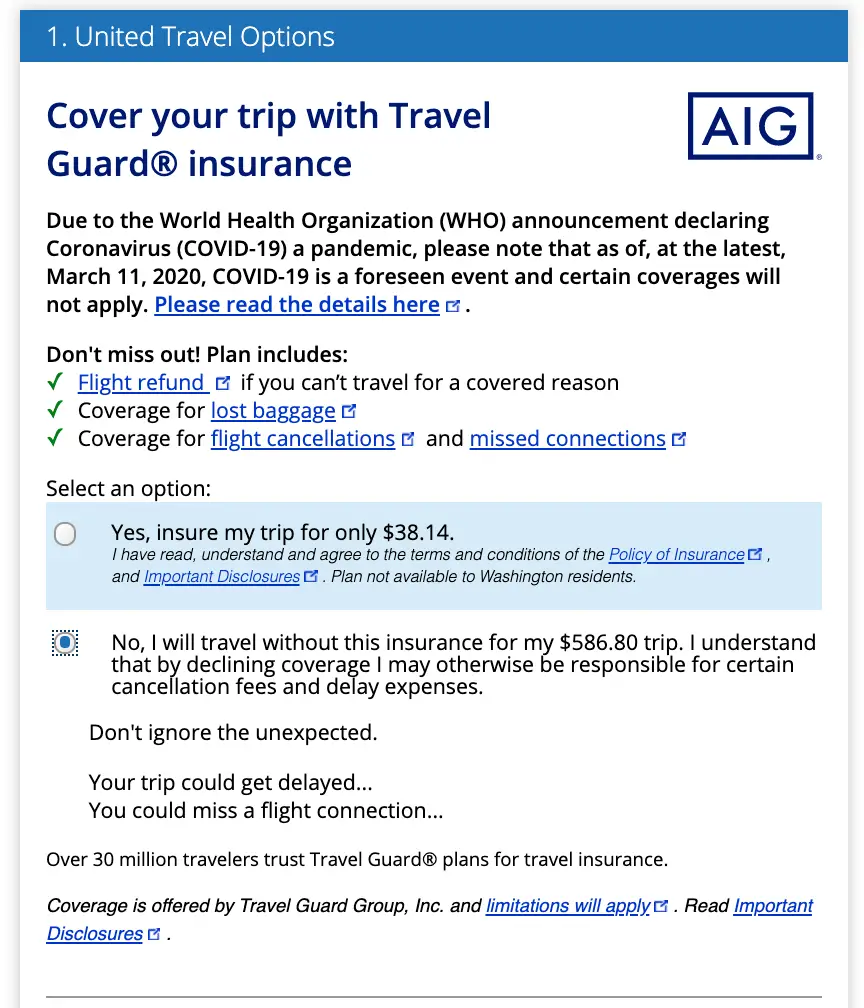

Next, United will offer you travel insurance (select yes/no), priority boarding, and miles for purchase.

Whether you decide to purchase these additional bells and whistles or decline, the payment section comes right after.

You have the following payment options:

- Debit / Credit Card

- Pay Monthly

- Travel Credits

- United TravelBank (if this option does not appear, then the ticket you’re buying is not permitted to be purchased using travel cash)

- Other Forms of Payments (PayPal, etc)

Select “TravelBank”

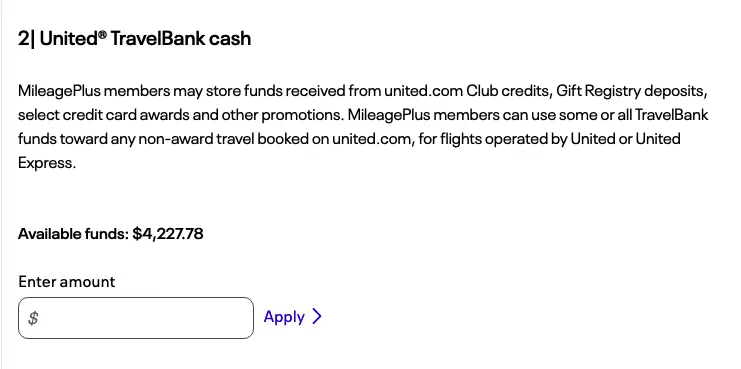

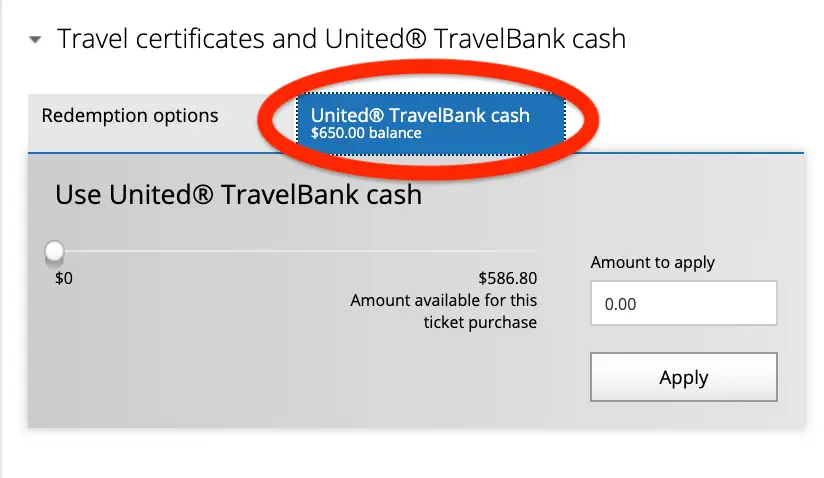

STEP 3:

Next, enter the amount you want to use for the flight you wish to book.

It is not necessary to spend your entire stash of United travel cash if you have other plans to spend it later.

As per United, MileagePlus members can use some or all TravelBank funds toward any non-award travel booked on united.com, for flights operated by United or United Express.

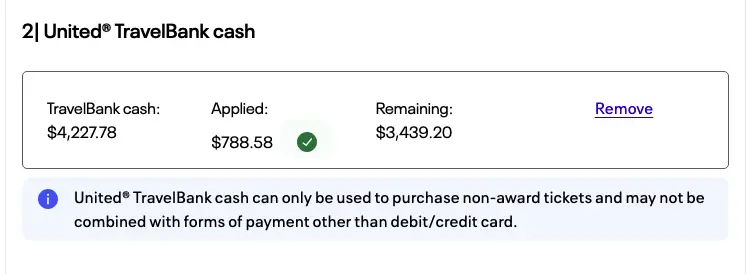

STEP 4:

Once you have a final amount in mind, click apply.

In this example, I decided to spend $788.58 of my TravelBank stash to purchase a plane ticket for a family member.

The remaining TravelBank funds will also be calculated.

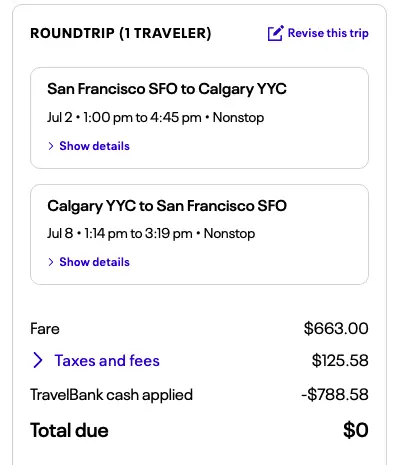

STEP 5:

After your travel cash is deducted, the total amount you still owe will automatically be calculated.

In the following example, I decided to pay the entire airfare using my TravelBank.

As previously mentioned, you also have the option to only pay a portion of your airfare.

In the next example (refer to the screenshot below), the total airfare amounted to $255.

However, I chose to apply only $75 from my TravelBank, leaving me with a remaining balance of $238.93.

This remaining amount can only be paid using a debit or credit card.

STEP 6:

Continue with your purchase by selecting the mode of payment you want to use for the remaining balance.

I highly recommend paying a portion of the flight with a credit card that offers travel protections, such as the Chase Sapphire Preferred® Card or the Chase Sapphire Reserve®.

Alternatively, you can purchase travel insurance to cover your entire trip.

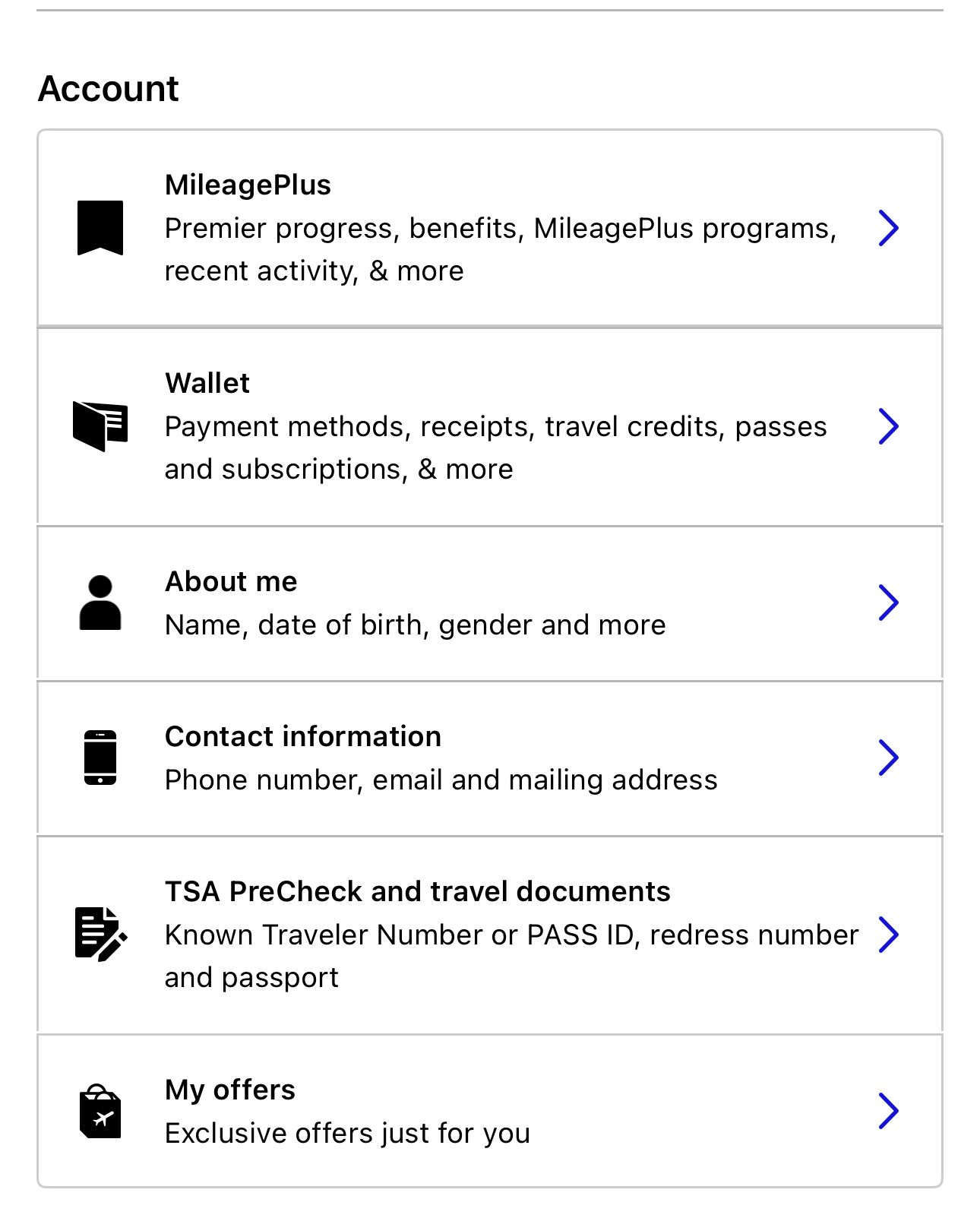

Where Do I Find My TravelBank Account?

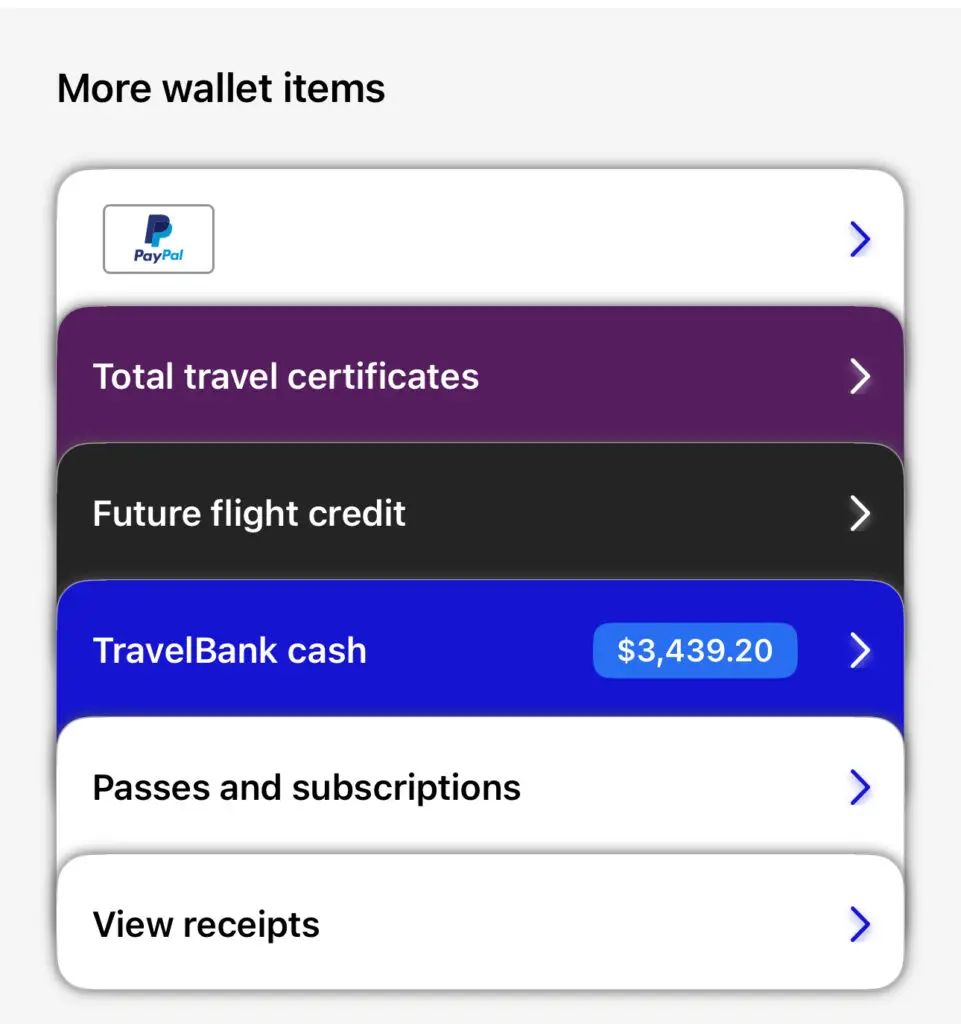

United has recently updated its website. You can find your United TravelBank account information and balance by navigating to your United Wallet on the app and the computer.

2024 Update: You can now see your TravelBank funds when you click your profile on the computer. On the app, you still have to navigate to your wallet.

Troubleshooting Potential Issues

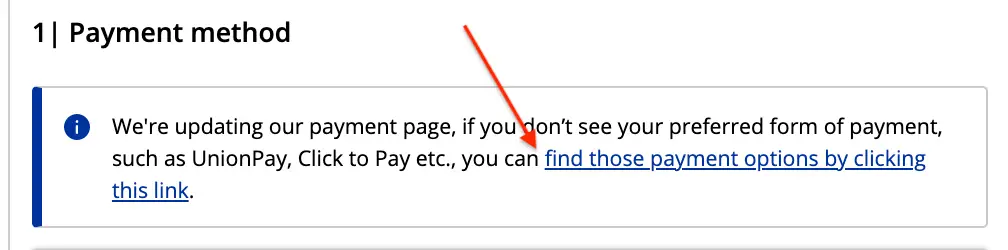

Issue 1: United TravelBank Does Not Show Up

A few readers have expressed that they are having difficulty locating the TravelBank option on United’s website.

STEP 1:

It appears that United’s site is currently updating its payment page. When you see the notice below under “Payment Method, ” click the “find those payment options…” link.

STEP 2:

This link will direct you to the “United Travel Options” section, where you can add travel insurance to your purchase. Make your selection.

STEP 3:

Afterward, you will be directed to “Payment Information,” where the TravelBank option appears.

STEP 4:

Click “Travel Certificates and United TravelBank Cash” and select Travel Cash as your mode of payment.

Type the amount you would like to spend.

As suggested, charge a small portion of your airfare on a credit card that provides travel insurance, like the Chase Sapphire Preferred® Card or the Chase Sapphire Reserve®.

You may also elect to purchase travel insurance for additional coverage.

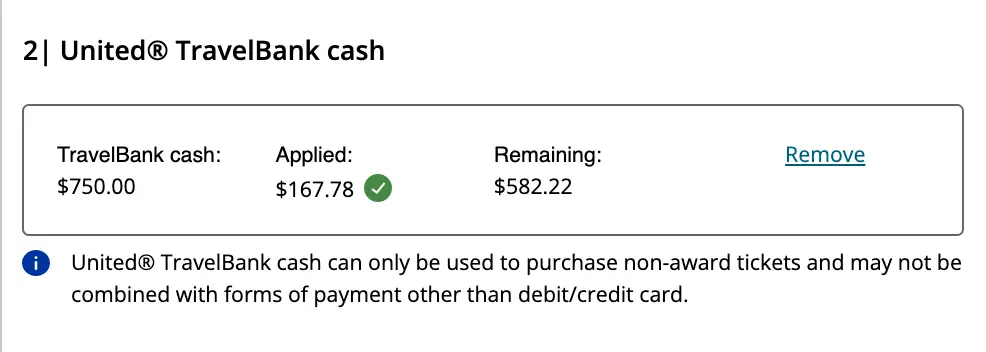

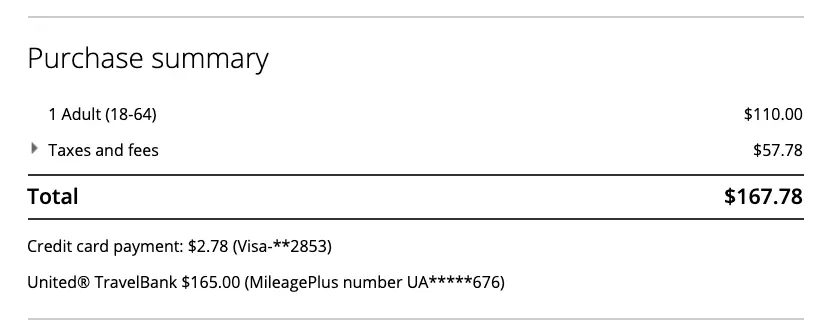

Issue 2: United TravelBank Keeps On Freezing

While booking a plane ticket to Cabo costing $167.78 recently, I found the United website struggling to process my TravelBank payment, ultimately freezing the payment page.

After attempting various troubleshooting strategies, I eventually made it work by typing a whole number into the TravelBank box.

In this case, I redeemed $165 of my TravelBank credits towards the purchase of this ticket and used a credit card that gives travel protections (Chase Sapphire Reserve®) to cover the remaining amount ($2.78).

Issue 3: TravelBank is Unable to Add a New Credit Card (Payment Error)

United.com can only save a certain number of credit cards on your profile.

If the website is not allowing you to add another credit card to your United TravelBank account, you will need to log in to your main United.com account, go to “Wallet,” remove the credit cards that you no longer use, and then add the ones you would like saved.

Once your new credit card is linked, note the last four digits of your card and its expiration date so you can easily find it on your list of saved cards when you try to purchase United TravelBank funds again.

Issue 4: Unable to Purchase

As mentioned above, your United TravelBank funds can either be used alone or in combination with select forms of payment when booking United or United Express flights only.

Therefore, we are unable to use United TravelBank to purchase flight itineraries that include segments on partner airlines such as Air Canada, Lufthansa, etc.

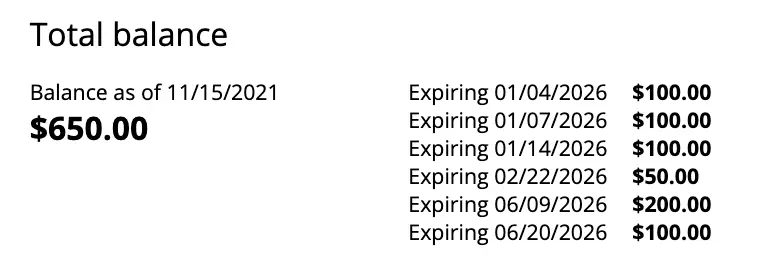

When Do United TravelBank Funds Expire?

As of this update, TravelBank funds appear to expire after five years.

The screenshot below, captured from my TravelBank account, supports this assertion.

While the money deposited in our United TravelBank accounts has a 5-year validity, it can be forfeited if no activity is recorded in our TravelBank accounts for 18 consecutive months.

Therefore, ensure that you either add money to your TravelBank or use your TravelBank funds to purchase tickets at least once every 18 months.

Heads up: United also stipulated that re-deposited funds originating from canceled tickets purchased with TravelBank money do not qualify as an eligible activity. In short, re-deposited funds will NOT reset the expiration date.

United may also change the expiration date of subsequent deposits or discontinue the program altogether. Only time will tell.

For now, this option to convert our credit card airline credits to some form of flexible currency is available, so certainly consider this method if you are running out of ways to redeem your expiring credits.

United TravelBank purchased using certain IHG Credit Cards has a shorter lifespan. Please check the terms of your IHG Credit Cards for the most current UnitedTravel Bank policy.

Which Credit Cards to Use?

You should only purchase TravelBank funds when you anticipate no other eligible travel-related purchases for the remainder of the year.

Chase Credit Cards

Chase Sapphire Reserve® (CSR)

The Chase Sapphire Reserve (CSR) comes with a $300 travel credit that resets every year on the card member’s anniversary date and does not roll over onto the following year; therefore, you either use it or lose it.

I do not recommend using your CSR travel credits to purchase funds on United’s TravelBank, given that Chase provides an extensive array of valuable avenues to redeem this credit.

In addition to the traditional airfare purchase, you can also trigger the travel credit when paying for public transit, ride-sharing services, parking, hotels, campgrounds, cruises, etc.

Citi Credit Cards

Citi Prestige® Credit Card

This card is no longer available to new applicants.

This credit card comes with a $250 travel credit, which can be used to conveniently purchase groceries, restaurants, and takeout.

Like the Chase Sapphire Reserve, this credit resets every calendar year and likewise does not roll over.

I do not suggest using your Citi Prestige travel credits to purchase United TravelBank funds because you have other beneficial spending options.

American Express Travel Cards

American Express® Cards with Airline Fee Credits

- The Platinum Card® from American Express ($200 Annual Airline Credit)

- The Business Platinum Card® from American Express ($200 Annual Airline Credit)

- Hilton Honors American Express Aspire Card ($50 Quarterly Airline Credit)

American Express’s airline fee credit is challenging to redeem compared to Chase’s and Citi’s more flexible identical offerings.

In the past several years, consumers consistently find themselves jumping through hoops in search of effective methods to capitalize on these generous offers.

First and foremost, Chase and Citi do not require activation – their credits apply to all airlines and other forms of travel.

Whereas Amex’s airline fee credit will not work unless you activate it.

Plus, it can only be used on one airline you pre-select, ideally at the beginning of the year.

Even though there are data points (DP) that Amex has been lenient in allowing the preferred airline to be changed via chat as of late, there is no way to predict until when they will allow this.

AMEX Airline Fee Credit Restrictions

AMEX has strict restrictions on fees that qualify under this credit.

Technically, only incidental purchases, such as seat assignments, baggage fees, change fees, lounge access fees, and food/beverage inflight purchases, are eligible.

As such, traditional expenses such as award fees, plane tickets, upgrades, and gift cards do not qualify.

However, occasionally, we see additional methods temporarily open up that trigger this airline fee credit—and for now, United TravelBank is one of them.

While no language explicitly states that this particular purchase will not qualify, I have to underscore that Amex can undoubtedly claw back this credit at any moment if they deem TravelBank not eligible. So, just be aware of that possibility.

Hence, please utilize this tactic only if you do not anticipate using your airline fee credit throughout the rest of the year.

Steps in Selecting Your Airline With Amex

Before you go ahead with your purchase, follow the steps below to select your preferred airline, as AMEX does not make it simple to locate where to activate this benefit.

To optimize this TravelBank strategy, make sure that the airline you selected is United.

STEP 1:

Go to AmericanExpress.com, then log in to your account.

STEP 2:

Select the particular AMEX credit card that currently offers an airline fee credit.

STEP 3:

On the main page, click “More,” then select “Benefits.”

STEP 4:

On the Benefits page, scroll down to locate “Airline Fee Credit.”

This is where you can also change your selected airline for the year.

It bears repeating that you’re technically not allowed to change your preferred airline mid-year, so choose wisely.

With that said, there are data points from people reporting that they have successfully modified their airline choice by contacting AMEX through chat, but this is YMMV (your mileage might vary).

As of this writing, you can use your airline fee credit with the following U.S. carriers:

- United

- American

- Delta

- Alaska

- Southwest

- Frontier

- Hawaiian

- JetBlue

- Spirit

On the Benefits page, enroll in all the offers available, even if you are not sure you will use them.

It is practically money you had already paid for when you paid your annual fee, so you might as well take advantage of it.

At any rate, maximizing this airline fee credit is a fantastic way to offset the steep annual fees Amex charges on their ultra-premium cards.

STEP 5:

Add funds to your travel credit using your AMEX card.

If unsure how much airline credit you have left, AMEX generates a tracker under this benefit to display your remaining funds.

STEP 6:

Periodically check your Amex credit card to see if the airline fee credit was successfully triggered.

If they did not show up, Amex has likely terminated this redemption method.

United TravelBank FAQs

What is United Travel Bank and how does it work?

United Travel Bank is a digital account offered by United Airlines that allows you to add funds and use them to purchase air travel with United. It functions as a prepaid account where you can store money to cover flight costs.

What are the benefits of using United Travel Bank for travelers?

- Easy budgeting for air travel expenses.

- Helps manage travel funds in one place.

- Allows access to promotions or credits like the American Express Airline Fee Credit.

Are there any fees associated with United Travel Bank?

No, there are no fees associated with creating or using a United Travel Bank account.

What are the restrictions or limitations when using United Travel Bank?

- Funds can only be used for airfare on United Airlines flights.

- United Travel Bank cannot be used for taxes on award tickets or for partner airlines like Air Canada, SwissAir, or Lufthansa.

- Funds cannot be transferred to other accounts or redeemed for non-United Airlines purchases.

- Combining United TravelBank funds with mileage or travel credits for ticket purchases is not allowed.

How can I create a United Travel Bank account?

You can create a United Travel Bank account by signing into your United Airlines account and navigating to the “Travel Bank” section.

If you don’t already have a United MileagePlus account, you’ll need to register for one first.

How do I add funds to my United Travel Bank account?

You can add funds by logging into your United Travel Bank account and selecting “Add Funds.”

Enter the desired amount and complete the payment using your preferred method, such as a credit card.

Many users take advantage of the American Express Airline Fee Credit to fund their accounts.

How do I check the balance of my United Travel Bank account?

To check your balance, log into your United Airlines account and access the Travel Bank section.

Your current balance and transaction history will be displayed.

How do I close my United Travel Bank account?

If you wish to close your United Travel Bank account, contact United Airlines’ customer service for assistance.

Note that any remaining funds in your account may not be refundable.

What should I do if I encounter issues with my United Travel Bank account or transactions?

If you experience problems or discrepancies, you can contact United Airlines’ customer service by phone or through the Help section on their website.

Can I use United Travel Bank for all United Airlines purchases?

No, United Travel Bank funds can only be used for purchasing airfare on United Airlines flights.

They cannot be used for taxes, baggage fees, seat upgrades, or in-flight purchases.

Can I use my United TravelBank cash to book tickets for someone else?

Yes, you can use your United Travel Bank funds to book tickets for others as long as the purchase is made through your account.

Can I use my United TravelBank cash to book tickets for United partners such as Air Canada, SwissAir, or Lufthansa?

No, United Travel Bank funds can only be used for flights operated by United Airlines.

They cannot be applied to partner airline bookings.

Can I use my United TravelBank cash to pay for taxes when booking award tickets?

No, United Travel Bank funds cannot be used to pay for taxes or fees associated with award tickets.

Can I use my United TravelBank cash to purchase airfare in combination with travel credits or vouchers?

No, United Airlines does not allow combining United TravelBank funds with other travel credits or vouchers for a single ticket purchase.

Can I combine United miles with my United TravelBank cash to purchase air tickets?

No, United TravelBank funds and MileagePlus miles cannot be combined for purchasing air tickets.

How long does the American Express Airline Credit take to show up after purchasing United TravelBank cash?

Typically, the American Express Airline Fee Credit appears in your account within 7-10 business days after purchasing United Travel Bank cash.

However, this may vary depending on your card issuer’s processing time.

Final Thoughts

Indeed, United’s TravelBank is an excellent addition to the dwindling menu of possible purchases that can activate Amex’s elusive airline credit.

Being fully aware that this method is temporary, I try to take advantage of it while it’s still possible, especially when I am on the verge of running out of redemption alternatives for my Amex airline fee credit.

I hope that Amex follows Chase’s and Citi’s lead and relaxes this benefit, making it much easier to redeem in the future.

Until then, we will have to adjust to American Express’ policies.

Ultimately, I am glad that United’s TravelBank provides another fantastic alternative for using our travel credits.

Not only does it prolong the shelf-life of our funds, but it also affords us the flexibility we genuinely need.

ADVERTISER DISCLOSURE: The Frugal Tourist is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as MileValue.com and Cardratings. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All information about the American Express Schwab Platinum has been collected independently by The Frugal Tourist.

EDITORIAL DISCLOSURE: Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities.

USER-GENERATED CONTENT DISCLOSURE: The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.

The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.

Bank of America Premium card also include benefits of $100 incidental travel credits, can I use it to purchase United Travel Bank fund too?

Hi Angie, I am not familiar with Bank of America rules but upon checking what qualifies under “incidental”, I got the following info: Get up to $100 in Airline Incidental Statement Credits annually for qualifying purchases such as seat upgrades, baggage fees, in-flight services, and airline lounge fees – automatically applied to your card statement.

It seems to me that this is similar to Amex. I would suggest purchasing the lowest allowed denomination of $50 to see if it would trigger it but if you have anticipated travel in the near future, I suggest redeeming the credits there instead.

Hi, I booked the ticket and when I entered the payment page, there is no Travel Bank part, I got 200+ dollars in travel bank and cannot seem to use it. Why is this? I can only see “Travel certificates” instead of “Travel certificates and United Travel Bank Cash”. What should i do?

Hi Tristan, thanks for asking. Sorry about that. Not all purchases in United.com are eligible. I wonder if the ticket you are purchasing includes a partner airline. From the Terms and Conditions: “TravelBank Cash is valid for air travel purchases on United and United Express® flights and as otherwise permitted by United. After a TravelBank Award is issued, a service charge may be imposed for each change or cancellation requested by the Member.”

I have encountered this exact problem and I am definitely booking a United airline airfare (from LAX – EWR): any more update on this?

HI Cindy, I had updated the post with hopefully a potential solution to your problem. Jump to the section “What to do? United Travel Bank Does Not Show Up”. I tried your route (LAX-EWR) and the steps I outlined worked in making Travel bank re-appear! Good luck and please let me know if it worked for you too!

Thank you for this post and the very detailed instructions!!! Really helpful as I’ll be using this as long as we can get that $200 credit from Amex Plat!

Thank you Tony for the kind feedback. I am glad you found it useful. Please feel free to ask questions anytime.

Great information, thank you!

Thank you so much!

Its unfortunate you can’t use your Travel Bank just to upgrade your seat. Or pay for the bundles upon checkout

I am sorry! Sadly, it is just not as flexible 🙁 But United might make some changes in the future that will allow us to use it for incidentals.

Newbie to United Travel Funds.

Is it possible to use it for booking a ticket for anyone else, any restrictions?

You can book it for anyone else. When they cancel though, the travel credits will be under their account.

This article saved me 30mins! I was typing a non-whole number to use my United Travel Bank and it would NOT take it. Apparently, it needs to be a WHOLE NUMBER. Thanks for the tip!

Glad you found it useful!

Can you combine miles and a travel bank balance? I have 33k miles I need to use and $600 in travel bank credits.

Unfortunately, you can not mix miles and travel bank balance. I’d use the travel bank first if you find cheap tickets as those expire. United miles do not expire.

Hi, how long does the Amex Airline Credit usually take? It’s been a week now and my credits have not shown up yet.

HI Kunal. It’s been about 10 days, on average, for me.

I wanted to add that you Travel Bank does not come up as an option to pay if your flight involves a leg operated by a partner airline (eg. Swiss Air).

I called United to see if they could book the ticket but it errored out for the representative and he gave me that as the reason.

This might be helpful to incorporate in your article.

HI Stephanie, thank you for sharing. That’s correct. Apologies that it was not clear in the article. Yes, it is sadly for United and United Express flights only. I highlighted that part of the article and added additional language under Troubleshooting so it’s much clearer. Thanks so much again for the feedback and Safe travels!