ADVERTISER DISCLOSURE: The Frugal Tourist is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as MileValue.com and Cardratings. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All information about the American Express Schwab Platinum has been collected independently by The Frugal Tourist.

EDITORIAL DISCLOSURE: Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities.

If you’re an American Express cardholder looking for a way to cash out your Membership Rewards points, the Charles Schwab Platinum® Credit Card may be the right option for you.

This card allows cardholders to convert their points into cash, which can be a great way to get some extra money to spend or invest.

In this blog post, we’ll discuss the details of the Charles Schwab Platinum® Card and the steps on how you can use it to cash out your points.

Charles Schwab Platinum Card by American Express

The Charles Schwab Platinum card is an excellent option for American Express cardholders who want to convert their points into cash.

This card has many of the same benefits as other Platinum cards, such as access to exclusive events and perks, lounges, and discounts at various merchants.

The only difference is that the Charles Schwab Platinum also provides the option to cash out your valuable American Express Membership Rewards points, a benefit other American Express Platinum cards do not currently offer.

If you’re interested in using your Amex Membership Rewards points for cash, the Charles Schwab Platinum card is an excellent option for you to consider.

Good to Know: Although the Charles Schwab Platinum card’s annual fee is $695, if you have at least $250,000 in your Schwab account, you can receive a $100 statement credit yearly. If your account amounts to more than one million dollars with Schwab, you’ll receive an annual credit of $200. Therefore, these credits can assist greatly in offsetting the card’s annual fee cost.

Who is Eligible to Apply for a Charles Schwab Platinum Card?

The Charles Schwab American Express Platinum® Credit Card is currently only available to existing Charles Schwab customers.

Eligibility for this program is subject to change, but as of this writing, you’ll need a Schwab brokerage account (either in your name or held by a living trust you oversee) or an IRA managed by Schwab.

If you’re not a customer, don’t worry. It’s easy to open a brokerage account with Charles Schwab, whether online or in person at a branch. There is also no required minimum balance to maintain an account.

Charles Schwab Platinum Card Benefits

Charles Schwab Platinum cardholders have access to all the same perks as the other Platinum cards, which include:

- $200 Airline credit each year

- $300 Equinox credit per year

- $200 back in statement credits per year on prepaid Fine Hotels + Resorts or the Hotel Collection booked through Amex Travel

- $200 in Uber savings on Uber rides or Uber Eats orders in the U.S.

- $100 in statement credits per year for purchases at Saks Fifth Avenue

- Access to Global Lounge Collection (Centurion Lounge, Delta Sky Club, Priority Pass, and Airspace Lounge)

- Earn 5X American Express Membership Rewards points per dollar on flights booked directly from airlines or American Express Travel

- Earn 5X American Express Membership Rewards points per dollar on prepaid hotel purchases booked online at amextravel.com

- Zero foreign transaction fees

Cash Out Conversion Rate

1 American Express Membership Rewards Point = 1.1 Cent ($0.011)

When you use your Charles Schwab Platinum card to cash out your Membership Rewards points, you’ll get $0.011 per point.

So, if you have 10,000 points, you can convert that into $110 in cash.

This is a fantastic way to access extra spending money or if you need cash quickly, especially in emergencies.

Since my ROTH IRA is invested with Charles Schwab, this is also a terrific use of my American Express Membership Rewards points, especially since retirement is just a few decades away.

Ultimately, the decision is yours. I have recently started splitting our household stash of American Express Membership Rewards points – reserving half of our points for flights and earmarking half for retirement.

Steps in Cashing Out American Express Membership Rewards Points

Step 1:

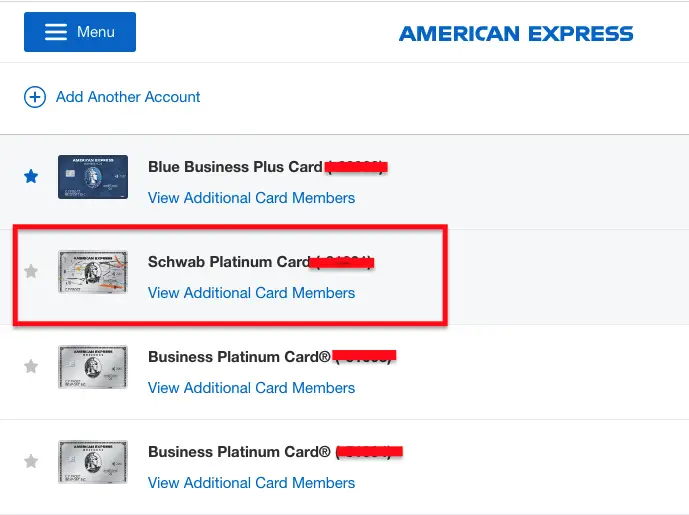

First, sign in to your American Express account and check how many Membership Rewards Points you presently have.

Doing this will give you an idea of whether you want to cash out everything or keep some for future award flight bookings.

From there, proceed to your Charles Schwab Platinum card by clicking the credit card icon on the upper right-hand corner of your American Express account page.

Step 2:

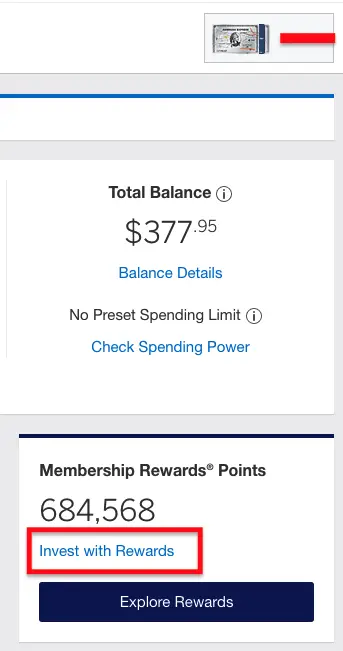

On your Schwab Platinum account page, locate the “Membership Rewards® Points” section halfway down.

Your total number of points and the option to “Invest With Rewards” will be displayed here. Click “Invest With Rewards.”

Step 3:

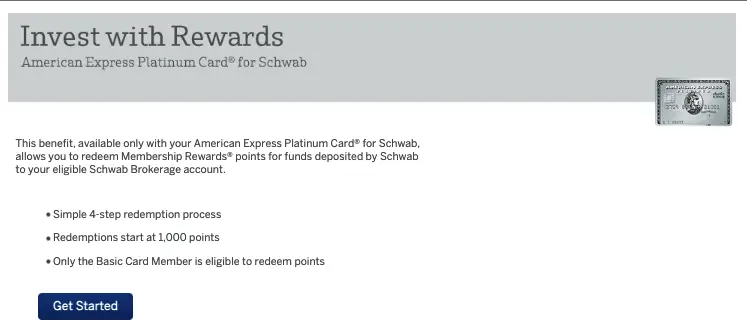

You will then be directed to the “Invest with Rewards” page. Click “Get Started.”

This page will provide you with an overview of this American Express Charles Schwab Platinum benefit, which includes the following terms:

- Membership Rewards Points can be cashed out and deposited to your eligible Schwab Brokerage Account

- The cash-out conversion process will involve four steps

- Redemption starts at a required minimum amount of 1,000 Membership Rewards points

- Only American Express Charles Schwab Platinum members are eligible to convert their points into cash

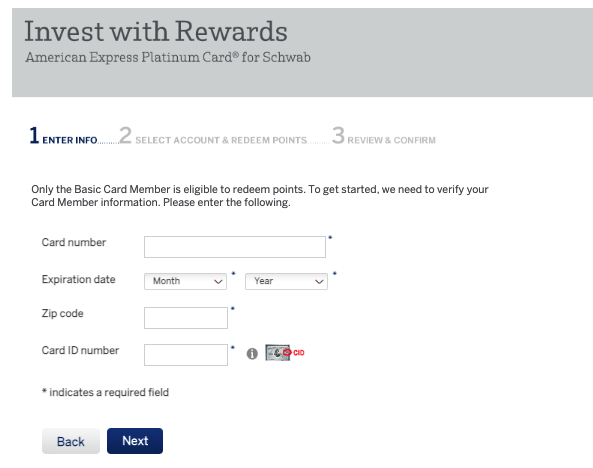

Step 4:

On the following page, you will be required to enter the following information to verify your identity:

- Your Charles Schwab American Express Platinum card number,

- Credit card expiration date,

- Billing address, zip code, and

- Card ID number, which is the 4-digit number on the front of your card

Once you have entered all of the required information, click Next.

Heads Up: Unfortunately, at this time, you will have to enter your information manually every time you cash out. In the future, we hope to have the option to save your information and make the process quicker.

Step 5:

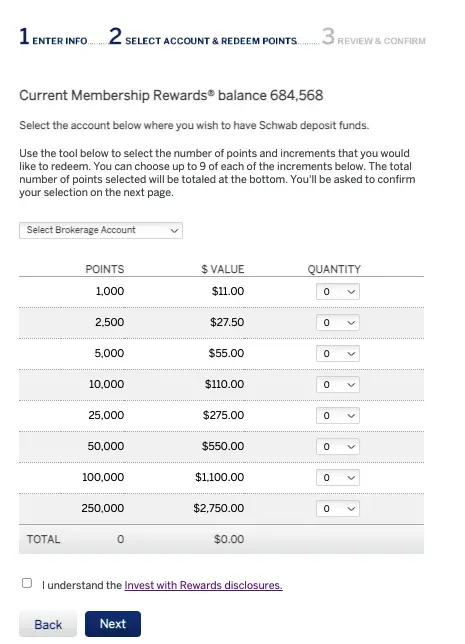

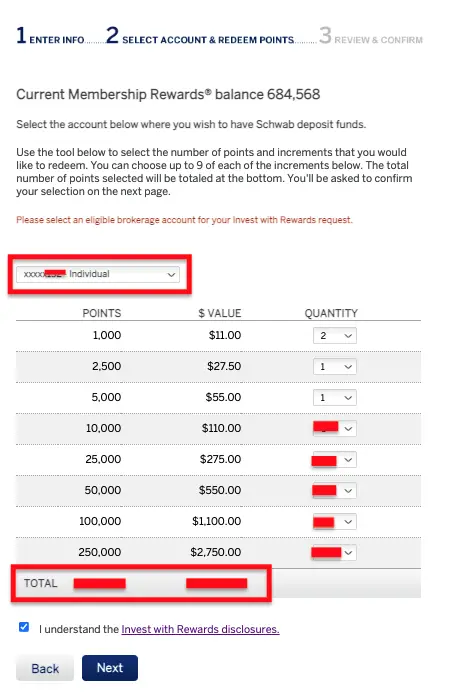

On the next page, you can select how many American Express Membership Rewards points you want to transfer into your Schwab brokerage account.

To begin, select the account you want to deposit from the drop-down menu at the top of this page.

In my case, I was given the option to transfer my points to either my brokerage account or directly to my ROTH IRA account.

Since I have already maxed out my contributions for my ROTH IRA this year, I selected to move my points to my personal brokerage account.

You can choose up to nine of each point denomination.

After that, choose your preferred quantities and ensure that the total number of points is precisely the amount you want to cash out.

Once all the entries have been verified, check the box “I understand the Invest with Rewards disclosures” at the bottom of the page before clicking next.

Step 6:

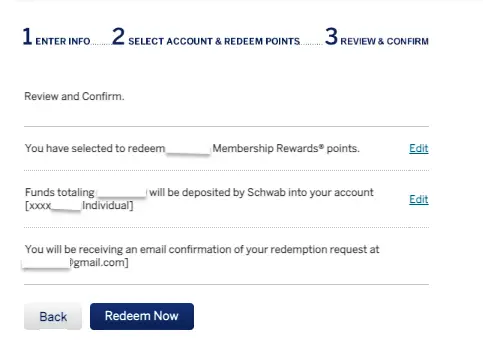

You will then be able to review your choices on the following page.

You can also edit your entries before proceeding to the final steps. If everything checks out correctly, click “Redeem Now.”

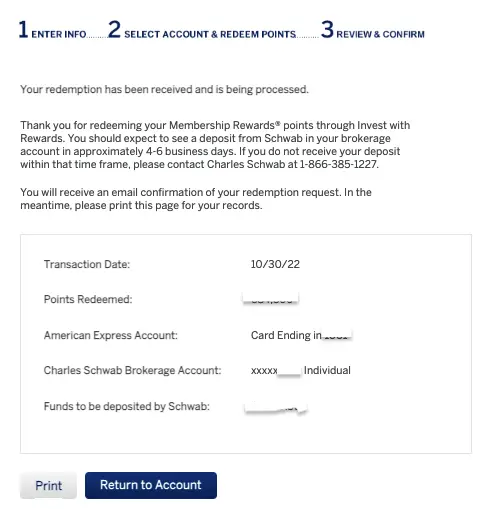

Step 7:

A confirmation notice indicating that the redemption has been received and is being processed will be on the next page.

Thank you for redeeming your Membership Rewards® points through Invest with Rewards. You should expect to see a deposit from Schwab in your brokerage account in approximately 4-6 business days. If you do not receive your deposit within that time frame, please contact Charles Schwab at 1-866-385-1227.

You will receive an email confirmation of your redemption request. In the meantime, please print this page for your records. You will receive an email to the address associated with your Amex account(s) confirming the redemption.

With Schwab Platinum, you can expect your points to cash transfer to go through quickly and smoothly- even if you redeem outside of bank business hours.

I did this recently at 11 PM on a Sunday, and the cash was posted to my account after a few minutes. I was quite impressed with how effortless the process was.

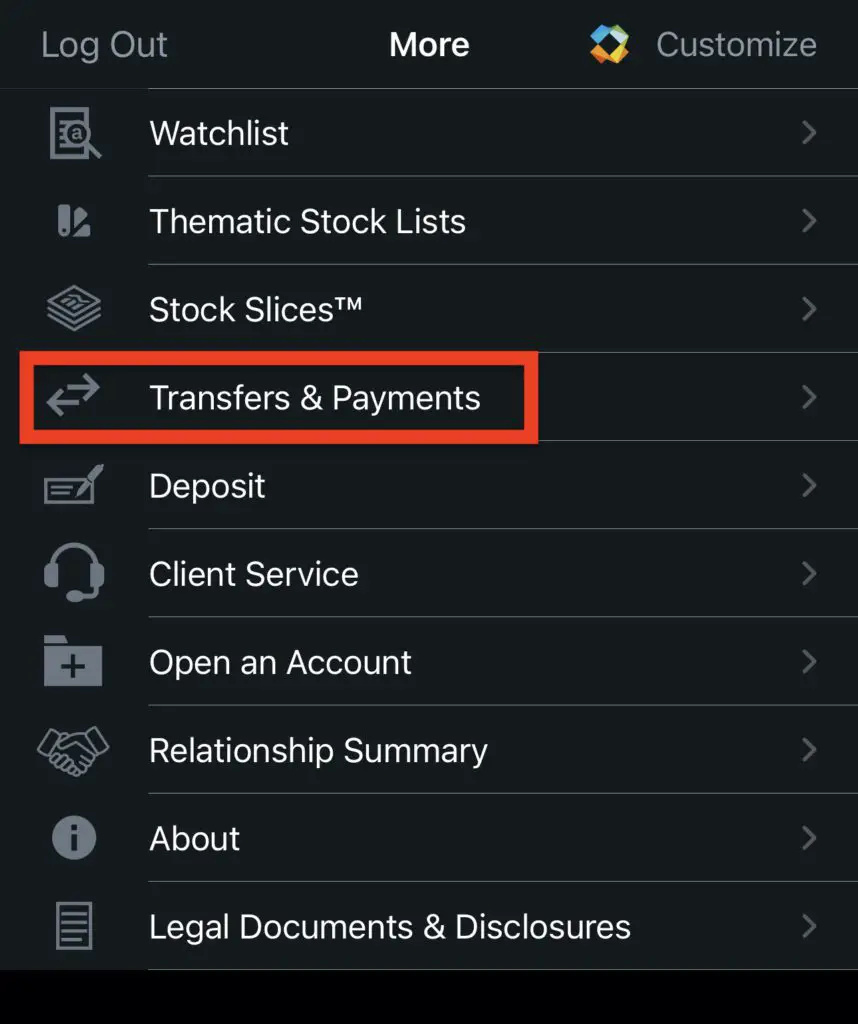

Step 8:

For the final step, go to the specific Charles Schwab account where you moved your funds.

Your redeemed points should appear as “cash” in your brokerage or IRA account. Congratulations!

You can then invest your money or transfer your cash to another (external) account. In my case, I moved it quickly and easily to Chase, my primary bank, where I can easily deploy it for whatever purpose I need.

Whether for investing, adding cash to a sinking fund, or stashing more cash in my emergency fund, this ability to cash out American Express Membership Rewards points has been invaluable.

Glitches Sometimes Happen

Every now and then, fund transfers may be stalled or canceled; however, this doesn’t happen often.

In cases like these, American Express usually restores the ability to redeem rewards within a day or so.

If push comes to shove, you might be required to resubmit your request for redemption again.

All things considered, I have found the Invest with Rewards Redemption method to generally work without issues.

Final Thoughts

American Express Membership Rewards points can be readily cashed out using the Charles Schwab Platinum card.

This simple process can be done online in just a few minutes. Additionally, your points will be deposited directly into your brokerage account- making it easy to use for future investments or purchases.

With cash, you always have the option to use it as you see fit. And with Schwab, you can rest assured that your points will be transferred quickly and efficiently.

So if you’re looking for a way to cash out your Membership Rewards points, the Charles Schwab Platinum card is definitely worth considering.

And that’s it! Now you can cash out your American Express Membership Rewards points using the Charles Schwab Platinum card. If you have any questions, feel free to leave a comment below.

Happy investing and safe travels!

ADVERTISER DISCLOSURE: The Frugal Tourist is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as MileValue.com and Cardratings. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All information about the American Express Schwab Platinum has been collected independently by The Frugal Tourist.

EDITORIAL DISCLOSURE: Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities.

USER-GENERATED CONTENT DISCLOSURE: The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.