ADVERTISER DISCLOSURE: The Frugal Tourist is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as MileValue.com and Cardratings. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All information about the American Express Schwab Platinum has been collected independently by The Frugal Tourist.

EDITORIAL DISCLOSURE: Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities.

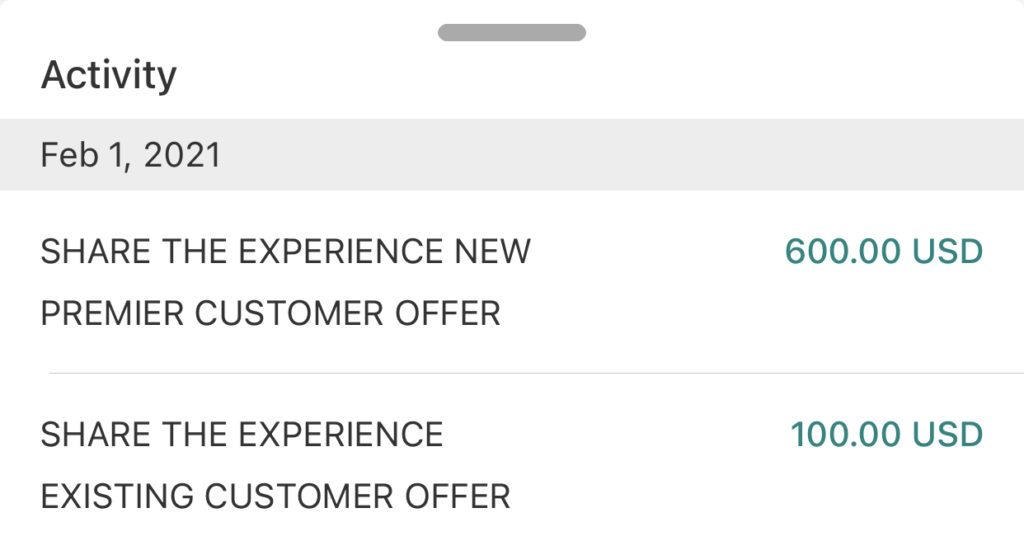

Fresh off the heels of the HSBC Bank Bonus I received from an offer last month, where I earned $600 after completing a few requirements and an extra $100 for referring a friend, another opportunity for a bank bonus just landed in my inbox a few days ago.

This time around, it is from BBVA, which stands for Banco Bilbao Vizcaya Argentaria. They are the second-largest commercial bank in Spain, and is virtually everywhere in Mexico, too.

Unbeknownst to me that BBVA also has a decent footprint in my home state of California and a handful of states. In fact, I have a branch practically 5 minutes from where I live.

Since BBVA’s network is limited in scope, this current bank offer is sadly not offered nationwide. Presently, only residents of states where BBVA has physical locations can take advantage of this generous offer, but that may change anytime soon.

At any rate, if you live in one of the states below, I suggest you take a look at BBVA’s current offer for an opportunity to earn $250 of passive income.

- Alabama

- Arizona

- California

- Colorado

- Florida

- New Mexico

- Texas

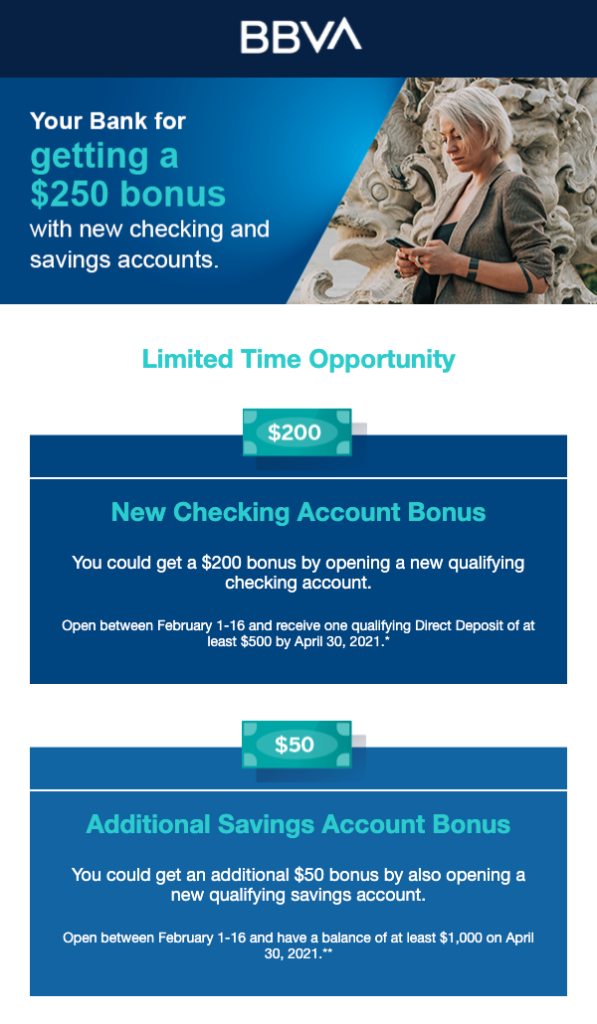

The BBVA Bank Bonus Offer

$200 Checking Account Bonus

- Open a qualifying checking account by February 16, 2021.

- Deposit at least $25 to open the account (BBVA.com will accept funds from debit/credit cards, another bank, or an existing BBVA account. Heads up: credit cards may charge a cash advance fee).

- You can open in-branch, online, or by calling 1800-BBVA-USA.

- One required $500 Direct Deposit by April 30, 2021, should trigger the bonus.

- If more than one Direct Deposit is received before April 30, 2021, at least one of the Direct Deposits must be at least $500.

- New BBVA consumer checking customers only.

- You are not eligible if you have been a BBVA consumer checking account open within the last 36 months, even if the account has already been closed.

- Bonus will be awarded by July 30, 2021, if requirements are met.

- To avoid forfeiture of the cash bonus, the account must be open for at least a year.

- There is no fee required to meet the minimum balance but a $5 fee is charged for accounts that are inactive. So, perhaps doing transfers to and from this account monthly after April 30th can fulfill this requirement.

- A valid government-issued ID such as a driver’s license, state-issued ID with photo, or a passport as well as your Social Security number will be necessary to complete the application.

- Use the promo code WB2021 when opening an account in the branch.

- For online applications, you must enter promo code WBOL2021 to be eligible, or click the button below, which will automatically generate the code for you.

Other Terms and Conditions for the $200 Checking Bonus:

- For accounts opened online, eligible accounts include BBVA Free Checking and BBVA Easy Checking.

- For accounts opened in branch or by calling 1-844-BBVA USA, eligible accounts include BBVA Premium Checking, BBVA Convenience Checking (in Florida and California), BBVA Free Checking, and BBVA Easy Checking.

- BBVA Free Checking and Easy Checking are only available in Alabama, Arizona, California, Colorado, Florida, New Mexico, and Texas.

- A qualifying direct deposit is a recurring paycheck, pension, or benefit (such as Social Security) from your employer or the government.

- The following deposits are not qualifying direct deposits: interest payments or transfers from your investment accounts; payments received from payment apps such as PayPal, Venmo, and other similar payment service providers; tax refunds or one-time economic stimulus payments such as financial assistance made available under the CARES Act or any other financial assistance made available in express response to the COVID-19 pandemic.

- BBVA Employees and Workplace Solutions / BBVA For Your Cause clients are eligible for this offer.

- Only one bonus can be earned by each customer.

- These bonuses are not combinable with other BBVA Direct Deposit or Savings Account cash bonus promotions, and you may not have received a Direct Deposit or Savings Account bonus in the past 36 months. Offer subject to change at any time without notice.

- BBVA may report the value of the bonus to the IRS as required by law. Any client whose tax status would require BBVA to impose tax withholding of any sort will not be eligible for this bonus.

$50 Savings Account Bonus

- Sign up for a qualifying Savings Account by February 16, 2021.

- Not available as a stand-alone offer. It needs to be combined with the $200 offer above.

- Deposit at least $1,000 by April 30th to receive this bonus.

- The $50 bonus will be awarded by July 30th, 2021, if all requirements are met.

- Account needs to be active for at least a year to avoid forfeiting your bonus.

- The minimum balance is $500 to avoid the monthly $15 fee, so I’d keep $1000 until I get the bonus then transfer $500 elsewhere where you can get another bank bonus.

Other Terms and Conditions for the $50 Savings Account Bonus:

- You must meet stipulations for the $200 Checking Bonus to be eligible for the $50 Savings Bonus.

- For accounts opened online, the eligible account is BBVA Savings.

- For accounts opened in branch or by calling 1-844-BBVA USA, eligible accounts include BBVA Savings, Build My Savings, and Young Savers.

- The BBVA savings account holder must be an account holder on the new BBVA consumer checking account.

- You must be a new BBVA savings customer who has not had a BBVA consumer savings account in the past 36 months or closed due to a negative balance.

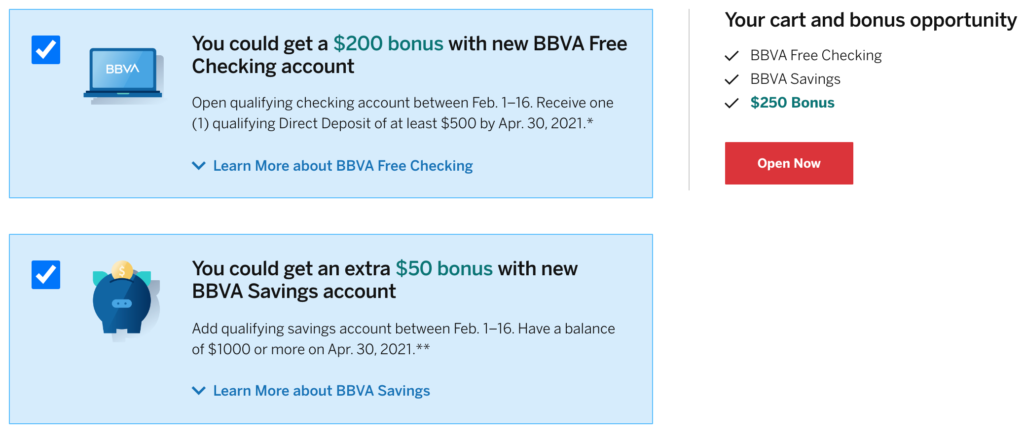

The Application Process

The application process was straightforward.

STEP 1:

If you plan to participate in both the Checking and Savings Account promotions, make sure you check both as it may be difficult to undo if you change your mind later on.

STEP 2:

Fill out your personal information. If you already have an existing BBVA credit card, sign in to your account and your personal information will auto-populate.

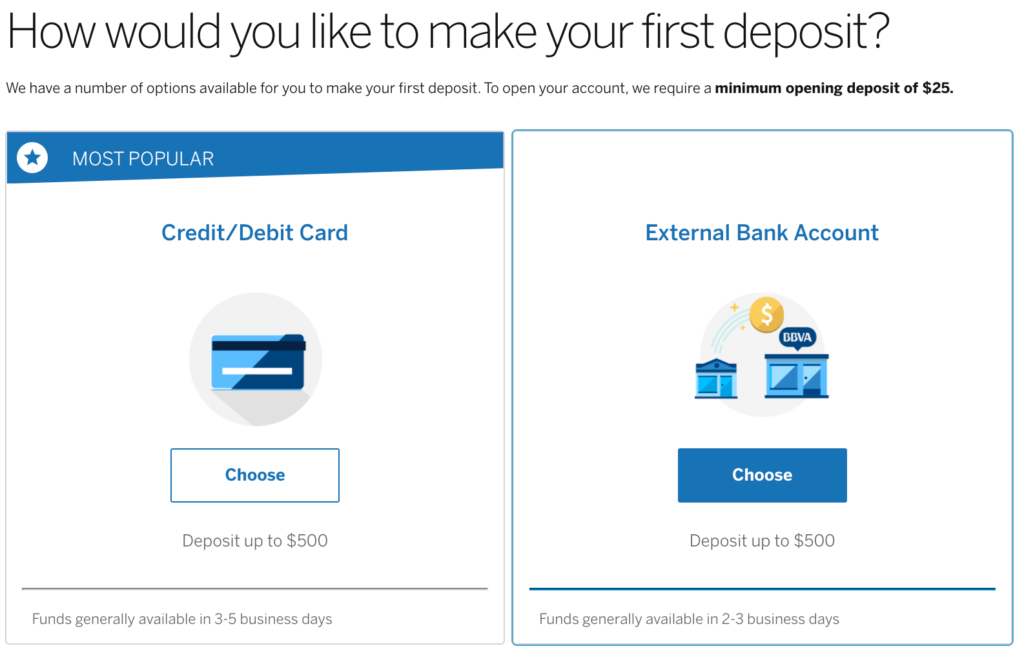

STEP 3:

Choose your funding source. I was tempted to use a gift card (debit card) to see if it will be allowed but just realized that I had run out of them. So, I picked the “External Bank Account” option instead. I entered my bank information, including routing and account numbers to initiate the funding of my new BBVA accounts.

STEP 4:

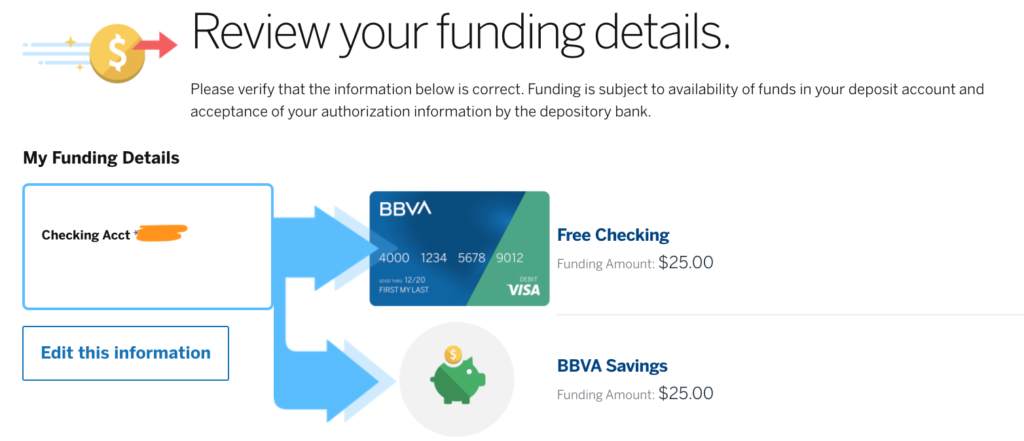

Review your funding details, then hit submit. Make sure that you are depositing at least $25 to each new account to satisfy the conditions of this promotion.

STEP 5:

Once you are approved, BBVA will provide you with your account and routing numbers.

Please save this information on a spreadsheet as you will need it in the near future (before April 30, 2021) when you set-up direct deposit and transfer additional funds to meet the $1000 requirement.

STEP 6:

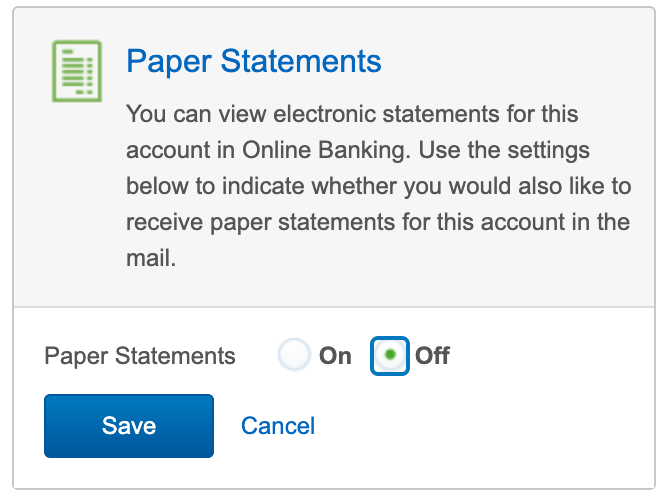

Do not forget to activate E-Statements to avoid a $3 monthly fee. You can always opt-out of paper statements by logging on to your profile in case you inadvertently bypassed this step during the application process.

Return of Investment

- Checking: $200 from $500 Direct Deposit: 40% Profit

- Savings: $50 from $1000 Deposit: 5% Profit

- Both: $250 from the combined deposit of $1500: 16.66% Profit

Hard or Soft Pull

Even though Doctor of Credit reports that BBVA does soft pulls, my experience was different. I immediately received an email notification from Lifelock indicative of a hard pull. Also, I got additional datapoint from Suzanne of TravelswithSuz.com that she got a hard pull as well.

Therefore, if you are planning to purchase a house, car, or refinance, I’d steer clear from this offer as it can adversely impact your credit score, albeit temporarily.

Final Thoughts

Receiving bank bonuses is one of my favorite ways of earning passive income. As a matter of fact, I try to participate in several offers year after year.

As a result, the profit I earn immediately gets diverted to either my emergency fund, travel bucket, or retirement accounts.

Moreover, bank bonuses provide an opportunity to put our saved money to work, so our cash essentially becomes our employees and churns additional revenue for us even in our sleep.

Deals offered by banks ordinarily involve no more than an hour to set up. Yet the returns are significantly more favorable than keeping your hard-earned cash trapped in your current savings account.

While this offer may not be the most generous deal out there, the relatively low deposit requirements make this an easy money-maker nonetheless.

Good luck!

ADVERTISER DISCLOSURE: The Frugal Tourist is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as MileValue.com and Cardratings. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All information about the American Express Schwab Platinum has been collected independently by The Frugal Tourist.

EDITORIAL DISCLOSURE: Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities.

USER-GENERATED CONTENT DISCLOSURE: The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.

Good stuff! One point: I believe what I saw indicated that the bonuses will be paid out in July, rather than June.

And…it’s definitely a hard pull.

Thanks! This is Great!!!!

Thank you! The dates are now corrected!

BTW – I received the bonuses in March (checking) and April (savings) – thanks for the heads up!