ADVERTISER DISCLOSURE: The Frugal Tourist is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as MileValue.com and Cardratings. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All information about the American Express Schwab Platinum has been collected independently by The Frugal Tourist.

EDITORIAL DISCLOSURE: Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities.

This blog post explains how to transfer Chase Ultimate Rewards Points to Southwest Rapid Rewards.

The Southwest Rapid Rewards program is one of the best programs for domestic travel.

You get two free checked bags per person, no cancelation or change fees, and there are frequent sales. The Companion Pass is also an excellent deal for travelers.

Chase is currently the only bank that partners with Southwest.

Chase Ultimate Rewards Points is a popular travel points currency among points enthusiasts and frugal tourists like myself.

Since Southwest Airlines is a transfer partner of Chase, earning Chase Ultimate Rewards (UR) points can essentially accumulate Southwest Airlines miles.

Earning Ultimate Rewards Points is relatively easy and straightforward – it is typically accumulated through generous sign-up bonuses and regular spending using any of the credit cards below:

| Chase Personal Credit Cards That Earn Ultimate Rewards Points | Chase Business Credit Cards That Earn Ultimate Rewards Points |

|---|---|

| Chase Freedom Unlimited® | Ink Business Cash® Credit Card |

| Chase Freedom Flex® | Ink Business Unlimited® Credit Card |

| Chase Sapphire Preferred® Card | Ink Business Preferred® Credit Card |

| Chase Sapphire Reserve® |

Feel free to skip to Instructions on How to Transfer Chase Ultimate Rewards to Southwest Rapid Rewards if you already know why transferring to a Chase premium card is necessary before we can initiate this transfer.

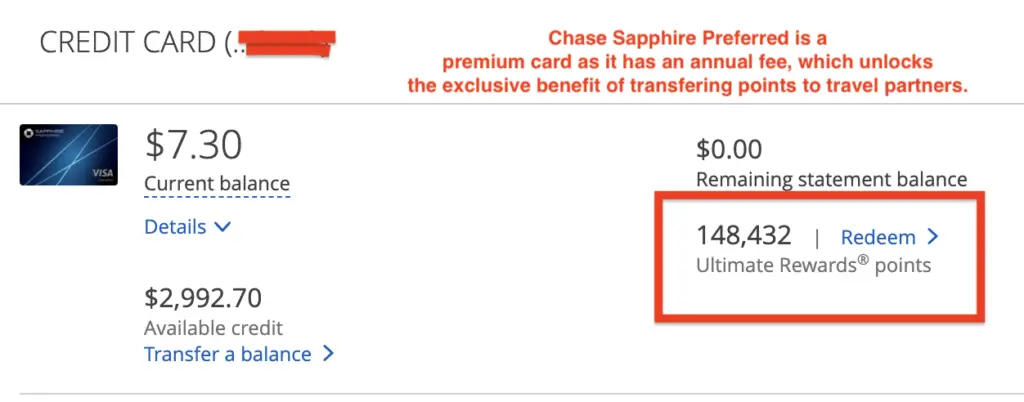

Important: You Need to Own A Chase Premium Card

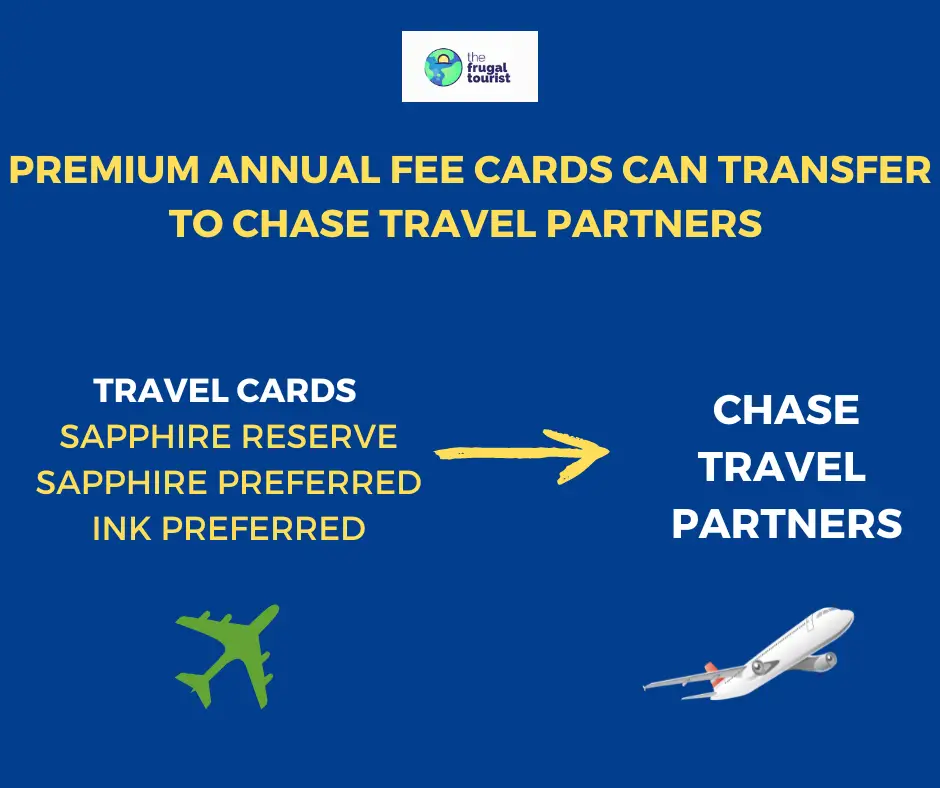

You only need one of these Chase premium cards to transfer Chase Ultimate Rewards Points to the Southwest Airlines Rapid Rewards Program.

| Chase Premium Credit Cards |

|---|

| Chase Sapphire Preferred® Card Chase Sapphire Reserve® Ink Business Preferred® Credit Card |

Heads Up: Without one of these three Chase premium cards, you cannot transfer your Chase Ultimate Rewards points to the Southwest Airlines Rapid Rewards Program or any of Chase’s Travel Partners. In my opinion, the Chase Sapphire Preferred is the best of the three.

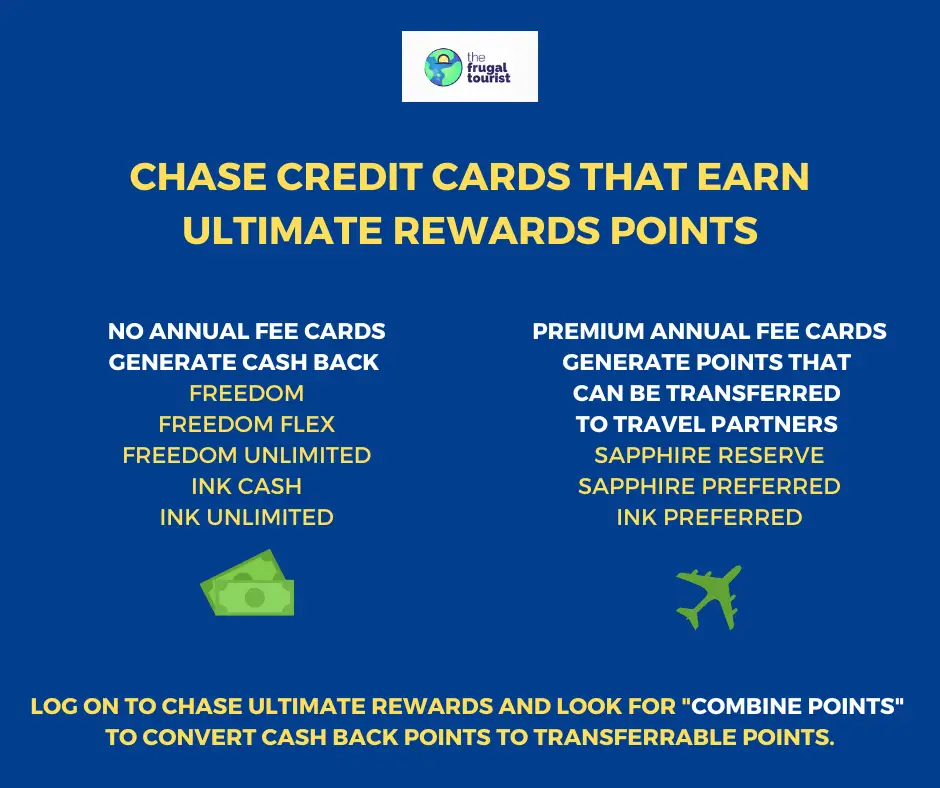

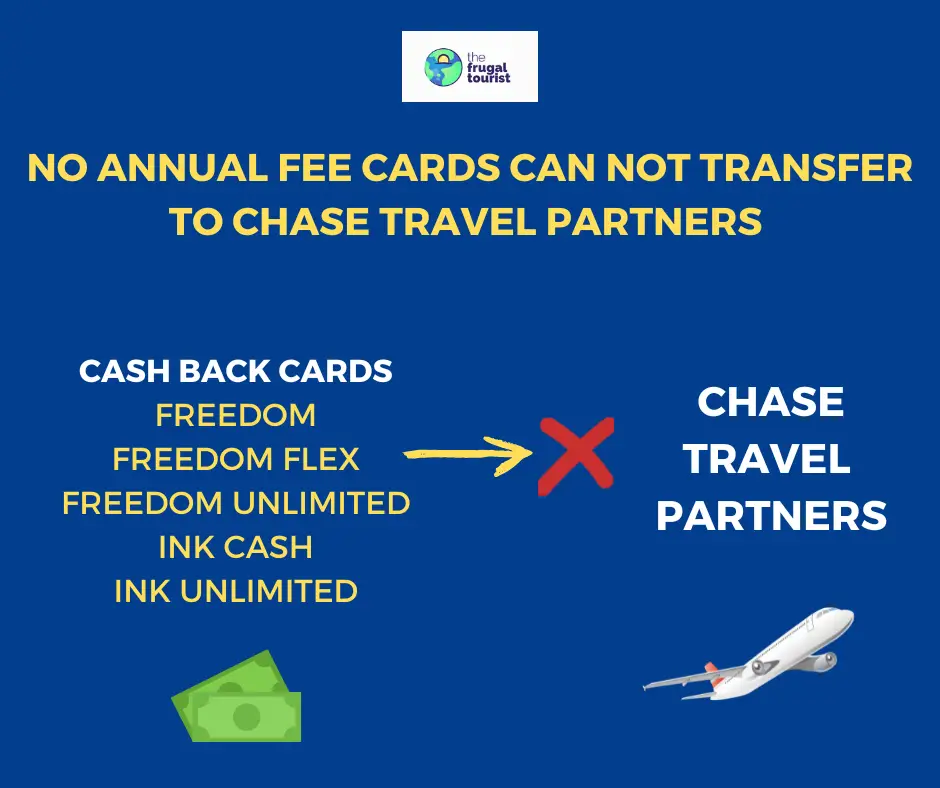

Deep Dive on Chase Credit Cards: No Annual Fee Cashback Cards versus Premium Cards

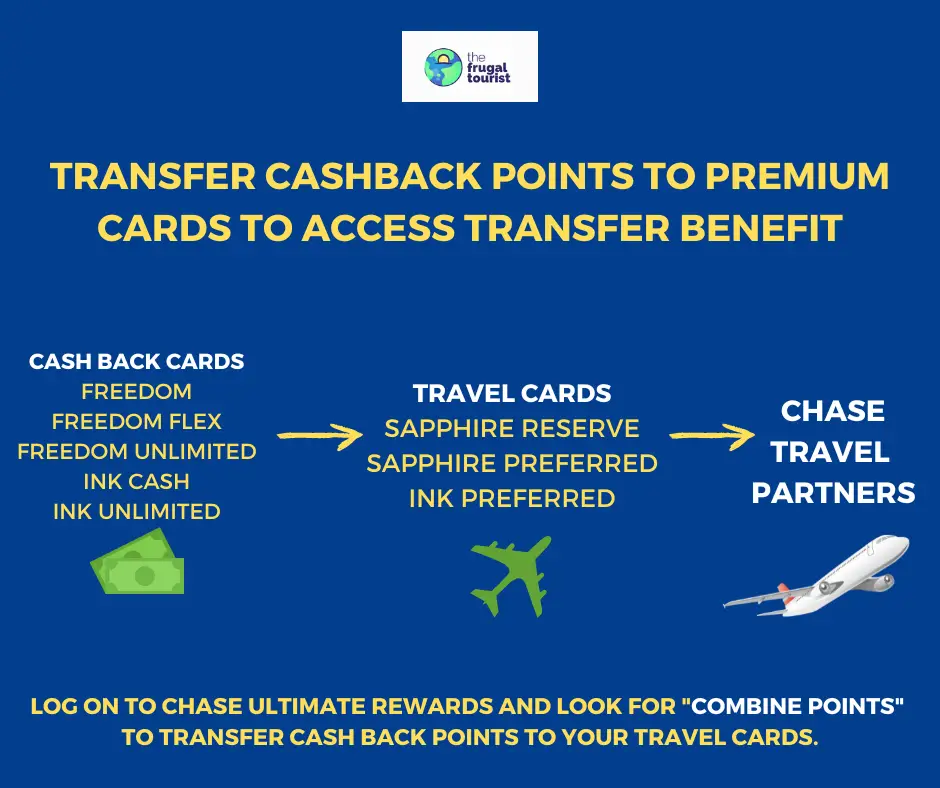

Before we proceed with the steps involved in transferring Chase Ultimate Rewards Points to the Southwest Airlines Rapid Rewards Program, we must understand the difference between no-annual-fee cashback cards and premium Chase cards.

The table below illustrates which category each card belongs in.

| No-Annual-Fee Cards | Premium Cards (AF=Annual Fee) |

|---|---|

| Chase Freedom / Flex | Chase Sapphire Preferred ($95 AF) |

| Chase Freedom Unlimited | Chase Sapphire Reserve ($550 AF) |

| Ink Business Cash | Chase Ink Business Preferred ($95 AF) |

| Ink Business Unlimited |

To soften the blow of the steep annual fees on Chase’s premium cards, the bank provides additional benefits to consumers unavailable to those with no-annual-fee cards.

One of these valuable premium Chase card benefits is having access to my all-time favorite Ultimate Rewards (UR) redemption option – TRANSFER TO TRAVEL PARTNERS.

Redemption Options for Chase No-Annual-Fee Cashback Cards and Premium Cards

Let’s compare the redemption options of “no-annual fee” cashback cards versus premium travel cards.

Redemption Options for No-Annual-Fee Cards

| No-Annual-Fee Chase Card Redemption Options |

|---|

| Travel Pay Yourself Back Gift Cards Chase Dining Cash Back Pay With Points |

At first glance, you might think that the choices are pretty generous for no-annual-fee cards, specifically, the cashback and gift card options.

But if you want to maximize the value of your Chase Ultimate Rewards Points, it is recommended that you explore redemption methods other than cashback, especially if you also have a premium card.

Unless you have an emergency and need cash, exchanging your hard-earned points for cash or gift cards will not generate the best bang for your buck.

Redemption Options for Premium Chase Cards

| Premium Chase Card Redemption Options |

|---|

| Travel Pay Yourself Back Gift Cards Chase Dining Cash Back Pay With Points Transfer to Travel Partners |

The table above shows that “Transfer to Travel Partners” became a redemption option for Chase premium cards.

This exclusive “transfer benefit” will appear on your Chase Sapphire Preferred, Chase Sapphire Reserve, or Chase Ink Business Preferred accounts because they are all premium cards but not in your no-annual-fee cards.

Transfer Chase Ultimate Rewards to Travel Partners Such As Southwest Airlines Rapid Rewards

It is essential to underscore that each Ultimate Rewards Point is not created equal.

The value of each Ultimate Rewards Point will depend on whether they originate from a premium card or a no-annual-fee card.

Even if no-annual-fee cards generate Ultimate Rewards Points, you cannot transfer your points to travel partners like Southwest Airlines unless you have one of Chase’s premium cards.

Therefore, I strongly recommend owning at least ONE premium Chase card because this incredibly fantastic redemption benefit would not be possible without one.

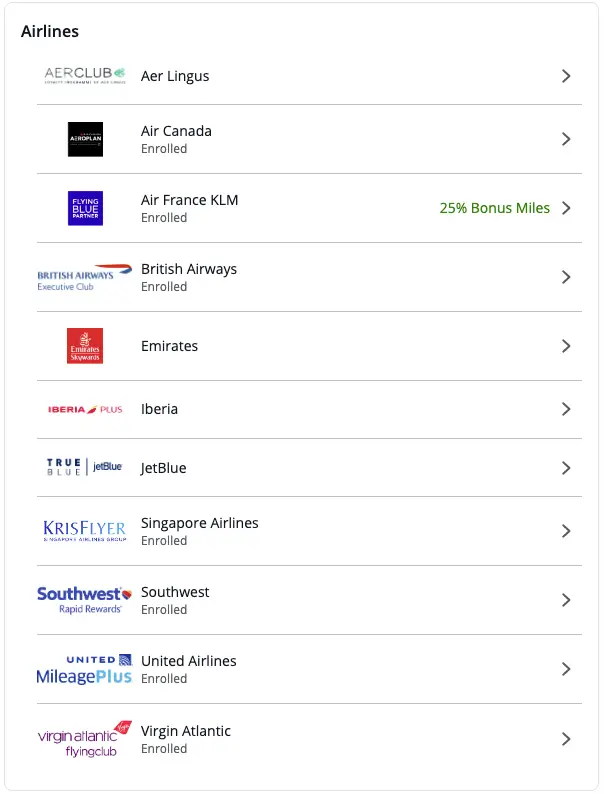

Chase Travel Partners

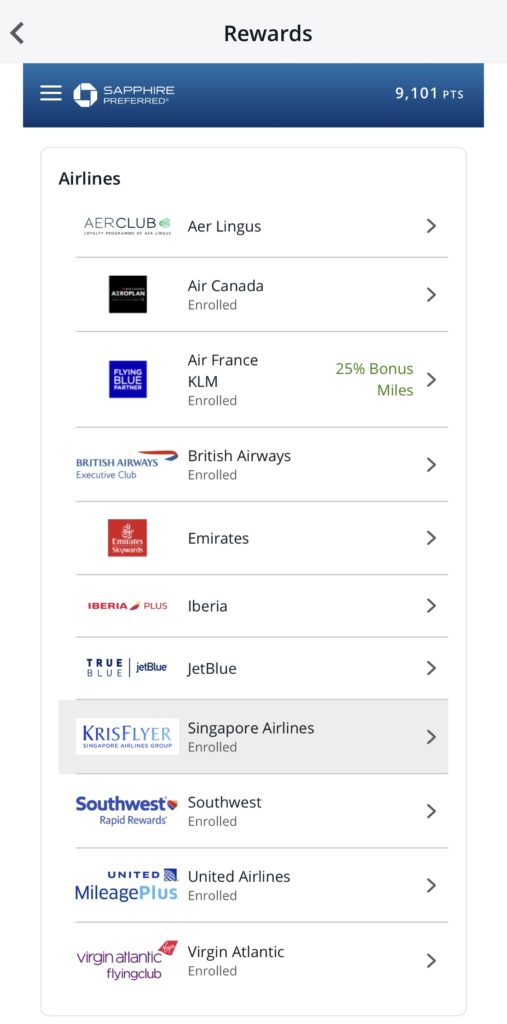

The image below lists all the other Chase travel partners.

Please check their website regularly.

It is not unusual for Chase to initiate new relationships (Hello, Aer Lingus!) and terminate old ones (Bye, Korean Air).

What if my Ultimate Reward Points are in my No-Annual Fee Cashback Cards?

Should you find most of your points in a no-annual-fee card, do not worry.

Chase allows the transfer of points between Chase Ultimate Rewards credit cards.

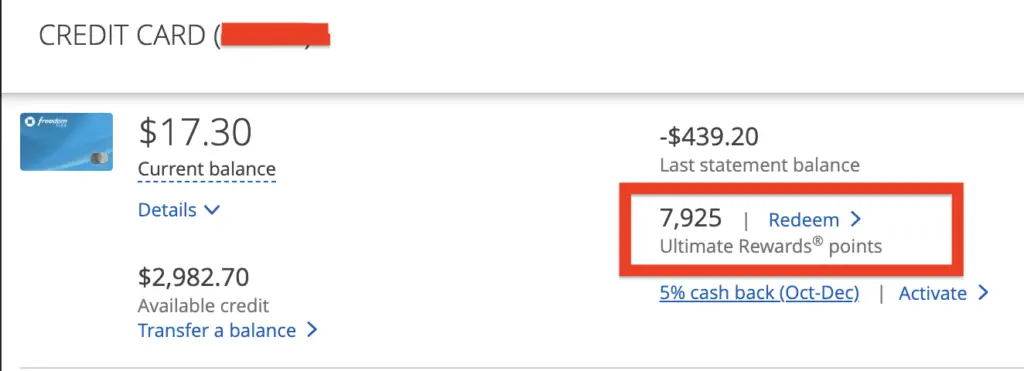

Log in to your Chase account and click any of your Ultimate Rewards-earning credit cards.

Look for the “Ultimate Rewards Points” button, then click “Redeem” to access your points.

Next, click the “Rewards Details” dropdown arrow to find “Combine Points“.

If this is your first time combining Chase Ultimate Rewards Points, please continue reading for a step-by-step walkthrough.

As a general rule of thumb, I suggest transferring all of your no-annual-fee (cash back) Chase Ultimate Rewards Points to your premium cards, so you can have the ability to move your Chase Ultimate Rewards Points to travel partners, such as Southwest Rapid Rewards anytime.

This transfer also significantly increases the worth of your Ultimate Rewards Points acquired from your no-annual-fee cards, making them all the more valuable.

What if my Personal and Business Credit Cards have Different Log-In Information?

Before transferring your Chase Ultimate Rewards Points between your personal and business credit cards, you must merge your personal and business accounts.

To do so, you can call Chase’s customer service using the phone number on any of your Chase credit cards and request that your accounts be combined into one profile.

“Can you link my personal and business accounts so I only need one username and password?”

During the call, you must provide your personal and business account information to verify your identity. After verification, the agent will then merge both accounts.

Once the accounts are linked, you’ll be able to access all of your accounts with one login and password.

This can save you time and make managing your finances and Chase Ultimate Rewards Points easier.

Whether you have questions about the linking process or need assistance with anything else, Chase’s customer support team is available 24/7 to provide help and support.

Steps for Combining Points or Converting No-Annual-Fee Cashback Points to Premium Travel Points

STEP 1:

Log in to your Chase profile and select one of your Chase cards that earns Ultimate Rewards points.

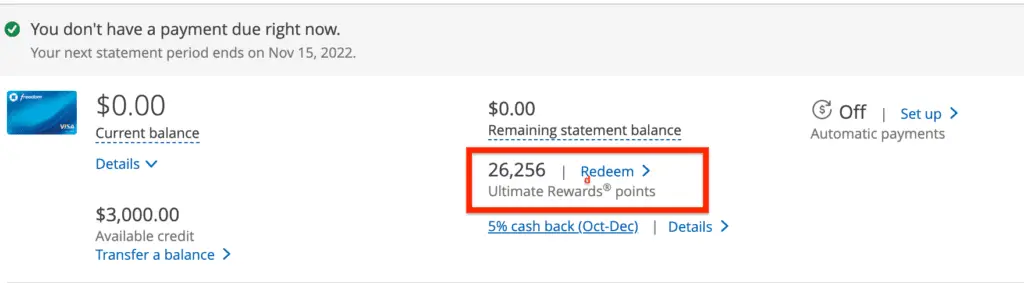

In the image below, I selected my Chase Freedom Flex, which currently has 7,925 Chase Ultimate Rewards Points.

I then click “Redeem” in the Ultimate Rewards points section (inside the red box).

STEP 2:

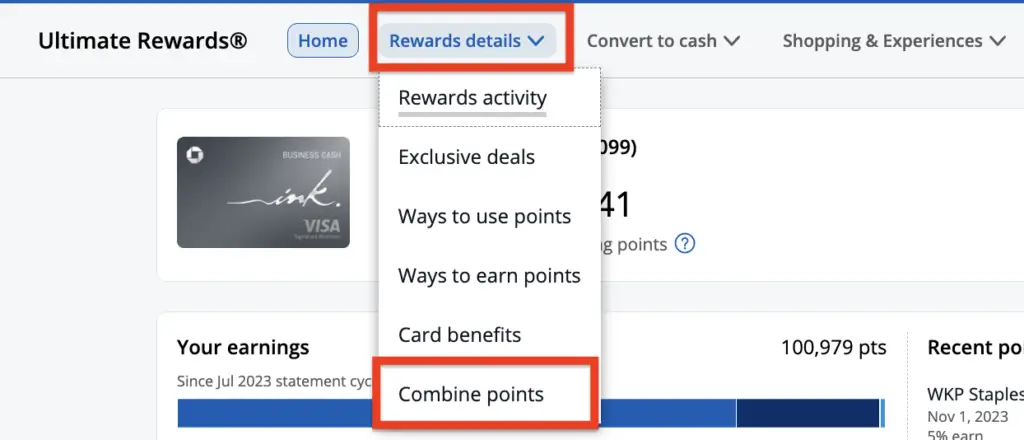

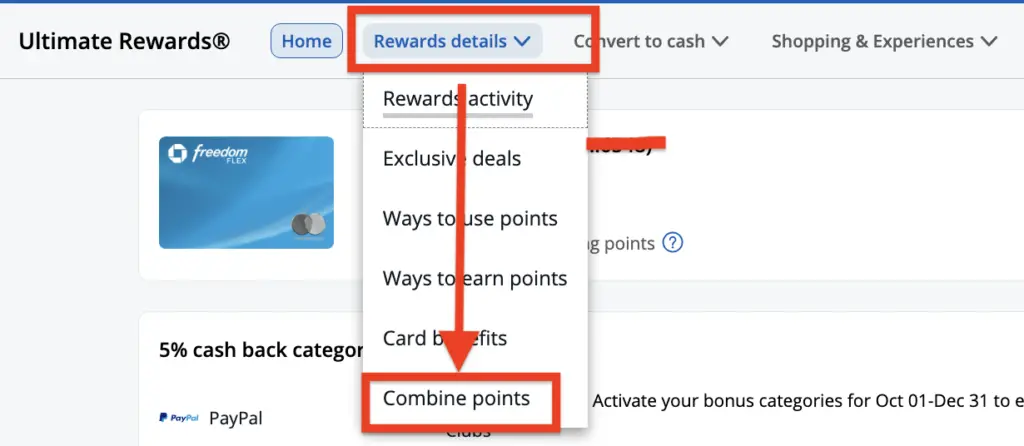

Clicking “Redeem” will lead you to the “Ultimate Rewards” page.

Click the “Rewards Details” drop-down menu, then navigate to “Combine Points“.

STEP 3:

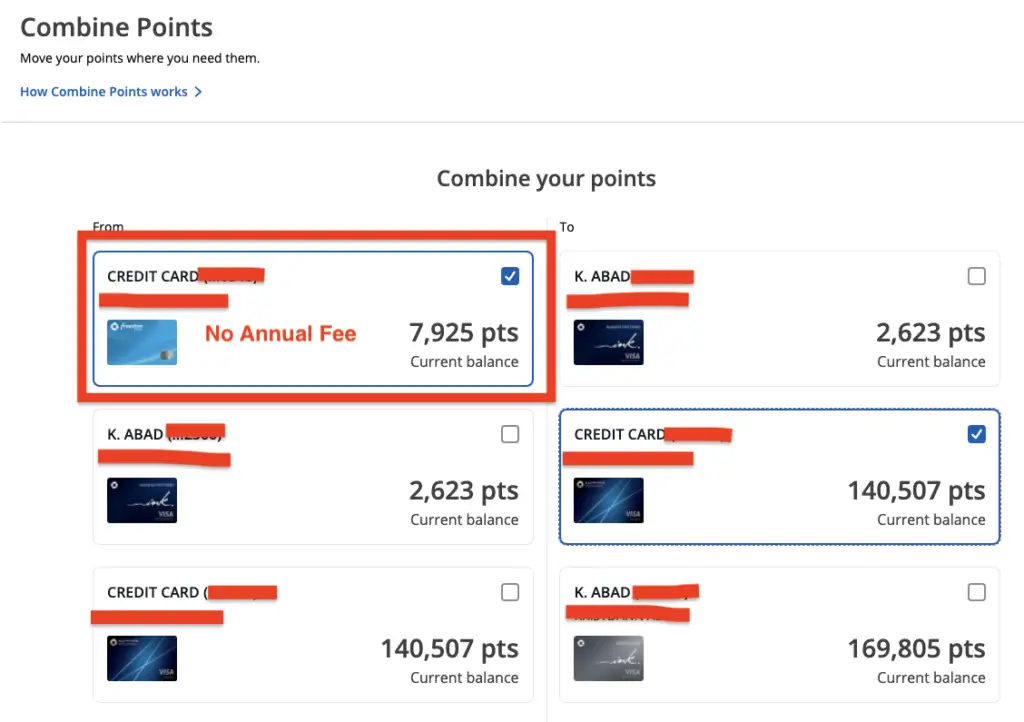

Click “Combine Points,” then select a no-annual-fee card under “From” on the left column.

In the example below, I selected my no-annual-fee Chase Freedom Flex.

This account will have the points you will transfer to a premium Chase card.

STEP 4:

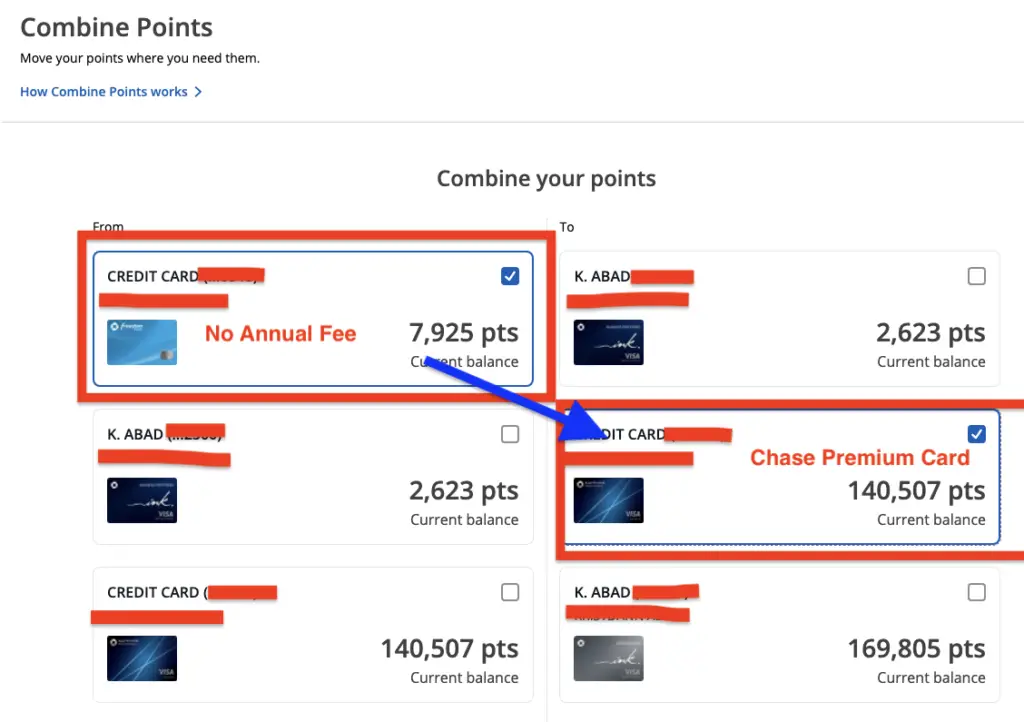

Select a premium card under “To”, which is the Chase card where you want your points to go.

In the image below, I am moving points from my no-annual-fee Chase Freedom Flex to my premium card, the Chase Sapphire Preferred® Card.

STEP 5:

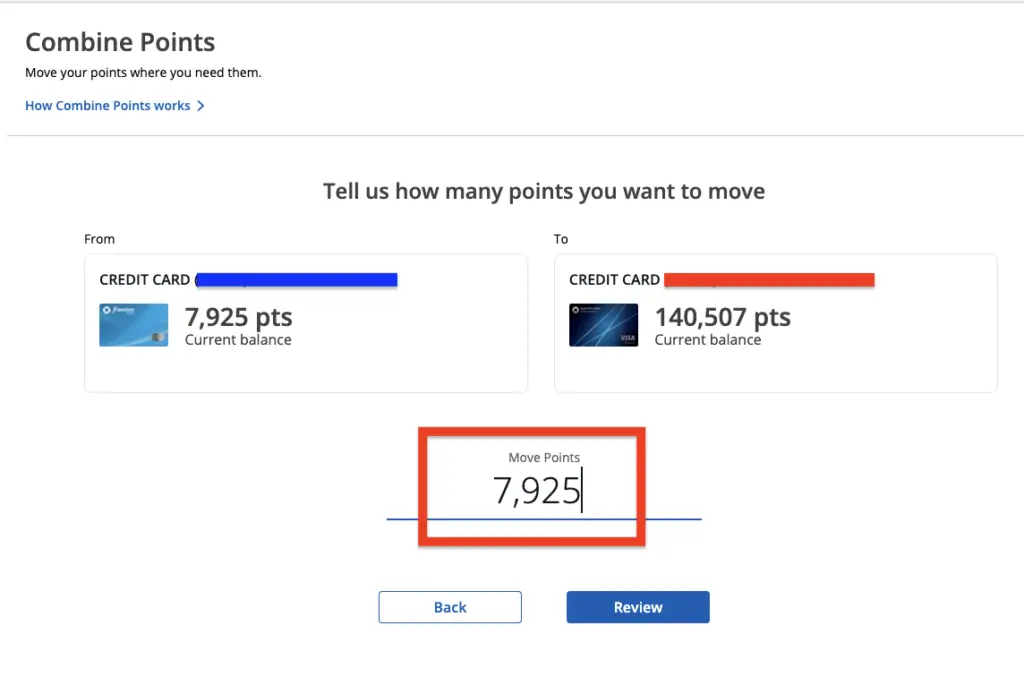

Initiate the transfer by clicking “Continue.”

You will be directed to a page where you can indicate the number of points you would like to transfer to your premium card.

Since the value of your no-annual-fee Ultimate Rewards points significantly increases when transferred to a premium card, I highly suggest transferring all of your points.

Generally speaking, you would always want your Ultimate Rewards Points stored in one of your premium cards.

Click “Review” once you have made your selection.

If you have two premium cards that include the Chase Sapphire Reserve®, transfer all of your points to the CSR, as that provides the best redemption value among all the other Chase cards.

STEP 6:

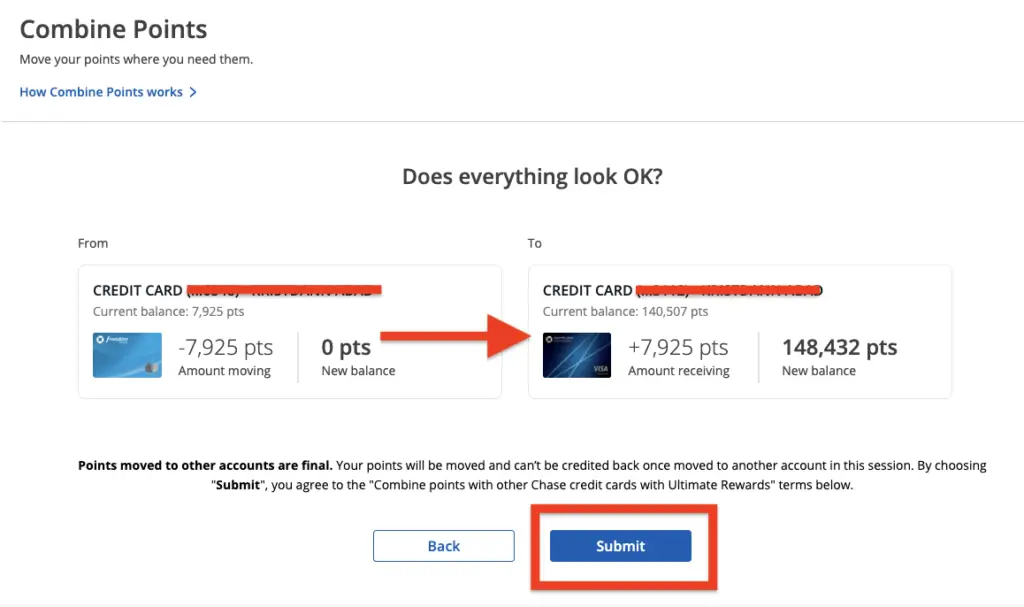

Chase will give you another opportunity to review your selection.

You want to ensure that you transfer no-annual-fee Ultimate Rewards Points to a premium card and not vice versa.

In this example, I am moving my Ultimate Rewards Points from my no-annual-fee Chase Freedom Flex to the Chase Sapphire Preferred, a premium card.

Confirm & Submit.

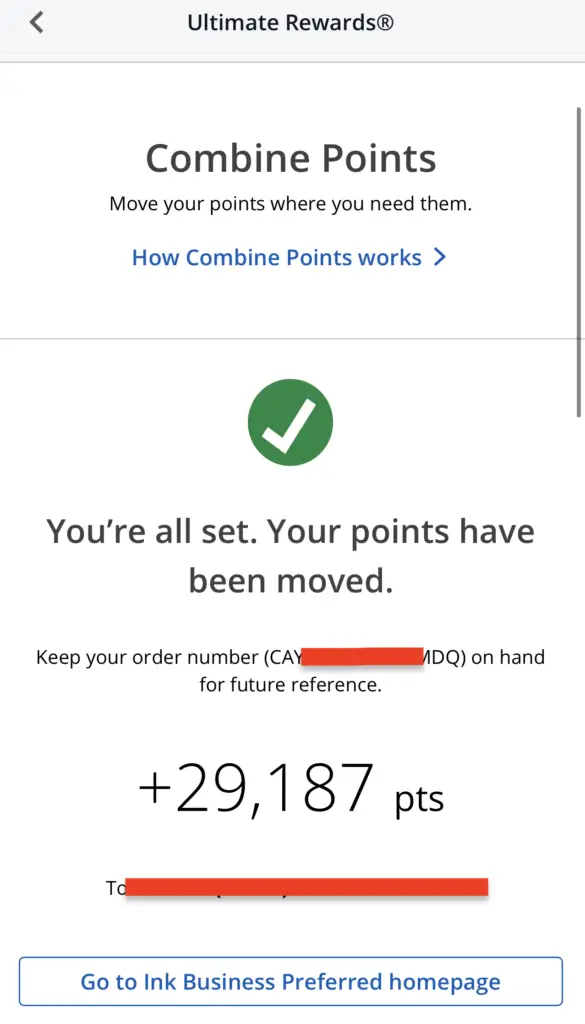

STEP 7:

Once you have completed this transfer, you will be notified if the transfer was successful.

Once your points are in your premium card, you can now transfer your Ultimate Rewards Points to your Southwest Airlines Rapid Rewards Account (see next section).

Pro Tip: If you are part of a couple/family who lives in the same address, transferring Chase Ultimate Rewards Points between different individual accounts (between player 1 and player 2) is possible. Holding two premium cards is no longer necessary as long as you meet Chase’s criteria as a household member. One player can keep a premium card, and the other can continue accumulating no-annual-fee Ultimate Rewards Points that can be easily transferred to the owner of the premium card. You need to call Chase to initiate this transfer.

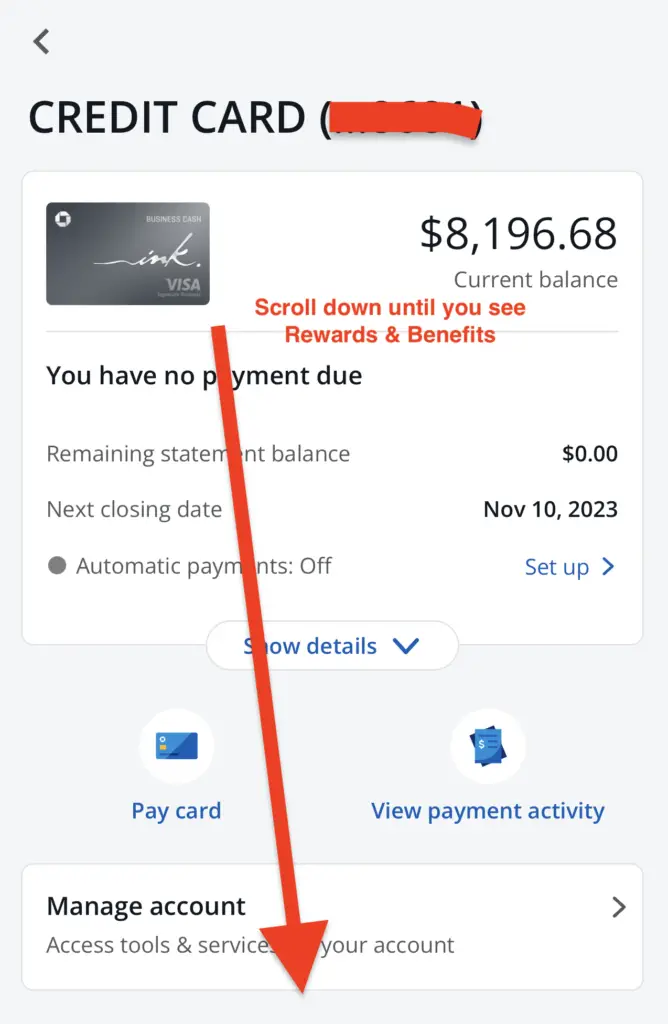

Steps for Combining Chase Ultimate Rewards Points (Mobile App)

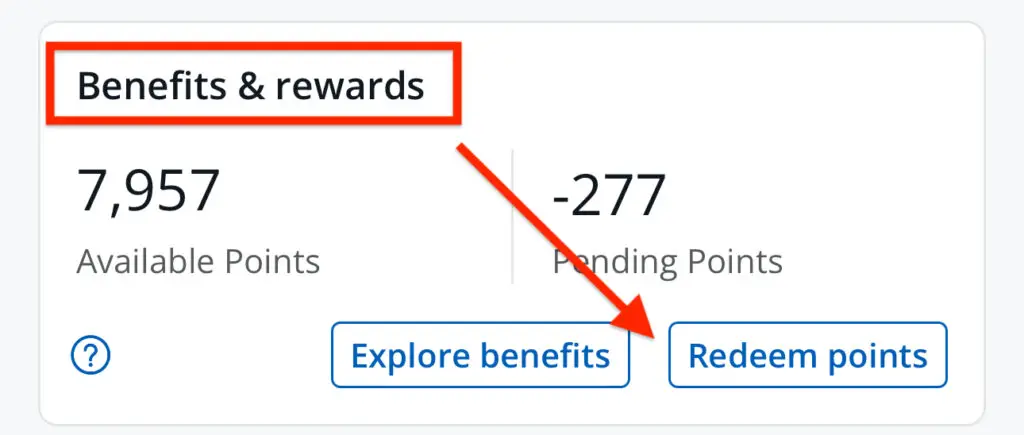

STEP 1:

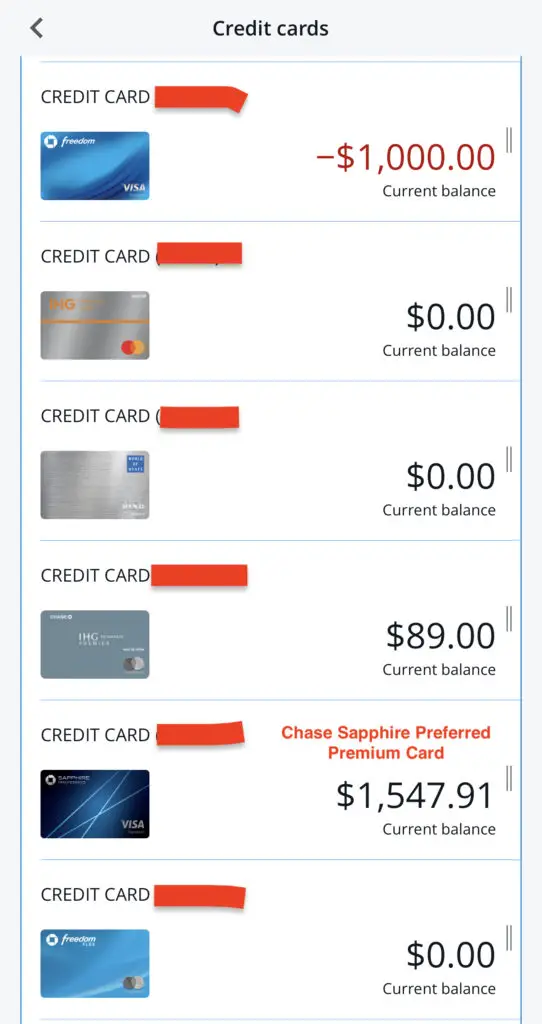

Log in to your Chase profile and select one of your Chase cards that earns Ultimate Rewards points.

In the image below, I selected my Chase Ink Business Cash card.

Scroll down until you see the “Benefits and Rewards” section.

Click the “Redeem Points“.

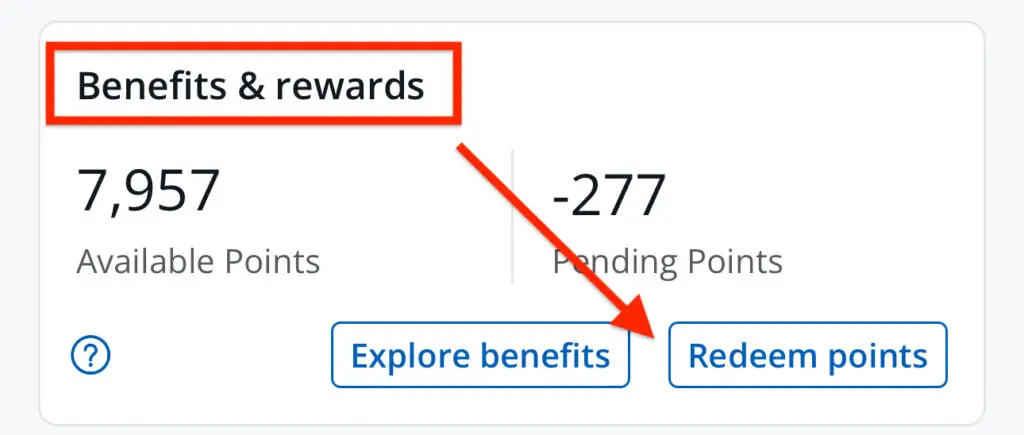

STEP 2:

Navigate down to “Combine Points“.

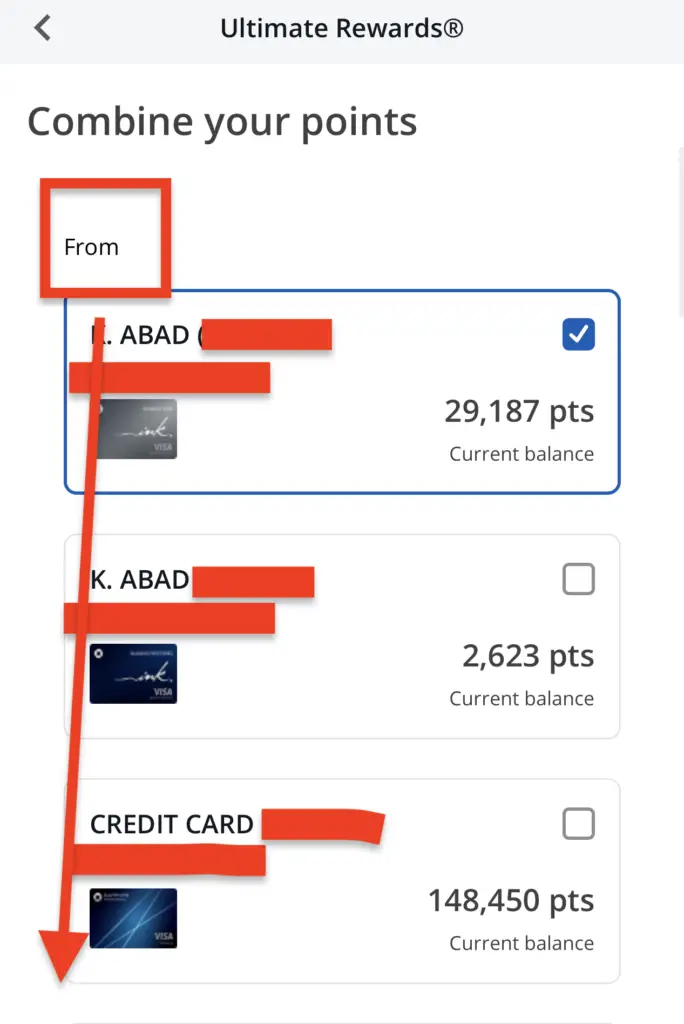

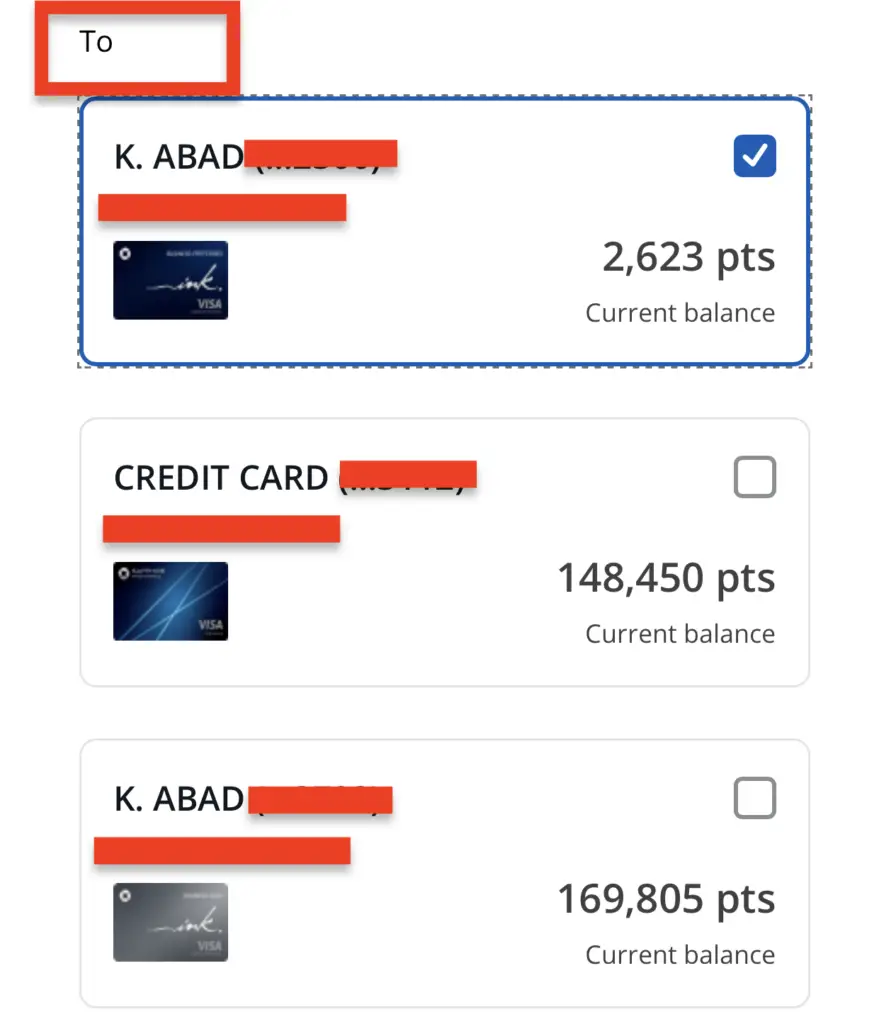

STEP 3:

Select your “No-Annual-Fee” Chase card under “From“.

Then, select a Chase premium card under “To“.

In the example below, I am moving Chase Ultimate Rewards Points from my no-annual-fee Chase Ink Business Cash card to my Chase Ink Business Preferred card, a premium card.

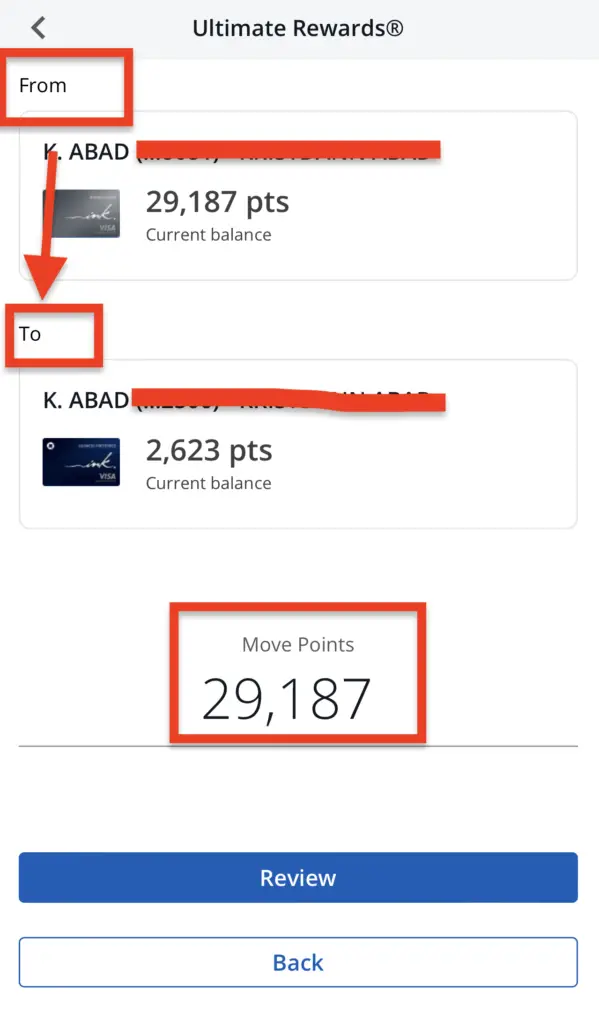

STEP 4:

You will be directed to a page where you can indicate the number of points you would like to transfer to your premium card.

Since the value of your no-annual-fee Chase Ultimate Rewards points significantly increases when transferred to a premium card, I highly suggest transferring all of your points.

Generally speaking, you would always want your Ultimate Rewards Points stored in one of your premium cards.

Click “Review” once you have made your selection.

If you have two premium cards that include the Chase Sapphire Reserve®, transfer all of your points to the CSR, as that provides the best redemption value among all the other Chase cards.

STEP 5:

Chase will give you another opportunity to review your selection.

Again, you should ensure that you are transferring no-annual-fee Ultimate Rewards Points to a premium card and not vice versa.

Confirm & Submit.

Congratulations! You are now ready to transfer your Chase Ultimate Rewards Points to Chase’s many travel partners.

Join Other Points Enthusiasts In Our Free Travel Miles & Points Facebook Group

Steps on How to Transfer Chase Ultimate Rewards to Southwest Airlines Rapid Rewards

Assuming that you already have your Ultimate Rewards Points in either the Chase Sapphire Reserve®, Chase Sapphire Preferred® Card, or Ink Business Preferred® Credit Card, transferring to the Southwest Airlines Rapid Rewards Program is pretty straightforward.

STEP 1:

Make sure that you have a Southwest Airlines Rapid Rewards Account.

Registering is free. Once you have your Southwest Rapid Reward account number, please write it down on paper, as we will need it shortly.

If you do not yet have a Southwest Rapid Rewards account, click the button below to sign up. It is free to enroll.

STEP 2:

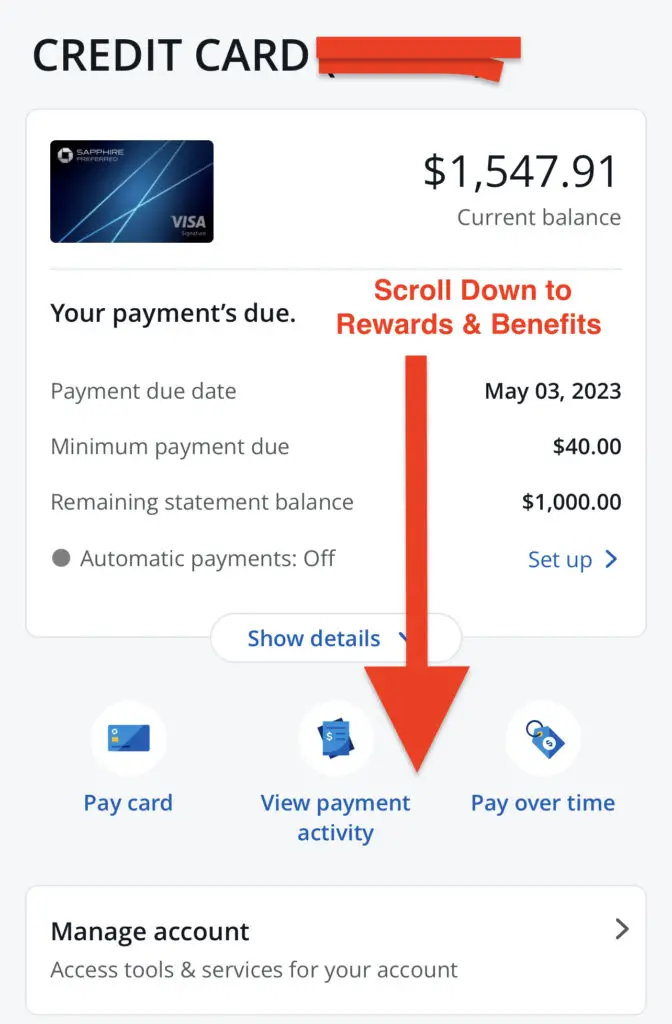

Go to Chase.com, then Access One of Your Premium Cards.

Each premium card will give you the option to access Ultimate Rewards.

In this example, I transferred Chase Ultimate Rewards Points from my Sapphire Preferred Card, a premium card.

Click “Redeem Ultimate Rewards points.” You will then be directed to the Ultimate Rewards Page.

You can transfer points from your other no-annual-fee Chase cards to your premium card if you do not have sufficient points.

Please see the previous sections for steps to “Combine Points.”

STEP 3:

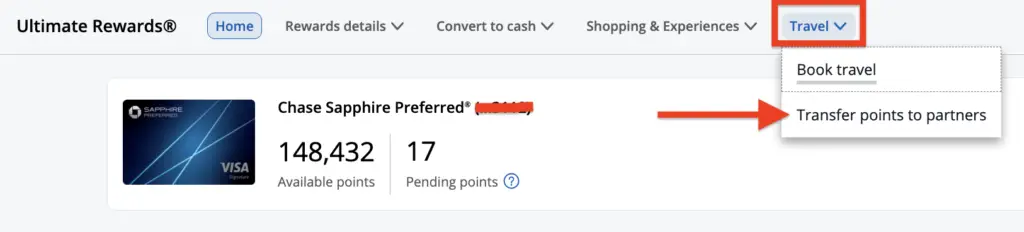

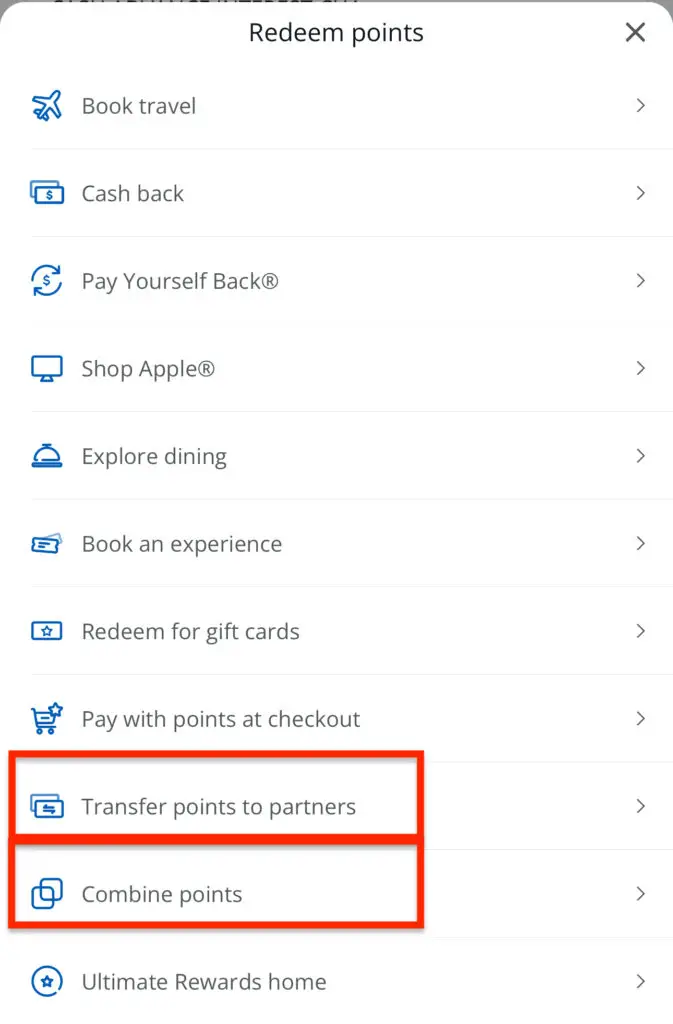

On the Ultimate Rewards page, click the “Travel” drop-down arrow and then navigate to “Transfer Points to Partners. “

Southwest Rapid Rewards is one of Chase’s many travel partners.

STEP 4:

Look for Southwest Airlines Rapid Rewards and click the right arrow to proceed to the transfer.

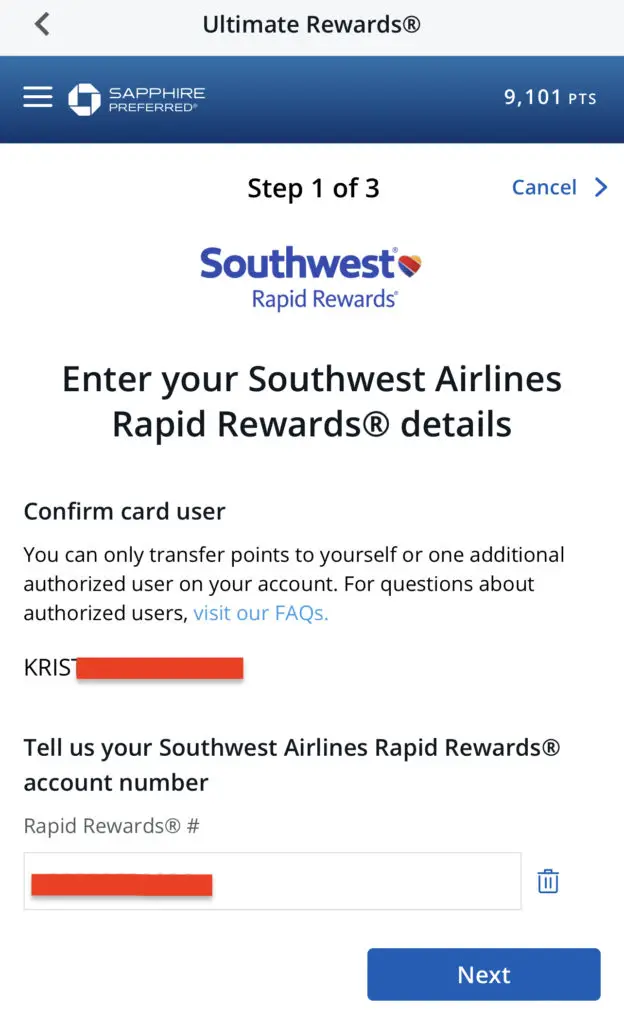

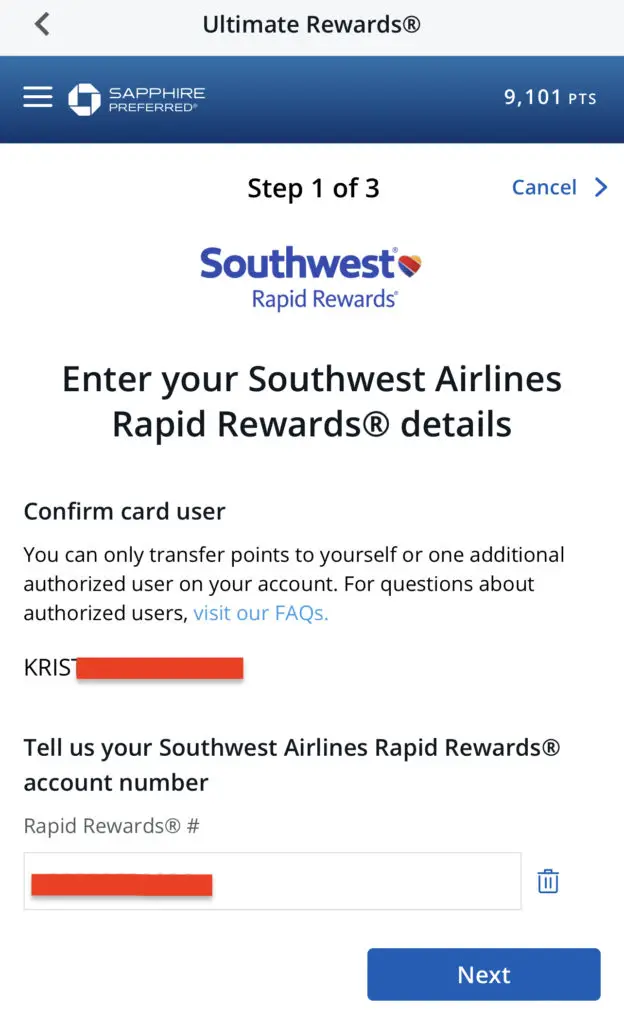

STEP 5:

Enter your Southwest Airlines Rapid Rewards Account Number.

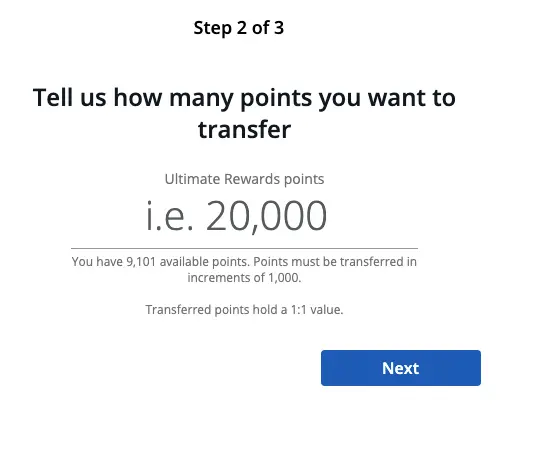

STEP 6:

Type in the number of points you would like to transfer in 1,000 Ultimate Rewards Points increments.

The minimum amount that you can transfer is 1,000 Ultimate Rewards points.

The transfer ratio is 1:1, so 1 Ultimate Rewards Point = 1 Southwest Airlines Rapid Rewards Mile.

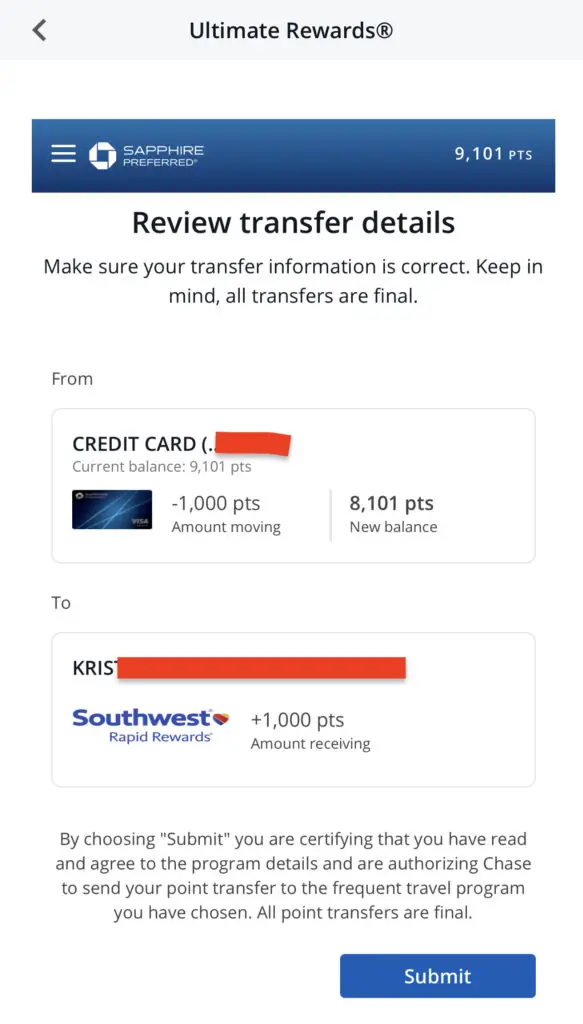

STEP 7:

Verify if all the information you entered is correct, then click “Confirm & Submit.”

STEP 8:

After the transfer, check your Southwest Rapid Rewards account, then book your flight.

Moving Ultimate Rewards Points from Chase to Southwest is typically instant, so refresh your browser if you do not see your points show up instantly.

How Fast/Long Does It Take For Chase Ultimate Rewards Points To Transfer to the Southwest Airlines Rapid Rewards Program?

If you make this transfer for the first time, it may take a few days to complete.

Conversely, if you have already transferred Chase Ultimate Rewards Points to Southwest in the past, then the transfer should be instant.

This can change over time, though.

Do Southwest Rapid Rewards Miles Expire?

No, they no longer expire.

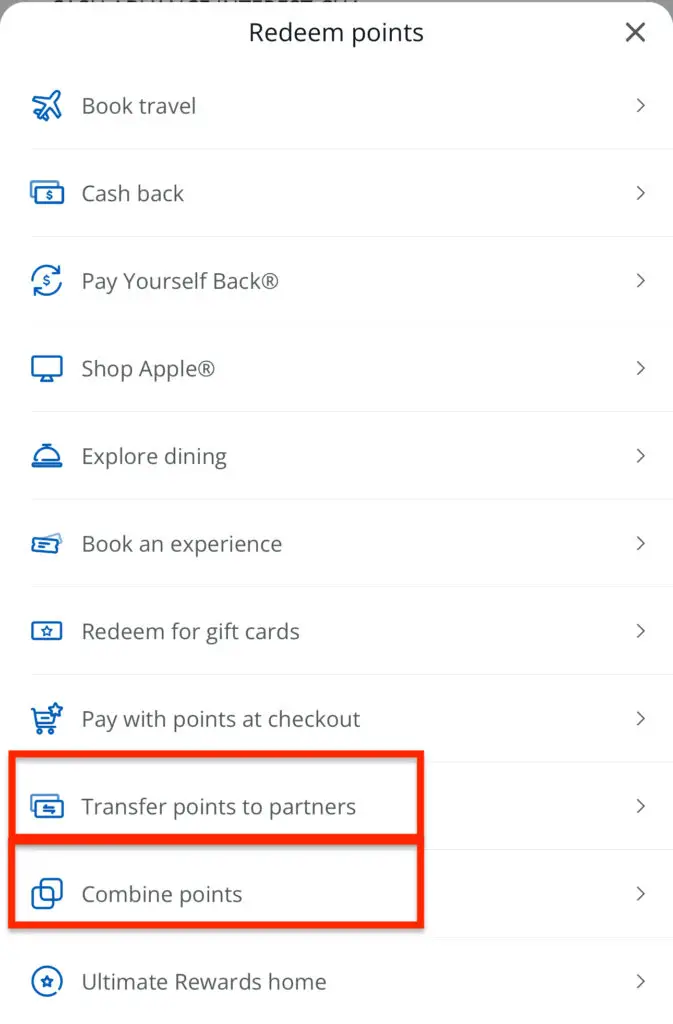

Transferring Chase Ultimate Rewards to Southwest Rapid Rewards on the Chase Mobile App

Performing the above functions, such as combining points and transferring to travel partners, using the Chase Mobile app can initially be a bit confusing.

Here are the steps to navigate the Chase Mobile App to quickly transfer your Chase Ultimate Rewards Points wherever you are.

STEP 1:

Log in to your Chase account using your Chase Mobile App, then select a Chase Premium Card.

In this example, I will access my Chase Ultimate Rewards points through my Chase Sapphire Preferred® Card.

STEP 2:

Under your premium card, navigate to the “Benefits and Rewards” section, then click “Redeem Points”.

STEP 3:

Navigate to “Transfer Points to Partners“.

STEP 4:

Select Southwest Rapid Rewards from the list of Chase’s travel partners.

STEP 5:

Enter your Southwest Rapid Rewards Number.

Before transferring your points, make sure you sign up for a Southwest Rapid Rewards account, as Chase will require this information.

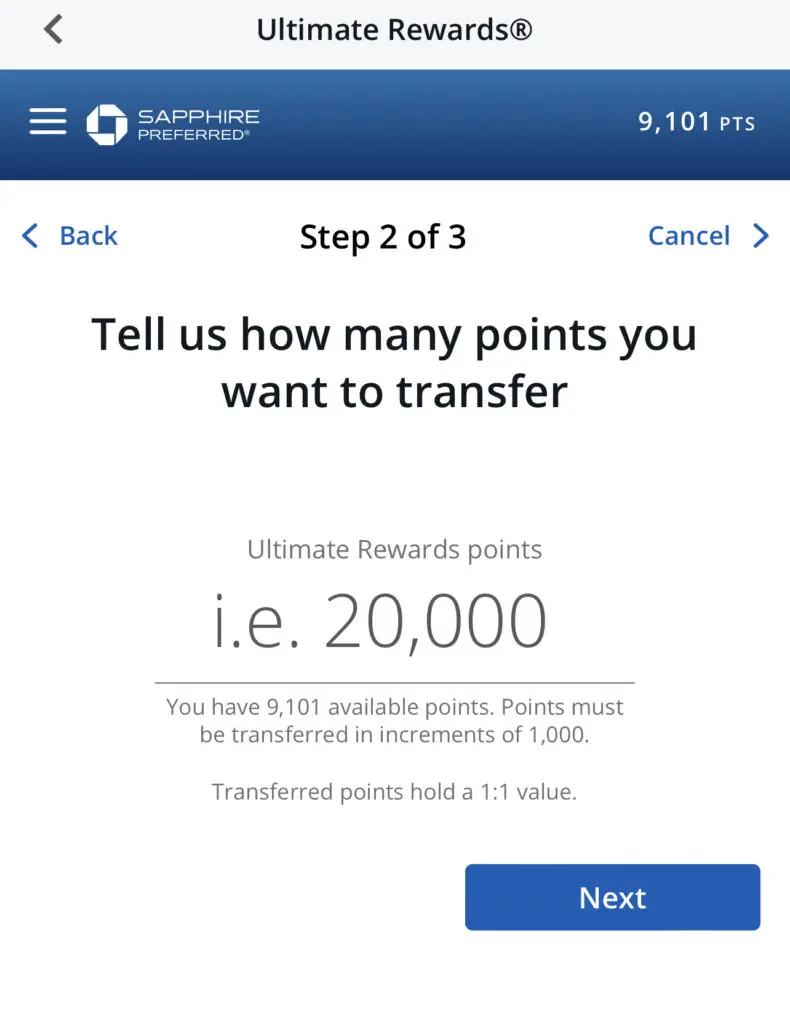

STEP 6:

Indicate the number of Chase Ultimate Rewards Points you would like to transfer to Southwest.

Before you transfer, remember that this is a one-way street.

Any points transferred from Chase to Southwest can not be reversed, so make sure the award space is available before proceeding with this transfer.

After typing in the number of Chase Ultimate Rewards Points you would like to transfer, click “Next”.

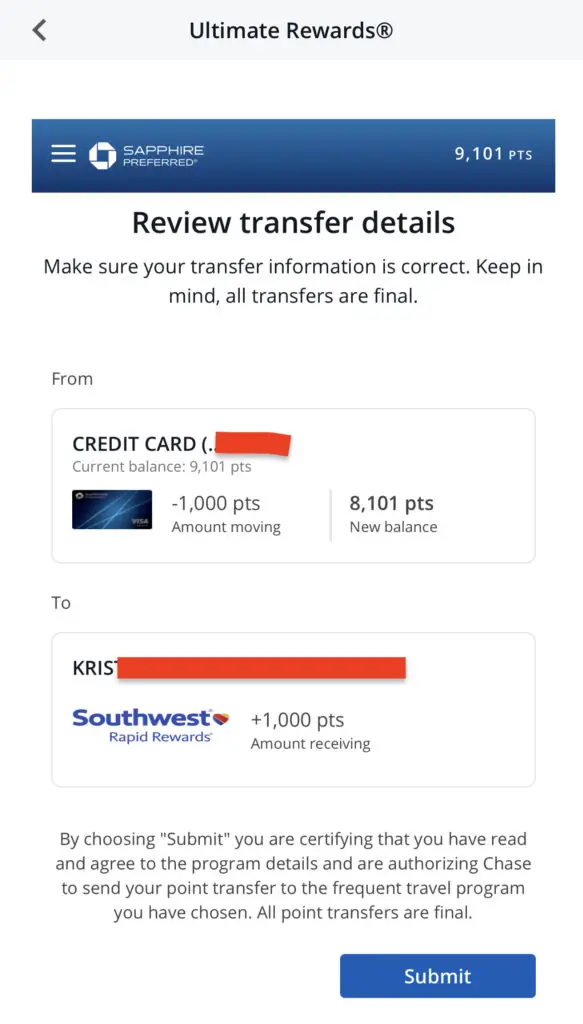

STEP 7:

Review transfer details, then “Submit.”

Reminder to only transfer points when you see award availability.

The transfer process is irreversible – you can not transfer Southwest Rapid Rewards miles back to Chase Ultimate Rewards.

STEP 8:

Run your award searches and safe travels.

Pro-Tip: Check your award flights to see if they have gone down in price. Southwest generously allows free flight changes and will refund the price difference, whether in cash or points.

Summary

Credit Cards that Earn Chase Ultimate Rewards Points

| Credit Cards | Details |

|---|---|

| Credit Cards that earn Ultimate Rewards (UR) Points | 1 Chase Ultimate Rewards. |

| Chase Sapphire Preferred® Card | Welcome Offer |

| Chase Sapphire Reserve® | Welcome Offer |

| Ink Business Preferred® Credit Card | Welcome Offer |

| Credit Cards that can convert into Chase Ultimate Rewards (UR) Points* | Steps to Convert |

| Chase Freedom Flex® | Welcome Offer |

| Chase Freedom Unlimited® | Welcome Offer |

| Ink Business Cash® Credit Card | Welcome Offer |

| Ink Business Unlimited® Credit Card | Welcome Offer |

Final Thoughts

I believe earning free or discounted travel is the best way to use my credit card points.

And if you’re looking for a flexible travel currency, Chase Ultimate Rewards should be at the top of your list.

They’re relatively easy to earn and can be used for everything from premium cabins to discounted airfare.

With Southwest’s partnership with Chase, you can now earn Southwest miles as a reward for using Chase credit cards that earn Ultimate Rewards.

Flying Southwest using miles is excellent because you can get free flights, no blackout dates, and the ability to change your flight for free.

These benefits make it easy to travel on your schedule without worrying about paying high prices or dealing with restrictions.

Have you ever transferred Chase Ultimate Rewards Points to Southwest before?

ADVERTISER DISCLOSURE: The Frugal Tourist is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as MileValue.com and Cardratings. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All information about the American Express Schwab Platinum has been collected independently by The Frugal Tourist.

EDITORIAL DISCLOSURE: Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities.

USER-GENERATED CONTENT DISCLOSURE: The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.

Thank you for this thorough guide – especially linking personal and business profiles

You’re welcome!