ADVERTISER DISCLOSURE: The Frugal Tourist is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as MileValue.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All information about the American Express Schwab Platinum has been collected independently by The Frugal Tourist.

EDITORIAL DISCLOSURE: Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities.

When it comes to travel rewards, Chase Ultimate Rewards and American Express Membership Rewards have long been the gold standard.

However, Capital One has recently stepped into the spotlight, offering a robust and competitive rewards program that allows cardmembers to transfer their points to an extensive list of airline and hotel partners.

In fact, Capital One just rolled out an array of enticing credit card options, including the Capital One Venture X Rewards Credit Card and the Capital One Spark Miles for Business, which offer lucrative welcome bonuses.

These Capital One travel rewards cards expand the choices available for both points enthusiasts and budget-conscious travelers, enhancing their credit card portfolios.

In this blog post, I will walk you through the steps to transfer your Capital One miles to its numerous travel partners.

Join Other Points Enthusiasts in Our Free Travel Miles & Points Facebook Group

Why I Like Capital One Rewards?

For frugal tourists, frequent travelers, and points enthusiasts looking to maximize their rewards, Capital One credit cards present a compelling option. Here’s why:

- Wide Range of Partners: With an extensive list of airline and hotel partners, you have the flexibility to choose how and where to redeem your points.

- Frequent Bonuses: Take advantage of transfer bonuses to enhance the value of your points and get more bang for your buck.

- Accessibility and Ease of Use: Capital One’s rewards program is designed to be user-friendly, making it accessible for both seasoned points enthusiasts and those just starting their travel rewards journey.

Important: You Need to Have A Capital One Credit Card that Earns Transferable Miles

To transfer Capital One miles to travel partners, you need to own at least one of the travel rewards cards listed in the table below.

Without one of these cards, you cannot transfer your Capital One miles to its airline and hotel partners.

Capital One Credit Cards That Can Transfer to Partners

| Capital One Venture Rewards Credit Card |

| Capital One Venture X Rewards Credit Card |

| Capital One Venture X Business |

| Capital One Spark Miles for Business |

| Capital One VentureOne Rewards Credit Card |

| No Annual Fee Capital One Travel Rewards Credit Card |

|---|

| If the high annual fees of some Capital One credit cards don’t appeal to you, consider the Capital One VentureOne Rewards Credit Card. This no-annual-fee card earns Capital One miles that can be transferred to travel partners. |

Read This Before You Transfer Your Capital One Miles to Travel Partners

Ensure award space is available, or your desired hotel room can be booked on points before transferring your Capital One miles to their airline and hotel partners.

Once you’ve transferred your points, there’s no turning back.

It’s a one-way street, so be mindful of this rule—you wouldn’t want your points trapped in a partner account instead of being used for your travels.

What Makes Capital One’s Rewards Program Stand Out?

One of the most appealing aspects of Capital One’s Rewards Program is its ability to transfer points to a wide array of airline and hotel partners.

The diversity of these transfer partners means that cardmembers have numerous options for booking flights and hotels, whether they’re jetting off for business or leisure.

The tables below list Capital One’s current transfer partners.

Capital One Airline Transfer Partners

(1 Capital One Mile : 1 Airline Mile) Minimum Transfer: 1,000 points |

| Aeromexico Club Premier |

| Air Canada Aeroplan |

| Air France-KLM Flying Blue |

| Avianca LifeMiles |

| British Airways Executive Club |

| Cathay Pacific Asia Miles |

| Emirates Skywards (1000 Cap One Miles = 750 Skywards Miles) |

| Etihad Guest |

| EVA Infinity MileageLands (1000 Cap One Miles = 750 Infinity MileageLands Miles) |

| Finnair Plus |

| Flying Blue (Air France/KLM) |

| Japan Airlines Mileage Bank (1000 Cap One Miles = 750 JAL Miles) |

| JetBlue TrueBlue (1000 Cap One Miles = 600 TrueBlue Points) |

| Qantas Frequent Flyer |

| Qatar Airways – Privilege Club |

| Singapore Airlines KrisFlyer |

| TAP Portugal Miles&Go |

| Turkish Airlines Miles&Smiles |

| Virgin Red |

Capital One Hotel Transfer Partners

(1 Capital One Mile: 1 Hotel Point) Minimum Transfer: 1,000 points |

| ALL Accor Live Limitless (1000 Cap One Miles = 500 All Rewards) |

| Choice Privileges |

| Preferred Hotels & Resorts – I Prefer (1000 Cap One Miles = 2000 I Prefer Points) |

| Wyndham |

Steps On How to Transfer Capital One Miles to Partners (Computer/Browser)

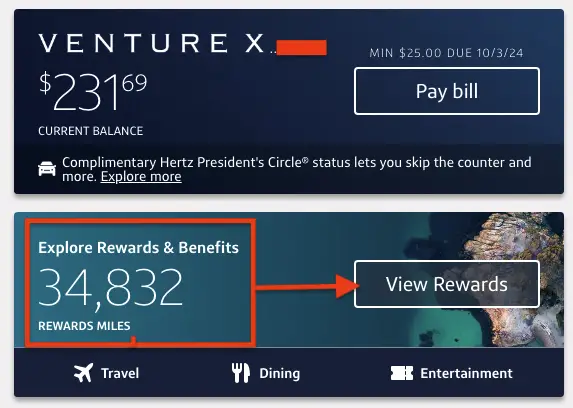

Step 1: Log In to Capital One & Click View Rewards

I selected to transfer miles from my Capital One Venture X Rewards Credit Card.

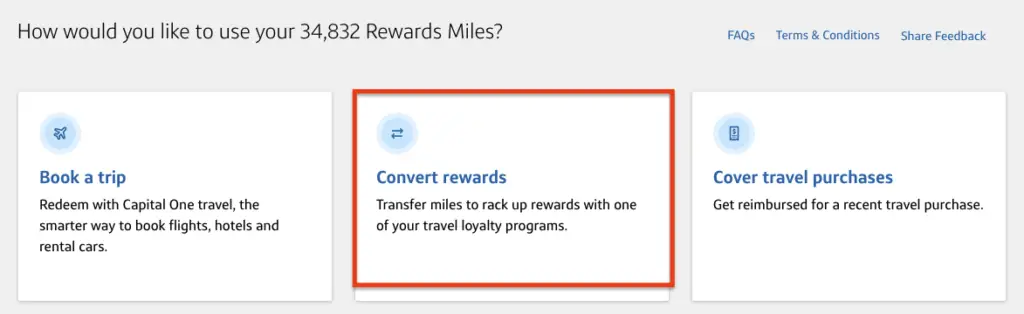

Step 2: Select “Convert Rewards”

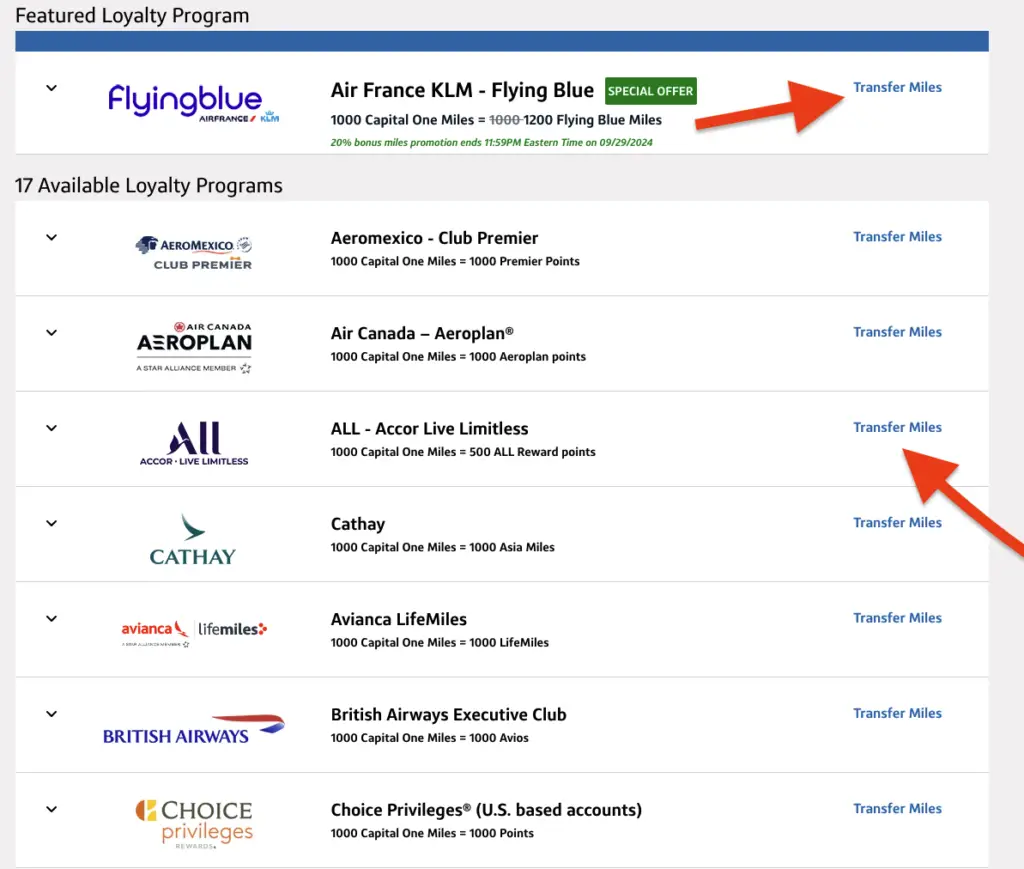

Step 3: Select Your Preferred Transfer Partner

Select your preferred transfer partner and click “Transfer Miles”.

Loyalty programs with transfer bonus offers are usually featured at the top of this page.

In the example below, Capital One is offering a 20% transfer bonus to Air France KLM – Flying Blue through September 29, 2024.

We announce transfer bonuses at our free Travel Miles and Points Facebook Group.

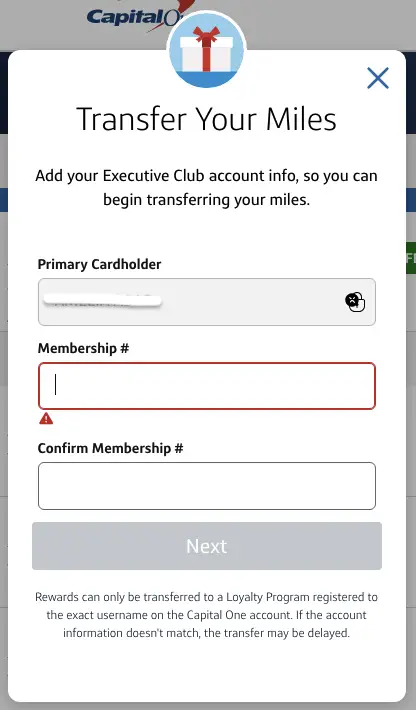

Step 4: Enter Your Frequent Flier Program Account Number

Make sure that you have signed up for a frequent flier account before you transfer, as you will need your frequent flier number to complete the process.

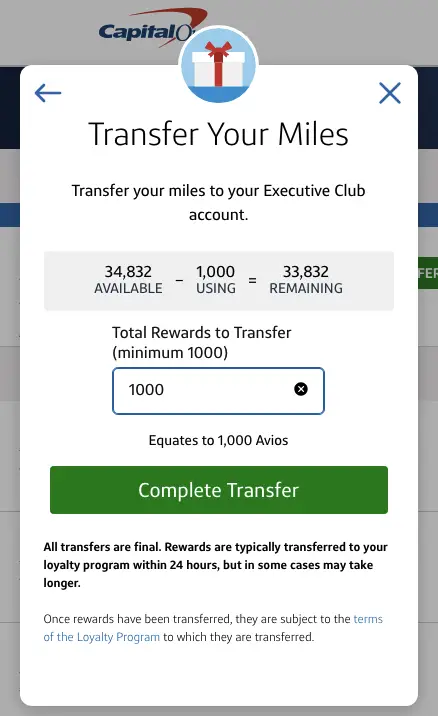

In the example below, I selected to transfer Capital One miles to the British Airways Executive Club program.

Step 5: Transfer Your Capital One Miles

The minimum amount miles that you can transfer is 1,000 Capital One miles.

As mentioned above, you should only begin the transfer process if you are absolutely certain of award availability with your chosen transfer partner.

Step 6: Book Your Flight or Hotel

Check your loyalty program to make sure that the transfer was successful.

As mentioned previously, all transfers are final and irreversible.

Capital One miles typically appear in your frequent flier account within 24 hours, but some transfers may take longer.

Once the points are in your loyalty account, book your flight or hotel.

Steps On How to Transfer Capital One Miles to Partners (Mobile App)

The steps on the app are similar to the computer version.

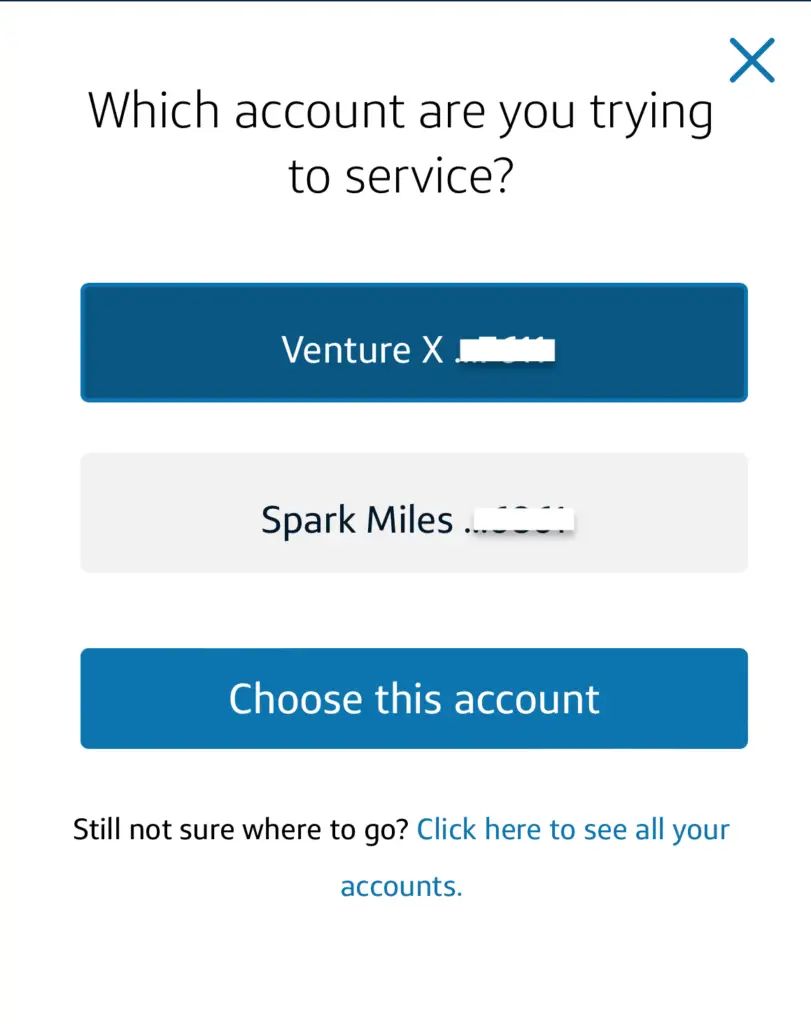

Once you log in, you will be asked to select the Capital One credit card you would like to transfer points from.

In the example below, I am prompted to select to move miles from either my Capital One Venture X Rewards Credit Card or my Capital One Spark Miles for Business Credit Card.

I opted to transfer miles from my Capital One Venture X card.

You will then be directed to a web browser, which will have the identical steps as in the previous section.

Capital One Credit Cards That Earn Transferrable Miles

Recommended Capital One Guides

| Capital One Venture X Rewards Card: The Best Credit Card for Lounge Access |

| The Best Ways to Fly to Hawaii Using Capital One Miles |

Final Thoughts

Capital One has firmly established itself as a major player in the travel rewards landscape, offering a competitive and valuable program.

Whether you’re looking to book your next flight or secure a comfortable hotel stay, the Capital One Rewards Program provides the flexibility and benefits you need.

So, make sure that you consider Capital One’s travel rewards credit cards and start your journey towards smarter, more rewarding travel today.

ADVERTISER DISCLOSURE: The Frugal Tourist is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as MileValue.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All information about the American Express Schwab Platinum has been collected independently by The Frugal Tourist.

EDITORIAL DISCLOSURE: Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities.

USER-GENERATED CONTENT DISCLOSURE: The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.