ADVERTISER DISCLOSURE: The Frugal Tourist is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as MileValue.com and Cardratings. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All information about the American Express Schwab Platinum has been collected independently by The Frugal Tourist.

EDITORIAL DISCLOSURE: Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities.

If you’re like me, you must love to travel and save money whenever possible. That’s where Rakuten comes in.

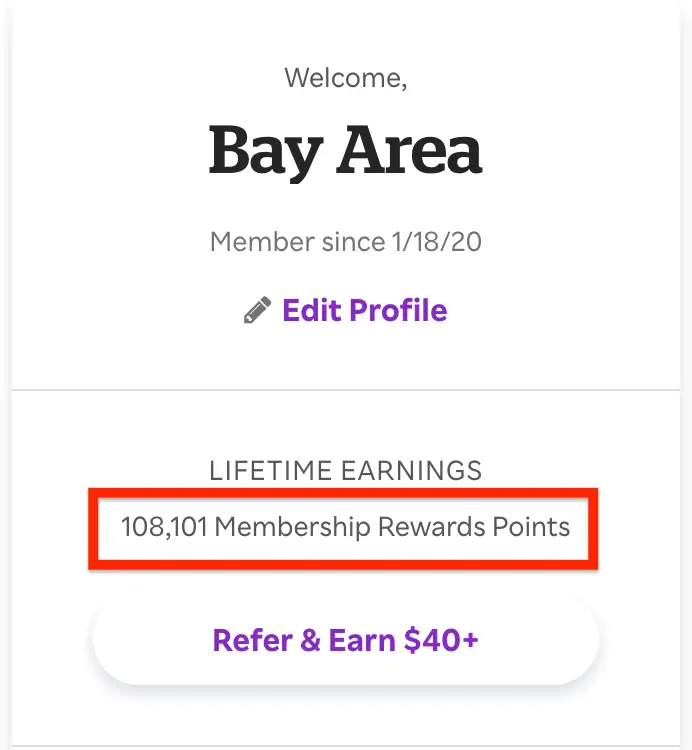

Rakuten is a shopping portal that allows consumers to earn extra cashback or travel points for every purchase.

These rewards can add up quickly and help get us closer to our dream vacation on points or cash!

Since most of us love to redeem our points for nearly free travel, I set up my Rakuten account to receive American Express Membership Rewards points that I can use for discounted flights.

In this blog post, I will walk you through the steps to set up your Rakuten account and earn American Express Membership Rewards, which can help you reach your next bucket list destination.

How Does Rakuten Work?

Rakuten is a shopping portal that allows consumers to earn extra cashback or points for every purchase.

Rakuten partners with over 3,500 stores and brands, so you can earn cashback on items you’re already buying.

To earn cashback, create a free account on Rakuten.com and visit your favorite store’s page on Rakuten.

From there, click through to the store’s website and make your purchase as usual.

The cashback or American Express Membership Rewards points will be added to your Rakuten account within a few days. It’s that simple!

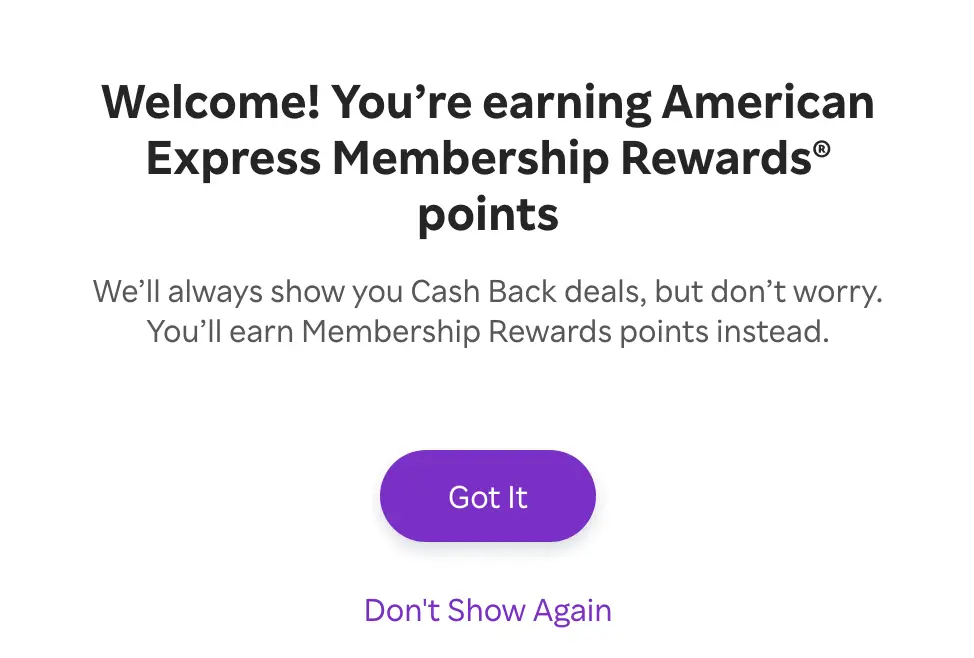

Now, let’s look at maximizing your earnings by setting up your Rakuten account to earn American Express Membership Rewards points.

How to Sign Up for Rakuten?

Creating a Rakuten account is quick and easy.

Go to Rakuten.com and click the “Sign Up” button at the top right corner.

You’ll be prompted to enter your name and email address and create a password.

Once you’ve done this, you’ll be ready to earn cashback or American Express Membership Rewards points!

Use a Referral Link From a Friend, Family Member, or Favorite Content Creator

If you know someone who is already a Rakuten member, they can give you a referral link to sign up.

When you use a referral link, you’ll get $10-$40 after you make your first qualifying purchase within 90 days of signing up.

And the best part is that the person who referred you will also get a bonus!

Additionally, once you have signed up with Rakuten, you can start referring too!

The more people you refer, the more you earn cashback and points.

| Pro-Tip |

|---|

| Do not use the same device when signing up friends or family members. Rakuten will be able to detect this, and they will claw back your points. They can also ban you from the portal. Ensure you are using different devices when signing up for multiple accounts. |

Summary: Earning Only Takes Three Steps

According to Rakuten, earning cashback or points from their site is as easy as taking these three steps:

- Log on to Rakuten.com: On the Rakuten website or the Rakuten App, click the store where you want to shop.

- Shop Like Always: Place an order, and Rakuten will automatically add cashback or points to your account.

- Choose How to Get Paid: Rakuten can send you cash or points. It’s your choice!

How to Earn American Express Membership Rewards Points with Rakuten

As stated above, when you purchase Rakuten, you can earn Membership Rewards points instead of cashback.

The only requirement to access American Express Membership Rewards points on Rakuten is to own an American Express card that earns this type of point currency.

So, if you have an American Express card that earns Membership Rewards points, you can link it to your Rakuten account to earn Membership Rewards points on your purchases.

Some of the cards that earn Membership Rewards points are as follows:

- American Express® Gold Card

- The Platinum Card® from American Express

- The Blue Business® Plus Credit Card from American Express

- American Express® Business Gold Card

- The Business Platinum Card® from American Express

Remember that you can only earn Membership Rewards points on purchases made in USD.

If you’re making a purchase using another currency, you’ll only be able to earn cashback.

Earning Membership Rewards points with Rakuten is a great way to get closer to your dream vacation.

With over 3,500 stores and brands, you can easily earn points on everyday purchases.

Why Earn American Express Membership Rewards Points?

The value of AMEX Membership Rewards Points comes from the ability to transfer them to different frequent flier programs, providing you with a range of flying options internationally.

For example, you can transfer your Membership Rewards points to British Airways Avios to access flights on British Airways or its One World partners.

Since British Airways and American Airlines are both in the One World Alliance, you can use British Airways Avios miles to book flights on American Airlines.

Similarly, you can transfer your Membership Rewards points to Virgin Atlantic, which can be helpful if you want to fly Virgin or one of its partners, like Delta.

And lastly, you can transfer your Membership Rewards points to Singapore Airlines KrisFlyer, which can be helpful if you want to fly on Singapore Airlines or one of its partners, like United Airlines.

No matter how you use your American Express Membership Rewards points, they are a valuable currency that can help you get closer to your dream vacation.

So, if you have an American Express card, be sure to link it to your Rakuten account so you can start earning points on your purchases!

| American Express Membership Rewards Travel Partners | Transfer Rate (AMEX = Airline/Hotel) |

|---|---|

| Airlines | |

| Aer Lingus | 1,000 AMEX Points = 1,000 Avios |

| AeroMexico | 1,000 Points = 1,600 Points |

| Aeroplan | 1,000 Points = 1,000 Points |

| Air France/KLM (Flying Blue) | 1,000 Points = 1,000 FB Miles |

| ANA Mileage Club | 1,000 Points – 1,000 Miles |

| Avianca LifeMiles | 1,000 Points = 1,000 LifeMiles |

| British Airways Executive Club | 1,000 Points = 1,000 Avios |

| Cathay Pacific | 1,000 Points – 1,000 Asia Miles |

| Delta | 1,000 Points = 1,000 Miles |

| Emirates Skyward | 1,000 Points – 1,000 Miles |

| Etihad Guest | 1,000 Points = 1,000 Miles |

| Hawaiian | 1,000 Points = 1,000 Miles |

| Iberia Plus | 1,000 Points = 1,000 Avios |

| JetBlue TrueBlue | 250 Points = 200 TrueBlue Points |

| Qantas Frequent Flyer | 500 Points = 500 Qantas Points |

| Singapore Airlines KrisFlyer | 1,000 Points = 1,000 KF Miles |

| Virgin Atlantic Flying Club | 1,000 Points = 1,000 Virgin Points |

| Hotels | |

| Choice Privileges | 1,000 Points = 1,000 Choice Points |

| Hilton Honors | 1,000 Points = 2,000 Hilton Points |

| Marriott Bonvoy | 1,000 Points = 1,000 Marriott Points |

Steps in Linking American Express with Rakuten

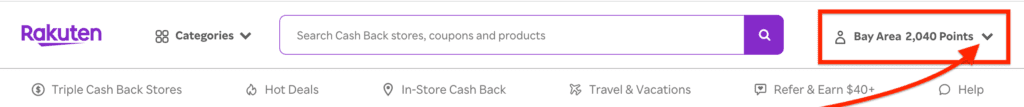

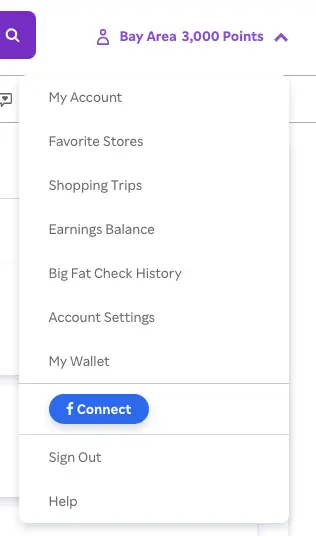

Step 1: Log On To Your Rakuten Account on your Computer

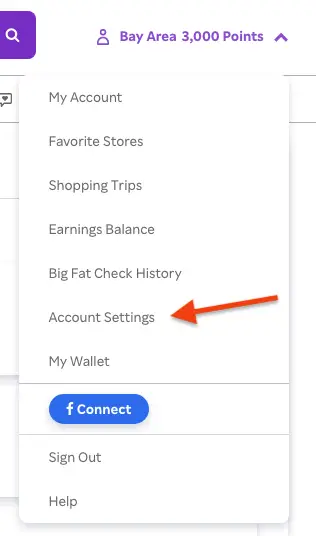

Look for your Account Name and click the “drop-down” arrow next to it.

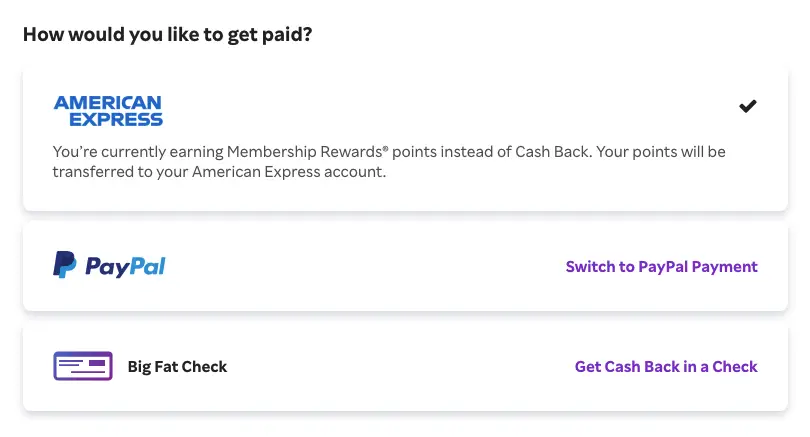

Step 3: Look for the Heading “How would you like to get paid?”

Step 4: Select American Express

The conversion rate is 1 cent = 1 American Express Membership Rewards point.

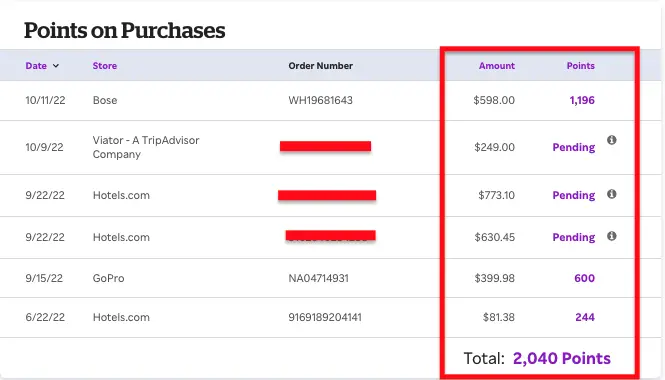

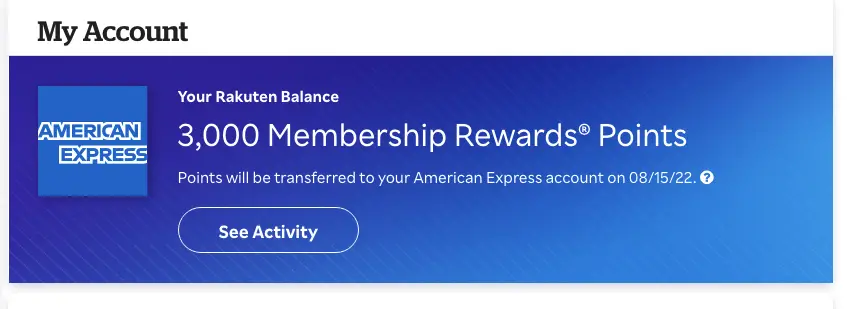

Once you have selected to receive American Express Membership Rewards, your points will be deposited to your American Express account once per quarter.

Your Rakuten account will show when those points will be transferred to your AMEX account.

Troubleshooting: I Can’t Link Rakuten to Amex

Don’t worry, linking Rakuten with American Express can be challenging sometimes.

Here are some troubleshooting ideas that you can try to link the two programs:

a. Currently, you can only link through the Rakuten desktop version.

b. Ensure your American Express credit card earns Membership Rewards (MR) points. If your American Express credit card is not an MR-earning card, you can only opt to receive your rewards on PayPal or a Big Fat Check.

c. If you are new to Rakuten, sign in using your American Express credentials to link your account with American Express.

d. Try using different browsers, including in incognito/private mode.

e. If you are an existing Rakuten member and encounter difficulties with linking, please contact Rakuten for further instructions.

Frequently Asked Questions

How Often Does Rakuten Send Cashback or Points?

Cash Back or points are sent every three months based on the schedule below.

If cashback or points for an order are still pending approval by the end of the payment quarter, they will be carried over to your next payment.

| Purchases Posted Between | Big Fat Check Sent |

|---|---|

| January 1 – March 31 | May 15 |

| April 1 – June 30 | Aug 15 |

| July 1 – September 30 | Nov 15 |

| October 1 – December 31 | Feb 15 |

When Does The Purchase Show Up in My Rakuten Account?

Stores usually take a little time to confirm that purchases were completed.

Depending on the store, this can take several hours to several days.

Rakuten will add cashback or points to your account once the store lets Rakuten know you’ve made a purchase.

Rakuten typically sends out an email notification to its members once a shopping trip has been successfully tracked and registered.

What is the Minimum Amount I Need to Receive a Rakuten Payout?

If you have less than $5.00 in your balance, don’t worry! It will automatically roll over to the next quarter. The minimum payout amount is only $5.00.

Can I Change Back to Cashback If I Do Not Want to Earn American Express Membership Rewards Points Anymore?

Yes, you would follow the steps above and select cashback.

However, you may not be able to change it back to American Express Membership Rewards again.

Ensure you contact Rakuten for their most current policy before making changes.

Can I Use Any Credit Card When Making a Purchase Via Rakuten?

While you can use any credit card to make a purchase, a new credit card offering a generous sign-up bonus (SUB) is ideal.

Do I Need to Activate My Rakuten Account Every Quarter?

There is no need to reactivate your account every quarter. Your account will stay active as long as you do not close it.

Do I Need to Go Through Rakuten Every Time I Shop?

You will only receive cashback for your purchase if you click on a Rakuten link to start the shopping trip.

If you don’t begin by clicking the Rakuten link, the store cannot know you’re a member.

Can I Still Earn Cash Back If I Forget to Click Through Rakuten?

Rakuten Cash Back is only available when you begin your Shopping Trip on Rakuten.com.

If it’s challenging to remember to go to Rakuten before making a purchase, you can install their cash-back extension instead.

Currently only available on Chrome, the extension button automatically pops up on any site where Rakuten cashback is offered and also finds coupons for you—making it easier than ever to save some money.

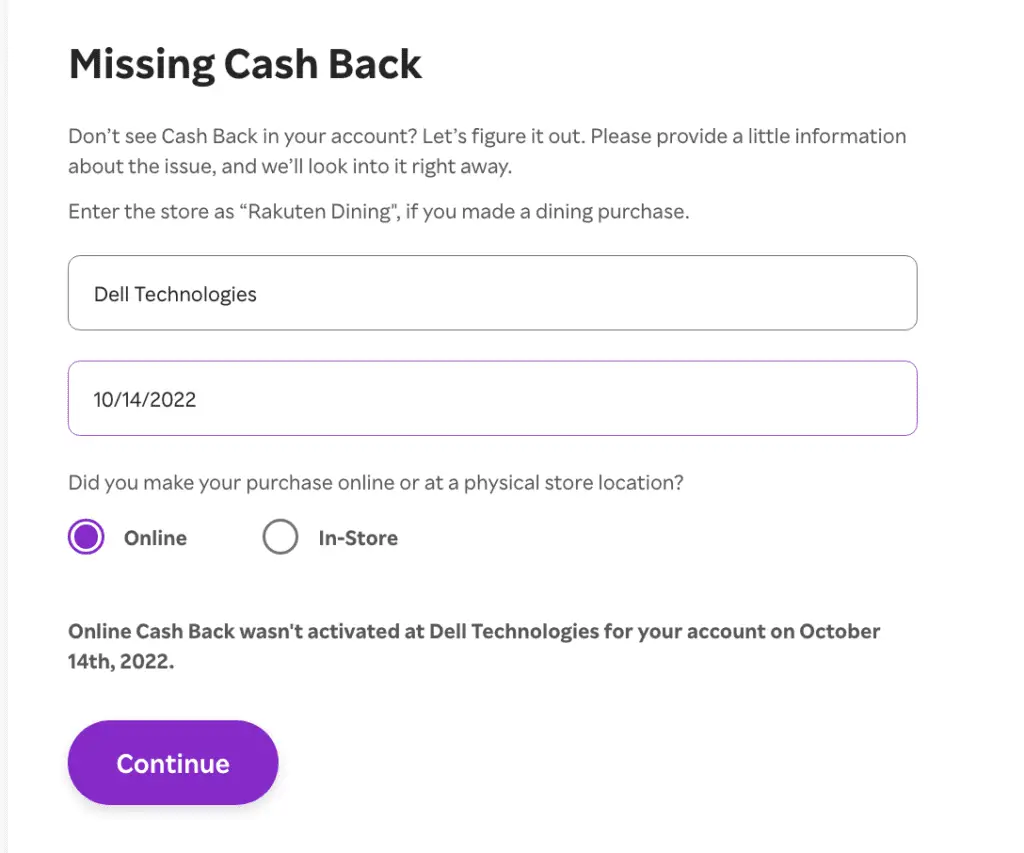

What If My Purchase Did Not Track?

Most purchases are not tracked because cookies are disabled on the buyer’s browser.

Cookies must be enabled so that Rakuten can credit your account with cashback.

Click “Shop Now” on the Rakuten website if you’re using a mobile device.

You’ll be redirected to the store’s mobile site, where your purchase will be tracked and credited to your account with Cash Back.

If you want Rakuten to be able to track your purchase and give you cash back, make sure not to shop using an incognito or private browsing window.

For missing cashback or rewards, you can contact Rakuten by clicking the button below and providing the following information:

- The store where you made your purchase

- The date of your purchase

- The approximate time of your purchase

- Your order total

- Proof of purchase, such as a receipt that clearly shows your order details

What Happens If I Cancel or Return Merchandise?

Depending on the store’s policy, returning or canceling an order may void your cashback, which will then be subtracted from your cashback balance.

If a store processes your exchanged order as if it were canceled and creates a new transaction, the exchange will not generate cashback.

If you want to ensure you get cashback for exchanged items, it’s easier to return the item and order something else. You can do this online. Just make sure you start your shopping trip through Rakuten.

What If I Want to Cash Out My American Express Membership Rewards Points?

You can cash out your American Express Membership Rewards Points through the American Express Charles Schwab Platinum Credit Card.

Charles Schwab Platinum cardholders can cash out their Membership Rewards Points and deposit them to their Charles Schwab retirement, individual or joint accounts.

This blog post outlines the steps to cash out your American Express Membership Rewards Points.

Why Convert Your Cashback to Travel Points?

This is a personal decision. There are pros and cons for each.

However, I would like to highlight an example of why I believe travel points are much more lucrative for a specific population.

Those interested in travel points know that American Express Membership Rewards points can be transferred to multiple transfer partners.

Refer to the table above for American Express travel partners.

Some of those partners offer sweet spots where points can be redeemed for round-trip business class travel to Europe for as low as 88,000 American Express Membership Rewards points.

For example, I flew a round-trip business class flight from San Francisco to Athens on Turkish Airlines using 88,000 American Express Membership Rewards points transferred to ANA (All Nippon Airways) Mileage Club.

If I had not selected to convert my Rakuten cashback bonuses into American Express Membership Rewards points, I would have only gotten an $880 check as my Rakuten reward.

Some might argue that cash is king and that $880 can grow exponentially if appropriately invested, thanks to compound interest. This is also true and equally valuable.

That is why you would need to make that determination yourself.

No-Annual-Fee American Express Card

The high annual fee on American Express credit cards can be offputting for some consumers.

While these cards offer a range of benefits, such as travel rewards, purchase protection, and other perks, the annual fees can be in the hundreds of dollars.

This can make it difficult for some people to justify the cost, especially if they do not use the card frequently enough to earn rewards or take advantage of its benefits.

Thankfully, American Express offers a no-annual-fee credit card that earns Membership Rewards points.

The Blue Business® Plus Credit Card from American Express (Rates and Fees) is a no-annual-fee card that allows you to convert your Rakuten cashback rewards into valuable travel points.

Final Thoughts

Rakuten is a great way to save money and earn points on everyday purchases.

With over 3,500 stores and brands to choose from, you can easily earn cashback or points on the items you’re already buying.

Plus, if you have an American Express card that earns Membership Rewards points, you can link it to your Rakuten account to earn even more points!

So what are you waiting for? Sign up for Rakuten today and start saving and earning rewards! Happy shopping!

ADVERTISER DISCLOSURE: The Frugal Tourist is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as MileValue.com and Cardratings. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All information about the American Express Schwab Platinum has been collected independently by The Frugal Tourist.

EDITORIAL DISCLOSURE: Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities.

USER-GENERATED CONTENT DISCLOSURE: The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.