ADVERTISER DISCLOSURE: The Frugal Tourist is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as MileValue.com and Cardratings. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All information about the American Express Schwab Platinum has been collected independently by The Frugal Tourist.

EDITORIAL DISCLOSURE: Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities.

If you’re a frequent traveler, you understand the importance of leveraging credit card points to book free or discounted travel.

However, what if I told you that you can now earn points on your rent payments as well?

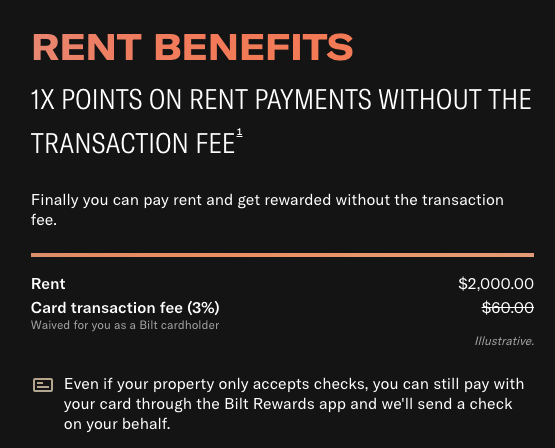

Earning points on rent payments can be a challenge with traditional credit cards, as most landlords don’t accept them.

When landlords do accept credit cards, they often add fees to cover the credit card transaction fees.

Sadly, these pesky fees are typically passed on to the tenant.

This is where Bilt Rewards comes in.

This blog will discuss how Bilt Rewards allows renters to earn points on their rent payments through the Bilt Mastercard, making it an excellent credit card alternative.

We will also cover the awesome November Rent Day promo, which allows Bilt Rewards members to earn extra points by transferring their points to Emirates.

What is Bilt Rewards?

Are you tired of paying rent without getting anything in return?

Let me share about Bilt Rewards – a program that offers you the opportunity to earn points on your rent payments and some select purchases.

Bilt allows renters to earn points when paying rent as long as the property is within “The Bilt Rewards Alliance, ” a vast network comprising over 3.5 million premium rental homes nationwide.

Renters can conveniently send rent payments through ACH, Credit Card, or Debit Card on the Bilt app.

Can’t find your property in Bilt’s network? Do not worry!

Bilt also offers an exclusive credit card – the Bilt Mastercard – which lets you send rent payments to virtually any landlord that accepts a check or ACH, even if they are outside of Bilt’s network.

The Bilt Mastercard also lets you earn points for everyday purchases that you can redeem for free travel, and hotel stays in the future.

Also, on the first day of each month, Bilt runs its Bilt Rent Day Promotion, which gives Bilt Rewards members multiple opportunities to earn extra points and enjoy exclusive benefits.

Keep reading to learn more about Bilt Rewards, their popular Bilt Rent Day Promotion, and how you can benefit from this program.

Pay Rent With the Bilt Mastercard Credit Card

Bilt Rewards is a cutting-edge program that enables renters to accumulate points through rent payments.

Even if your landlord doesn’t accept credit card payments, you can still earn points by using the Bilt app to pay your rent.

To facilitate these payments, you’ll need to hold a Bilt Mastercard credit card.

Go to the Bilt app and customize your rent preferences. The app offers the convenience of sending your landlord a check or money through ACH.

You can also program Bilt to send automatic rent payments on the same day each month, eliminating the need to remember and manually do it.

Without a doubt, this ability to use a credit card to pay rent and earn points from it is currently unmatched in the market.

But the best part is that the Bilt Mastercard does not charge extra transaction fees.

With the Bilt Mastercard, you can now pay your rent, fee-free, with a credit card and earn points from the transaction. How awesome is that?

How Many Points Do I Earn with the Bilt Mastercard?

With the Bilt Mastercard, you can earn 1x points on rent payments (up to 100,000 points per year).

You also earn 2x points on travel and 3x points on dining.

This allows you to quickly accumulate points by using it for your everyday expenses.

Once you accumulate enough Bilt Rewards points, you can redeem them for free travel, hotel stays, and other rewards.

| Category | Bilt Points Earned |

|---|---|

| Rent | 1 point per dollar |

| Dining | 3 |

| Travel | 2 |

| Everything Else | 1 |

Rent Day Promotion

As a Bilt Rewards member, you’ll also have access to their special promotion called “Rent Day.”

On the 1st of each calendar month, members with the Bilt Mastercard can earn double points on all non-rent purchases, which means you earn 2X on all purchases except rent.

But it gets better.

The Rent Day promo also doubles existing bonus categories, meaning that Bilt Mastercard cardholders can now earn 6x dining and 4x travel in addition to the regular points they earn.

So, don’t miss out on this limited-time promotion, as it is only available for 24 hours on the 1st of each calendar month (12:00 PM EST through 11:59 PM PST).

Please note that there is a maximum of 10,000 bonus points that you can earn each month so make sure you do not overspend on the card.

Make sure to mark Rent Day on your calendar and take advantage of this opportunity.

| Category | Points Earned | Rent Day Bonus (1st of each month) |

|---|---|---|

| Rent | 1 point per dollar | 2 points per dollar |

| Dining | 3 | 6 |

| Travel | 2 | 4 |

| Everything Else | 1 | 1 |

November 2023 Rent Day Special Promotion

In addition to the double points promotion that occurs every first day of the month, Bilt offers another special deal that changes monthly.

In previous months, Bilt Rent Day Special Promotions included deals with Hyatt, Virgin, etc.

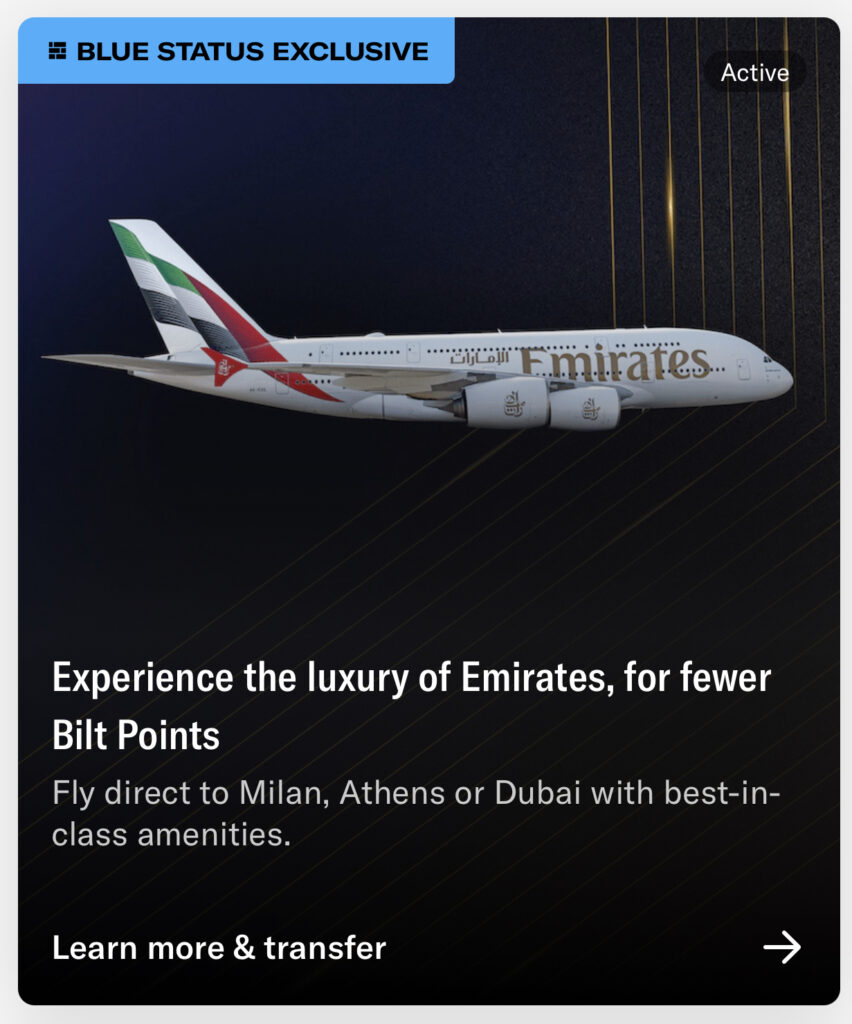

For November’s Rent Day, Bilt offers a 75-150% transfer bonus on points transferred to Emirates Skywards.

This means that for every point transferred, you will receive an additional 0.75-1.50 points, depending on your membership tier.

Blue members earn a 75% bonus, and Platinum members earn a maximum of 150% transfer bonus.

For example, a Platinum member who transfers 1000 Bilt points to Emirates will receive a total of 1750 points in their Emirates Skywards account.

Check out the table below to see how many extra points you will earn in November’s Rent Day Special Promotion

| Bilt Status | Transfer Bonus to Emirates |

|---|---|

| Blue | 75% |

| Silver | 100% |

| Gold | 125% |

| Platinum | 150% |

Should I Transfer to Emirates On Rent Day?

Although Emirates Skywards has partnerships with most major transferable points currencies and banks, transfer bonuses to Emirates are almost never offered.

Therefore, the opportunity to receive a transfer bonus ranging from 75% to 150% is exceptionally exciting.

While this provides a fantastic opportunity to earn Emirates miles, make sure that you are familiar with how the Emirates Skyward program works before transferring points.

Emirates premium award seats may have limited availability, and their taxes and fees tend to be on the expensive side.

I enjoy flying Emirates First Class, so I won’t think twice about participating in this promotion.

Important: Use the Bilt Mastercard at least 5X to Earn the Points

To actually earn Bilt Rewards points, you must remember one critical requirement.

To receive all the points you earned, you must use your Bilt Mastercard at least five times within your billing cycle.

If you fail to meet this 5-transaction threshold, all the Bilt Rewards points you’ve earned will be forfeited.

So I won’t forget this crucial step, I always use my Bilt Mastercard at least 5X on the first day of each month.

Not only does it help me fulfill this requirement, but I also earn double points during Rent Day!

Travel Miles & Points Facebook Group

If you would like to join a community of points enthusiasts, feel free to join the Travel Miles and Points Facebook Group. It’s free!

Frequently Asked Questions

What is Bilt Rewards?

Bilt Rewards is a loyalty and rewards program offered by Bilt, a financial technology company that allows renters to pay their rent using credit cards.

The program allows users to earn points for paying rent, which can be redeemed for various rewards and benefits.

With Bilt Rewards, users can earn 1 point for every $1 spent on rent payments through Bilt.

These points can be redeemed for popular travel, dining, and shopping rewards such as airline miles, hotel stays, restaurant gift cards, and more.

In addition to earning points through rent payments, users can earn bonus points by referring friends to Bilt Rewards or using the Bilt Mastercard for everyday purchases.

Right now, Bilt Mastercard holders earn 2x for travel and 3x for dining.

Bilt Rewards also offers a variety of exclusive member benefits, such as discounts on moving services and access to special events and promotions.

Overall, Bilt Rewards provides renters with a convenient and rewarding way to pay rent and earn benefits at the same time.

How do I Join Bilt Rewards?

Joining Bilt Rewards is simple and free.

All you need to do is sign up for a Bilt account and enroll in the Bilt rewards program.

You can do this through the Bilt website or downloading the Bilt app from the App Store or Google Play.

You don’t even need to sign up for a Bilt Mastercard in order to have a Bilt account.

However, if you would like to increase your earning potential, you can consider signing up for the Bilt Mastercard to earn even more points on rent, and everyday purchases, and enjoy other cardholder benefits.

Is Bilt Rewards worth it?

Whether or not Bilt Rewards is worth it depends on your financial goals and habits.

If you are a renter interested in using a credit card to pay for rent, joining Bilt Rewards can be a great way to earn rewards and benefits for paying such a significant monthly expense.

Additionally, the program offers flexibility in terms of redeeming points for various rewards, making it appealing to a wide range of users.

How do I earn points on Bilt Rewards?

To earn points on Bilt Rewards, simply make rent payments through the Bilt platform using the Bilt Mastercard.

Bilt members can earn up to 50,000 points every year from rent payments.

You can also earn bonus points by referring friends to Bilt Rewards or using the Bilt Mastercard for other purchases.

Points are earned at a rate of 1 point per $1 spent on rent payments and at higher rates for other purchases, depending on the type of transaction.

Bilt Mastercard holders earn 2 points per dollar on travel and 3 points per dollar on dining.

During Rent Day, all points are doubled except for rent. Each member can earn up to a maximum of 10,000 points during Rent Day.

Points can then be redeemed for various rewards and benefits, making it a valuable program for renters looking to maximize their spending.

Can I earn Bilt points even though I don’t have the Bilt Mastercard?

Yes, you can still earn Bilt points even if you don’t have the Bilt Mastercard.

While having the card does offer additional opportunities for earning bonus points, it is not a requirement to participate in the Bilt Rewards program.

As long as you make rent payments through Bilt and the property you’re renting is a part of the Bilt Rewards affiliate network, you can still accumulate points that can be redeemed for rewards and benefits.

However, renters can only earn 250 points per rent payment without the Bilt Mastercard.

Bilt Rewards members should consider adding the Bilt Mastercard to their credit card portfolio to accumulate additional points.

What is the Bilt Mastercard?

The Bilt Mastercard is a credit card that offers rewards and benefits for paying rent through the Bilt platform.

It also offers bonus points for other purchases, such as travel and dining.

Cardholders can earn 2x on travel and 3x on dining, making it a valuable tool for those who are looking to maximize their spending.

In addition, the Bilt Mastercard offers various perks, such as no annual fee and no foreign transaction fees.

It is a great option for those who want to earn rewards on their rent payments while having a credit card that can be used for everyday spending.

Do I need good credit to get the Bilt Mastercard?

While having good credit can increase your chances of being approved for the Bilt Mastercard, it is not a requirement.

Bilt looks at various factors when determining eligibility for the card, including credit history and income.

Even if you have limited credit history or a lower credit score, you may still be able to qualify for the Bilt Mastercard.

It is always recommended to check your credit score and report before applying for any credit card, including the Bilt Mastercard.

Lastly, some other factors, including employment status, credit utilization, and credit inquiries, can affect eligibility for the Bilt Mastercard.

Therefore, if you are interested in the Bilt Mastercard, it is vital to research and understand all of the terms and conditions associated with the card before applying.

What is the minimum credit limit on the Bilt Mastercard?

The minimum credit limit on the Bilt Mastercard is $500.

However, this may vary depending on individual factors such as credit history and income.

If you are approved for a lower credit limit than desired, requesting a credit limit increase is possible after establishing good payment habits.

How do I apply for a Bilt Mastercard?

You can apply for a Bilt Mastercard through the Bilt website or download the Bilt app from the App Store or Google Play.

The application process is simple and only takes a few minutes to complete.

Once you submit your application, you will typically receive a decision within minutes.

If approved, you will receive your physical card in the mail within 7-10 business days.

Does Bilt have an annual fee?

No.

Does the Bilt Mastercard add to my 5/24 Chase Status?

Yes, since it’s a personal card, it will add to your 5/24 count.

Please reach out to us if you are unsure whether the Bilt Mastercard is right for you.

You can join our Free Travel Miles and Points Facebook Group or fill out this free credit card consultation form.

If you’d like to learn more about Chase’s 5/24 rule, check out this 5/24 guide.

How do I redeem my Bilt Mastercard rewards?

To redeem your Bilt Mastercard rewards, log into your account and go to the “Rewards” tab.

From there, you can select which reward or benefit you would like to redeem with your accumulated points.

Rewards can be redeemed for popular travel, dining, and shopping options such as airline miles, hotel stays, restaurant gift cards, and more.

Are there any fees associated with the Bilt Mastercard?

The Bilt Mastercard does not have an annual fee or foreign transaction fees.

However, late payments and returned payments may result in additional fees.

It is essential to always make payments on time and in full to avoid any potential fees.

Balance transfers and cash advances may also incur fees, so it is best to check with the issuer for specific details.

Does Bilt charge foreign transaction fees?

No.

Can I use my Bilt Mastercard overseas?

Yes, the Bilt Mastercard can be used overseas wherever Mastercard is accepted.

There are no foreign transaction fees, so it can be a convenient and cost-effective option for making purchases while traveling internationally.

However, it is important to notify your card issuer before traveling to ensure your card will not be declined for potential fraudulent activity.

Can I refer friends to the Bilt Mastercard?

Yes, Bilt Rewards members can earn bonus points by referring friends to the Bilt Mastercard.

For every successful referral, both the member and friend will receive 2,500 points.

Plus, you can earn an extra 10,000 bonus points for every five referrals.

This is a great way to earn even more rewards while introducing friends to the benefits of the Bilt Rewards program.

Is my information secure with Bilt Rewards?

Bilt takes the security of its members very seriously.

The company uses advanced encryption technology and other security measures to protect personal and financial data.

In addition, Bilt does not sell or share member information with third parties without explicit consent.

Members can also set up two-factor authentication for an extra layer of protection when logging into their accounts.

How do I track my Bilt Rewards points?

You can easily track your Bilt Rewards points through the Bilt website or app.

Simply log into your account and go to the “Rewards” tab to view your current point balance and transaction history.

You can also set up alerts to receive notifications when you have accumulated a certain number of points or when new reward options are available.

Is there a limit to how many points I can earn with Bilt Rewards?

Cardholders can earn 1 point for every dollar spent on rent, with a maximum of 50,000 points per year, so a monthly rent of about $4,167 can get you to this threshold.

During rent day, the maximum amount of bonus points each cardholder can earn is 10,000 points.

What are Bilt’s transfer partners?

| Bilt Transfer Partners |

|---|

| American Airlines AAdvantage Air Canada Aeroplan Air France-KLM Flying Blue Cathay Pacific Asia Miles Emirates Skywards Hawaiian Airlines HawaiianMiles IHG One Rewards Turkish Airlines Miles&Smiles United Airlines MileagePlus Virgin Atlantic Flying Club World of Hyatt |

Final Thoughts

Bilt Rewards is the ultimate credit card alternative for renters who want to earn points on their rent payments.

With its awesome features, including Rent Day promotions, 1x points on rent payments, and access to exclusive deals and discounts, earning rewards has never been easier!

Bilt Rewards also offers multiple opportunities to earn bonus points – through the Bilt Mastercard – which can then be transferred to top travel partners for free or discounted airfare and hotel stays.

So, if you want to maximize your rent payments while also having a credit card for everyday spending, the Bilt Mastercard may be the answer.

With its easy application process, no annual fee or foreign transaction fees, and multiple ways to earn and redeem rewards, the Bilt Mastercard is definitely worth considering.

Remember always to use credit responsibly and make payments on time to avoid any potential fees or damage to your credit score.

Happy earning with Bilt Rewards!

ADVERTISER DISCLOSURE: The Frugal Tourist is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as MileValue.com and Cardratings. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All information about the American Express Schwab Platinum has been collected independently by The Frugal Tourist.

EDITORIAL DISCLOSURE: Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities.

USER-GENERATED CONTENT DISCLOSURE: The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.